Utah Equal Pay Checklist

Description

How to fill out Equal Pay Checklist?

Are you currently in a situation where you frequently require documents for business or personal reasons.

There are numerous legal document templates available on the web, but finding ones that you can rely on is not easy.

US Legal Forms offers a vast array of form templates, such as the Utah Equal Pay Checklist, designed to comply with federal and state regulations.

Once you find the right form, click Buy now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and make a purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you will be able to download the Utah Equal Pay Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you require and ensure it corresponds to your specific city/region.

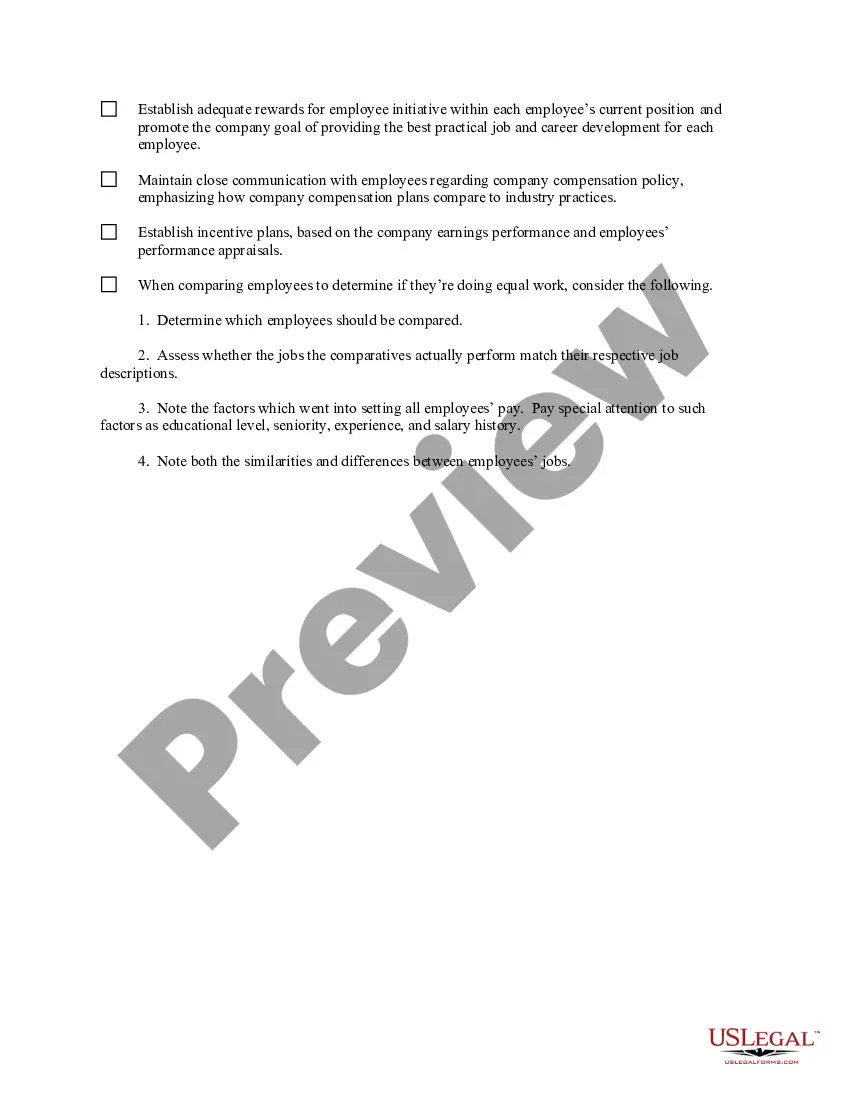

- Utilize the Preview feature to examine the form.

- Review the summary to confirm that you have selected the correct form.

- If the form does not meet your expectations, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

Filing payroll taxes in Utah involves submitting the necessary forms to both state and federal tax agencies. Employers must withhold state taxes from employees' paychecks and timely remit these amounts. Using the Utah Equal Pay Checklist can guide you through the filing process, ensuring that you meet your payroll tax responsibilities accurately.

Yes, Utah requires residents to file a state tax return if their income exceeds a certain threshold. This requirement applies to both individuals and businesses. The Utah Equal Pay Checklist can assist you in understanding your filing obligations and help you stay compliant with state tax laws.

Utah Form 33H is a document used for claiming an unpaid wage. This form is essential for workers seeking compensation for wages owed. To ensure that you correctly fill out this form, consult the Utah Equal Pay Checklist as a helpful resource for compliance and accuracy.

Filing a wage claim in Utah begins by gathering necessary documentation, such as pay stubs and employment records. You can submit your claim to the Utah Labor Commission, which will review your case. Understanding the Utah Equal Pay Checklist can empower you to navigate this process effectively and assert your rights.

Setting up payroll in Utah involves several steps, such as obtaining an Employer Identification Number (EIN) and registering for state tax accounts. You also need to familiarize yourself with residency and non-residency rules. Incorporating the Utah Equal Pay Checklist into your setup process can streamline compliance and help avoid common pitfalls.

Indeed, Utah has a state payroll tax that employers must withhold from their employees' wages. This tax is essential for funding various state services and programs. By utilizing the Utah Equal Pay Checklist, employers can better navigate payroll tax requirements and ensure they meet legal obligations.

Yes, Utah has its own W4 form. This form is used for state withholding purposes and helps employees indicate their state tax withholding preferences. With a proper understanding of the Utah Equal Pay Checklist, both employers and employees can ensure accurate tax filings and compliance with state regulations.

Yes, there are exceptions to the Equality Act that could affect equal pay provisions. For instance, certain small businesses may not be covered by this law. Additionally, qualifications for specific job roles and merit-based factors can play a role in compensation decisions. For a comprehensive understanding of how these exceptions apply, reviewing the Utah Equal Pay Checklist can clarify your legal obligations and rights.

In Utah, new employees are required to complete specific forms as part of their onboarding process. This typically includes the W-4 form for federal tax withholding and the new hire reporting form. To ensure compliance with laws related to equal pay, it is also recommended to refer to the Utah Equal Pay Checklist, which can help new hires understand their rights and responsibilities concerning pay equity.

A powerful argument against the wage gap is the demonstration that equal pay leads to increased productivity and employee satisfaction. When employees are compensated fairly, they feel valued and motivated to contribute positively to their work environment. The Utah Equal Pay Checklist serves as a practical tool that employers can use to establish fair pay practices, ensuring compliance with equal pay laws while fostering a more equitable workplace. By utilizing this checklist, companies not only address the wage gap but also promote a culture of fairness and inclusivity.