Utah Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

If you wish to comprehensive, acquire, or printing lawful record web templates, use US Legal Forms, the greatest selection of lawful kinds, which can be found online. Make use of the site`s easy and hassle-free lookup to discover the documents you require. Different web templates for company and person reasons are categorized by classes and says, or key phrases. Use US Legal Forms to discover the Utah Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property in a couple of clicks.

In case you are currently a US Legal Forms customer, log in to the profile and click the Down load key to get the Utah Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. Also you can entry kinds you formerly downloaded in the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for your proper town/nation.

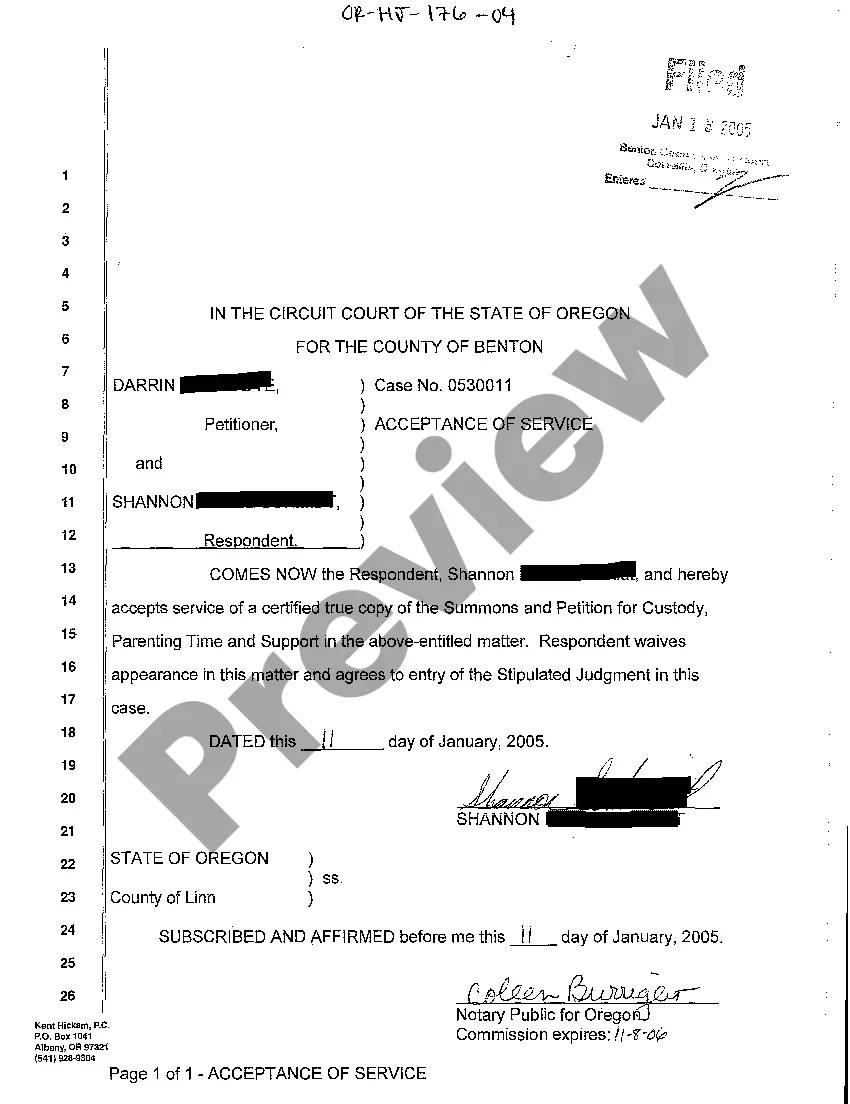

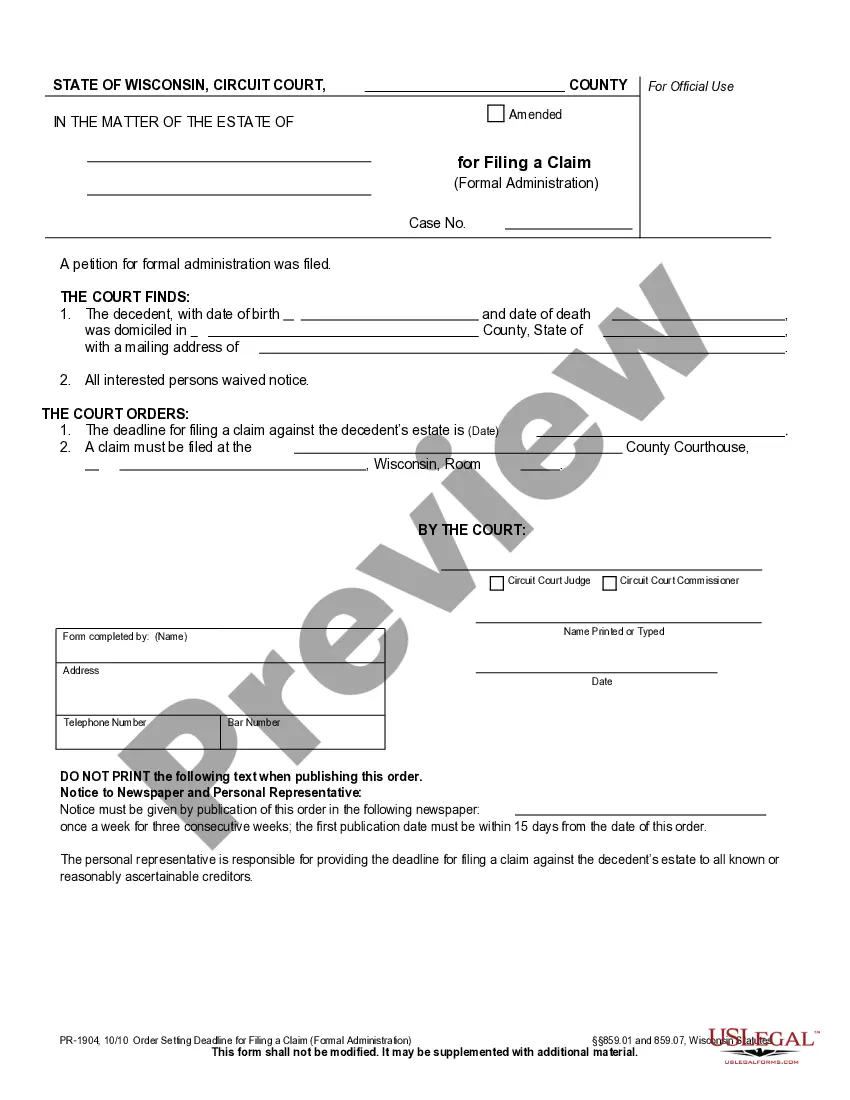

- Step 2. Use the Review method to look over the form`s content. Never forget about to read the explanation.

- Step 3. In case you are unsatisfied with the type, make use of the Look for industry near the top of the display to find other versions of your lawful type format.

- Step 4. After you have discovered the shape you require, select the Purchase now key. Opt for the prices strategy you favor and add your references to register for the profile.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal profile to perform the transaction.

- Step 6. Choose the formatting of your lawful type and acquire it on your system.

- Step 7. Complete, revise and printing or signal the Utah Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

Every lawful record format you buy is the one you have forever. You may have acces to each and every type you downloaded in your acccount. Select the My Forms segment and select a type to printing or acquire once more.

Compete and acquire, and printing the Utah Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property with US Legal Forms. There are millions of professional and express-particular kinds you can use to your company or person requires.

Form popularity

FAQ

If you decide to disclaim an inheritance, there are specific steps you must follow to ensure that the process is legally valid. First, the disclaimer must be in writing and signed by the potential heir. The disclaimer must also be delivered to the executor of the estate or the trustee in charge of the assets.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusal?known as the "disclaimer"?and the procedure you must follow to ensure that it is considered qualified under federal and state law. Declining an Inheritance - Investopedia Investopedia ? articles ? refuseinherit... Investopedia ? articles ? refuseinherit...

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ... Thanks, But No Thanks! How To Refuse An Inheritance By Disclaiming greatoakadvisors.com ? disclaiming greatoakadvisors.com ? disclaiming

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from. How to Disclaim an Inheritance (And Why You Would) SmartAsset ? financial-advisor ? disclaim-in... SmartAsset ? financial-advisor ? disclaim-in...

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal. Reasons to Disclaim an Inheritance - Trust & Will Trust & Will ? learn ? reasons-to-disclaim-a... Trust & Will ? learn ? reasons-to-disclaim-a...