Alaska PLLC Notices and Resolutions

What this document covers

The PLLC Notices and Resolutions form is a collection of essential documents designed for the operation of a Professional Limited Liability Company (PLLC). This set includes various notices and resolutions necessary for conducting meetings, amending articles, and managing membership changes. Unlike other business forms, these documents specifically cater to the unique needs and legal requirements of PLLCs, ensuring compliance with state regulations and internal governing policies.

Key parts of this document

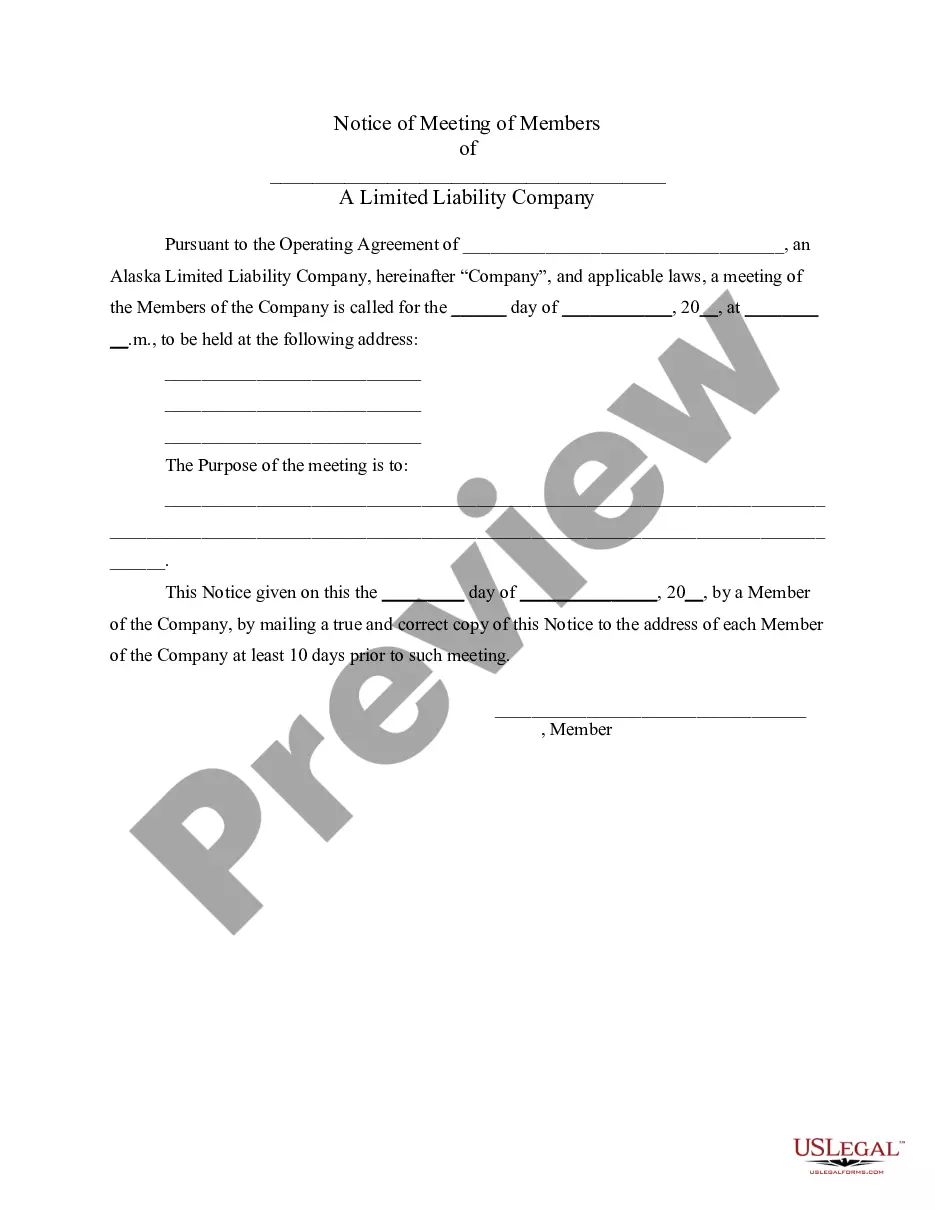

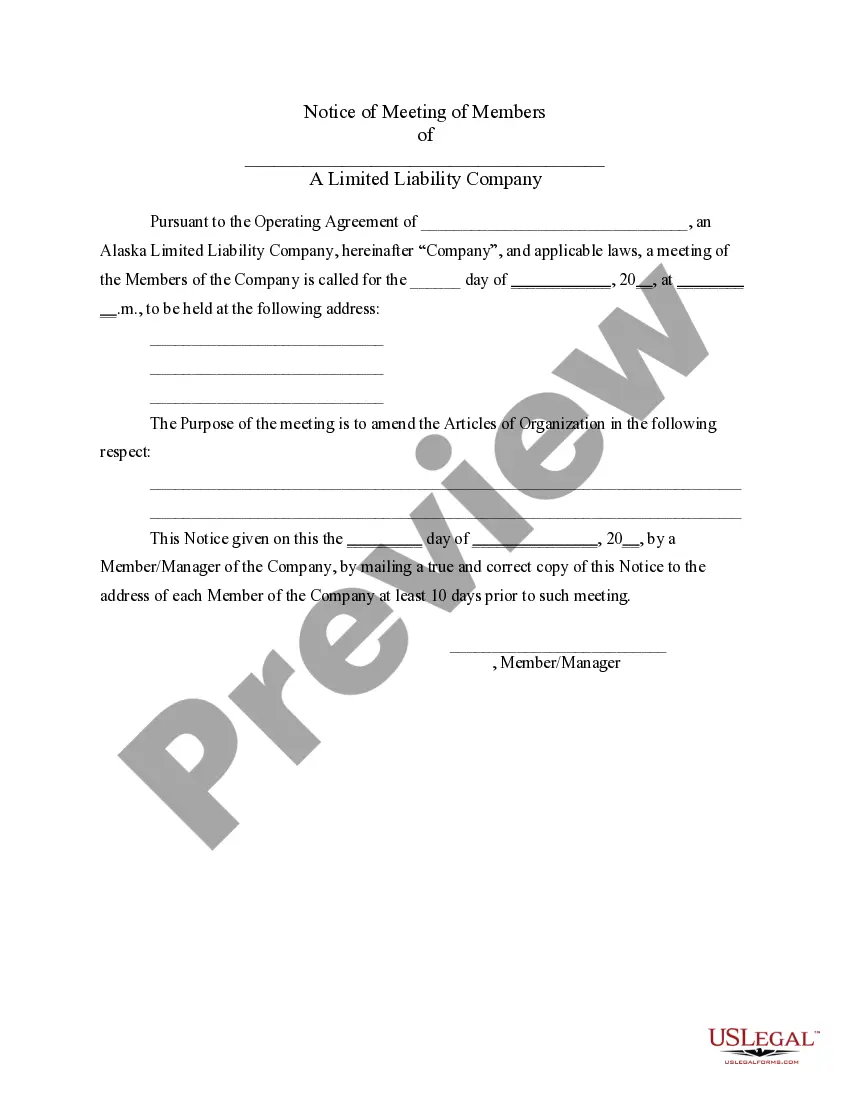

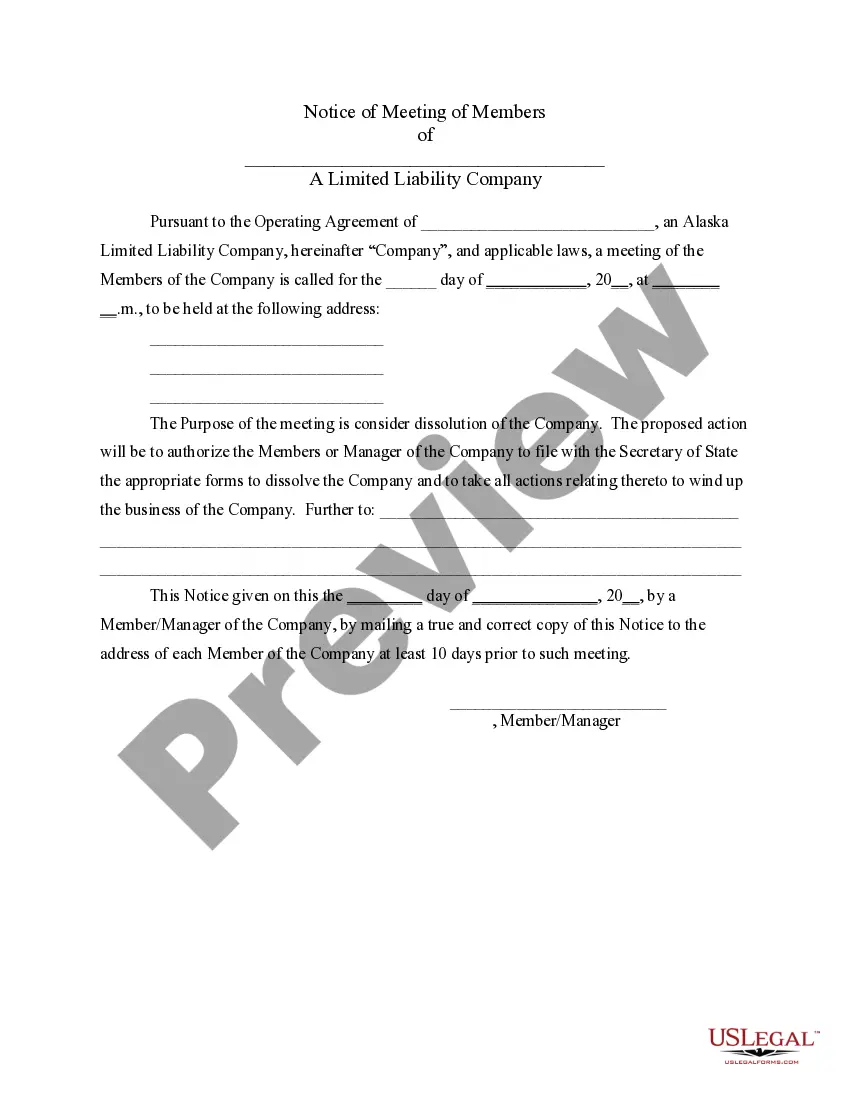

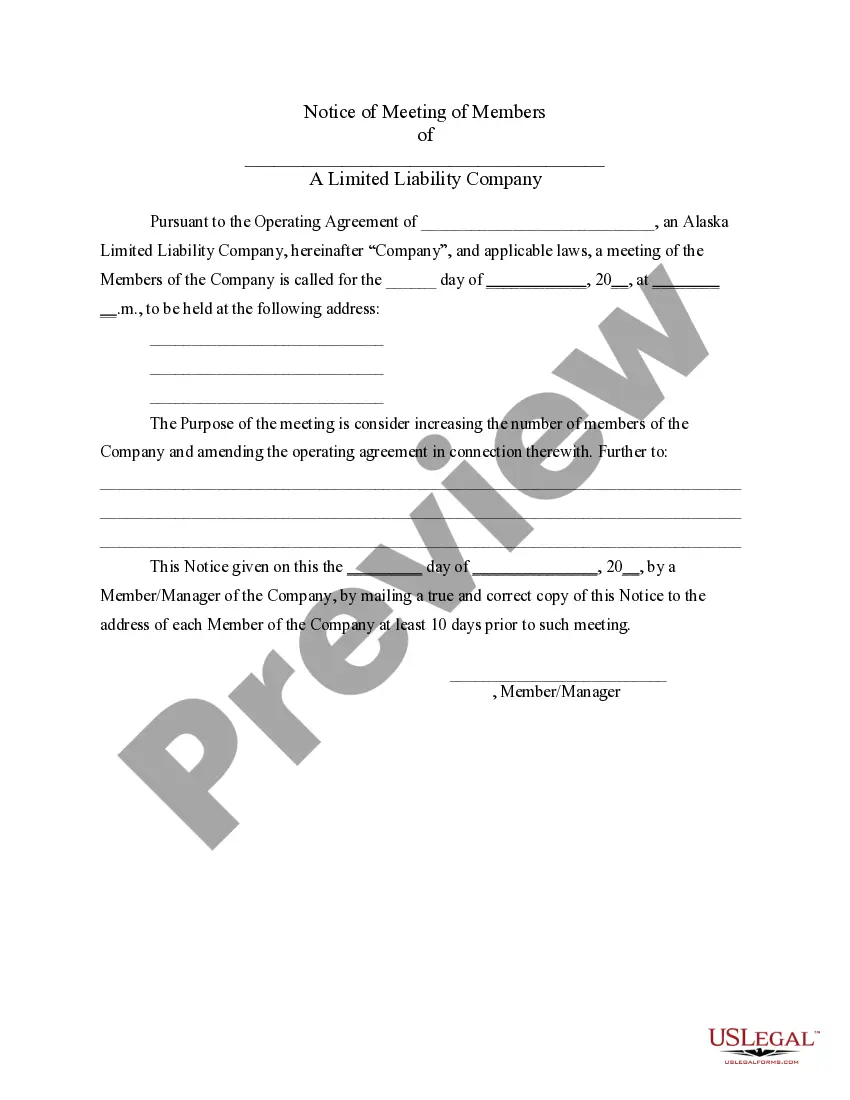

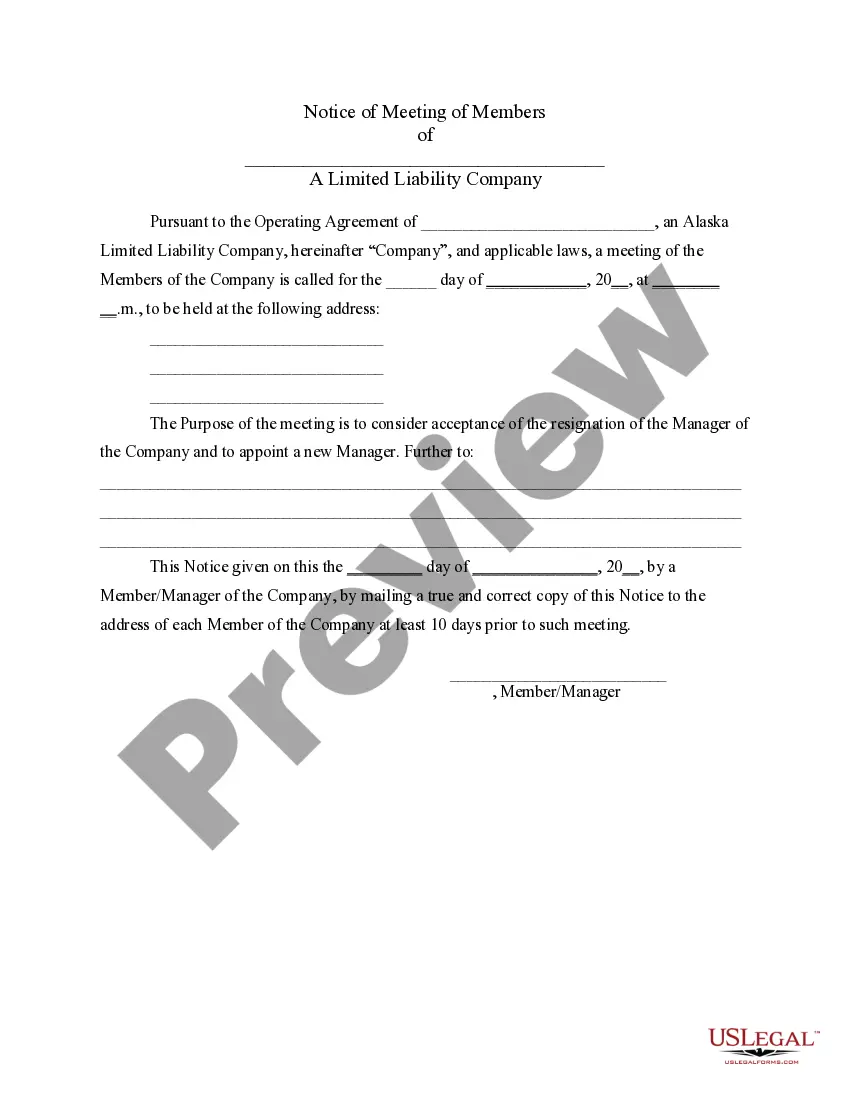

- Notice of Meeting for various purposes, including general discussions, amendments, and resignations.

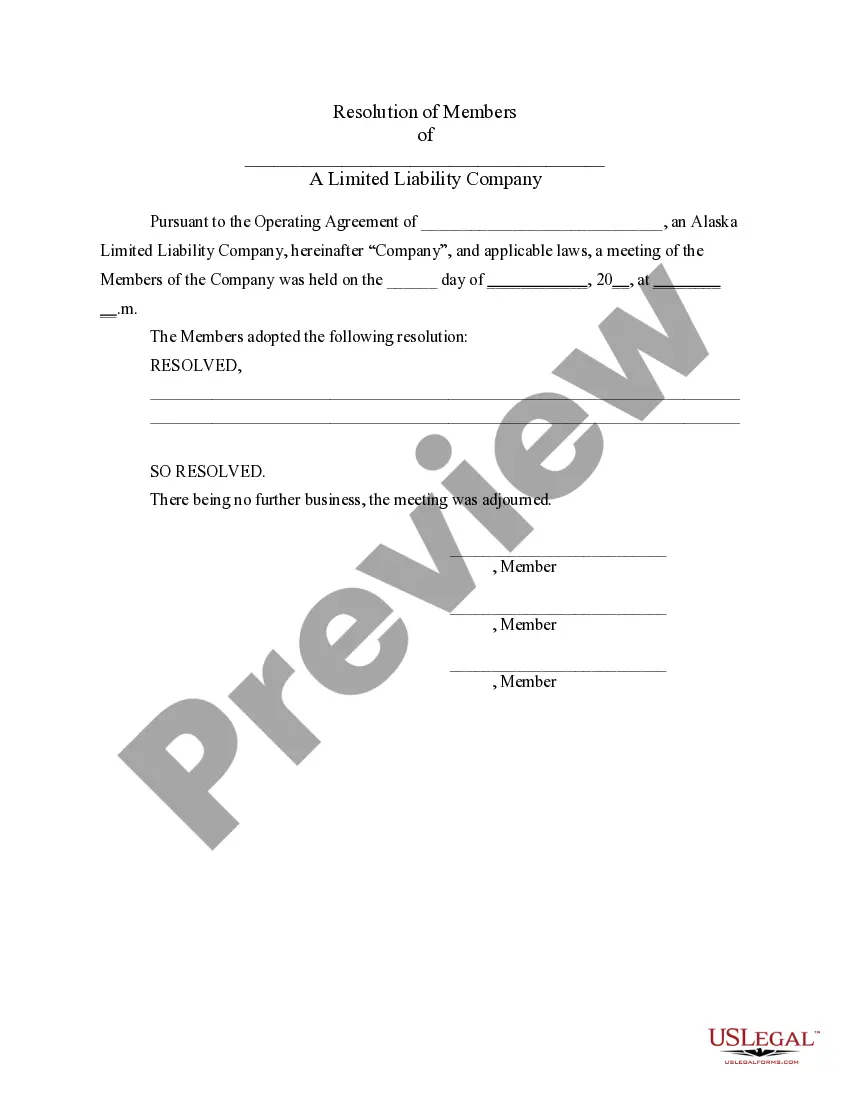

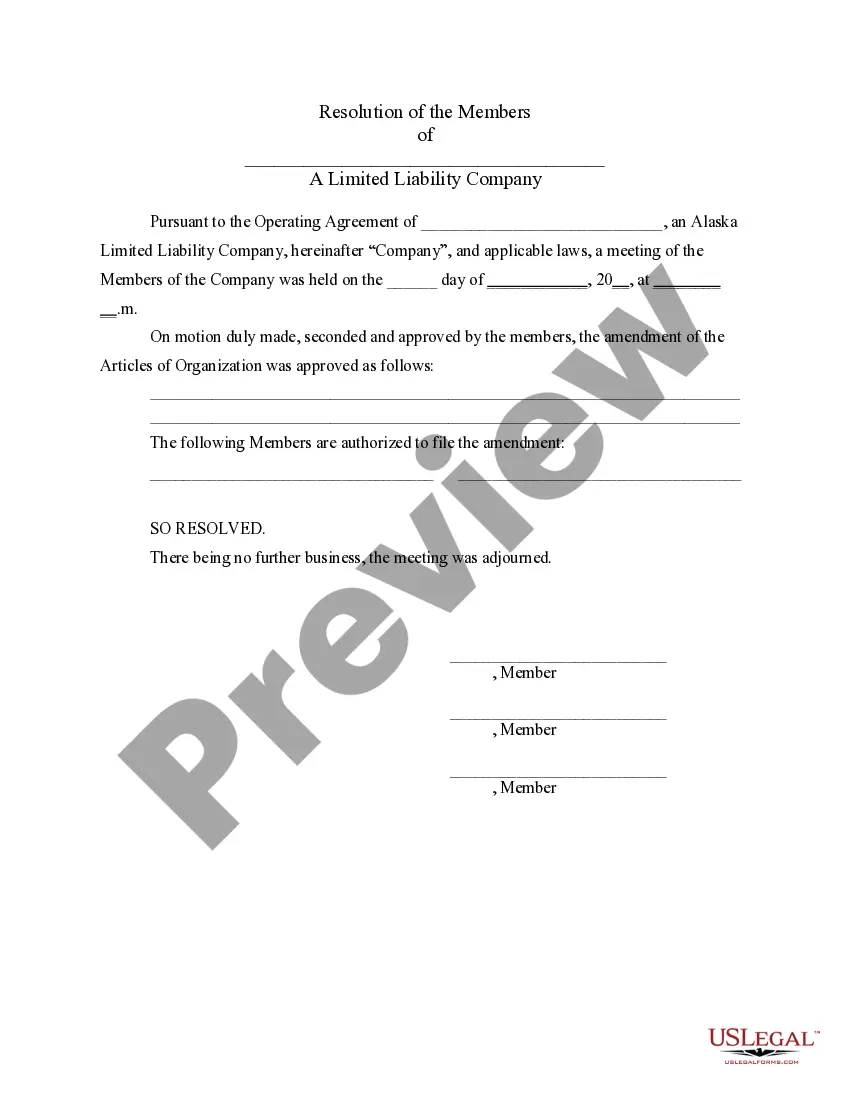

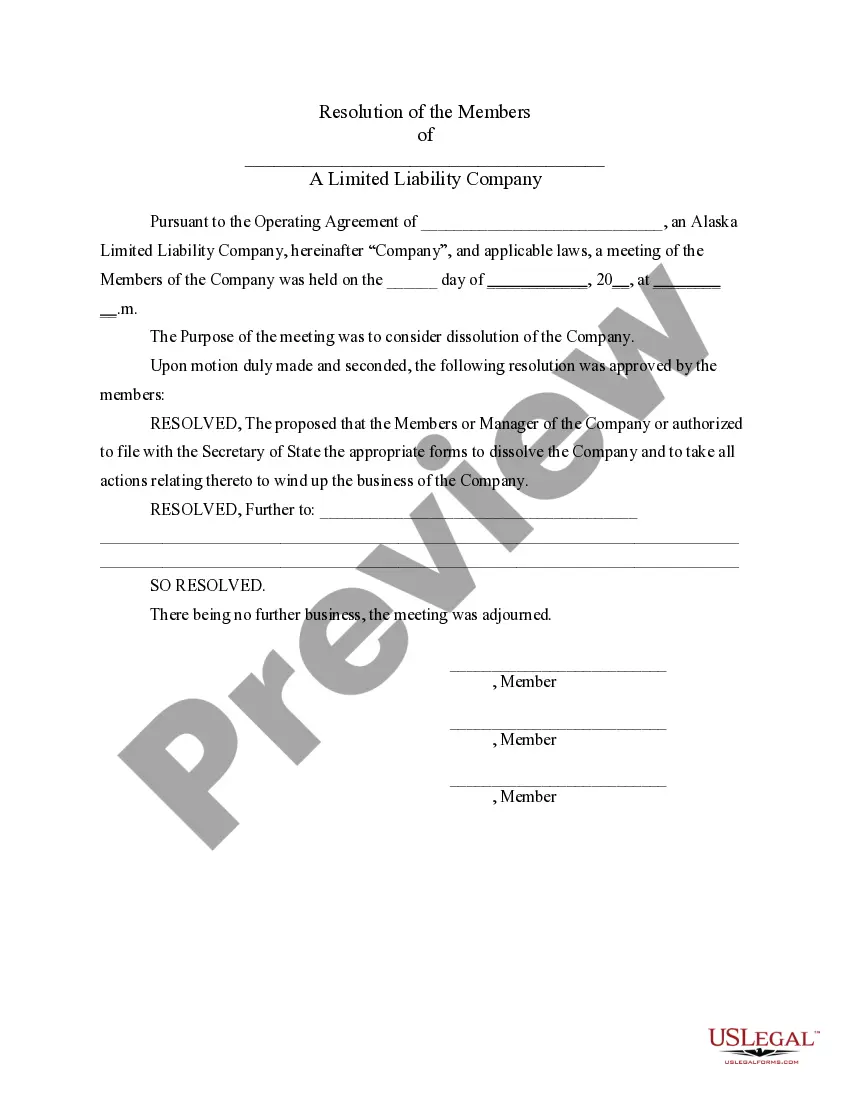

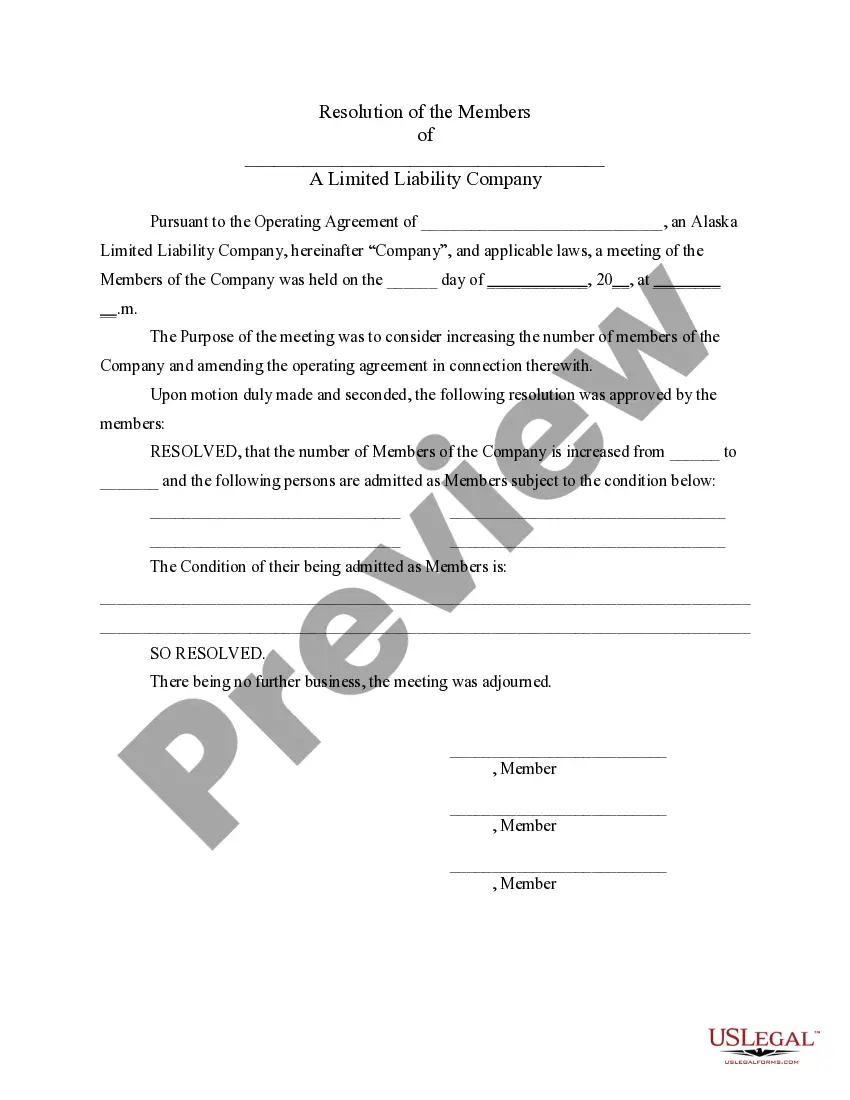

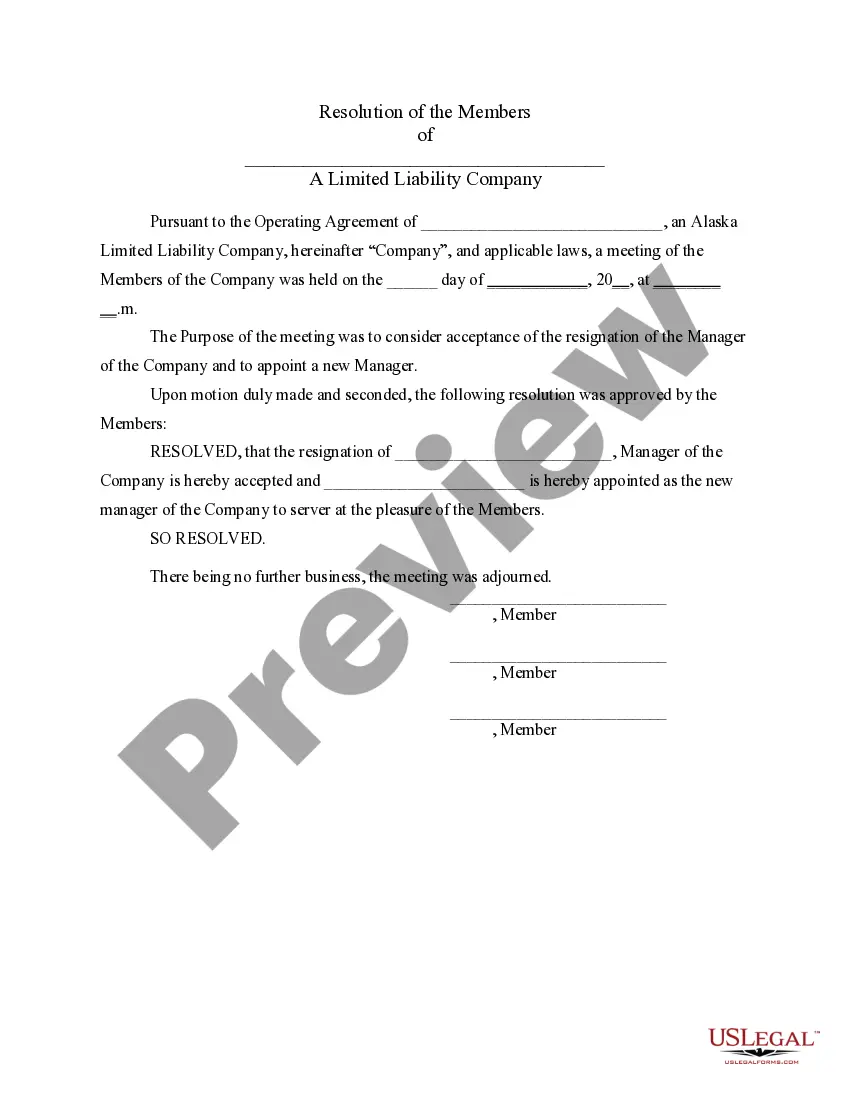

- Resolutions adopted during meetings to formalize decisions made by members.

- Assignment of Member Interest to transfer ownership rights in the PLLC.

- Indemnity demand for members or managers relating to claims made against them.

- Provisions for member disbursements and operational changes.

When to use this document

This form is crucial when a PLLC needs to conduct formal meetings regarding significant business decisions, such as amending articles of organization, dissolving the company, adding or removing members, or addressing managerial changes. Additionally, it is used for authorizing disbursements to members and handling indemnity requests in response to legal claims against members or managers.

Intended users of this form

- Owners and members of a Professional Limited Liability Company (PLLC).

- Managers and designated representatives responsible for the administration of the PLLC.

- Attorneys advising PLLCs on compliance and operational procedures.

Instructions for completing this form

- Identify the PLLC's name and the date of the meeting.

- Specify the purpose of the meeting clearly, whether itâs for amendments, disbursements, or managerial changes.

- Gather signatures from all members or managers present for formal adoption of resolutions.

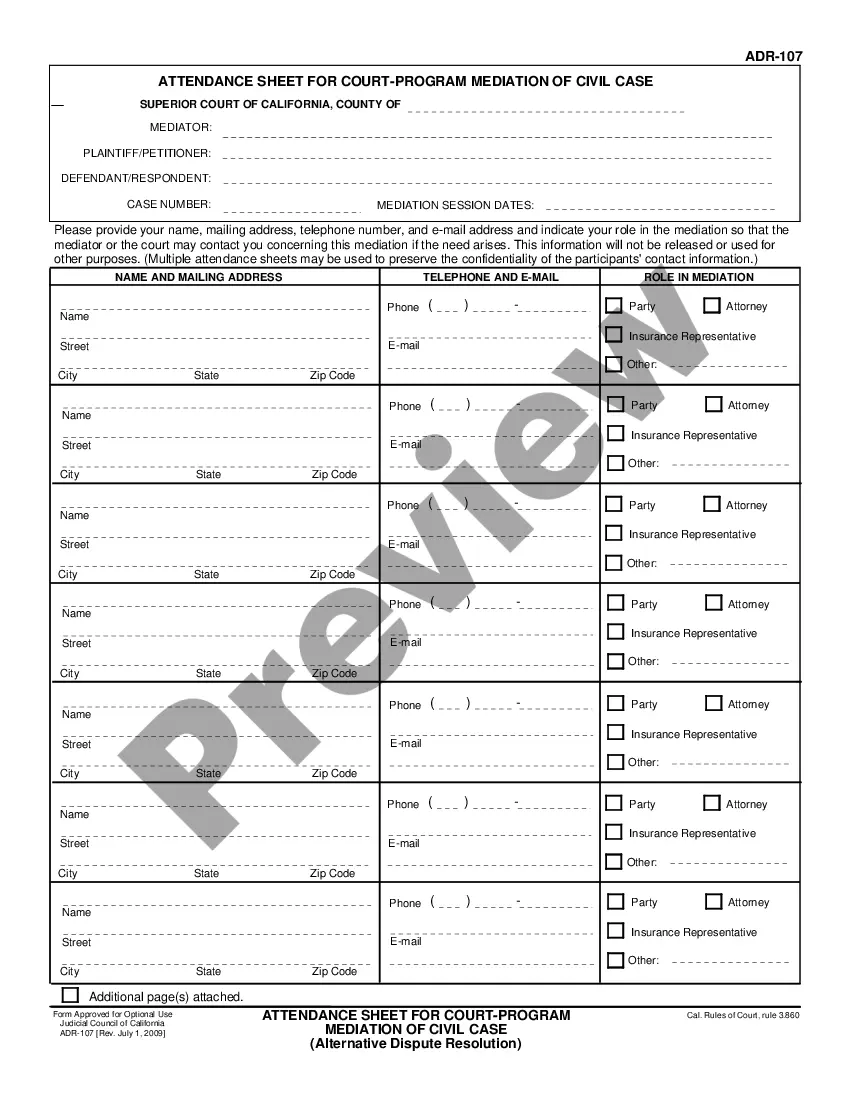

- Provide complete mailing information for all members for proper notice delivery.

- Complete any additional sections related to specific resolutions or claims as needed.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide appropriate notice to all members prior to the meeting.

- Not including all necessary signatures on resolutions, which could invalidate the decisions made.

- Using outdated forms that may not comply with current state law requirements.

Advantages of online completion

- Convenient access to legally vetted templates drafted by licensed attorneys.

- Easy customization to suit your specific PLLC needs.

- Faster turnaround for meeting and resolution documentation compared to traditional methods.

Looking for another form?

Form popularity

FAQ

The PLLC files a standard Form 1120, Corporate Income Tax Return, and pays taxes at the regular corporate tax rate. It retains earnings as a corporation, however, and doesn't distribute them to members for personal taxation.

Professional LLCs The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs. The articles of organization are similar to those for a standard LLC, but extra steps are necessary to file.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

A PLLC is a special kind of business entity available to licensed professionals. By Christine Mathias, Attorney. A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.

The filing fee is $100 for Alaska LLCs, $200 for foreign LLCs. The Initial Report and Biennial Report must include: the LLCs name and the state or country where it is organized.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.