Utah Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

Finding the right legal file design could be a battle. Needless to say, there are a lot of web templates available on the Internet, but how do you find the legal develop you require? Use the US Legal Forms web site. The support delivers 1000s of web templates, such as the Utah Sample Letter for Fraudulent Charges against Client's Account, which you can use for enterprise and private requires. All the types are checked by pros and meet federal and state needs.

Should you be presently listed, log in for your account and click on the Acquire switch to have the Utah Sample Letter for Fraudulent Charges against Client's Account. Utilize your account to search from the legal types you possess purchased in the past. Visit the My Forms tab of the account and have one more version of your file you require.

Should you be a whole new user of US Legal Forms, here are simple directions that you should adhere to:

- Initially, make certain you have selected the proper develop for your metropolis/county. You are able to look through the shape while using Review switch and read the shape description to make sure this is the best for you.

- When the develop does not meet your preferences, utilize the Seach area to discover the proper develop.

- Once you are certain the shape would work, select the Get now switch to have the develop.

- Pick the pricing prepare you want and type in the necessary information. Build your account and pay money for the order with your PayPal account or bank card.

- Select the submit format and download the legal file design for your product.

- Full, modify and print out and signal the acquired Utah Sample Letter for Fraudulent Charges against Client's Account.

US Legal Forms may be the largest library of legal types for which you will find numerous file web templates. Use the service to download skillfully-created papers that adhere to condition needs.

Form popularity

FAQ

Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.

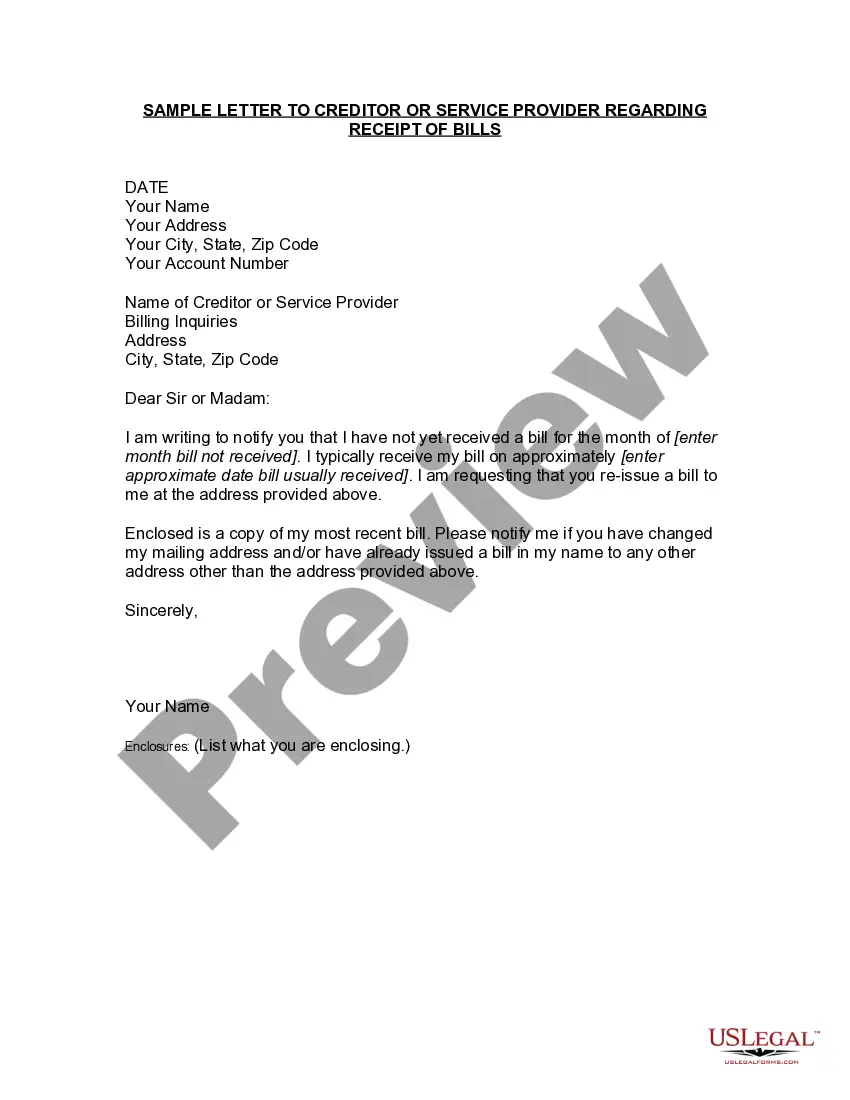

Disputing billing errors You must mail a letter to the creditor's address for ?billing inquiries,? not payments, and include your name, address, account number, a description of the billing error, and copies of receipts or other supporting documents.

Filing a false credit card dispute should never be done; it is credit card fraud and can have consequences like fines, court fees, jail time, blacklisting, and hurt your credit scores.

Your first move for an incorrect charge on your account should be to contact the merchant?you might be able to get a refund or some other resolution without involving the credit card issuer. If that fails, or you believe fraud was involved, you can contact your credit card issuer. Most have zero liability for fraud.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

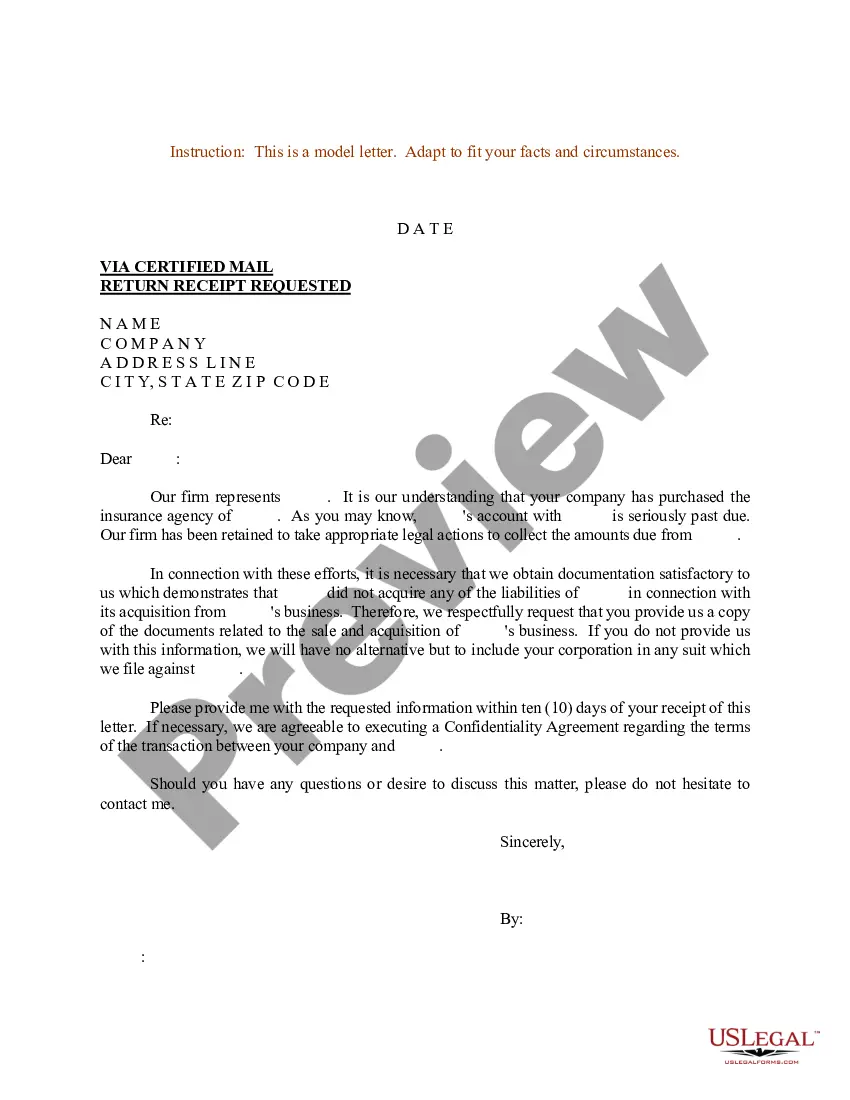

I am writing to tell you that the payment was an unauthorized transfer. My bank account number is [x-x]. My account statement or other notification sent by you shows that an automatic payment was made to [Company name]. However this payment was unauthorized.

Send your letter so that it reaches the issuer within 60 days after the first bill with the error was sent to you. If you send your letter certified mail and ask for a return receipt, that gives you proof of what the issuer got. Include copies (not originals) of receipts or other documents that support your position.

Steps to Disputing a Credit Card Charge Review the Charge. ... Contact the Merchant. ... Contact the Credit Card Company. ... Gather Evidence and Send Dispute Paperwork. ... Continue Making Minimum Payments. ... Wait for a Resolution (And Appeal if Necessary)