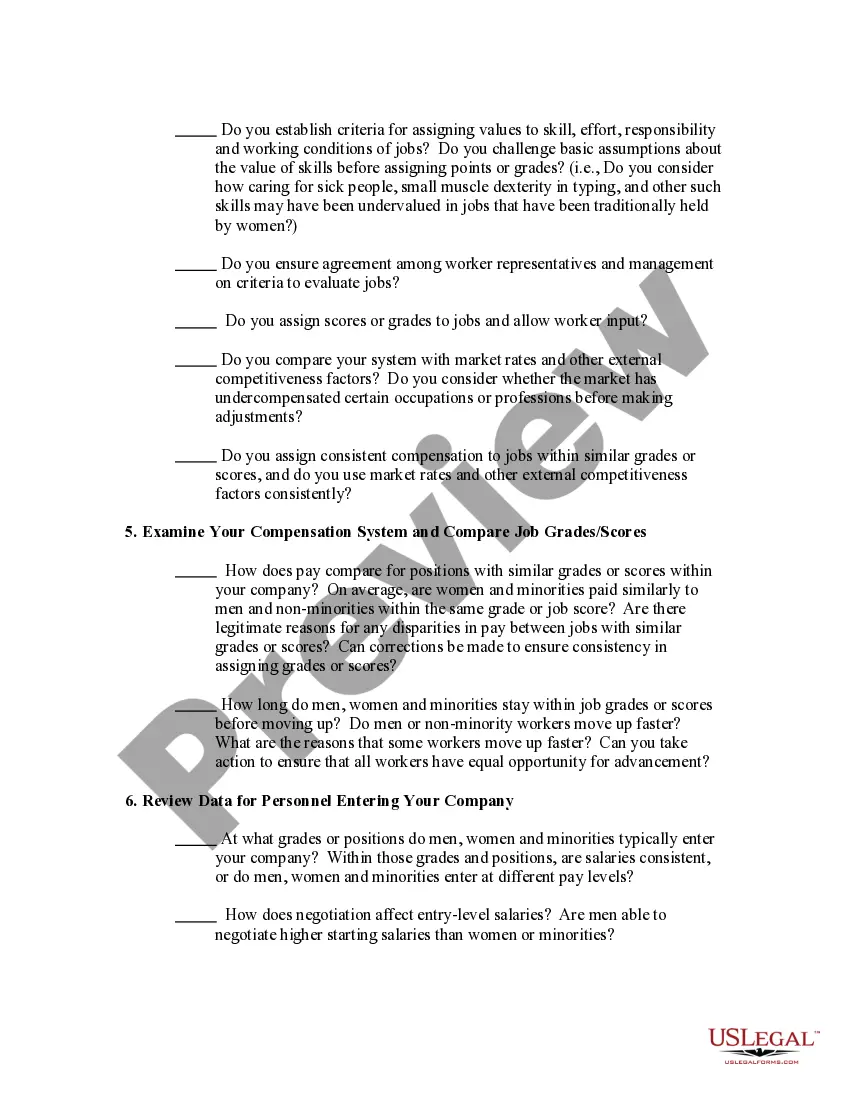

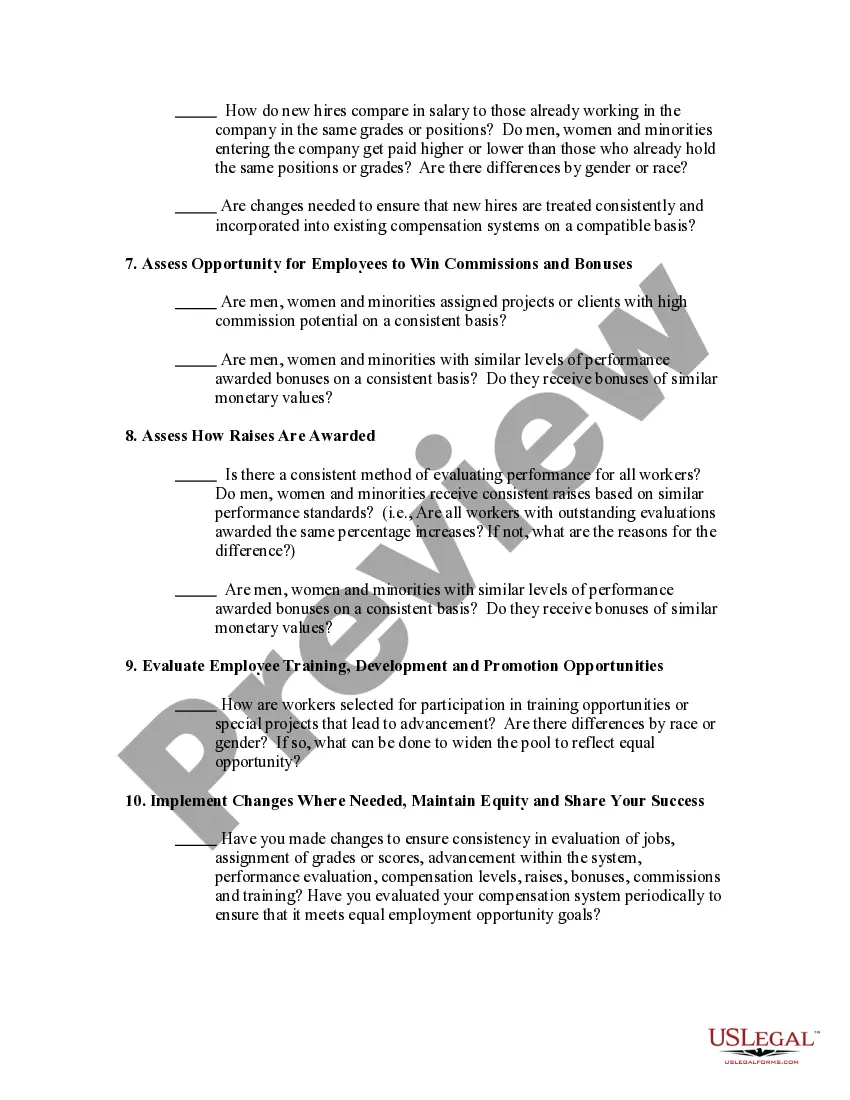

Utah Equal Pay - Administration and Enforcement Checklist

Description

How to fill out Equal Pay - Administration And Enforcement Checklist?

You can dedicate hours online searching for the legal document template that meets your state and federal requirements. US Legal Forms provides a vast collection of legal documents that have been reviewed by experts.

It is easy to download or print the Utah Equal Pay - Administration and Enforcement Checklist from my service.

If you possess a US Legal Forms account, you can Log In and select the Download option. Then, you can complete, edit, print, or sign the Utah Equal Pay - Administration and Enforcement Checklist. Every legal document template you receive is yours to keep for a long time. To acquire another copy of any purchased document, visit the My documents section and click the appropriate option.

Choose your document's format and download it to your device. Make edits to your document as needed. You can complete, revise, sign, and print the Utah Equal Pay - Administration and Enforcement Checklist. Download and print a wide array of document templates using the US Legal Forms website, which offers the largest selection of legal templates. Utilize professional and state-specific templates to address your business or personal requirements.

- If you are using the US Legal Forms website for the first time, follow the basic steps outlined below.

- First, ensure that you have selected the correct document template for the state/city you choose. Review the document overview to confirm you have chosen the right one.

- If available, utilize the Review option to examine the document template as well.

- If you want to obtain another version of your document, use the Search area to find the template that meets your requirements.

- After you have found the template you want, click Get now to proceed.

- Select the pricing plan you prefer, enter your information, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal template.

Form popularity

FAQ

Utah Code 34A-5-112 focuses on the enforcement of equal pay laws in Utah, emphasizing the importance of fair compensation practices. This code outlines what actions employees can take if they believe they have experienced wage discrimination based on gender or other protected characteristics. Familiarity with the Utah Equal Pay - Administration and Enforcement Checklist can help you navigate these regulations effectively. Utilizing resources like uslegalforms can provide you with valuable tools to ensure compliance and protect your rights.

In Utah, wrongful termination occurs when an employee loses their job for illegal reasons, such as discrimination or retaliation for exercising their rights. It can also involve cases where an employee is fired in violation of a contractual agreement or public policy. Understanding your rights under the Utah Equal Pay - Administration and Enforcement Checklist is crucial for identifying potential wrongful termination cases. If you think you have been wrongfully terminated, consider consulting a professional for guidance.

In Utah, residents must file a state tax return if they meet certain income thresholds, regardless of whether they owe taxes. This includes individuals who earn wages, self-employed persons, and others with taxable income. Utilizing the Utah Equal Pay - Administration and Enforcement Checklist provides clarity on tax filing requirements, ensuring compliance with state tax laws. Staying informed helps you avoid unnecessary penalties and fines.

Equal Employment Opportunity (EEO) in Utah refers to the legal principle that prohibits employment discrimination based on race, color, religion, gender, age, disability, and other characteristics. Various laws, including the Utah Antidiscrimination Act, enforce these protections. The Utah Equal Pay - Administration and Enforcement Checklist offers valuable resources for both employers and employees to understand their rights and obligations under EEO laws. Maintaining an equitable work environment contributes to overall organizational health.

Yes, in Utah, you can sue your employer for various reasons, including violations of employment law, discrimination, and unpaid wages. However, it is recommended to attempt resolution through internal channels before resorting to litigation. Referring to the Utah Equal Pay - Administration and Enforcement Checklist can provide you with detailed insights into your rights and the process involved. Protecting your rights is essential for a fair workplace.

Utah form 33H is a specific form used for reporting employee wages for unemployment tax under the state's unemployment insurance program. This form helps employers report wages and ensure contributions are made correctly. Utilizing resources like the Utah Equal Pay - Administration and Enforcement Checklist helps employers understand the requirements for filing this form. Accurate reporting is essential for compliance and avoiding penalties.

In Utah, new employees typically need to complete several forms, including the W-4 form for tax withholding and the I-9 form to verify their identity and employment eligibility. Additionally, employers may provide their own onboarding forms for company policies and procedures. The Utah Equal Pay - Administration and Enforcement Checklist can guide employers in ensuring all necessary paperwork is completed properly. This helps streamline the onboarding process and ensures compliance.

Yes, Utah requires Limited Liability Companies (LLCs) to file an annual report to keep their status active. Failing to submit this report can lead to administrative dissolution. The Utah Equal Pay - Administration and Enforcement Checklist assists business owners in understanding compliance obligations, including timely filing of annual reports. Knowing this helps maintain your business’s good standing and operational integrity.

In Utah, several factors can disqualify you from receiving unemployment benefits. If you quit your job without a valid reason, were fired for misconduct, or do not meet the minimum earnings requirement, you may not qualify. It's crucial to understand the criteria outlined in the Utah Equal Pay - Administration and Enforcement Checklist to ensure compliance. Evaluating your situation helps in navigating the unemployment process effectively.

In Utah, you typically need to complete a 1099 form for independent contractors, not employees. If someone works as a contractor rather than as an employee, this form helps report their earnings for tax purposes. Understanding the distinction is essential for compliance with the Utah Equal Pay - Administration and Enforcement Checklist and federal regulations. For accurate and efficient document preparation, consider utilizing US Legal Forms to simplify your tax reporting requirements.