Utah Disclaimer of Inheritance Rights for Stepchildren

Description

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

Choosing the right lawful record template can be a struggle. Naturally, there are plenty of web templates available on the net, but how can you discover the lawful develop you require? Utilize the US Legal Forms internet site. The service offers a huge number of web templates, including the Utah Disclaimer of Inheritance Rights for Stepchildren, which you can use for enterprise and personal requires. All the forms are checked out by specialists and meet state and federal requirements.

If you are currently listed, log in to the accounts and then click the Down load option to obtain the Utah Disclaimer of Inheritance Rights for Stepchildren. Make use of your accounts to check with the lawful forms you might have purchased earlier. Go to the My Forms tab of the accounts and have an additional copy from the record you require.

If you are a fresh consumer of US Legal Forms, allow me to share basic directions so that you can follow:

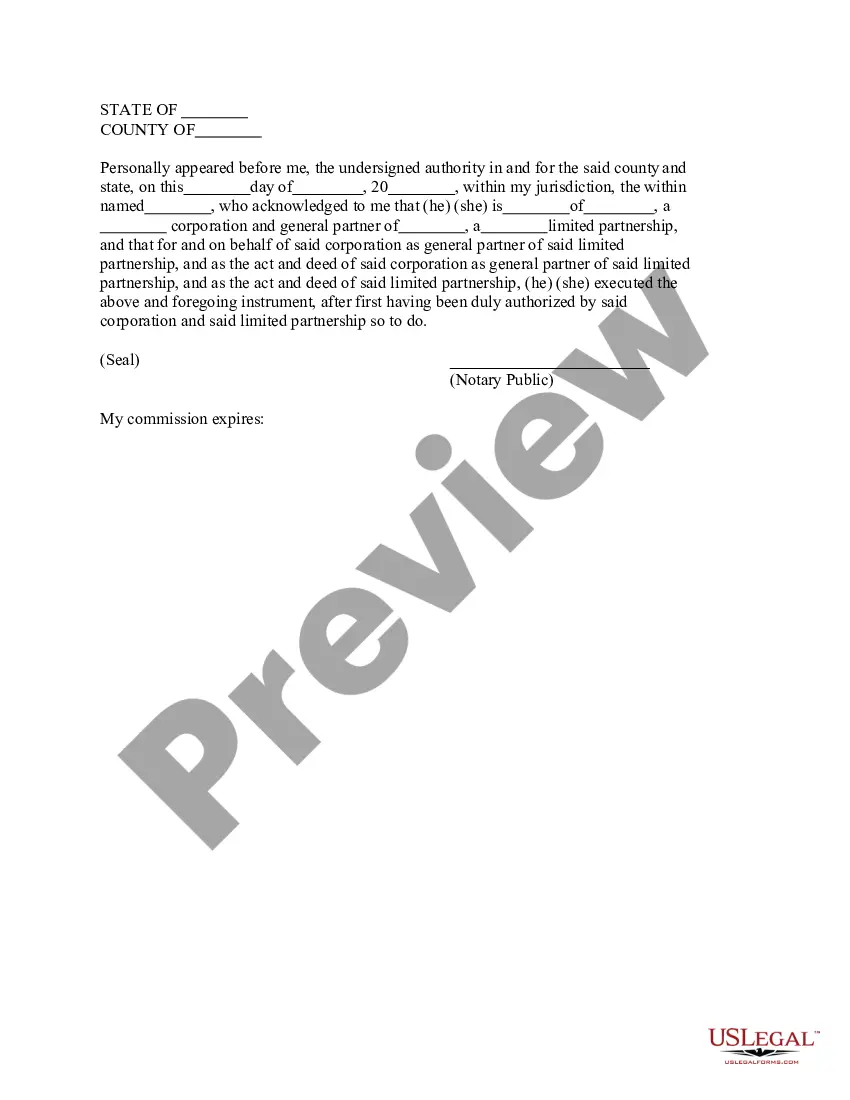

- Initial, be sure you have chosen the proper develop for your personal area/state. You may check out the form while using Review option and look at the form information to make certain it will be the best for you.

- In the event the develop will not meet your expectations, take advantage of the Seach field to discover the appropriate develop.

- When you are certain that the form is proper, click the Purchase now option to obtain the develop.

- Opt for the costs program you would like and enter the essential information and facts. Create your accounts and purchase your order using your PayPal accounts or Visa or Mastercard.

- Opt for the data file file format and obtain the lawful record template to the system.

- Complete, modify and print and signal the acquired Utah Disclaimer of Inheritance Rights for Stepchildren.

US Legal Forms will be the greatest catalogue of lawful forms where you can find different record web templates. Utilize the service to obtain appropriately-created documents that follow condition requirements.

Form popularity

FAQ

Survivorship period. To inherit under Utah's intestate succession statutes, a person must outlive you by 120 hours. So, if you and your brother are in a car accident and he dies a few hours after you do, his estate would not receive any of your property. (Utah Code § 75-2-104.)

Key Takeaways. Divvying up your estate in an equal way between your children often makes sense, especially when their histories and circumstances are similar. Equal distribution can also avoid family conflict over fairness or favoritism.

Your spouse will inherit the first $75,000 of your intestate property, and half of what remains of your intestate property after that. Your descendants will then inherit everything else. In Utah, the value of non-probate transfers count as part of the intestate estate.

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

Children in Utah Inheritance Law Intestate Succession: Spouses and ChildrenInheritance SituationWho Inherits Your PropertyChildren but no spouse? Children inherit everythingSpouse but no descendants? Spouse inherits everythingSpouse and descendants from you and that spouse? Spouse inherits everything1 more row ?

Selling a House with Multiple Inheritors in Utah: If the inherited property has multiple heirs, the majority can decide to sell the house by filing a lawsuit of partition action in the state probate court of Utah.

Parent and child relationship. Inheritance from or through a child by either natural parent or the child's kindred is precluded unless that natural parent has openly treated the child as the natural parent's, and has not refused to support the child.

Step-siblings would only fit into sibling intestate succession if they were legally adopted by the parent of the decedent, thus having become their legal sibling. Usually, siblings will each be given an equal share of the Estate through probate court.