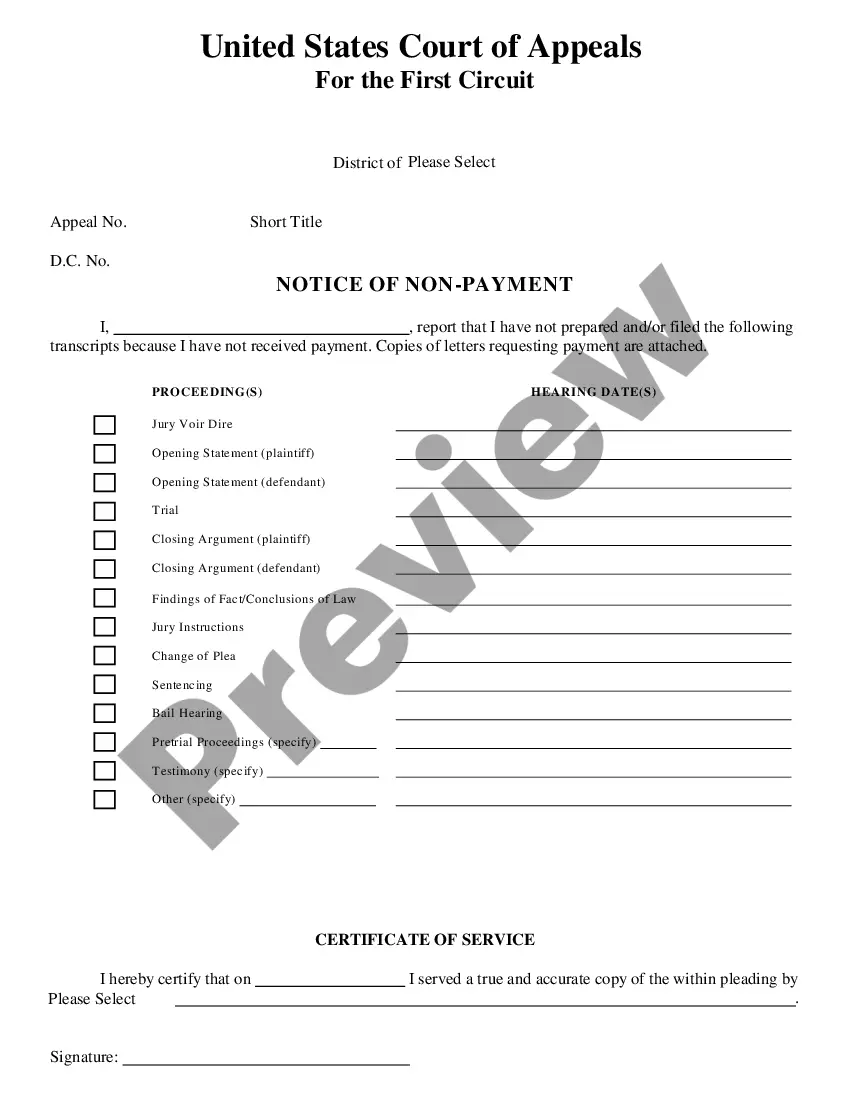

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Utah Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Finding the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers a wide array of templates, including the Utah Notice of Default in Payment Due on Promissory Note, suitable for both business and personal needs. All forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to save the Utah Notice of Default in Payment Due on Promissory Note. Use your account to review the legal forms you have previously purchased. Visit the My documents section of your account to download another copy of the form you need.

Fill out, modify, print, and sign the downloaded Utah Notice of Default in Payment Due on Promissory Note. US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of this service to obtain professionally crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct template for your town/county. You can preview the form using the Review button and examine the form details to confirm that it is suitable for you.

- If the template does not meet your standards, use the Search feature to find the appropriate form.

- Once you are confident that the form is correct, click the Purchase now button to acquire the document.

- Select the pricing plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

In Utah, a Notice of Default in Payment Due on Promissory Note is a formal declaration from a lender indicating that a borrower has failed to make timely payments. This notice is a critical step in the foreclosure process, as it outlines the borrower's default and the necessary actions they must take to remedy the situation. Utilizing resources like uslegalforms can help you navigate this process efficiently and protect your rights.

A promissory note is typically a highly enforceable legal instrument. As long as it includes essential details such as the amount due and repayment terms, courts generally uphold its validity. In cases of default, the Notice of Default in Payment Due on Promissory Note becomes a key document to proceed with legal actions against the borrower.

To foreclose on a promissory note, you must first issue a Notice of Default in Payment Due on Promissory Note to the borrower. This notice informs them of the default and provides a timeline for remittance. If the borrower fails to respond within the specified time, you can initiate court proceedings or a non-judicial foreclosure, depending on your state's laws.

Defaulting on a promissory note triggers a series of legal actions by the lender. This often begins with a Notice of Default in Payment Due on Promissory Note, which formally notifies you of late payments. Failure to address this notice can lead to foreclosure, where the lender seeks to reclaim the asset pledged against the note.

Yes, you can foreclose on a promissory note if the borrower defaults. A promissory note serves as a legal document indicating that a debt exists, and when payments are missed, this can lead to initiation of foreclosure. In Utah, understanding the Notice of Default in Payment Due on Promissory Note is crucial, as it outlines the process and the rights of the lender to reclaim the property.

When someone defaults on a promissory note, several things may occur depending on the agreement terms. Typically, the lender may issue a Utah Notice of Default in Payment Due on Promissory Note, notifying the borrower of their missed payments. If the borrower fails to address the situation, the lender can pursue legal remedies, which may include collection actions or foreclosure. Understanding these potential outcomes is essential for anyone involved in financing agreements.

If you receive a default notice, it indicates that you have missed payments on your promissory note. In the case of the Utah Notice of Default in Payment Due on Promissory Note, this document warns you about the seriousness of the situation and outlines the amounts due. It's important to address the notice promptly, either by making the overdue payment or contacting the lender to discuss your options. Ignoring the notice may lead to further consequences, including legal action.

When someone defaults on a promissory note, the first step is to review the terms of the note and determine the next course of action. If you receive a Utah Notice of Default in Payment Due on Promissory Note, reach out to the borrower to discuss their situation and explore potential solutions. It's crucial to document all communications and consider legal advice if the matter escalates. Taking proactive steps can lead to a resolution that benefits both parties.

To write a notice of default, start by including the date, the parties involved, and a clear statement of the default. In the case of the Utah Notice of Default in Payment Due on Promissory Note, you should specify the missed payments, the total amount owed, and any necessary actions the borrower must take. Make sure to use straightforward language and provide a deadline for the borrower to respond or remedy the default. Utilizing templates available on platforms like US Legal Forms can simplify this process significantly.

A notice of default on a promissory note is a formal declaration that the borrower has not met their payment obligations. In the context of the Utah Notice of Default in Payment Due on Promissory Note, this serves as a crucial communication tool. It alerts the borrower about the delinquency and details the specific payments that are overdue. This notice plays a key role in the collection process, letting borrowers know the seriousness of their missed payments.