Virginia Garnishment Instructions provide the legal procedures and forms necessary to garnish wages or other income in the state of Virginia. There are three types of Virginia Garnishment Instructions: Wage Garnishment Instructions, Bank Account Garnishment Instructions, and Non-Wage Garnishment Instructions. Wage Garnishment Instructions provide the steps necessary to garnish wages from an employer in Virginia. This includes filing court documents, notifying the employer, and providing an answer to the court. Bank Account Garnishment Instructions provide the steps necessary to garnish funds from a bank account in Virginia. This includes filing court documents, notifying the bank, and providing an answer to the court. Non-Wage Garnishment Instructions provide the steps necessary to garnish other types of income, such as Social Security or disability benefits, in Virginia. This includes filing court documents, notifying the payer, and providing an answer to the court.

Virginia Garnishment Instructions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Virginia Garnishment Instructions?

US Legal Forms is the most easy and profitable way to locate suitable formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with federal and local laws - just like your Virginia Garnishment Instructions.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Virginia Garnishment Instructions if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one corresponding to your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Create an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Virginia Garnishment Instructions and download it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Try it out!

Form popularity

FAQ

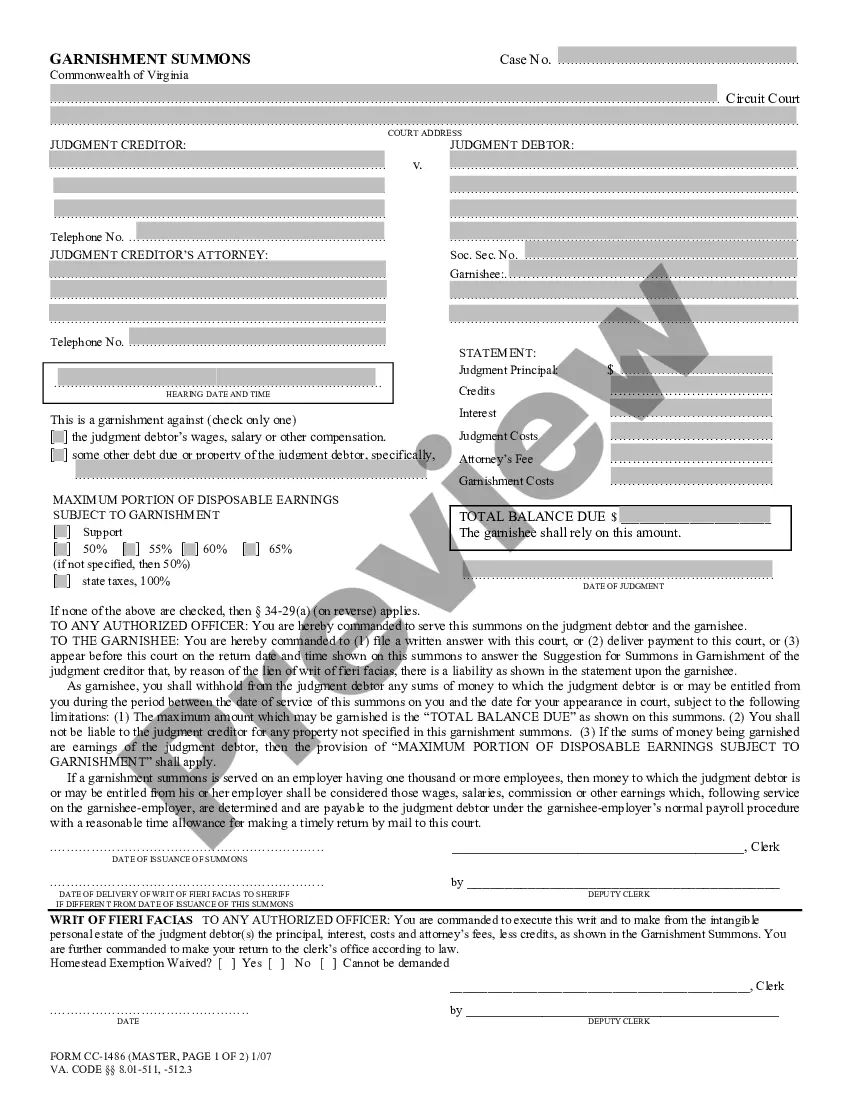

In order to garnish either a bank account or wages a judgment creditor must submit a ?Garnishment Summons? to the court requesting a garnishment order to be issued to either the bank or the employer of the judgment debtor. Judgment debtors are not require to receive notice of the garnishment prior to implementation.

5 Ways to Stop a Garnishment Pay Off the Debt. If your financial situation is dire, paying off the debt may not be an option.Work With Your Creditor.Challenge the Garnishment.File a Claim of Exemption.File for Bankruptcy.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

You do this by filing a Garnishment Exemption Claim Form with the court that issued the garnishment. You may be able to do this by yourself, but it is not recommended. You may lose income or property if you don't know the law. You should get legal help.

A creditor wants to take money out of your paycheck or your bank account. In Virginia, a creditor can perform either a wage garnishment or a bank garnishment.

A. No more than 25% of disposable earnings in any pay period may be garnished to satisfy an ordinary debt.

Limits on Wage Garnishment in Virginia Again, under Virginia law, garnishment limits are the lesser of: 25% of your disposable earnings, or. the amount by which your disposable earnings exceed 40 times the federal minimum hourly wage or the Virginia minimum hourly wage, whichever is greater.