Delaware Special Meeting Minutes of Shareholders

Description

How to fill out Special Meeting Minutes Of Shareholders?

Are you presently within a place the place you require papers for sometimes company or individual reasons virtually every time? There are a lot of lawful record templates accessible on the Internet, but getting kinds you can rely on is not straightforward. US Legal Forms provides thousands of form templates, much like the Delaware Special Meeting Minutes of Shareholders, that are published in order to meet state and federal needs.

If you are already acquainted with US Legal Forms internet site and get your account, just log in. Next, you can download the Delaware Special Meeting Minutes of Shareholders format.

Unless you come with an profile and wish to begin using US Legal Forms, follow these steps:

- Obtain the form you want and ensure it is for that appropriate town/county.

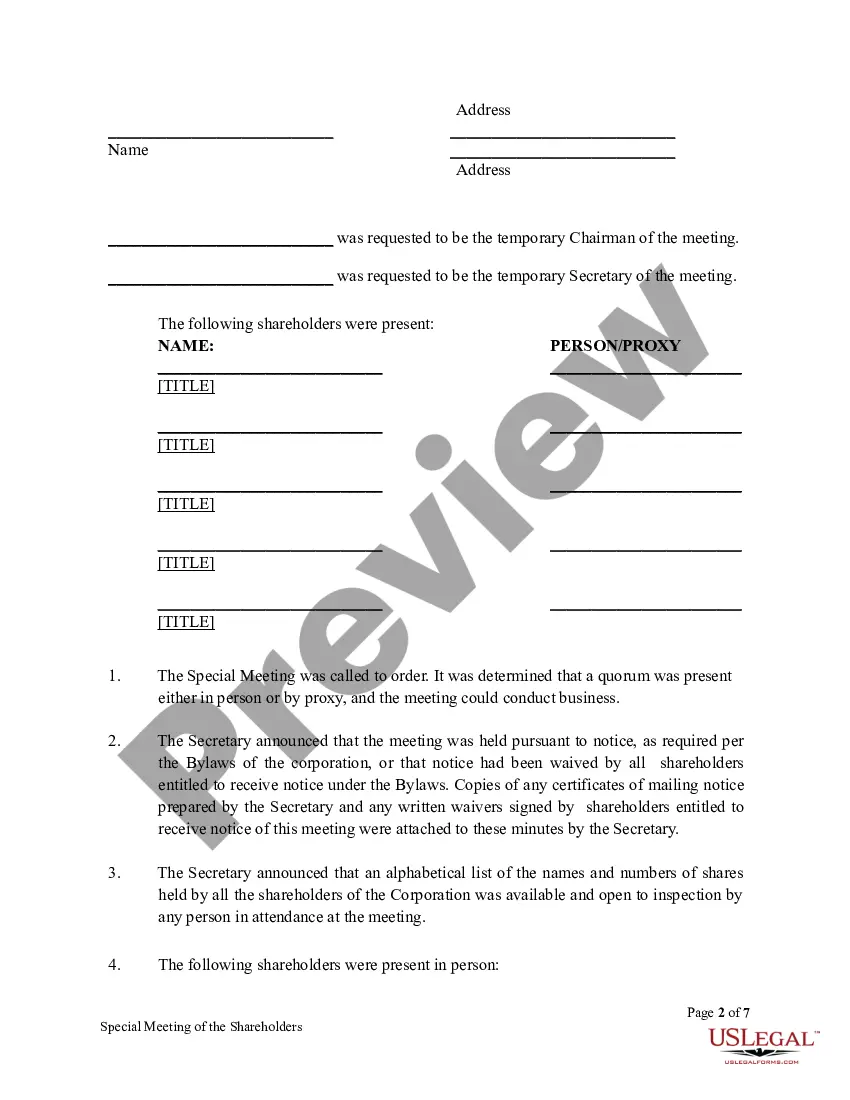

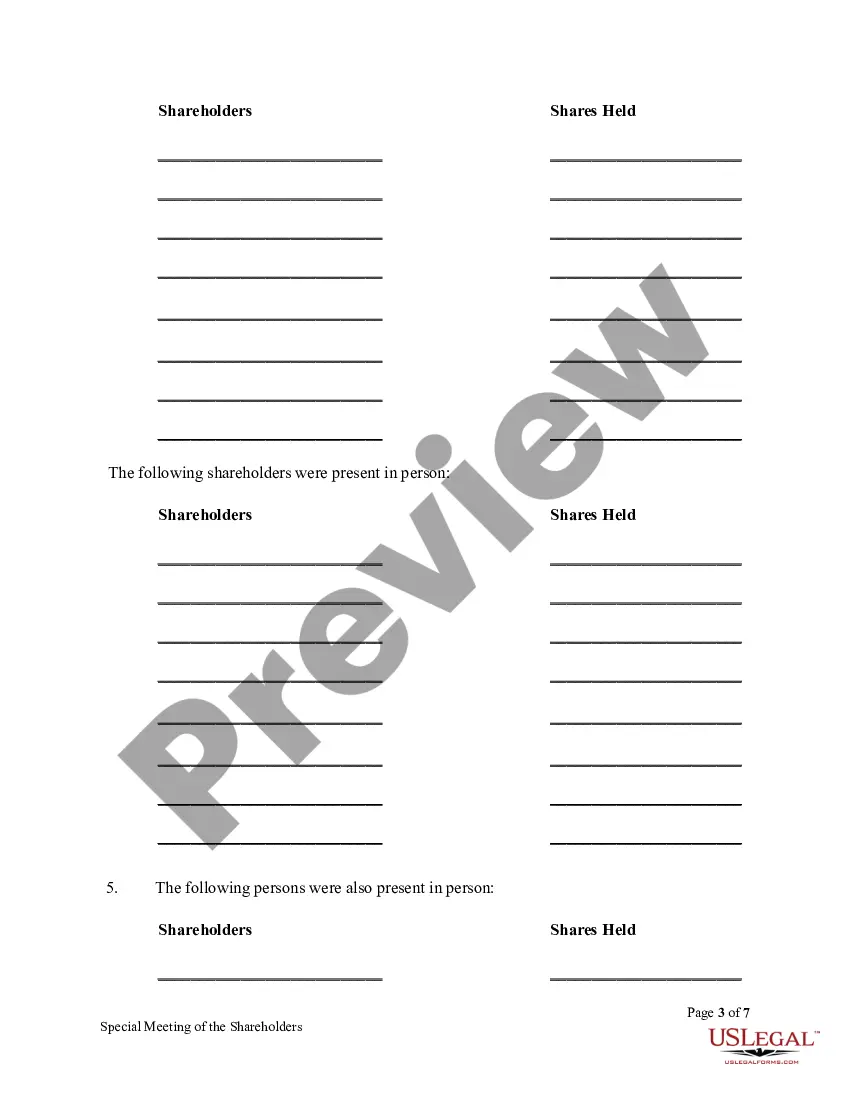

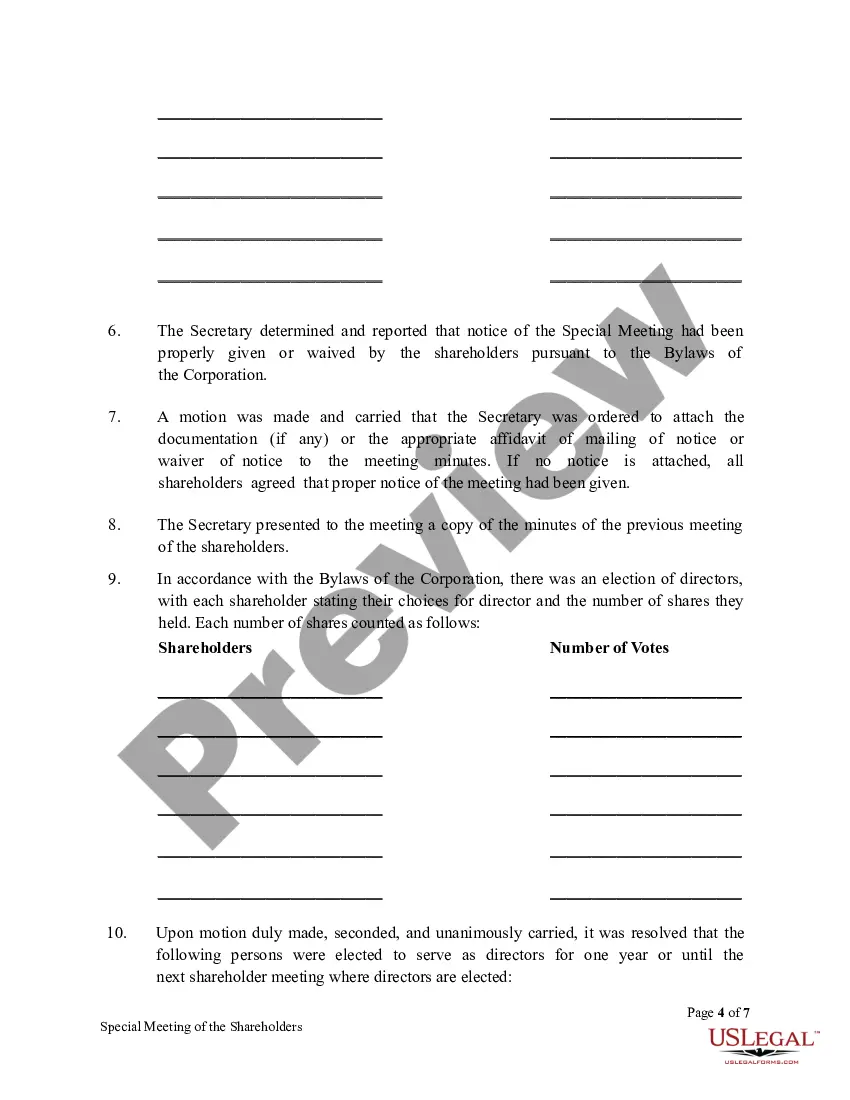

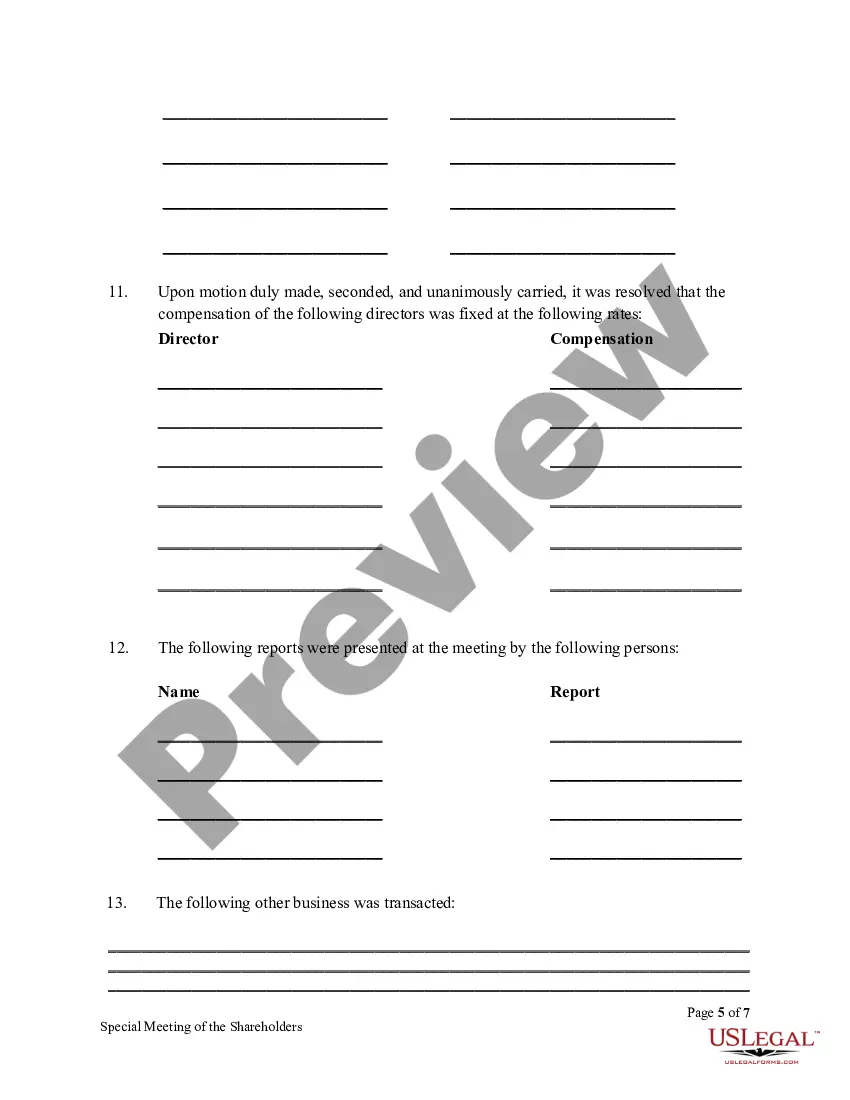

- Make use of the Preview option to examine the form.

- Read the description to actually have chosen the appropriate form.

- In the event the form is not what you`re trying to find, take advantage of the Research industry to obtain the form that fits your needs and needs.

- Once you obtain the appropriate form, just click Buy now.

- Opt for the rates plan you need, fill out the required details to generate your money, and purchase an order utilizing your PayPal or charge card.

- Choose a convenient document file format and download your version.

Get each of the record templates you might have bought in the My Forms food selection. You can obtain a more version of Delaware Special Meeting Minutes of Shareholders whenever, if necessary. Just click on the needed form to download or print out the record format.

Use US Legal Forms, the most substantial collection of lawful forms, to save lots of time as well as avoid blunders. The service provides professionally made lawful record templates that can be used for a selection of reasons. Make your account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

Meeting minutes must be recorded for all government meetings, even closed ones. The minutes must include a record of those members present and a record, by individual members, of each vote taken and action agreed upon.

In general, companies require a letter or similar notification from investors having a sufficient number of shares, demanding a special meeting and stating the purpose for that meeting. The company can then set the date for the meeting, typically within a 30 to 90 day time period after receipt of the demand.

The people who may convene an SGM are: the chairperson of the owners corporation; or. the secretary of the owners corporation; or. a lot owner nominated by lot owners whose lot entitlements total at least 25% of all lot entitlements for the land affected by the owners corporation; or.

Often, these meetings are held annually at the same time and place, but this can differ between companies. Lastly, the minutes are signed either by the secretary or the chairperson of the meeting.

The ?call to meeting? needs to include all the necessary details, obviously ? time, date, and location. But you must also say generally what topics will be discussed, including a clear indication of what's open for discussion and what's not (see #3 below). You don't have to state the precise motions that will be made.

An extraordinary general meeting (EGM) is a shareholder meeting called other than a company's scheduled annual general meeting (AGM). An EGM is also called a special general meeting or emergency general meeting.

The directors must call an annual meeting no later than 18 months after the date of incorporation (or date of amalgamation) and no later than 15 months after the date of the last annual meeting.

A general meeting can be called (ie initiated) either by the company directors or requested by the company shareholders. Different periods of notice are required depending on how a general meeting is being called, the type of company calling it, and whether or not the meeting is an AGM.