Plan of Liquidation

Description

Definition and meaning

A Plan of Liquidation is a formal process by which a corporation concludes its financial operations, distributes its assets, and dissolves its legal entity. This plan outlines the steps for liquidating assets, settling debts, and distributing remaining assets to shareholders. It is typically initiated when a company decides to cease operations and is required to fulfill legal obligations before its dissolution.

Key components of the form

The essential components of a Plan of Liquidation include:

- Approval Process: Details the steps necessary for shareholder approval of the plan.

- Liquidation Procedure: Outlines the systematic approach for disposing of assets and addressing liabilities.

- Contingency Reserve: Specifies the establishment of funds to cover potential future claims against the company.

- Indemnification Provisions: Describes the protections afforded to directors and officers involved in the liquidation process.

How to complete a form

Completing a Plan of Liquidation requires several key steps:

- Gather necessary documentation, including financial statements and shareholder lists.

- Draft the Plan of Liquidation, ensuring all relevant legal and operational details are included.

- Submit the plan to the Board of Directors for review and approval.

- Schedule a special meeting of shareholders to discuss and vote on the plan.

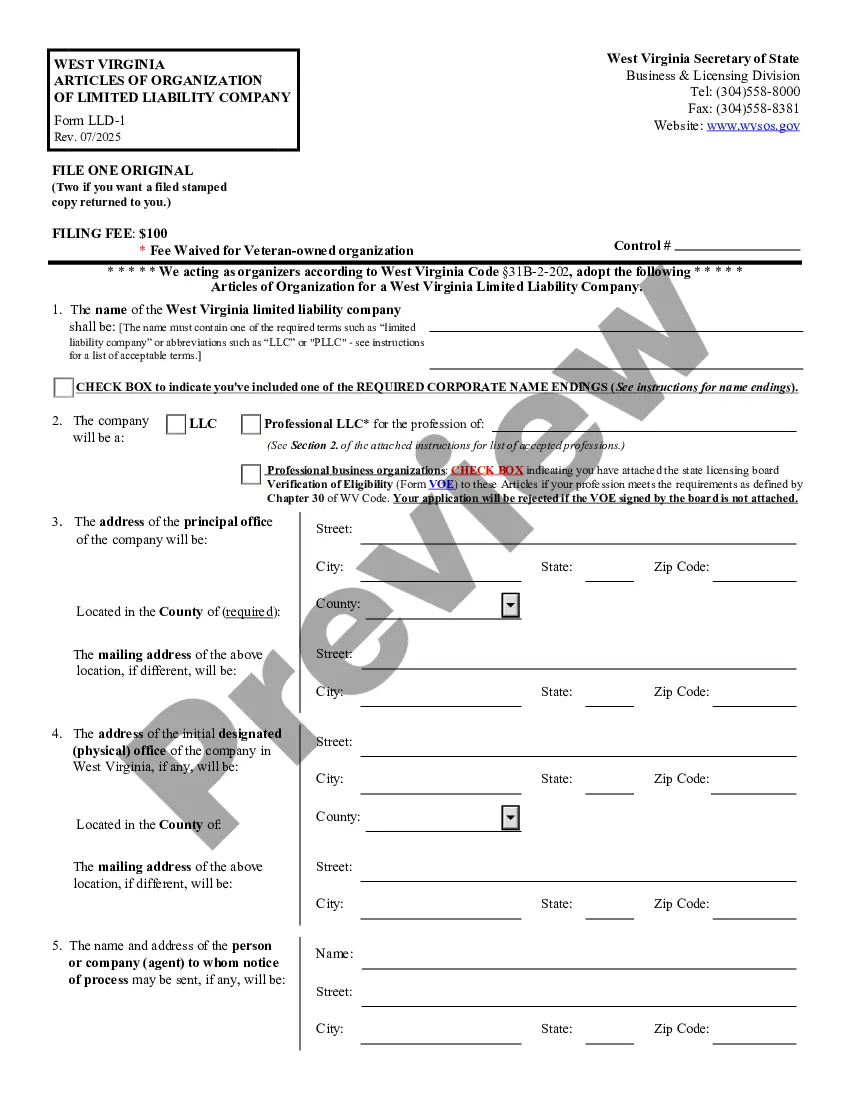

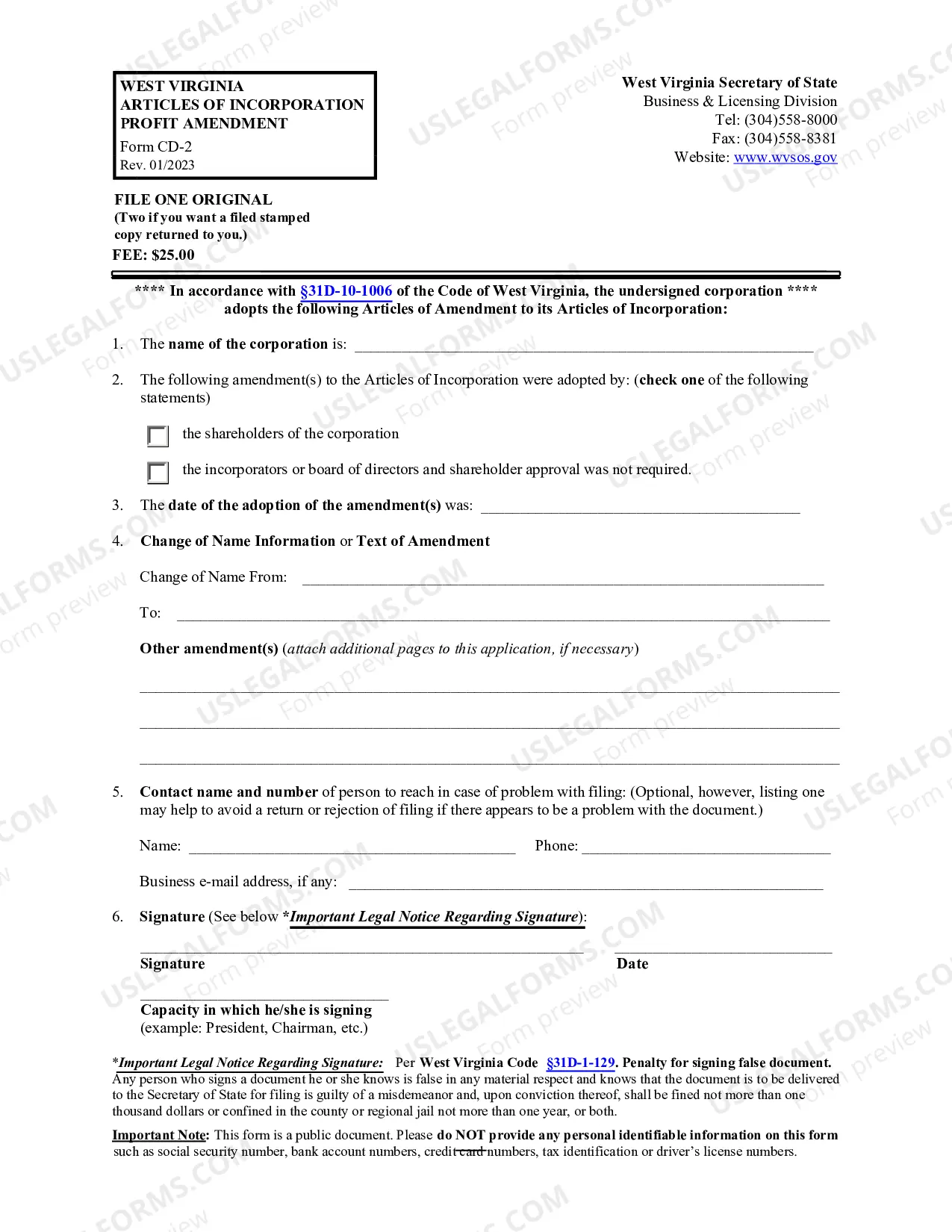

- File required documents with the appropriate state authorities once approved by shareholders.

Who should use this form

This form is designed for corporations contemplating liquidation and dissolution. It is essential for:

- Business owners wishing to cease operations and dissolve their corporation.

- Shareholders needing a structured process to distribute assets after a company’s closure.

- Corporate directors focused on ensuring compliance with state regulations during the liquidation process.

Common mistakes to avoid when using this form

Users should be cautious of the following common pitfalls:

- Failing to secure proper shareholder approval, which can invalidate the entire process.

- Neglecting to address all outstanding debts before asset distribution.

- Not properly documenting all steps taken during the liquidation, which can lead to legal complications.

- Ignoring state-specific filing requirements, which vary by jurisdiction.

How to fill out Plan Of Liquidation?

When it comes to drafting a legal form, it’s easier to leave it to the professionals. However, that doesn't mean you yourself cannot find a sample to use. That doesn't mean you yourself cannot get a template to utilize, nevertheless. Download Plan of Liquidation right from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. After you’re signed up with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Plan of Liquidation quickly:

- Be sure the form meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Hit Buy Now.

- Select the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the file.

After the Plan of Liquidation is downloaded you can complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

332 provides tax-free treatment to the corporate shareholder's gain or loss from the receipt of the subsidiary's property in liquidation, and Sec.1504(a)(2) (generally 80% by voting power and value) and the distribution was made in complete cancellation or redemption of all the stock of the liquidating corporation.

Under Sec. 331, a liquidating distribution is considered to be full payment in exchange for the shareholder's stock, rather than a dividend distribution, to the extent of the corporation's earnings and profits (E&P).331 when they receive the liquidation proceeds in exchange for their stock.

After the costs of liquidation, secured creditors and preferential creditors are paid first, and then unsecured creditors. Creditors with valid specific security over stock and equipment (such as retention of title clauses or leases) generally have priority to recover those items where they can be clearly identified.

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.

Liquidate means converting property or assets into cash or cash equivalents by selling them on the open market. Liquidation similarly refers to the process of bringing a business to an end and distributing its assets to claimants.

Liquidation is important if a business fails due to anything from a lack of visionary management to increasing debts; from almost-zero revenue inflow to rising costs of unnecessary assets. Absence of profit planning and control on the continuity of losses for extended periods also call for liquidation.

Plan of Liquidation means a plan (including by operation of law) that provides for, contemplates or the effectuation of which is preceded or accompanied by (whether or not substantially contemporaneously) (i) the sale, lease, conveyance or other disposition of all or substantially all of the assets of the referent

In that process, the corporation notifies creditors of the impending cessation of business and does all acts appropriate to liquidate its business, such as collecting and selling assets, discharging liabilities, and distributing any remaining assets to shareholders.6 The corporation may, but is rarely required to,