This form is an Excel spreadsheet that can be used to calculate startup costs for a new business. It includes itemized categories for funding and costs, and is a valuable tool to help plan the financial aspects of your new business.

Business Startup Costs

Description

Definition and meaning

The term business startup costs refers to the expenses incurred in the process of establishing a new business. These costs can include a range of one-time and recurring expenses that entrepreneurs must plan for to launch their venture successfully.

Understanding these costs is essential for anyone looking to start a business, as it helps in budgeting and securing the necessary funding. Typical startup costs include expenses for equipment, licenses, inventory, marketing, and office space.

Key components of the form

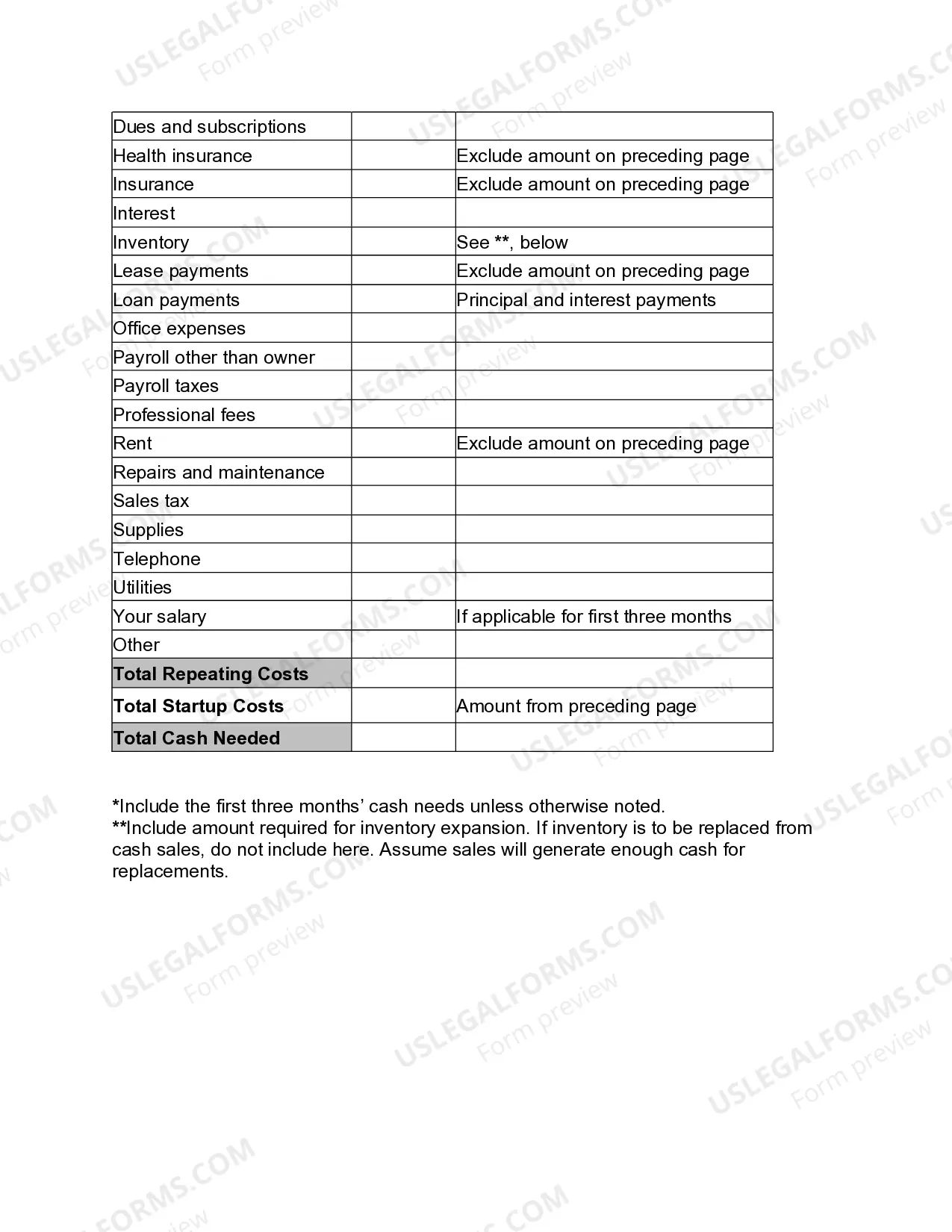

The Business Startup Costs form typically includes sections that cover:

- One-time startup expenses: These are costs that you will only incur once during the setup of your business, such as equipment purchase and initial marketing.

- Recurring monthly expenses: Ongoing costs that a business will face, such as rent, utilities, and payroll.

- Total estimated costs: A comprehensive summary of all anticipated expenses, both one-time and recurring, to ensure adequate funding.

How to complete a form

To effectively complete the Business Startup Costs form, follow these steps:

- Identify all one-time startup expenses related to your business, such as licensing fees, inventory purchases, and initial advertising costs.

- List out the recurring monthly expenses that you expect to incur after starting your business, which may include rent, utilities, and salaries.

- Carefully calculate the total of both sections to determine the complete startup capital requirements.

Common mistakes to avoid when using this form

When completing the Business Startup Costs form, be aware of the following common pitfalls:

- Failing to account for all one-time expenses can lead to underfunding.

- Overlooking recurring monthly expenses may result in cash flow issues.

- Not updating the form as you gather more accurate cost estimates or when plans change.

Who should use this form

The Business Startup Costs form is beneficial for:

- Entrepreneurs planning to start a new business.

- Existing business owners looking to expand and assess their financial needs.

- Individuals seeking funding from investors or financial institutions.

How to fill out Business Startup Costs?

When it comes to drafting a legal form, it’s easier to leave it to the experts. Nevertheless, that doesn't mean you yourself cannot find a sample to utilize. That doesn't mean you yourself cannot get a template to utilize, however. Download Business Startup Costs Spreadsheet from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. After you are signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we have incorporated an 8-step how-to guide for finding and downloading Business Startup Costs Spreadsheet quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Press Buy Now.

- Choose the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Business Startup Costs Spreadsheet is downloaded you may complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

For each expense, enter the date and description. Use the dropdown menus to select payment type and category for each expense. For each expense, enter the total cost. Attach all necessary receipts to the document. Submit for review and approval!

1Open a blank Microsoft Excel spreadsheet.2Write down the necessary categories for your spreadsheet.3Type the date in the first column on the Excel spreadsheet.4Type a column for the "Payee" of the costs and expenses next to the "Date" column.5Add all additional categories in the following columns.How to Create Cost & Expense Sheets in Excel Techwalla\nwww.techwalla.com > articles > how-to-create-cost-expense-sheets-in-excel

Open Excel. Add headings for the columns in the top row your income worksheet. Format your columns. Select your expense worksheet and set it up for recording expense data. Format your expenses columns.

Open your income and expenses Excel worksheet. Select an empty cell beneath the last item in your "income" column. Type "Total Income" in this cell, then press the "Enter" key. Select the cell directly beneath the "Total Income" label. Type "=SUM(" into this empty cell.

Open Excel. Add headings for the columns in the top row your income worksheet. Format your columns. Select your expense worksheet and set it up for recording expense data. Format your expenses columns.

Click the cell that you want to use to calculate your total in the income column, select the list arrow, and then choose the Sum calculation. There are now totals for the income and the expenses.

Open Microsoft Excel 2010 and start a new workbook by choosing "File" and "New." In the "Available Templates" section, choose "Blank Workbook" to begin. Decide how many worksheets you want to use for your accounts. Create headings for each data item you plan to record in your worksheets.

Click the cell that you want to use to calculate your total in the income column, select the list arrow, and then choose the Sum calculation. There are now totals for the income and the expenses. When you have a new income or expense to add, click and drag the blue resize handle in the bottom-right corner of the table.

Customize a monthly budget template in Excel Step 2: Enter your budget data of income and expenses into the table, and calculate the total incomes of every month and every item: (1) Calculate total income per month: In Cell B7 enter =SUM(B4:B6), then drag the Fill Handle to apply this formula to Range C7:M7.