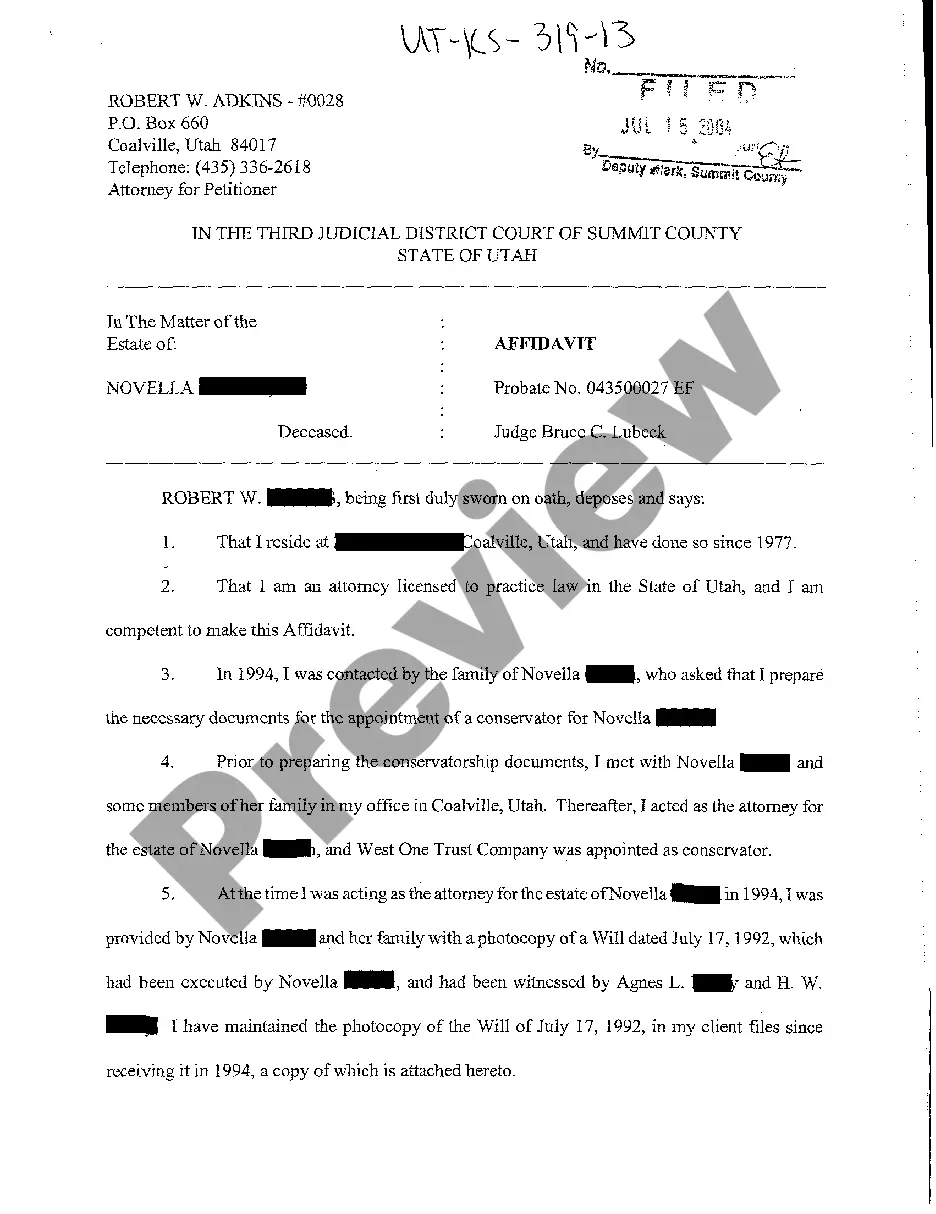

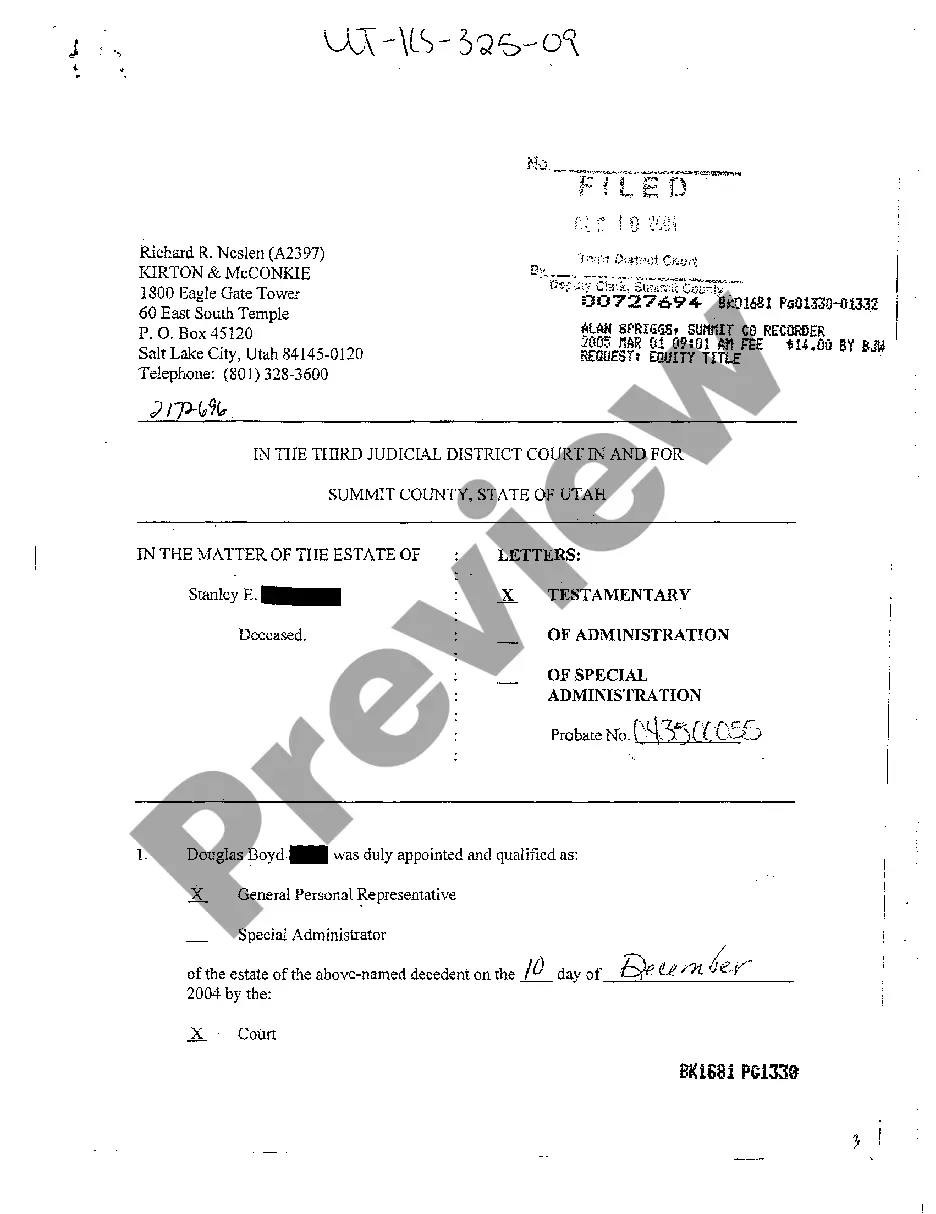

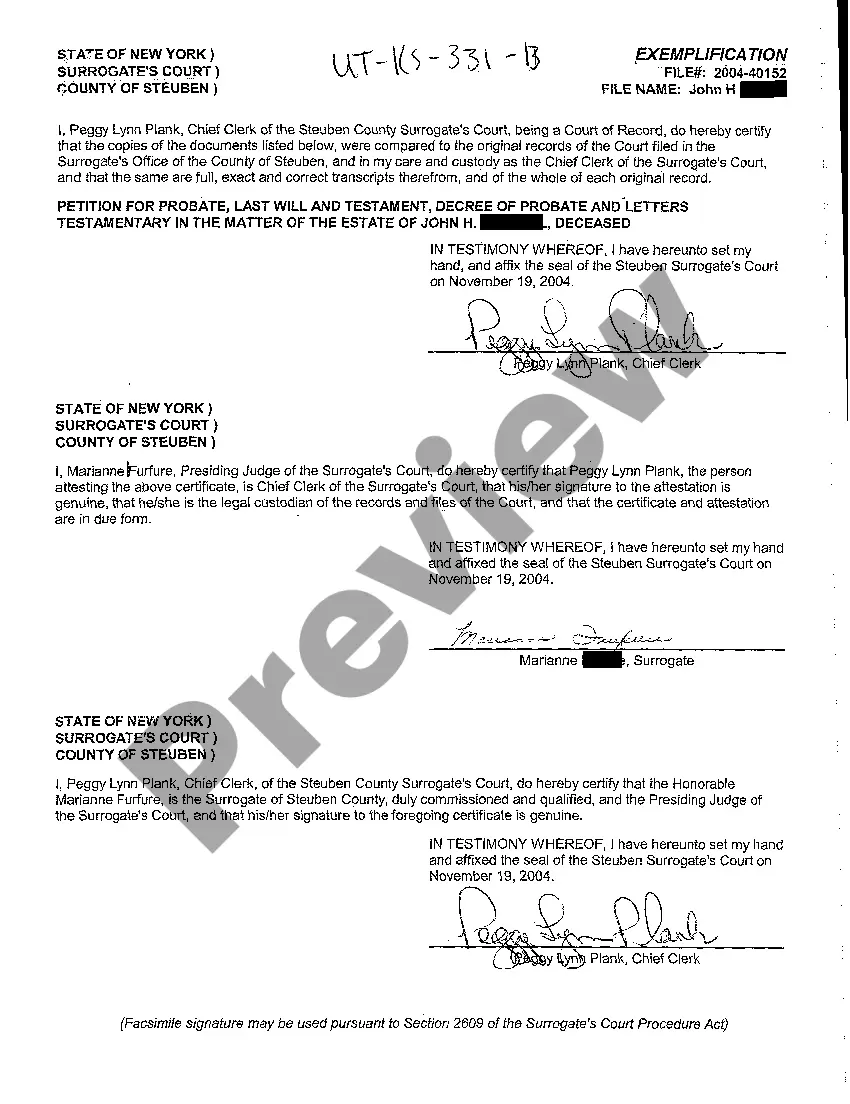

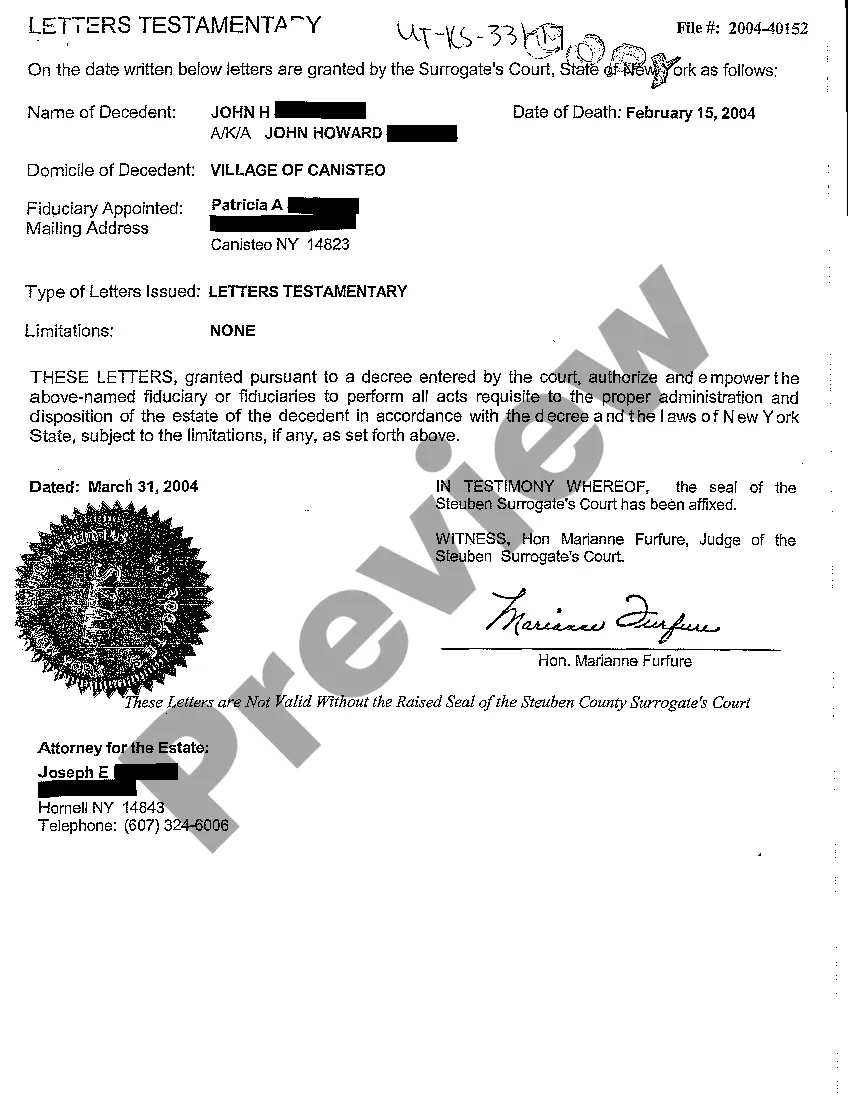

Utah Decree of Probate

Description

How to fill out Utah Decree Of Probate?

Among numerous free and paid samples that you can get on the web, you can't be sure about their accuracy and reliability. For example, who made them or if they’re competent enough to take care of what you require those to. Always keep calm and utilize US Legal Forms! Find Utah Decree of Probate samples created by skilled legal representatives and get away from the costly and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access all of your earlier downloaded templates in the My Forms menu.

If you’re using our website for the first time, follow the instructions below to get your Utah Decree of Probate fast:

- Make sure that the document you discover is valid where you live.

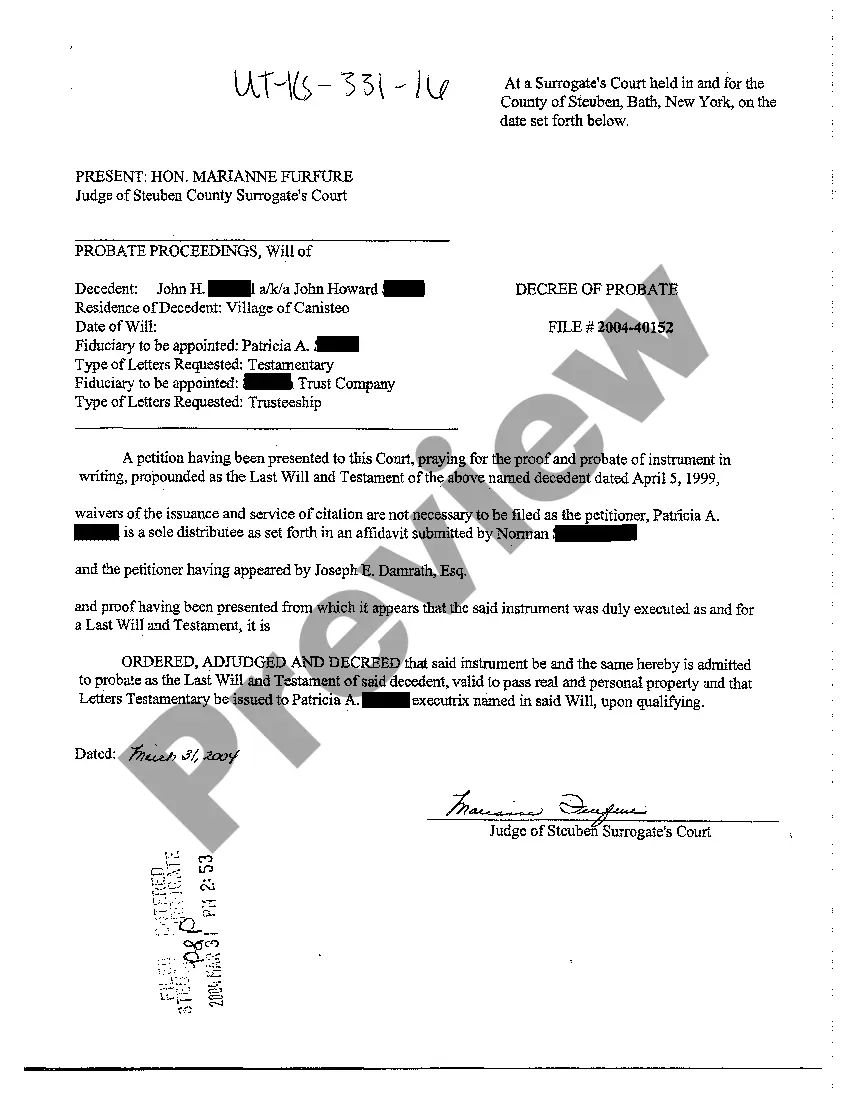

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another template utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you’ve signed up and bought your subscription, you can use your Utah Decree of Probate as often as you need or for as long as it remains active in your state. Revise it with your favorite editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

In Utah, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

It begins when a person, usually a family member, petitions the court to probate the estate and appoint a personal representative. The personal representative then administers the estate. This includes paying debts and claims against the estate, selling property (if required), and distributing assets.

Informal probate allows the estate to be probated through an administrative process without any court involvement and no court hearings. The estate is opened by an application and can be opened the day that the application is filed, or within a few days.

Applying for probate in New South Wales All applications must be filed at the Supreme Court of New South Wales Registry, either in person or by post. The application must be accompanied by supporting documents including the will and death certificate, as well as an application fee.

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

Probate records are court records dealing with the distribution of a person's estate after death. Information recorded may include the death date, names of heirs, family members, and guardians, relationships, residences, inventories of the estate (including trade and household goods), and names of witnesses.

In 2016, the filing fee for both an informal and formal probate in District Court statewide is $360.00. Attorney fees depend on the duration of probate and complexity of the estate, the existence of a Will and the location of real property owned by the estate.

Register the death. Find out if there's a will. Apply for a grant of probate and sort inheritance tax. Complete a probate application form. Complete an inheritance tax form. Send your application form. Tell all organisations and close accounts. Pay off any debts.