Utah Sample Letter for Request to Include Landlord in Tenant's Liability Insurance

Description

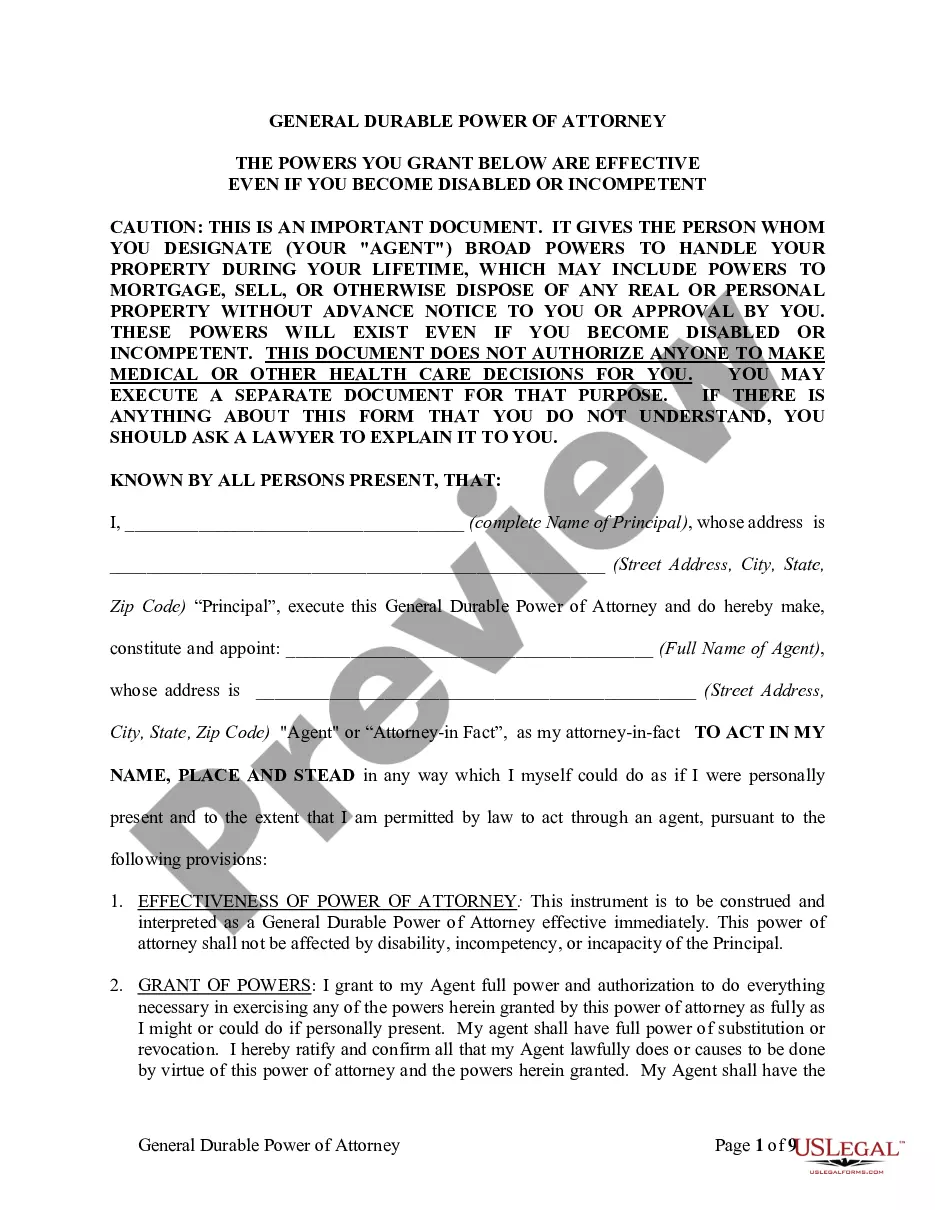

How to fill out Sample Letter For Request To Include Landlord In Tenant's Liability Insurance?

If you need to finish, acquire, or print legal document templates, leverage US Legal Forms, the largest selection of legal documents available on the web.

Make use of the site's straightforward and convenient search feature to obtain the documents you need.

A wide range of templates for business and individual purposes are categorized by type, claims, or keywords.

Step 4. Once you have identified the necessary form, click the Purchase now button. Choose your preferred pricing plan and provide your information to register for an account.

Step 5. Complete the transaction. You can use a credit card or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the Utah Sample Letter for Request to Include Landlord in Tenant's Liability Insurance with just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Obtain button to locate the Utah Sample Letter for Request to Include Landlord in Tenant's Liability Insurance.

- You can also access forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Review option to examine the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal document format.

Form popularity

FAQ

I am writing to make a formal complaint about:Summarise the original problem. Be as clear as you can. It is best to make it short and to the point.Explain why you are dissatisfied (list what you think wasn't done properly when the landlord responded)Explain what impact this has had on you.

The average cost of renters insurance in Utah is $12 per month, or $144 per year.

Do you need renters insurance in Utah? While renters insurance is not required by law in Utah, it can be a low-cost way to protect your property.

When writing to your landlord, be specific in describing the problems you are having. Do not exaggerate or under-emphasize the extent of the problem. The landlord may show this letter to a judge if your problem is ever litigated.

Yes, your landlord can require renters insurance as part of the legal agreement between tenant and landlord.

It keeps a clear record of conversations and it is easy to speak to all tenants and landlords at once. It is neither too formal nor too casual: you can send legal documents via email, but also wish your tenants a happy New Year. If you want to keep things simple, email is the one for you.

Homeowners insurance will not cover a dwelling that is not occupied by its owner, which is why you need landlord insurance. Core coverages of landlord insurance are property damage, rental income lost due to a property's temporary inhabitability, and liability protection.

Landlord liability insurance is a cover that can protect you from injury or damage claims related to your rental property. For example if a visitor tripped on a loose piece of flooring, your landlord liability insurance would be there to pay the compensation amount and legal fees.

There's no legal obligation for you to have landlord insurance, but most buy-to-let mortgages come with the condition that you have it. Being a landlord comes with risks that you don't have when you live in your own home.

The main difference is that contents insurance covers your belongings. If it doesn't include tenants' liability, it won't cover any damage to your landlord's belongings. If you damage your own belongings, it won't affect the deposit return on your rental.