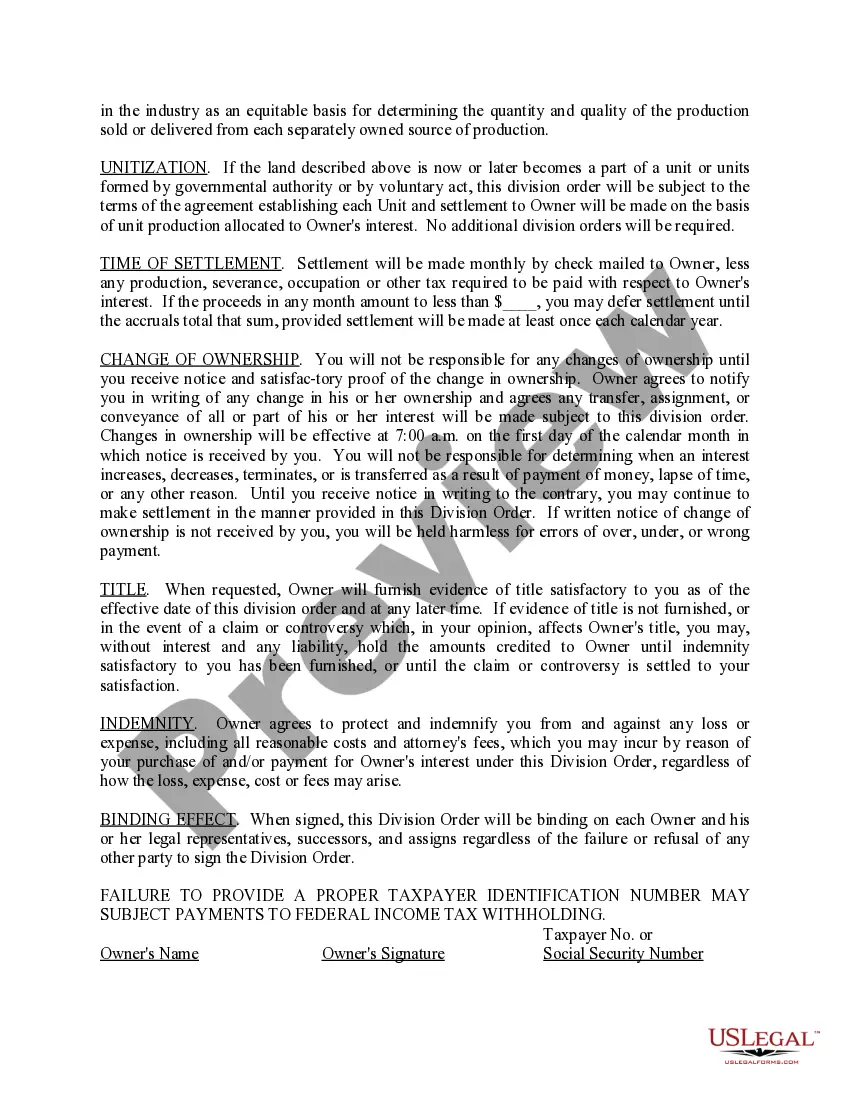

Oil and Gas Division Order

Description

How to fill out Oil And Gas Division Order?

When it comes to drafting a legal form, it’s better to leave it to the professionals. However, that doesn't mean you yourself can not get a template to use. That doesn't mean you yourself can not find a sample to utilize, however. Download Oil and Gas Division Order from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. As soon as you are registered with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things much easier, we have provided an 8-step how-to guide for finding and downloading Oil and Gas Division Order promptly:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Select the appropriate subscription for your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Oil and Gas Division Order is downloaded you can fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A division order is a record of your interest in a specific well. It contains your decimal interest, interest type, well number and well name. Division orders are issued to all that own an interest in a specific well after that well has achieved first sales of either oil or gas.

Whenever oil or gas production begins, the landowner is entitled to part of the total production. A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the Lessee's production costs. The royalty is paid by the Lessee to the owner of the mineral rights, the Lessor in the Lease.

Use this formula to calculate your decimal share of royalties from the producing well: (Mineral Interest Share) times (Royalty Rate) = (Royalty Share Decimal). Example 1: (1/3 x 100% mineral interest) times (1/8 Royalty Rate) = 1/3 x 1/8 = 1/24 = 0.04166667 RI.

A royalty interest in the oil and gas industry is an interest in an oil and natural gas lease that gives the owner of the interest the right to receive a portion of the production from the leased acreage (or of the proceeds of the sale thereof), but generally does not require the owner to pay any portion of the costs

To calculate the number of net royalty acres I'm selling, I use this formula: acres in tract X % of minerals owned X 8 X royalty interest reserved in lease X fraction of royalty interest being sold. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Net revenue is the amount that is shared among the property owners. To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

A Division Order (DO's), also known as a Division of Interest (DOI), is the instrument which details the proportional ownership of produced minerals, including oil, liquids, natural gas, etc., in a well or unitized area of production.

Calculating net revenue interest formula To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.