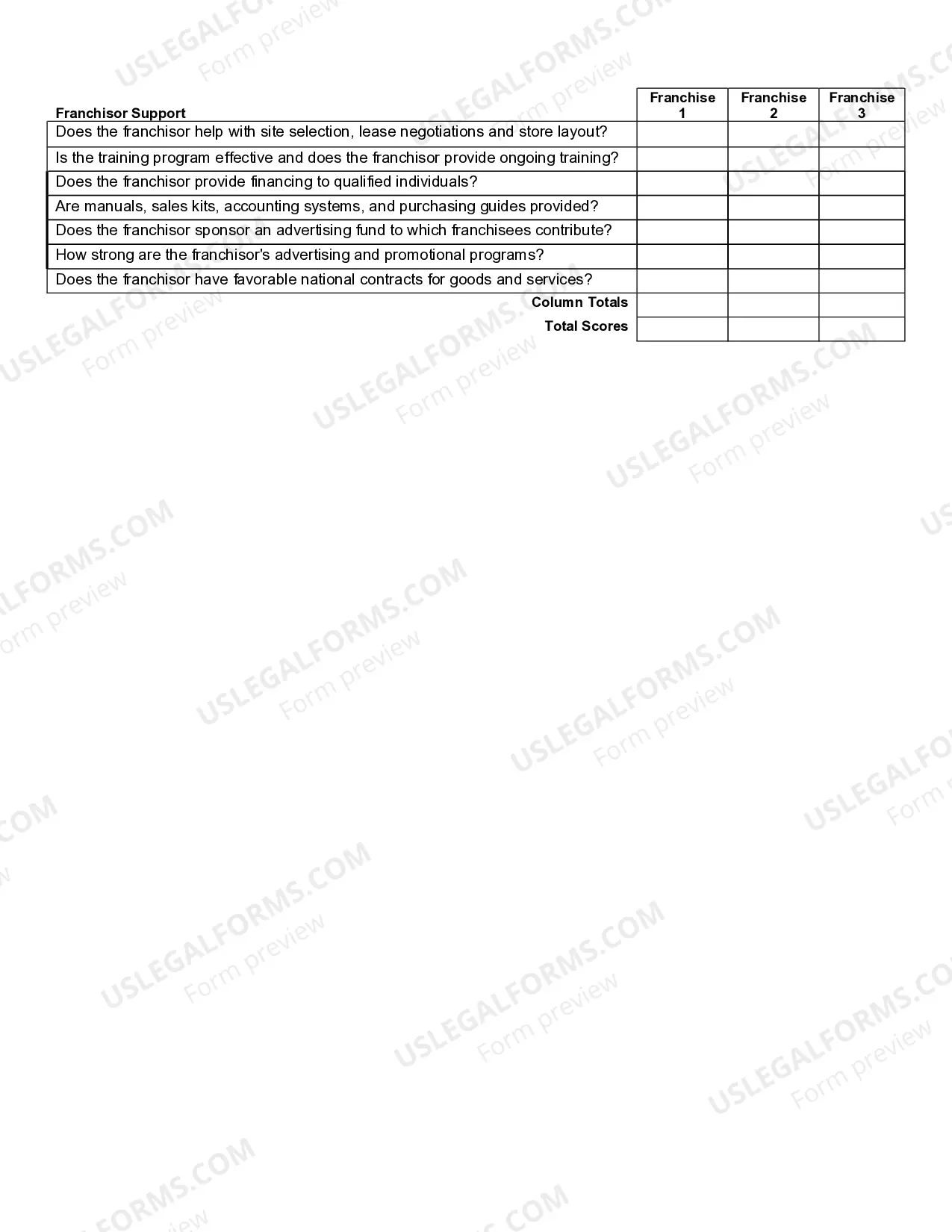

Utah Franchise Comparison Worksheet

Description

How to fill out Franchise Comparison Worksheet?

Are you currently within a position that you need files for possibly business or individual uses almost every working day? There are a variety of authorized file web templates available on the Internet, but discovering kinds you can rely on isn`t effortless. US Legal Forms offers 1000s of form web templates, such as the Utah Franchise Comparison Worksheet, that happen to be created to fulfill federal and state needs.

Should you be currently knowledgeable about US Legal Forms site and also have your account, merely log in. After that, you are able to download the Utah Franchise Comparison Worksheet template.

Unless you have an profile and need to start using US Legal Forms, follow these steps:

- Discover the form you require and make sure it is for that right area/area.

- Make use of the Preview key to review the form.

- See the information to ensure that you have chosen the right form.

- When the form isn`t what you`re trying to find, take advantage of the Search field to obtain the form that meets your needs and needs.

- When you obtain the right form, simply click Get now.

- Pick the rates plan you need, fill in the specified information to produce your account, and pay money for your order utilizing your PayPal or credit card.

- Choose a hassle-free file formatting and download your version.

Locate every one of the file web templates you have bought in the My Forms menus. You may get a more version of Utah Franchise Comparison Worksheet anytime, if possible. Just click on the essential form to download or print the file template.

Use US Legal Forms, by far the most extensive collection of authorized forms, in order to save some time and steer clear of faults. The assistance offers professionally created authorized file web templates which can be used for a selection of uses. Make your account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

Failure to file your returns or pay in a timely manner will result in a penalty of $20 or 10% of the total tax due, whichever is larger. If your bill remains unpaid after 90 days from the original due date, another $20 or 10% penalty will be added on.

On March 23, 2023, Utah enacted Senate Bill 203, allowing unlimited carryforward of NOLs from taxable years beginning on or after Jan. 1, 2008. NOLs carried forward to a taxable year beginning on or after Jan. 1, 2023 are limited to 80% of Utah taxable income.

Franchise Tax C corporation returns are filed on form TC-20. Every corporation that files form TC-20 must pay a minimum tax (privilege tax) of $100, regardless of whether or not the corporation exercises its right to do business.

Utah has a flat-rate income tax system. But retirees can get stung by the Beehive State's income tax, since Utah is one of 11 states that tax Social Security benefits. Sales taxes in Utah aren't high compared to other states. But Utah's average combined state and local sales tax rate is 7.19%, which is above average.

The rules state that the amount of the NOL is limited to 80% of the excess of taxable income without respect to any § 199A (QBI), § 250 (GILTI), or the NOL. For example: In this example, tax is paid on $20,000 of income even though there was an NOL carryover more than the current year's income.

The Tax Commission may only begin an audit of a Utah individual income tax return within three years of the later of the due date or the date filed, unless a substantial error is identified or fraud is involved.

The Utah corporate franchise and income tax rate is: 4.65% for taxable years beginning on or after January 1, 2023; 4.85% for taxable years beginning on or after January 1, 2022, and before January 1, 2023; 4.95% for taxable years beginning on or after January 1, 2018, and before January 1, 2022; and.

NOL provisions have been part of the federal tax code in varying degrees since 1918. [10] When states determine how to treat operating losses, they often use federal taxable income as the starting point. As of 2021, 19 states[11] and the District of Columbia conform to federal NOL provisions.