Utah Sample Letter for Partnership Buyout

Description

How to fill out Sample Letter For Partnership Buyout?

Have you ever been in a situation where you need documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating those you can trust is challenging.

US Legal Forms offers a wide array of form templates, including the Utah Sample Letter for Partnership Buyout, designed to comply with state and federal regulations.

Select the pricing plan you prefer, complete the necessary details to create your account, and pay for your order using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms site and have your account, simply Log In.

- After that, you can download the Utah Sample Letter for Partnership Buyout template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and confirm it is for the correct city/state.

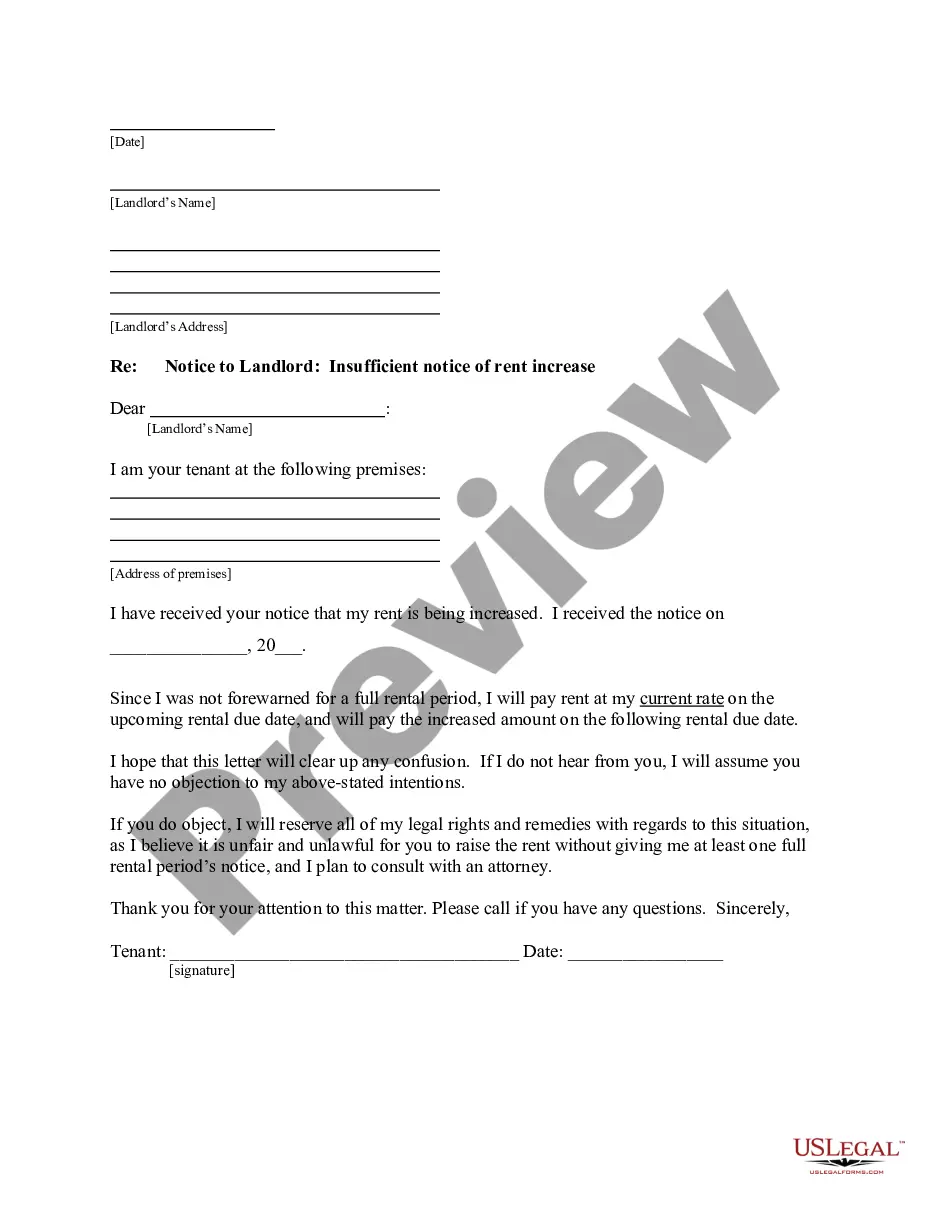

- Utilize the Review button to examine the form.

- Check the details to ensure that you have selected the correct template.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- When you locate the appropriate form, click Purchase now.

Form popularity

FAQ

To file an amended Utah state tax return, use the appropriate form designated for amendments. Clearly indicate the changes you are making and provide supporting documents as needed. If your amendment relates to a partnership situation, having a Utah Sample Letter for Partnership Buyout can guide the communication process between parties involved.

Yes, if you earn income in Utah or are a resident, you are generally required to file a state tax return. This requirement also applies if you are part of a partnership. Furthermore, if you are involved in a partnership buyout, a Utah Sample Letter for Partnership Buyout can help clarify financial obligations before filing.

Utah TC 65 should be filed with the Utah State Tax Commission. You can submit it electronically or by mail, depending on your preference and circumstances. When dealing with partnership income and operations, consider utilizing a Utah Sample Letter for Partnership Buyout, as it may streamline discussions related to tax obligations.

You can file withholding tax in Utah by using the appropriate forms available through the Utah State Tax Commission. Ensure you complete these forms accurately to avoid penalties. For partnerships, incorporating a Utah Sample Letter for Partnership Buyout can facilitate the process when partners decide to withdraw or sell their interests.

Yes, if your partnership operates in Utah and has income, you are required to file a Utah partnership return. This is important to ensure compliance with state tax laws. Additionally, if your business structure includes a partnership, using a Utah Sample Letter for Partnership Buyout can help in structuring your exit process properly.

Buying out a partner in a partnership typically involves negotiating the buyout terms and drafting a formal agreement. You should agree on the valuation of the partner’s share and set a clear timeline for the process. With the right tools, such as a Utah Sample Letter for Partnership Buyout, you can effectively facilitate discussions and outline all necessary steps for a seamless buyout.

Writing a buyout requires careful consideration of the terms involved. Start by outlining the reason for the buyout, the valuation method used, and the proposed payment structure. A Utah Sample Letter for Partnership Buyout can provide you with a solid template, ensuring you include all critical elements while maintaining clarity and professionalism.

The primary document for a buyout is often the buyout agreement, which clearly defines the terms and conditions of the transaction. This document should cover aspects such as valuation, payment method, and timelines. Utilizing a Utah Sample Letter for Partnership Buyout can help draft a comprehensive buyout document to protect all parties involved.

When writing a buyout email, keep your message clear and concise. Begin by stating your intention to discuss the buyout, then outline key details such as the reasons for the buyout and proposed terms. A well-structured Utah Sample Letter for Partnership Buyout can serve as an excellent reference to ensure you communicate every necessary detail effectively.

To calculate a partner buyout, you first need to determine the value of the partnership, considering assets, liabilities, and income. Once you have this value, divide it by the number of partners to ascertain each partner's share. Implementing a Utah Sample Letter for Partnership Buyout can further clarify how the calculation affects each partner's interests.