District of Columbia Special Meeting Minutes of Shareholders

Description

How to fill out Special Meeting Minutes Of Shareholders?

You are able to invest hours online looking for the lawful document template that fits the federal and state demands you need. US Legal Forms gives 1000s of lawful varieties that are analyzed by pros. You can easily download or produce the District of Columbia Special Meeting Minutes of Shareholders from the service.

If you already have a US Legal Forms profile, you can log in and click on the Acquire switch. Next, you can total, modify, produce, or indication the District of Columbia Special Meeting Minutes of Shareholders. Each and every lawful document template you buy is yours forever. To acquire another duplicate for any purchased kind, proceed to the My Forms tab and click on the related switch.

Should you use the US Legal Forms site initially, adhere to the straightforward instructions beneath:

- First, make certain you have selected the correct document template for that region/area of your choosing. Browse the kind description to make sure you have selected the appropriate kind. If accessible, take advantage of the Preview switch to look with the document template too.

- In order to get another variation of the kind, take advantage of the Search discipline to obtain the template that fits your needs and demands.

- Upon having located the template you desire, click Acquire now to proceed.

- Find the costs prepare you desire, key in your references, and register for an account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal profile to pay for the lawful kind.

- Find the structure of the document and download it to the device.

- Make modifications to the document if possible. You are able to total, modify and indication and produce District of Columbia Special Meeting Minutes of Shareholders.

Acquire and produce 1000s of document themes utilizing the US Legal Forms site, that provides the greatest variety of lawful varieties. Use skilled and condition-distinct themes to tackle your small business or individual requires.

Form popularity

FAQ

Our meeting experts compiled 7 best practices that apply to all sorts of teams and scenarios. 1 Date and time of the meeting. ... 2 Names of the participants. ... 3 Purpose of the meeting. ... 4 Agenda items and topics discussed. ... 5 Key decisions and action items. ... 6 Next meeting date and place. ... 7 Documents to be included in the report.

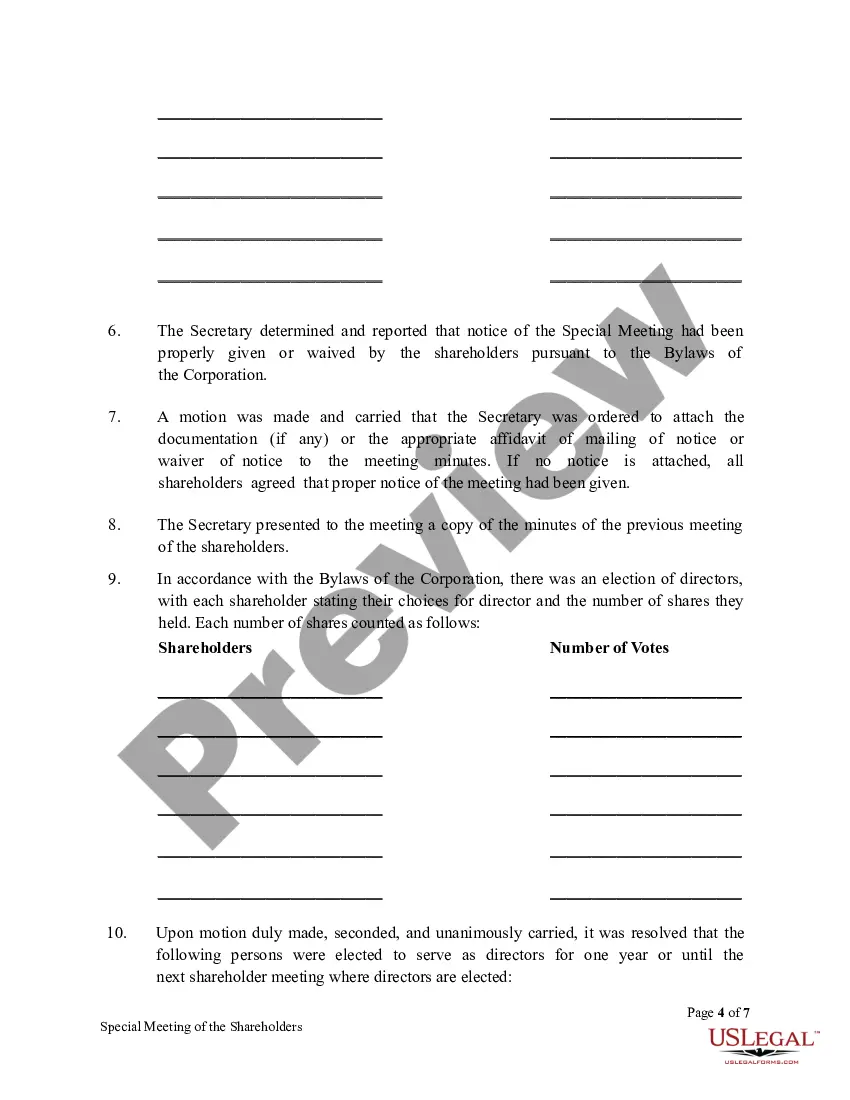

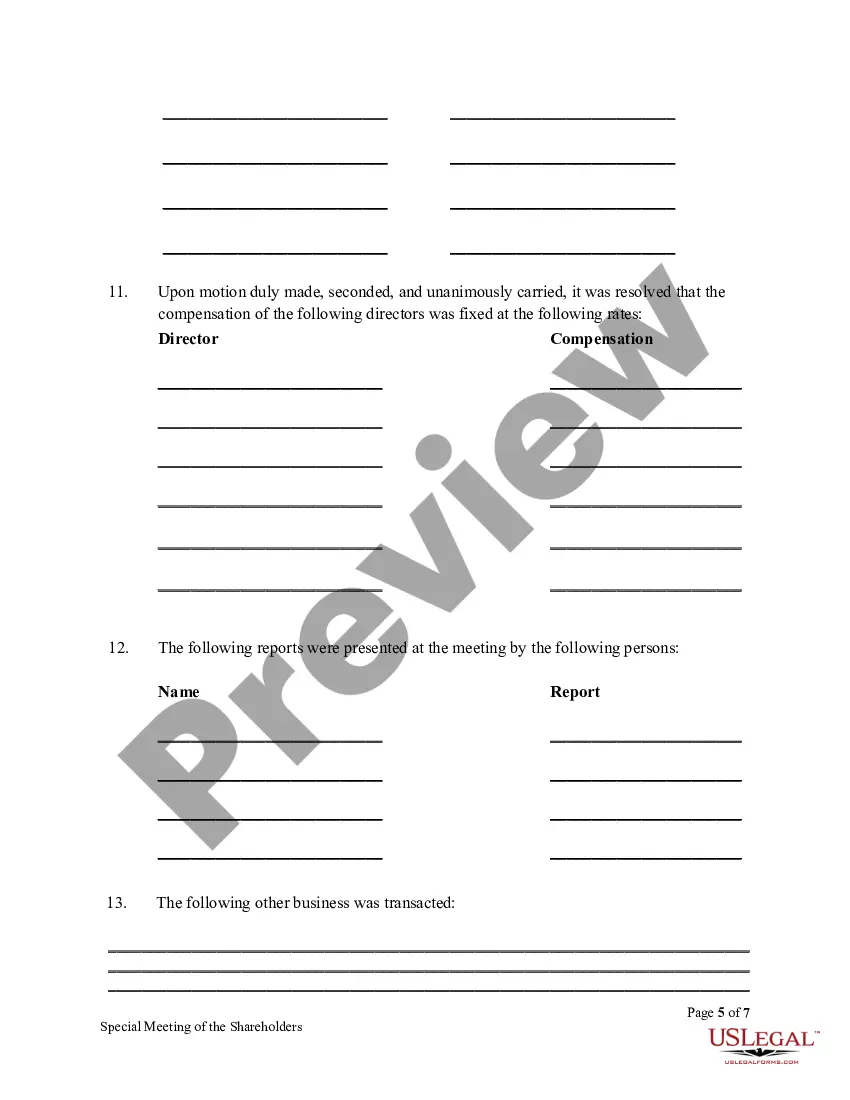

As for content, in general, your S corporation's meeting minutes should contain the following information: date and place of the meeting. who was present and who was absent from the meeting. details about the matters discussed at the meeting. results of votes taken, if any.

What should be recorded in meeting minutes? The minutes should include corporation details like the name of the corporation and the names of the chairperson and secretary of the meeting. The meeting place and time should also be found somewhere in the minutes, along with the names of the shareholders.

Minutes of general meeting Agenda item 1: Welcome, attendees and apologies. ... Agenda item 2: Proxy appointments. ... Agenda item 3: Minutes of previous meeting and matters arising. ... Agenda item 4: Business of the meeting. ... Agenda item 7: Special resolution/s (if relevant) ... Agenda item 9: Any other business.

How to write meeting minutes reports Make an outline. Prior to the meeting, create an outline by picking or designing a template. ... Include factual information. ... Write down the purpose. ... Record decisions made. ... Add details for the next meeting. ... Be concise. ... Consider recording. ... Edit and proofread.

Board of Directors (or ?the Board?) and shareholder minutes and written consents are your official, legal records of what was discussed at Board and shareholder meetings and of their decisions.

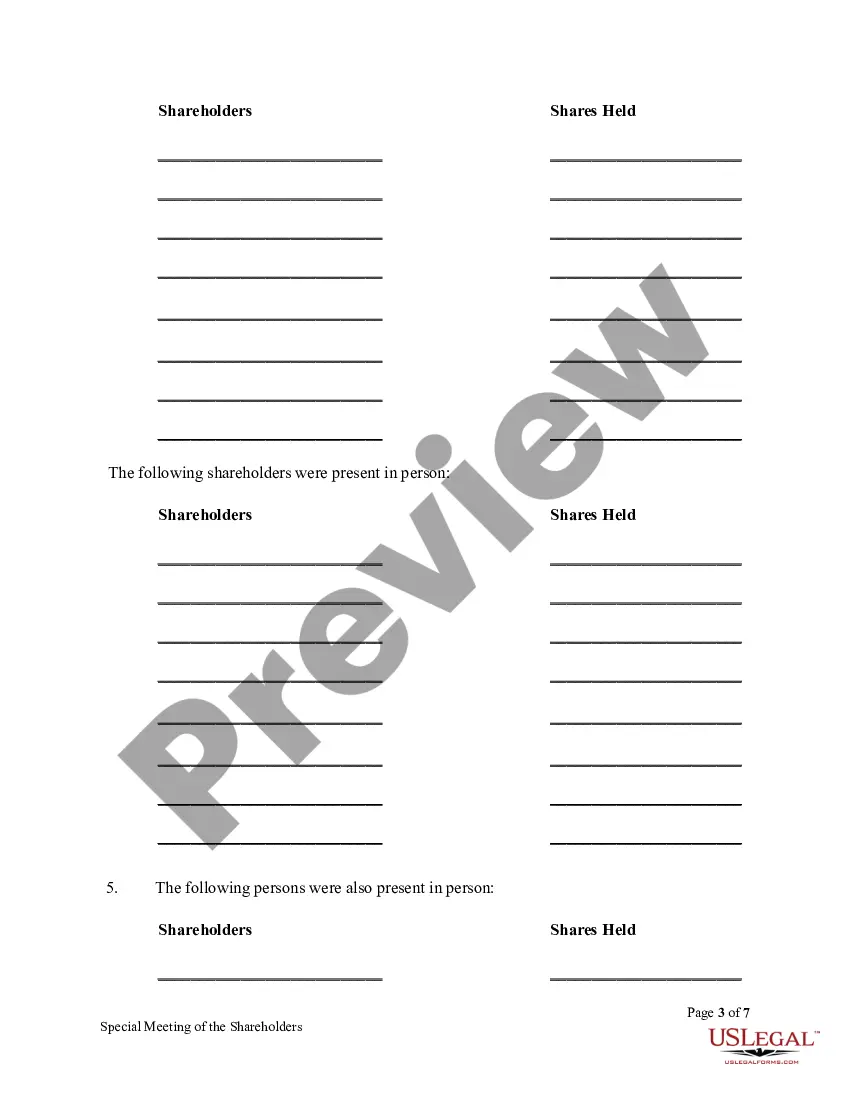

Taking Attendance Prepare a list of shareholders who were present and those who were not present. Take a roll call of all shareholders present in the meeting. Record the names and signatures of the shareholders present in the meeting. Ask for proxies for any shareholders who are not present.

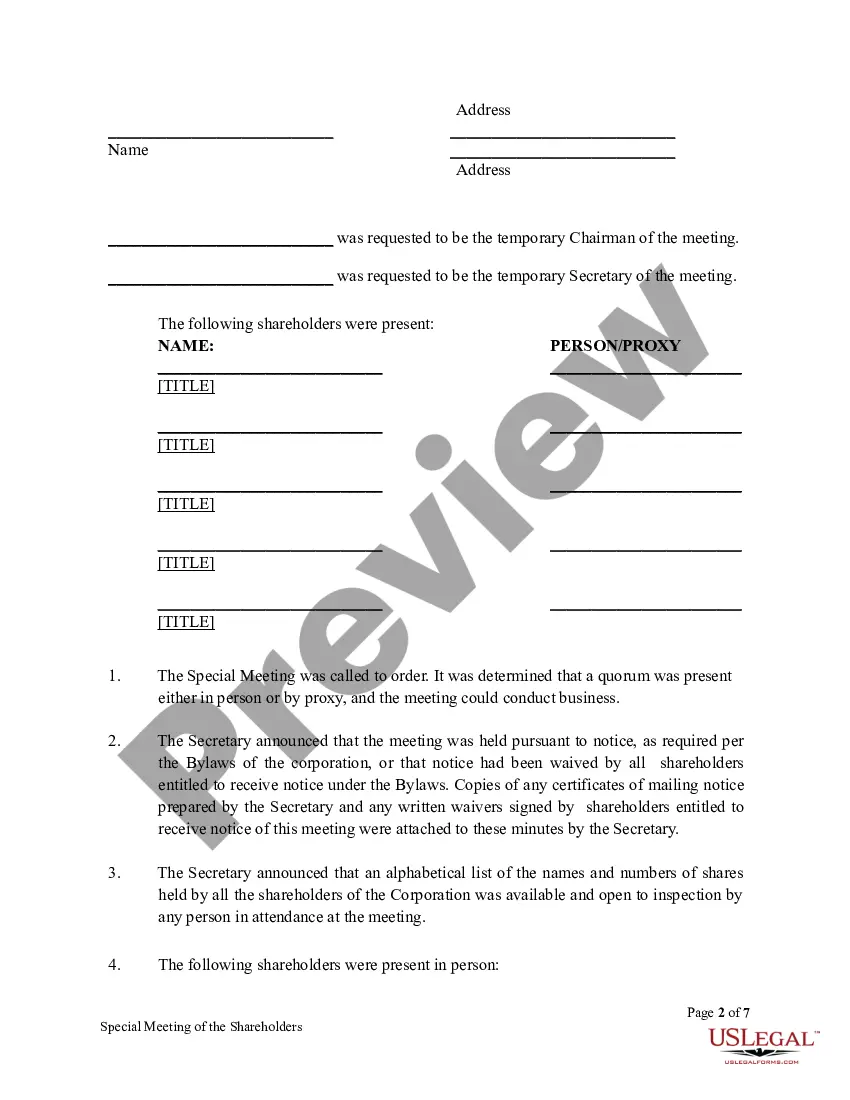

A special meeting allows shareholders to remove the current board of directors and elect a new board. The following is an explanation of the procedures for calling a special meeting of the shareholders. Enclosed are copies of documents, which you can use for your meeting.