Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

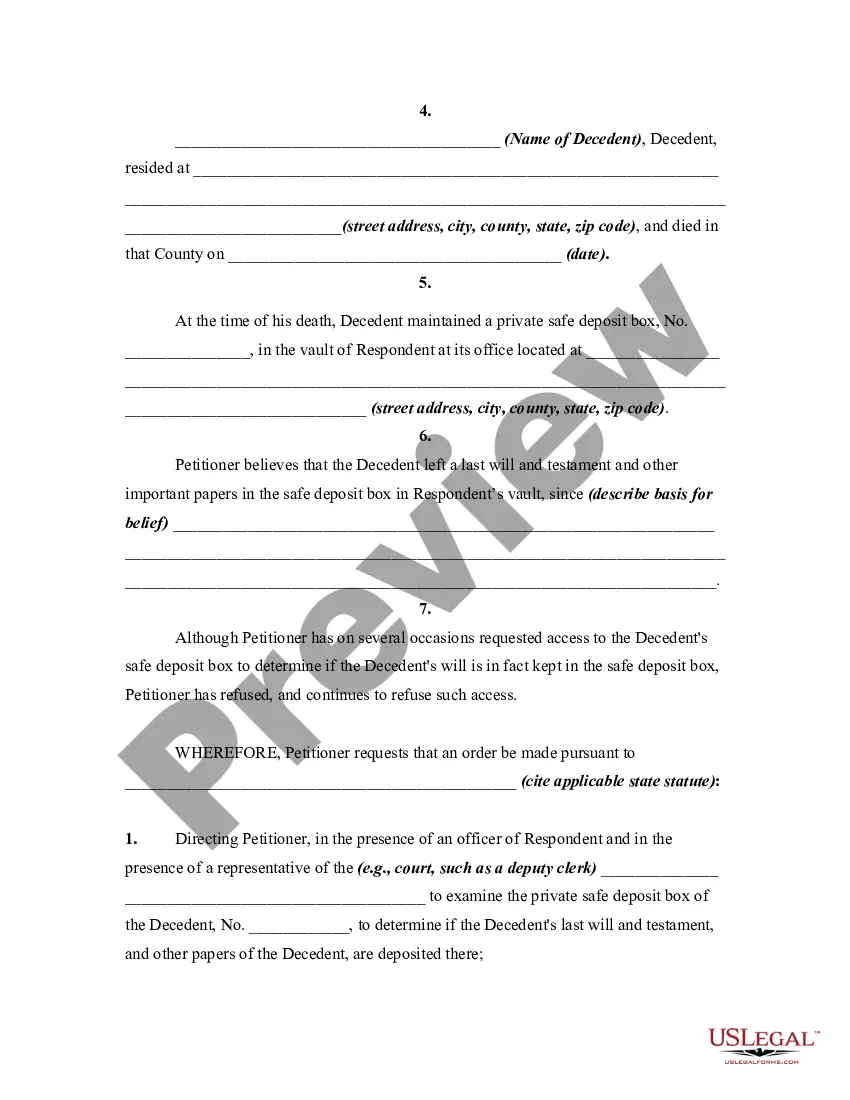

Utah Petition For Order to Open Safe Deposit Box of Decedent

Description

How to fill out Petition For Order To Open Safe Deposit Box Of Decedent?

If you want to total, obtain, or produce lawful papers layouts, use US Legal Forms, the most important selection of lawful types, which can be found on the web. Utilize the site`s easy and handy research to discover the paperwork you need. Various layouts for company and personal functions are sorted by types and says, or search phrases. Use US Legal Forms to discover the Utah Petition For Order to Open Safe Deposit Box of Decedent in a handful of clicks.

If you are currently a US Legal Forms customer, log in for your account and then click the Down load button to obtain the Utah Petition For Order to Open Safe Deposit Box of Decedent. You may also entry types you previously saved in the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for the appropriate area/nation.

- Step 2. Take advantage of the Preview option to check out the form`s articles. Never overlook to read the outline.

- Step 3. If you are unhappy together with the form, use the Look for discipline near the top of the display to find other models in the lawful form format.

- Step 4. Once you have found the shape you need, click the Get now button. Opt for the pricing strategy you choose and put your qualifications to register on an account.

- Step 5. Approach the purchase. You may use your bank card or PayPal account to finish the purchase.

- Step 6. Choose the formatting in the lawful form and obtain it in your device.

- Step 7. Full, modify and produce or sign the Utah Petition For Order to Open Safe Deposit Box of Decedent.

Each lawful papers format you get is your own property permanently. You may have acces to each form you saved with your acccount. Go through the My Forms segment and select a form to produce or obtain once more.

Compete and obtain, and produce the Utah Petition For Order to Open Safe Deposit Box of Decedent with US Legal Forms. There are thousands of specialist and express-certain types you can utilize to your company or personal requires.

Form popularity

FAQ

(3) Qualified person. ? A person possessing a letter of authority or a person named as a deputy, lessee or cotenant of the safe-deposit box to which the decedent had access.

During your lifetime, your safe deposit box can be accessed by you, a joint owner, or a Deputy designee. A Deputy is someone who can act on your behalf to access the box in your stead. The Deputy designation can be changed at any time by you with written notice to the bank. A Deputy's authority ceases upon your death.

You cannot pass a safe deposit box key to anyone. Only the owner of the safe deposit box has legal access to it. The bank will not allow this at all. You must sign a record of entry, date and time.

But in many states, such as Ohio, if an individual is the only person named as the owner of a safety deposit box, then no one else is able to access the box after the individual's death without the approval of the court.

If the signers are spouses and the contents are considered their community property, the survivor likely owns the contents. However, for joint signers who are not spouses, whether or not the survivor owns the contents is unclear.

Accessing a Deceased Person's Safety Deposit Box Notify financial institutions or banks about the death of the safety deposit box owner. Receive instructions from the financial institution on how to gain entry into the safety deposit box. Obtain court permission to access safe boxes if that is the only recourse.

An individual can rent a box in their name only, or they can add other people to the lease. Co-lessors on a safe deposit box will have equal access and rights to the contents of the box. For example, people who have an addiction, financial, marriage, and/or judgment issues may not be ideal candidates.

You can give someone access to your safety deposit box. This is a common practice among couples and families. You will need to visit your bank with the person you want to give access to. The person will need to provide their ID and signature.