Utah Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the best variety of legal forms available online.

Employ the site’s straightforward and effective search to locate the documents you need.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Every legal document template you purchase is yours indefinitely. You can access each form you downloaded in your account. Click the My documents section and choose a form to print or download again.

Compete and acquire, and print the Utah Notice of Default on Promissory Note Installment with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to locate the Utah Notice of Default on Promissory Note Installment in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Utah Notice of Default on Promissory Note Installment.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/territory.

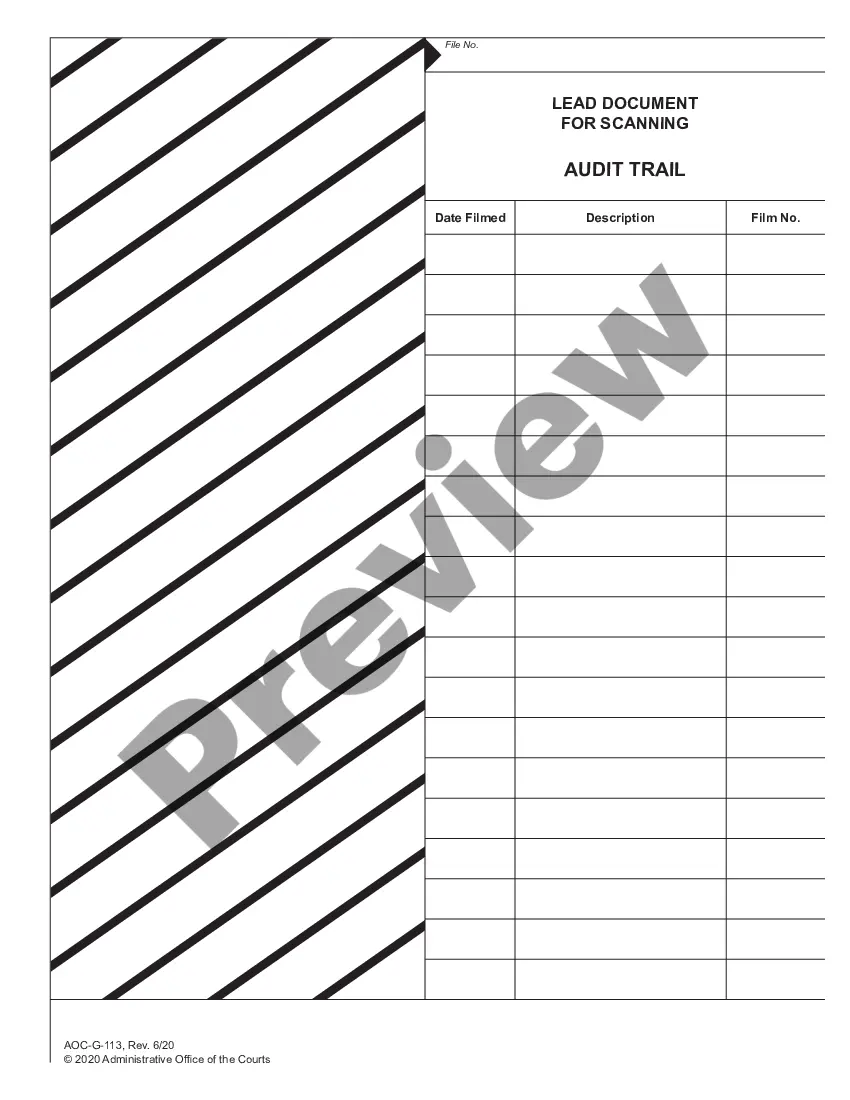

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types in the legal form template.

- Step 4. Once you find the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Utah Notice of Default on Promissory Note Installment.

Form popularity

FAQ

After a notice of default and trustee's sale is recorded, the first step is the opportunity for the borrower to bring their payments up to date. This stage often involves a period where the borrower can cure the default before further action is taken. If the borrower does not take the necessary steps, the property may proceed to trustee's sale, where it could be sold to recover the owed amount. Utilizing U.S. Legal Forms can offer valuable resources and guidance during this critical phase.

Receiving a default notice, especially a Utah Notice of Default on Promissory Note Installment, should prompt immediate action. This notice indicates that you are behind on payments, and it outlines your options to rectify the situation. Responding quickly can prevent further repercussions, such as foreclosure or judgment against you. Consider utilizing platforms like uslegalforms to help you prepare appropriate responses and documentation to address the notice effectively.

If someone defaults on a promissory note, particularly in the context of a Utah Notice of Default on Promissory Note Installment, they may face several consequences. The lender could initiate collection efforts or legal proceedings to recover the owed amount. Additionally, the default could negatively affect the borrower’s credit rating, making it challenging to secure future loans. It's vital to communicate with the lender to discuss possible solutions before the situation escalates.

When you receive a notice of default related to a Utah Notice of Default on Promissory Note Installment, it signifies that the lender has formally acknowledged that you have not fulfilled your payment obligations. This notice typically allows you a set period to address the default and make the necessary payments. Ignoring this notice might lead to further legal actions, which can impact your credit score. Therefore, it’s crucial to take this notice seriously and respond promptly.

To write a default notice regarding a Utah Notice of Default on Promissory Note Installment, start by clearly stating the reason for the notice. Include details such as the date of default, the amount owed, and any relevant terms from the original agreement. Next, provide a timeframe for the borrower to rectify the situation. Ensure you send this notice via a method that confirms receipt, like certified mail.

A notice of default on a promissory note is a formal declaration indicating that the borrower has failed to meet their payment obligations. This document serves as a warning, detailing the nature of the default and outlining the possible legal consequences. Issuing a Utah Notice of Default on Promissory Note Installment is a crucial step in protecting your rights and seeking resolution.

If someone defaults on a promissory note, start by reaching out to the borrower to discuss the default. This can often lead to amicable solutions like restructuring the payment plan. If those efforts are unsuccessful, you may then need to issue a Utah Notice of Default on Promissory Note Installment, setting the groundwork for further action.

To legally enforce a promissory note, first gather all relevant documentation, including the original note and any payment records. After ensuring your claim is valid, you can file a Utah Notice of Default on Promissory Note Installment to initiate formal proceedings. Engaging a legal professional can also help guide you through the enforcement process efficiently.

Remedies for default typically include enforcing the terms of the note through legal channels or negotiating repayment. You may also consider pursuing a Utah Notice of Default on Promissory Note Installment, which serves as a precursor to potential foreclosure or legal actions. Depending on your situation, you could explore payment plans or settlements to recover the owed amount.

When someone defaults on a promissory note, you should review the terms of the note and any applicable laws. Take a moment to communicate with the borrower to discuss the situation and explore possible solutions. If necessary, you can then issue a Utah Notice of Default on Promissory Note Installment, which formalizes your intent to take action regarding the default.