Utah Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business

Description

How to fill out Contract With Independent Contractor To Perform Advertising Services To A Financial Services Business?

You might spend hours online searching for the proper legal document format that complies with the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that can be examined by experts.

You can download or print the Utah Contract with Independent Contractor to Provide Advertising Services to a Financial Services Business from the services.

If available, use the Review button to browse through the document format as well.

- If you have a US Legal Forms account, you can Log In and then click the Acquire button.

- Afterward, you can complete, adjust, print, or sign the Utah Contract with Independent Contractor to Provide Advertising Services to a Financial Services Business.

- Every legal document format you buy is yours permanently.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your preferred area/city.

- Read the form description to make sure you have chosen the right template.

Form popularity

FAQ

'Misclassified' refers to a situation where an individual is incorrectly identified as an independent contractor rather than an employee or vice versa. This classification affects a worker's rights and benefits, especially under labor laws in Utah. Understanding these classifications is crucial when entering a Utah Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business. Clarifying these terms helps create transparent working relationships.

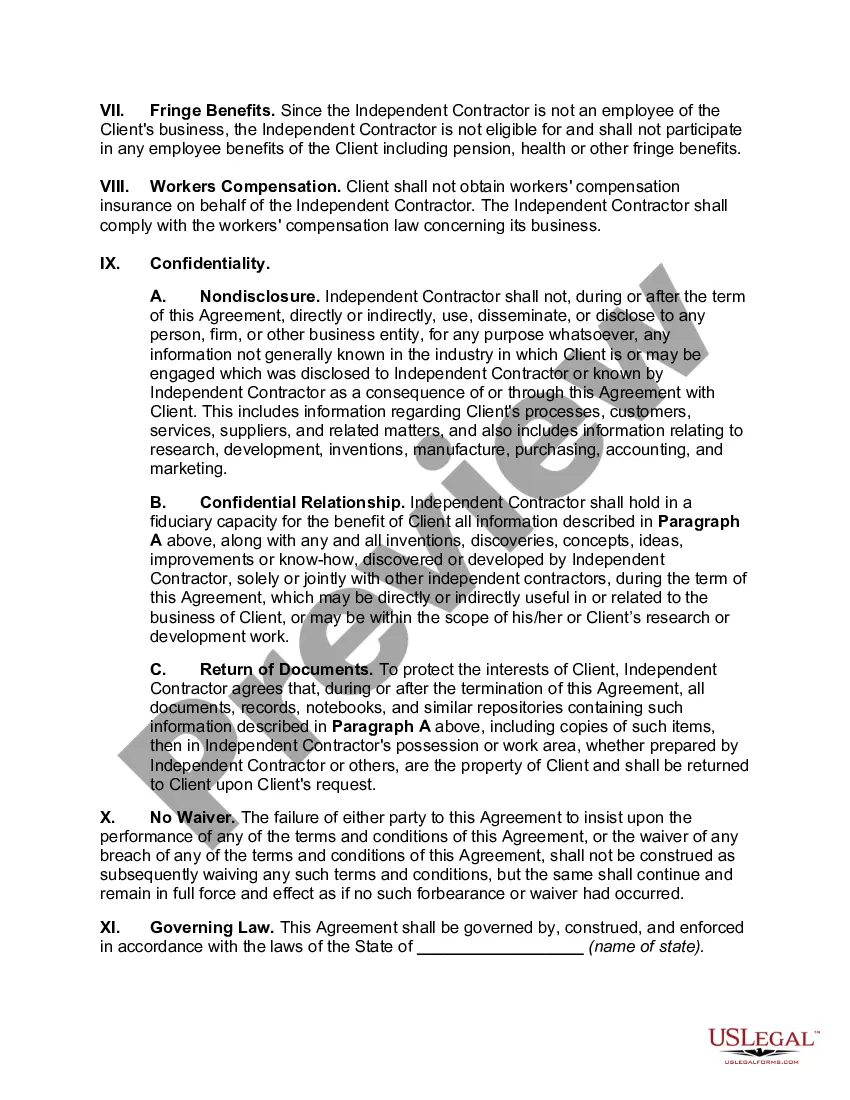

A contract for service is required when one wants to engage the services of a third-party as an independent contractor for a specific project or short-lived purpose. A contract of service is that of employment and is entered with employees who engage and perform services with the company on a day-to-day basis.

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

Using the One Stop registration, you'll pay filing fees for the Utah Department of Commerce and the Division of Corporations and Commercial Code, in addition to other agencies that may regulate your business. The fees typically range from $22.00 to $52.00 and can be paid with a credit card.

INDEPENDENT CONTRACTOR STATUS.The Contract CFO is an independent contractor. The Contract CFO shall not be deemed for any purpose to be an employee or agent of Company, and neither party shall have the power or authority to bind the other party to any contract or obligation.

All businesses in Utah are required by law to register with the Utah Department of Commerce either as a "DBA" (Doing Business As), corporation, limited liability company or limited partnership. Businesses are also required to obtain a business license from the city or county in which they are located.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Popular Business IdeasWhat Business Licenses and Permits are Needed in Utah?General Business License.Building & Zoning Permits.Business Tax Number.Sales Tax Exemption Certificate.Professional License.Employer Identification Number (EIN)Business Name Registration.