Utah Closing Statement

Definition and meaning

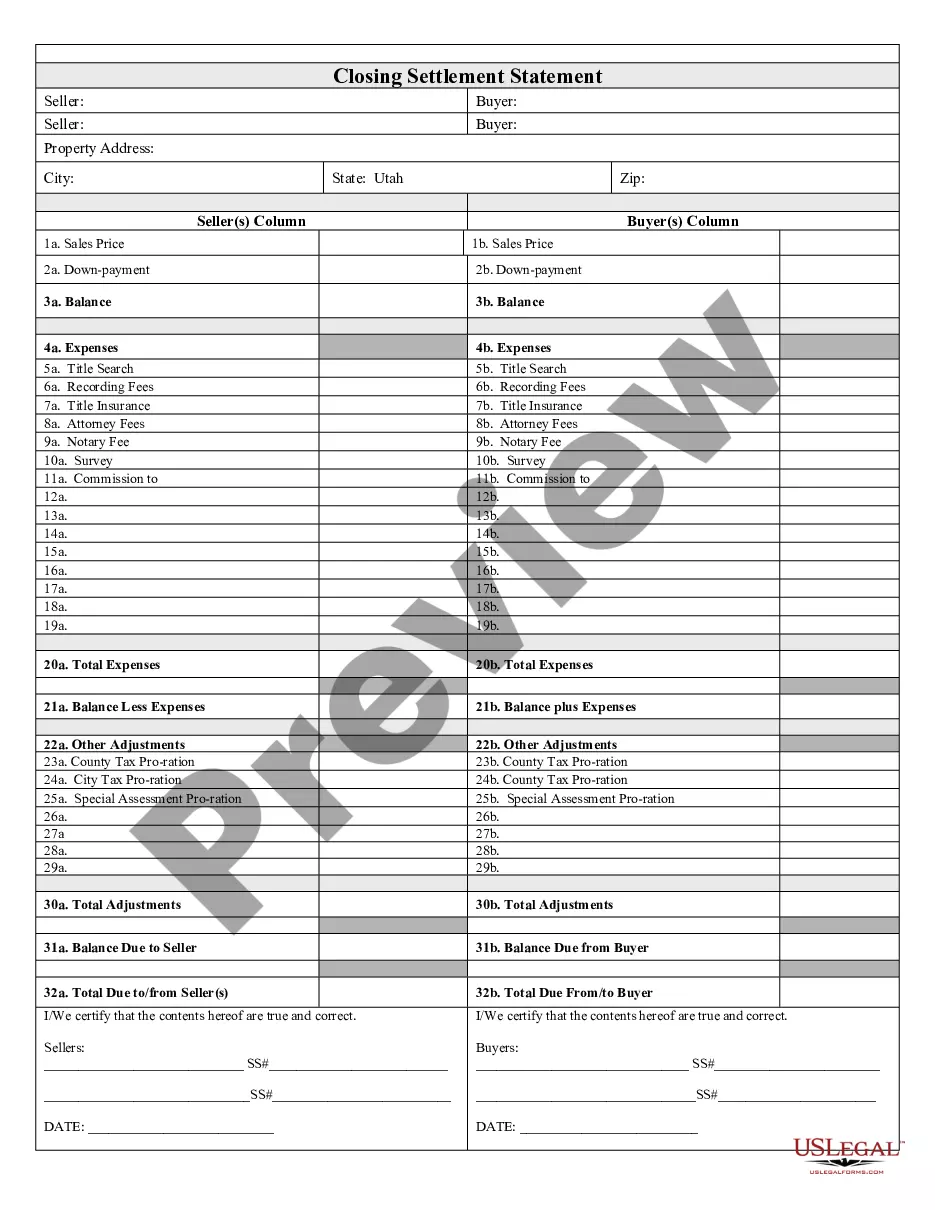

The Utah Closing Statement is a critical document used in real estate transactions. It serves as a detailed account of all financial aspects related to the sale of a property. This statement outlines the sales price, down payment, closing costs, and any other adjustments that may need to be addressed at closing. It ensures transparency for both the seller and buyer, confirming that all parties agree on the financial details involved in the transaction.

How to complete a form

Completing the Utah Closing Statement involves several key steps:

- Enter the names of the seller(s) and buyer(s) at the top of the form.

- List the property address, including the city, state, and ZIP code.

- Fill out the sales price in the appropriate section for both seller and buyer.

- Complete the down payment details.

- Detail all expenses, such as title search fees, recording fees, and any commissions.

- Add section for any applicable pro-rations, such as county and city tax adjustments.

- Certify the accuracy of the information with all parties’ signatures.

By carefully following these steps, users can ensure the Utah Closing Statement is accurately completed.

Key components of the form

The Utah Closing Statement contains several important components that serve to summarize the financial obligations of both parties involved in the real estate transaction. Key components include:

- Sales Price: The total agreed sale amount between seller and buyer.

- Down Payment: The initial amount paid by the buyer at closing.

- Expenses: Detailed listing of various fees, including title insurance, attorney fees, and recording fees.

- Total Expenses: Overall costs calculated from the expenses incurred in the transaction.

- Adjustments: Any additional financial adjustments that need to be considered at closing, such as tax prorations.

Each of these components contributes to creating a comprehensive overview of the transaction’s financials.

Who should use this form

The Utah Closing Statement should be utilized by anyone involved in a real estate transaction within the state of Utah. This includes:

- Sellers who need to provide a detailed account of the sale to the buyer.

- Buyers who require clarity regarding their financial obligations related to the purchase.

- Real estate agents facilitating the transaction, as they need to ensure all parties are accurately informed.

- Title companies handling the closing process, to maintain proper documentation and compliance.

Overall, this form serves as a vital document for all parties in a closing transaction.

Common mistakes to avoid when using this form

When completing the Utah Closing Statement, it is essential to avoid common errors that may cause disputes or legal issues. Some common mistakes include:

- Failing to accurately list all expenses and fees, which can misrepresent the actual costs of closing.

- Not including all necessary signatures from buyers and sellers, which is crucial for validation.

- Forgetting to update financial figures with any last-minute changes before finalizing the document.

- Omitting pro-ration adjustments for taxes or other fees, leading to unexpected costs for one party.

Being aware of and avoiding these common mistakes will help ensure a smooth closing process.

Form popularity

FAQ

And while they are two separate policies (and again, not legally required), it's generally customary for a lender to request both. As mentioned, it is typical for the seller to pay for an owner's policy and the buyer usually pays for the lender's policy.

A closing statement is a document that records the details of a financial transaction. A home buyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

How will it be shown on the closing statement? this amount will be included in the seller's expenses later under disbursements in the broker's Statement section of the closing statement.

The Closing Disclosure form is issued at least three days before you sign the mortgage documents. It is a final accounting of your loan's interest rate and fees, mortgage closing costs, your monthly mortgage payment and the grand total of all payments and finance charges.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

The attorney is responsible for preparing all necessary closing documents, scheduling the closing, explaining all necessary closing documents and having them properly executed and recorded. You will receive copies of most closing documents, including an itemized record of all money paid by you on your behalf.

The settlement statement is prepared by an impartial third party to the transaction, usually an officer with the title or escrow company that performs the closing. In California, both the buyer and the seller sign the HUD-1 settlement statement at closing.

Closing costs are all of the fees and expenses associated with the closing or settlement of a real estate transaction, and they can vary dramatically. The buyer typically pays the closing costs, while other costs are usually the responsibility of the seller.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.