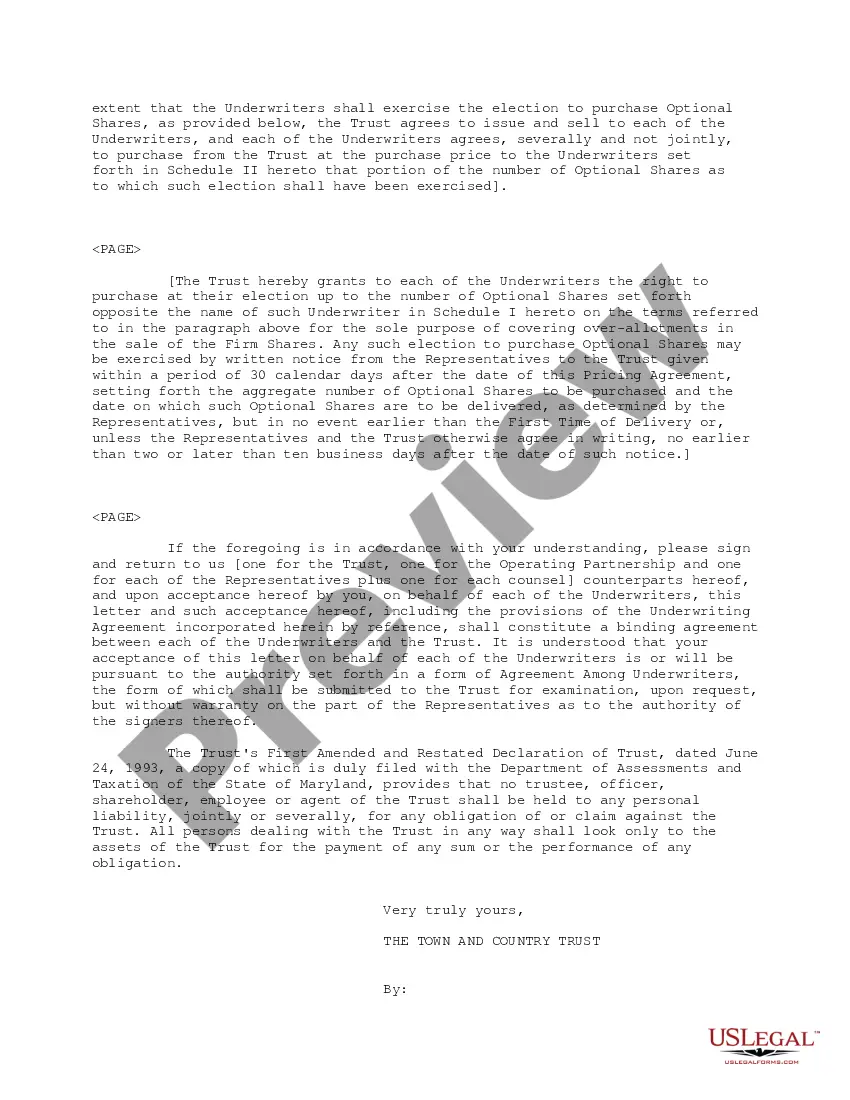

Utah Pricing Agreement

Description

How to fill out Pricing Agreement?

If you wish to full, download, or print lawful document web templates, use US Legal Forms, the greatest assortment of lawful forms, that can be found on the web. Make use of the site`s simple and easy handy research to get the documents you will need. A variety of web templates for company and person functions are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to get the Utah Pricing Agreement in just a couple of click throughs.

In case you are already a US Legal Forms buyer, log in to your profile and click the Obtain key to get the Utah Pricing Agreement. You can even gain access to forms you formerly downloaded inside the My Forms tab of your own profile.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the form to the correct town/nation.

- Step 2. Take advantage of the Preview method to look through the form`s articles. Don`t neglect to read through the outline.

- Step 3. In case you are unsatisfied using the develop, utilize the Lookup industry on top of the display to locate other variations in the lawful develop design.

- Step 4. Once you have located the form you will need, click the Acquire now key. Pick the rates strategy you like and include your accreditations to sign up to have an profile.

- Step 5. Approach the deal. You may use your credit card or PayPal profile to perform the deal.

- Step 6. Pick the file format in the lawful develop and download it on the gadget.

- Step 7. Total, change and print or indication the Utah Pricing Agreement.

Every lawful document design you buy is your own for a long time. You possess acces to each develop you downloaded in your acccount. Select the My Forms section and select a develop to print or download once more.

Remain competitive and download, and print the Utah Pricing Agreement with US Legal Forms. There are many professional and state-certain forms you can utilize for the company or person requires.

Form popularity

FAQ

Utah is an origin-based sales tax state. This means you should be charging Utah customers the sales tax rate for where your business is located. That rate could include a combination of state, county, city, and district tax rates. The state sales tax rate is 4.85%. Utah Sales Tax Guide and Calculator 2022 - TaxJar taxjar.com ? sales-tax ? utah taxjar.com ? sales-tax ? utah

State Sales Tax Rate: Utah's general sales tax rate is 4.85%. Local Sales Tax Rate: Utah localities impose their own sales tax at rates ranging from 0% to 7.6%. Food and Ingredients Sales Tax Rate: Utah has a uniform statewide rate of 3% on food and food ingredients.

Tax Rates Date RangeTax RateJanuary 1, 2023 ? current4.65% or .0465January 1, 2022 ? December 31, 20224.85% or .0485January 1, 2018 ? December 31, 20214.95% or .0495January 1, 2008 ? December 31, 20175% or .051 more row

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. Who Must File - Utah State Tax Commission utah.gov ? instructions ? who-must-file utah.gov ? instructions ? who-must-file

What is the sales tax rate in Price, Utah? The minimum combined 2023 sales tax rate for Price, Utah is 6.75%. This is the total of state, county and city sales tax rates.

Alone among states, Utah earmarks the entirety of its individual and corporate income taxes and generates almost all its general fund revenue from the sales tax. Modernizing Utah's Sales Tax: A Guide for Policymakers taxfoundation.org ? research ? all ? state ? moder... taxfoundation.org ? research ? all ? state ? moder...

Utah has a very simple income tax system with just a single flat rate. All taxpayers in Utah pay a 4.85% state income tax rate, regardless of filing status or income tier. No cities in the Beehive State have local income taxes.

If you cannot pay the full amount you owe, you can request a payment plan. Go to tap.utah.gov and choose ?Apply for a waiver or a pay plan.? You may also call the Tax Commission at 801-297-7703, or 1-800-662- 4335 ext. 7703. Payment Agreement Request - Utah State Tax Commission utah.gov ? paying ? payment-agreement utah.gov ? paying ? payment-agreement