Utah Sample Letter for Compromise of Integrity

Description

How to fill out Sample Letter For Compromise Of Integrity?

Are you currently in a position where you frequently require documentation for business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the Utah Sample Letter for Compromise of Integrity, designed to meet both federal and state requirements.

Once you find the correct form, click Purchase now.

Choose the pricing plan you want, enter the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Utah Sample Letter for Compromise of Integrity template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is appropriate for your specific city/state.

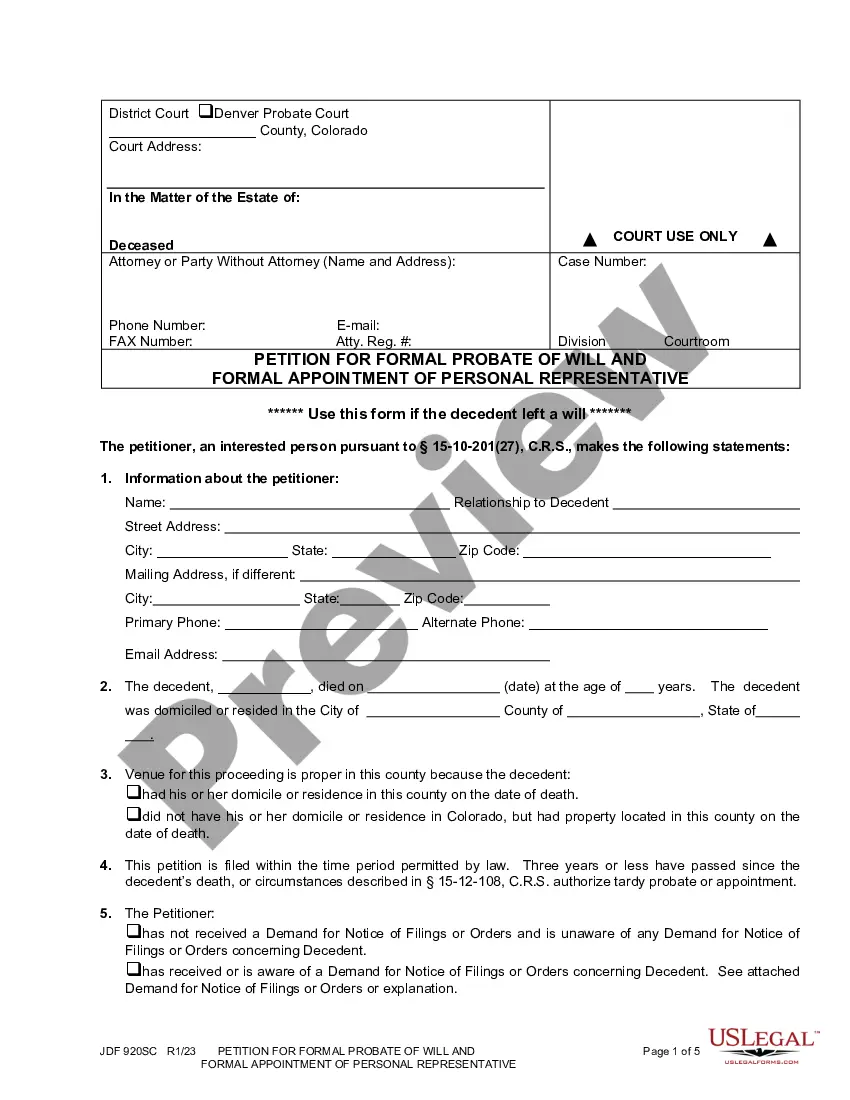

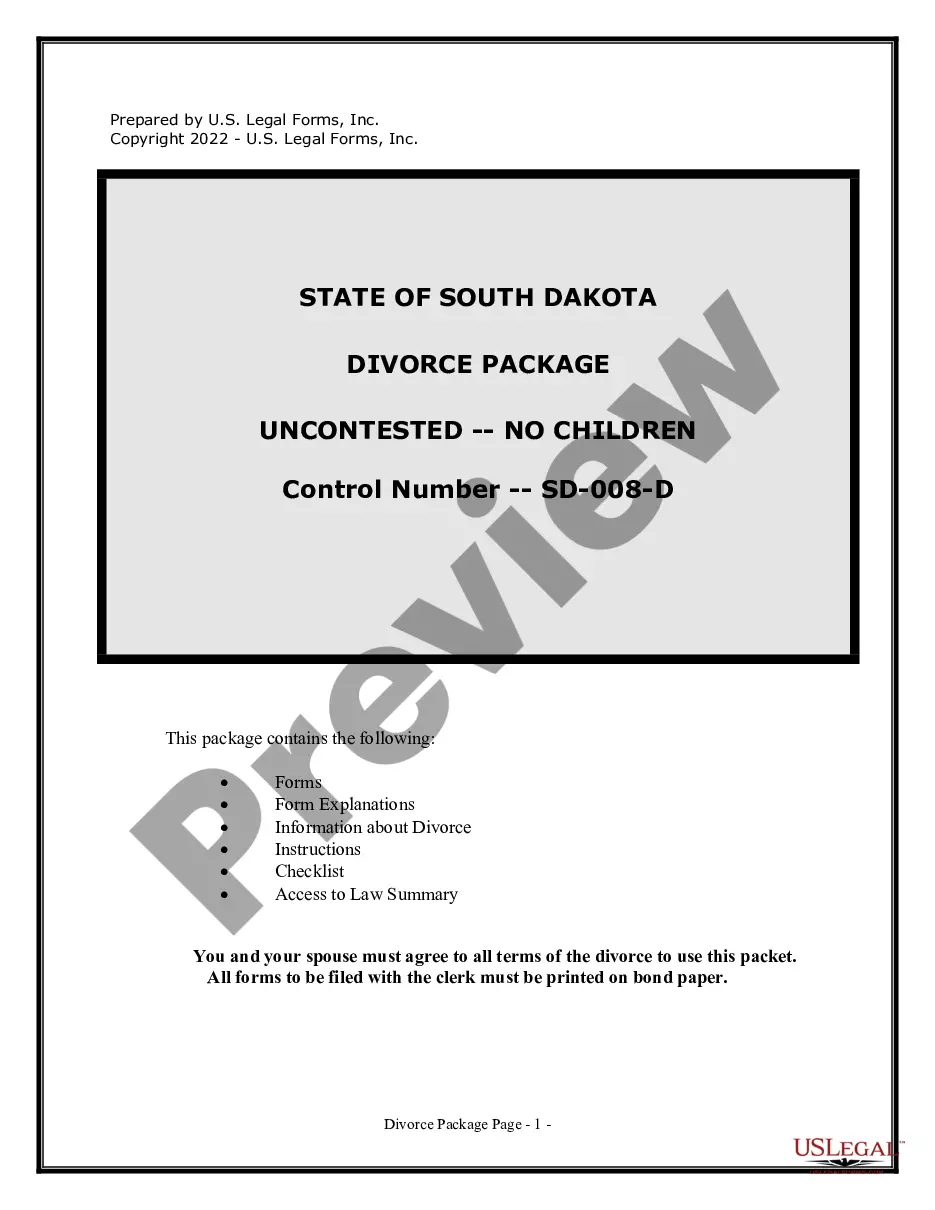

- Utilize the Preview button to review the document.

- Read the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search section to find a document that meets your requirements.

Form popularity

FAQ

To cancel your tax withholding in Utah, you must complete the proper forms and notify the Utah State Tax Commission. Make sure to indicate clearly your reason for cancellation. If you need assistance in this communication, consider using the Utah Sample Letter for Compromise of Integrity for a well-structured request.

To request a penalty abatement in Utah, you should write to the Utah State Tax Commission, providing a clear explanation of why you believe the penalties should be waived. Attach any supporting documents that can strengthen your case. Using the Utah Sample Letter for Compromise of Integrity can assist in crafting a professional request.

You need to file the Utah TC 65 form with the Utah State Tax Commission at their designated mailing address. Ensure that all required information is included to avoid processing delays. For better communication, drafting a letter using a Utah Sample Letter for Compromise of Integrity could clarify any complex points regarding your filing.

In Utah, seniors can benefit from property tax exemptions or reductions starting at age 66. This exemption can significantly ease the financial burden on retired individuals. If you qualify, you may want to check your eligibility by using resources like the Utah Sample Letter for Compromise of Integrity to interact with local tax offices.

Requesting a penalty abatement from the Franchise Tax Board (FTB) typically requires you to submit a specific request form along with a detailed letter explaining your circumstances. It’s essential to provide compelling evidence for your request. If you're unsure about how to structure your request, the Utah Sample Letter for Compromise of Integrity can serve as a template.

To inquire about Utah withholding tax, you can reach the Utah State Tax Commission at their designated phone number, which is available on their official website. They can provide you with accurate information related to your queries. If you need to follow up, a Utah Sample Letter for Compromise of Integrity could help you format your communication appropriately.

Closing a Utah withholding account involves submitting a final tax return and informing the Utah State Tax Commission of your intent to close the account. Ensure that all tax obligations are fulfilled before you make this request. If you need assistance, the Utah Sample Letter for Compromise of Integrity can guide you on drafting your closing request.

To apply for property tax abatement in Utah, you will need to complete a specific application form set by your local county assessor. Make sure to provide all required information to support your application. If you encounter obstacles, the Utah Sample Letter for Compromise of Integrity can assist in drafting a request for reconsideration.

In Utah, the late payment penalty for unpaid taxes accrues at a rate of 5% of the unpaid amount for each month the payment is late. This can add up quickly, so timely payments are crucial. If you find yourself facing penalties, the Utah Sample Letter for Compromise of Integrity can provide guidance on how to address your situation with tax authorities.

Utah state withholding generally follows a flat tax rate. As of now, the rate is 4.95% of an employee's gross income. This ensures that you are withholding the correct amount needed for state taxes. If you need clarification on how to calculate this, consider using a Utah Sample Letter for Compromise of Integrity to communicate with tax experts.