A Demand Promissory Note (DPN) is a legally binding document that is typically used for secured lending between two parties. It is a written promise from one party (the maker) to pay another party (the payee) a certain amount of money on demand—or at a specified time in the future. A DPN typically includes the amount of money due, the date on which payment is due, and the interest rate to be paid. A Demand Promissory Note can be either unconditional or conditional. An unconditional DPN does not require any action from the maker to trigger a demand for payment. A conditional DPN requires certain conditions to be met before a demand for payment can be made. Types of Demand Promissory Note include: — Unconditional Demand Promissory Not— - Conditional Demand Promissory Note — Secured Demand Promissory Not— - Unsecured Demand Promissory Note — Revolving Demand Promissory Not— - Balloon Demand Promissory Note — Variable Demand Promissory Not— - Demand Line of Credit Promissory Note.

Demand Promissory Note

Description

Definition and meaning

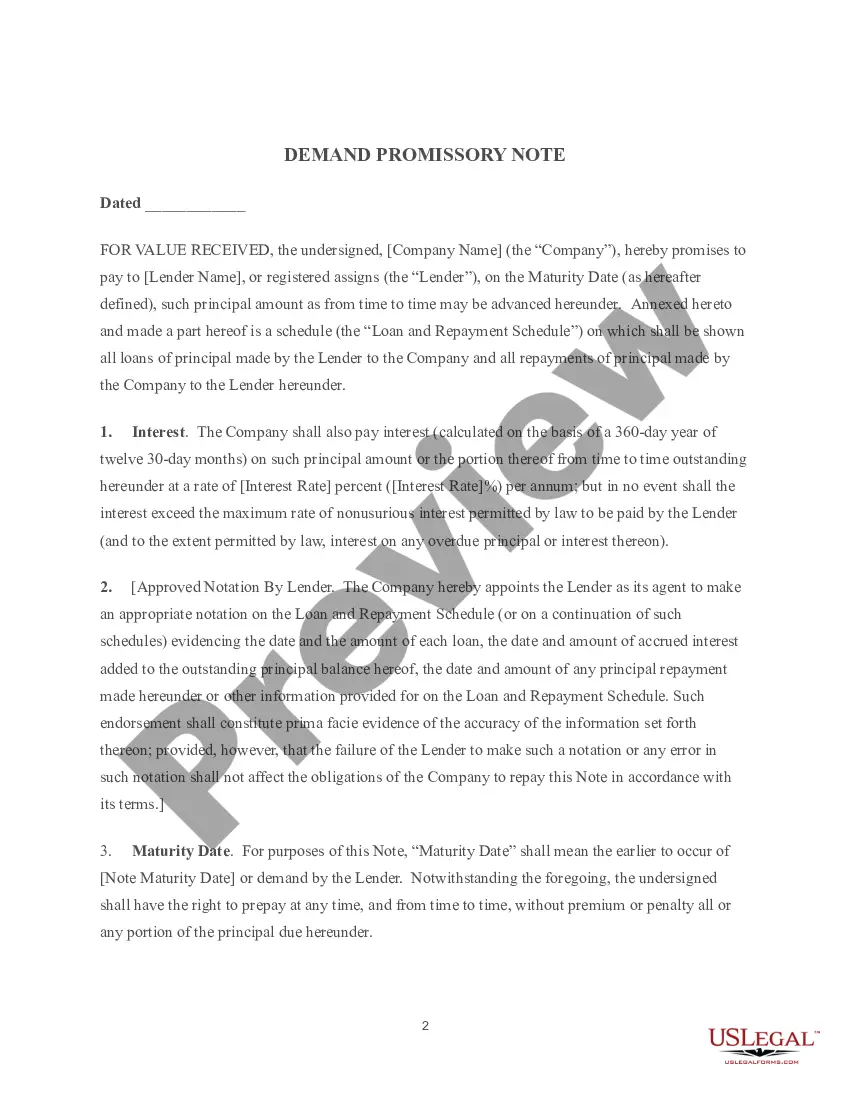

A demand promissory note is a financial instrument that serves as a formal loan agreement. It outlines the amount borrowed, the interest rate, and the conditions for repayment. This document is legally binding and indicates the borrower's commitment to repay the specified amount to the lender upon demand.

Key components of the form

The demand promissory note includes several essential components:

- Principal Amount: The total sum borrowed from the lender.

- Interest Rate: The percentage of interest that will be charged on the principal amount.

- Maturity Date: The date by which the loan must be repaid or can be demanded by the lender.

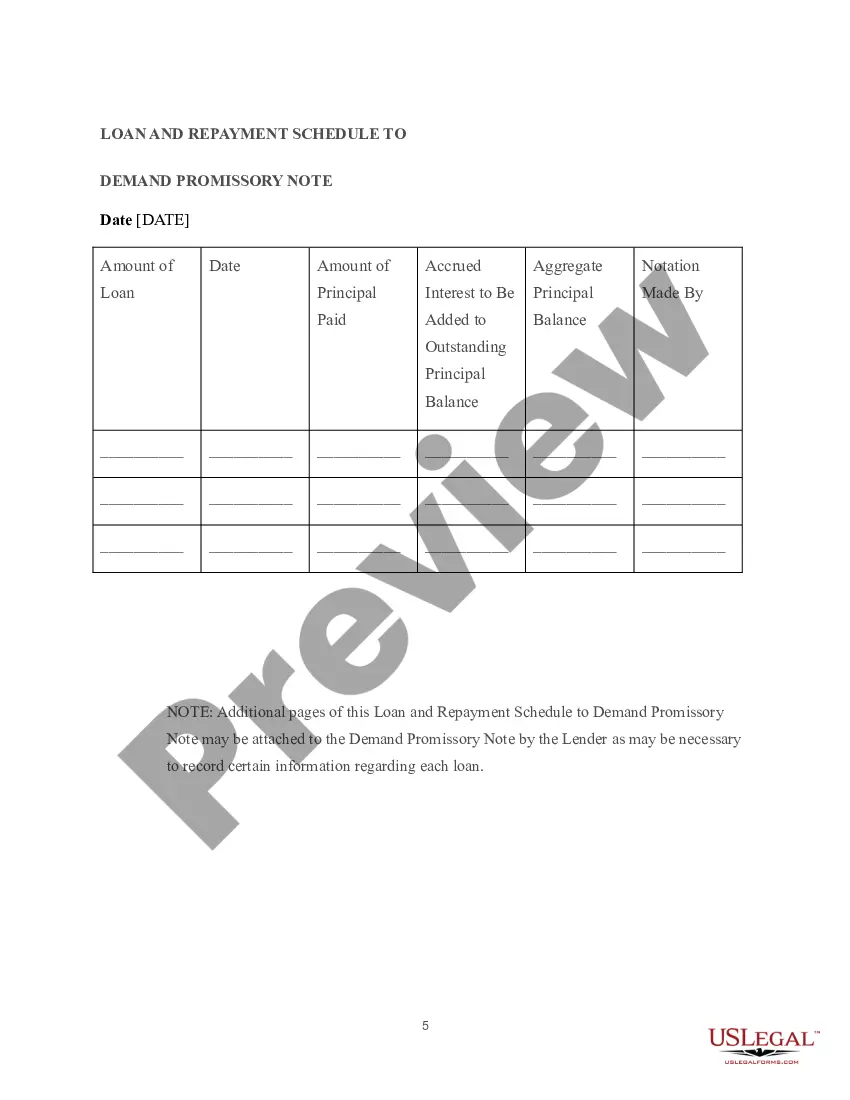

- Loan and Repayment Schedule: A detailed outline of loan disbursement and repayments made.

How to complete a form

To effectively fill out a demand promissory note, follow these steps:

- Enter the date on which the note is created.

- Fill in the names of the company and the lender.

- Specify the principal amount being borrowed.

- Indicate the agreed interest rate.

- Provide the maturity date for the loan.

- Attach a loan and repayment schedule detailing the terms.

Who should use this form

This form is suitable for individuals or businesses seeking to formalize a borrowing arrangement. It is beneficial for:

- Companies needing quick access to funds

- Individuals lending money to friends or family

- Investors looking to document loans in a legally enforceable manner

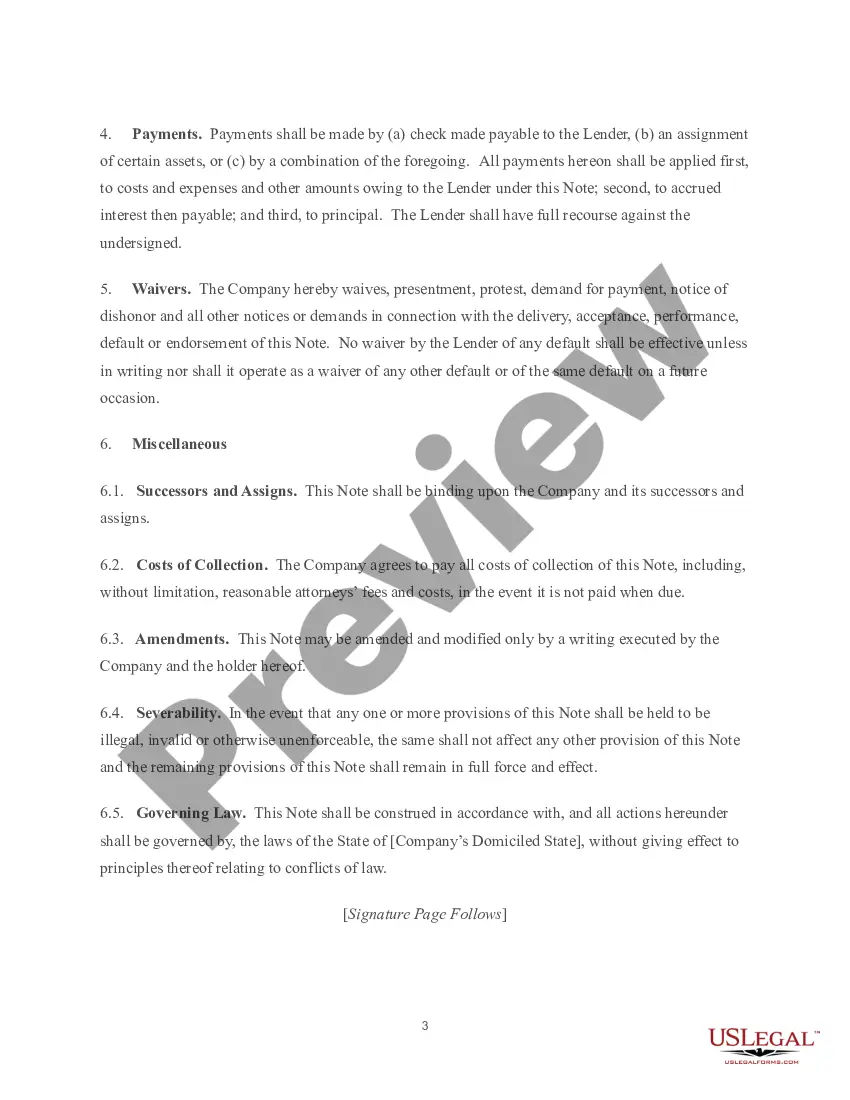

Legal use and context

A demand promissory note is useful in various contexts, particularly in financial transactions where immediate repayment may be requested. This document ensures both parties understand their rights and obligations, providing a clear legal framework governing the loan arrangement.

Common mistakes to avoid when using this form

When completing a demand promissory note, avoid these common errors:

- Not clearly defining the interest rate or maturity date.

- Failing to include a repayment schedule.

- Not signing the document, which may render it unenforceable.

How to fill out Demand Promissory Note?

If you’re searching for a way to appropriately complete the Demand Promissory Note without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of documentation you find on our online service is designed in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Demand Promissory Note:

- Make sure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and choose your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Demand Promissory Note and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

A promissory note payable on demand is a way to get repaid when you loan money to someone. It is a document that states the terms of the loan and includes the ?payable on demand? notation on it. This means that you can demand full payment of the loan at any time you deem necessary.

A demand (or due on demand) promissory note is a note that you as the lender, or holder, can collect on at any time. In other words, the loan comes due whenever you decide to ask for the money, whether the borrower is making regular payments or not.

There are two types of promissory notes often used to evidence a loan or debt. One type is referred to as ?demand? promissory note because the note is payable at any time on demand by the lender. The other type is ?with distinguishing characteristics.? A demand note is theoretically due from the moment it is executed.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.