Minnesota Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

If you require to complete, download, or print legal record templates, utilize US Legal Forms, the most comprehensive collection of legal documents that are accessible online.

Make use of the website's straightforward and user-friendly search to discover the files you require.

A variety of templates for business and personal purposes are categorized by types and regions, or keywords. Employ US Legal Forms to locate the Minnesota Revocable Living Trust for House in just a few clicks.

Each legal document template you purchase is yours indefinitely. You will have access to every type you downloaded in your account.

Click on the My documents section and choose a form to print or download again. Finalize, download, and print the Minnesota Revocable Living Trust for House with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the Minnesota Revocable Living Trust for House.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are new to US Legal Forms, refer to the guidelines below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Minnesota Revocable Living Trust for House.

Form popularity

FAQ

Establishing a Minnesota Revocable Living Trust for House offers seamless transfer of property upon death, avoiding probate. This can save your heirs time and legal fees. Additionally, it provides you the flexibility to amend or revoke the trust during your lifetime. Many people choose this option for its benefits in estate planning.

Putting your house in a Minnesota Revocable Living Trust for House may limit your control over the property while alive. You also face possible costs related to trust management and legal fees. Furthermore, if you ever wish to sell the house, the process may require additional steps. Thus, it's crucial to understand these implications before proceeding.

To transfer your house into a Minnesota Revocable Living Trust for House, you need to execute a deed that transfers the property title. This deed must then be recorded with the county recorder's office. Ensure you have the correct legal documents ready, and it may be beneficial to use an online platform like US Legal Forms for simplicity in compliance.

One disadvantage of a Minnesota Revocable Living Trust for House is that it does not protect assets from creditors. Additionally, creating and managing a trust can come with upfront costs. While it allows for easy transfer of assets, it may also result in a lack of privacy, as trust documents can be reviewed during disputes. We recommend consulting professionals to weigh the pros and cons.

You can place a house with a mortgage into a Minnesota Revocable Living Trust for House. However, the lender may have specific requirements. It's important to notify the lender about the transfer to ensure compliance with the mortgage terms. Reviewing your mortgage documents will help clarify this process.

A trust is a legal arrangement where one party holds assets for the benefit of others, such as a Minnesota Revocable Living Trust for House. In contrast, a certificate of trust is a summary document that verifies the existence of a trust without disclosing its specific terms. While the trust outlines the management and distribution of assets, the certificate serves as proof for third parties. Understanding this distinction can clarify your estate planning strategy.

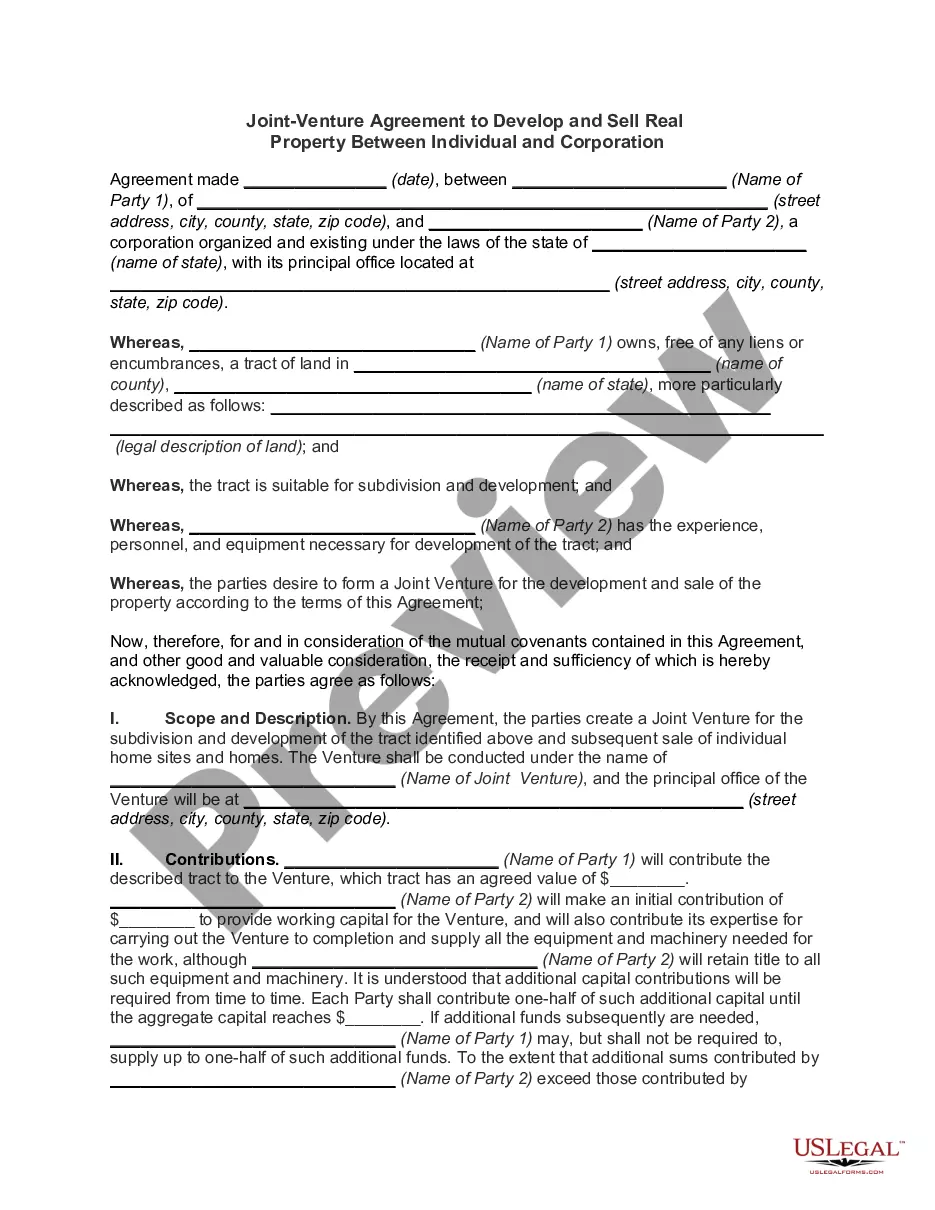

Filling out a Minnesota Revocable Living Trust for House involves several essential steps. Start by identifying the grantor, the beneficiaries, and the assets you want to include in the trust. You can use templates available on platforms like uslegalforms to simplify the process. Make sure to consult with an attorney to finalize the document and ensure it reflects your wishes clearly and accurately.

To record a certificate of trust in Minnesota, you should prepare a certificate that outlines the essential details of your Minnesota Revocable Living Trust for House. Although not required, you can file this certificate with the county recorder in the county where the trust holds real estate. Doing this adds an extra layer of security for your trust assets and allows third parties to verify trust details when necessary. Always consult with a legal professional to ensure the certificate is properly formatted.

Trusts in Minnesota are generally not recorded in public records. The Minnesota Revocable Living Trust for House operates privately, allowing you to maintain control over your assets without public scrutiny. This privacy can provide peace of mind while ensuring your estate planning aligns with your wishes. Keeping your trust details confidential can also help protect your family's financial future.

In Minnesota, a certificate of trust does not need to be recorded. However, if you want to enhance the credibility of your Minnesota Revocable Living Trust for House, you may choose to provide a certificate of trust to third parties. It can simplify transactions, such as when dealing with banks or real estate. This helps you establish your authority without publicly disclosing the entire trust document.