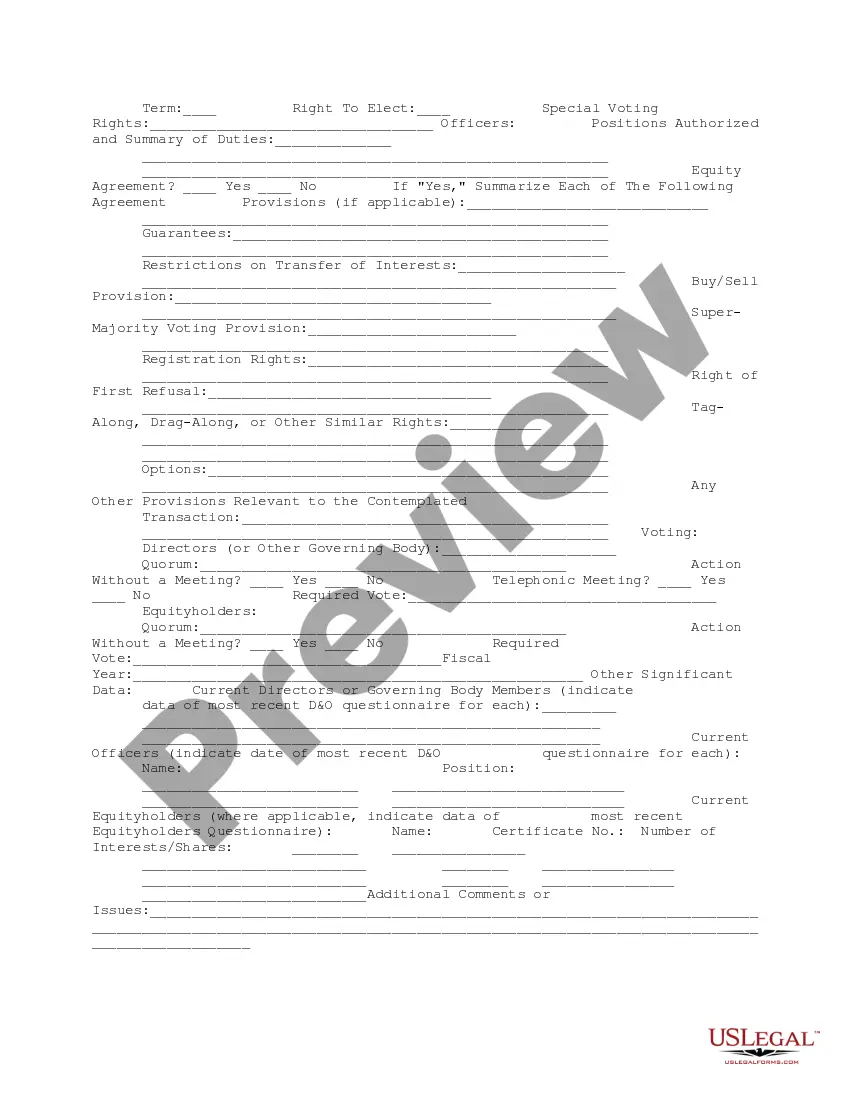

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Utah Company Data Summary

Description

How to fill out Company Data Summary?

If you desire to be thorough, download, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms accessible on the Web.

Employ the site's user-friendly and convenient search feature to locate the documents you need.

Different templates for business and personal purposes are organized by categories and regions, or keywords.

Every legal document template you obtain is yours indefinitely. You can access each form you have acquired in your account.

Check the My documents section and select a form to print or download again. Stay competitive and download, and print the Utah Company Data Summary with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Utah Company Data Summary with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Utah Company Data Summary.

- You can also retrieve forms you have previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm that you have selected the form for the correct state/region.

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you've found the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Utah Company Data Summary.

Form popularity

FAQ

Utah is famous for its breathtaking national parks and vibrant ski resorts, making it a top destination for outdoor enthusiasts. The state is also known for its unique cultural heritage, especially within its Mormon communities. Additionally, many people refer to the Utah Company Data Summary to learn about the notable businesses and startups that contribute significantly to this dynamic state. Its rich culture and entrepreneurial spirit are truly distinctive.

Utah is characterized by its stunning natural beauty, thriving economy, and diverse population. Its economy includes robust sectors such as technology, tourism, and healthcare. Utilizing the Utah Company Data Summary can help prospective business owners or investors understand the landscape, as it provides essential data on industry trends and company performances within the state.

Utah's story began with the arrival of pioneers seeking religious freedom in the mid-1800s. Over time, the state developed a rich history involving mining, agriculture, and diverse communities. Today, the Utah Company Data Summary reflects the evolution of businesses and economic opportunities that stem from this historical background. This combination of past and present creates a unique identity for the state.

Utah is known for its stunning national parks, including Zion and Bryce Canyon. It has a thriving technology sector, often referred to as Silicon Slopes. The state boasts a high quality of life, with a strong sense of community and family values. The Utah Company Data Summary showcases various businesses contributing to this vibrant economy. Additionally, Utah is recognized for its contributions to outdoor recreation and its unique cultural heritage.

The biggest employer in Utah is the State of Utah itself, which provides numerous job opportunities across various sectors. Additionally, companies like the University of Utah and health care organizations play significant roles in job creation. Analyzing the Utah Company Data Summary can help you understand more about these major employers and their impact on the economy.

Utah is a state located in the western United States, known for its diverse landscape and rich history. The Utah Company Data Summary can provide insights into the state's economic landscape, highlighting key industries and major companies operating within its borders. Visitors and residents alike appreciate Utah's blend of outdoor recreation and cultural experiences.

To find out who owns a business in Utah, you can use the Utah Department of Commerce's online business entity database. Simply enter the business name or registration number to access the Utah Company Data Summary. This resource provides key details about ownership and business status, helping you gather necessary information.

An annual report in Utah should include your company’s name, address, a summary of business activities, and financial information from the previous year. Ensure that you list your registered agent and any changes in ownership or management. A comprehensive Utah Company Data Summary provides a structured overview to support this reporting.

Annual report requirements in Utah usually include basic business information, officer details, and financial summaries for the previous year. You must submit your report before the state's deadline to maintain good standing. An accurate Utah Company Data Summary also assists in fulfilling these reporting obligations fully.

You can perform a Utah business search through the Utah Secretary of State's website. Enter your desired business name in the search tool, and you will receive a Utah Company Data Summary that outlines the relevant details. This process helps you verify the existence of a business and check for any filed documents.