Utah Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

If you need thorough, download, or printing legal document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Take advantage of the site's straightforward and convenient search to find the documents you require.

A range of templates for business and personal applications are organized by categories and states, or keywords.

Step 4. Once you locate the form you need, click on the Buy now button. Select the pricing plan you prefer and add your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Utah Self-Employed Independent Contractor Consulting Agreement - Detailed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to get the Utah Self-Employed Independent Contractor Consulting Agreement - Detailed.

- You can also find forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to explore other versions of the legal document template.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

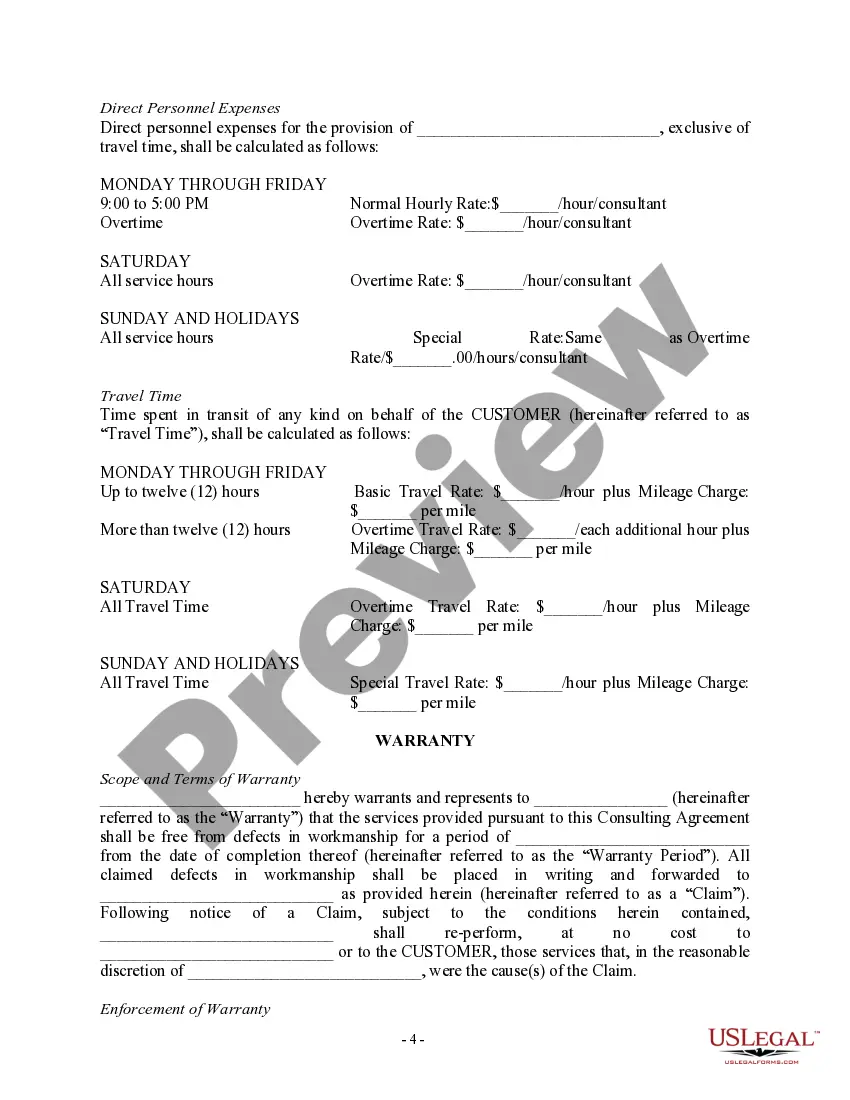

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.