Form of Revolving Promissory Note

Description

Key Concepts & Definitions

Form of Revolving Promissory Note: A financial document that evidences a type of loan where the borrower can repeatedly access funds up to a specified maximum limit and repay, only to borrow again. Revolving Credit Loans: Loans that provide borrowers with a maximum line of credit they can borrow against, typically seen in credit cards and home equity lines of credit. Credit Promissory Note: A form of promissory note specifically focused on the credit aspect, detailing the credit agreement between borrower and lender.

Step-by-Step Guide

- Determine Need: Assess if a revolving promissory note fits your financial requirements, especially for purposes like ongoing projects or fluctuating cash flow needs.

- Consult a Legal Expert: Engage with legal consultation services to tailor a promissory note that complies with intellectual property law, real estate transactions, and other relevant legal frameworks.

- Choose the Right Template: Use a promissory note template to ensure all critical components are included, such as terms of the credit, interest rates, and repayment schedule.

- Implement Monitoring: Regularly review the loan repayment schedule and adjust your financial planning accordingly.

Risk Analysis

- Credit Risk: The borrower might fail to adhere to the repayment obligations, impacting their credit score.

- Legal Risk: Improper documentation or failure to comply with relevant laws can lead to legal repercussions.

- Liquidity Risk: Over reliance on revolving credit may lead to liquidity issues if not managed properly.

Best Practices

- Regular Updates: Regularly update estate planning services to reflect changes in the borrower's financial status or revolving credit details.

- Detailed Documentation: Ensure all agreements and changes are well-documented to avoid future disputes.

- Risk Assessment: Periodically reassess the risks associated with the revolving promissory note, particularly if used for high-stake projects like a startup technology project.

Case Studies / Real-World Applications

Consider how evolving promissory notes have enabled flexibility in managing a startup technology project, allowing founders to strategically time when they draw down or repay debt based on cash flow and investment needs. Another example might exhibit how revolving credit loans facilitated real estate transactions providing immediate liquidity for quick property turnaround.

FAQ

- How is a revolving promissory note different from a traditional loan? Unlike traditional loans with fixed repayment schedules, revolving promissory notes allow repeated borrowing within the credit limit.

- Can revolving promissory notes be used for personal use? Yes, they are commonly used for personal lines of credit like credit cards.

- What legal aspects need to be considered? A legal consultation is vital to manage risks associated with intellectual property law, estate planning, and other contract-related legalities.

Summary

Revolving promissory notes are adaptable financial instruments suitable for businesses and individuals needing flexible access to funds. They are crucial in dynamic economic activities but require careful management and legal oversight to mitigate associated risks effectively.

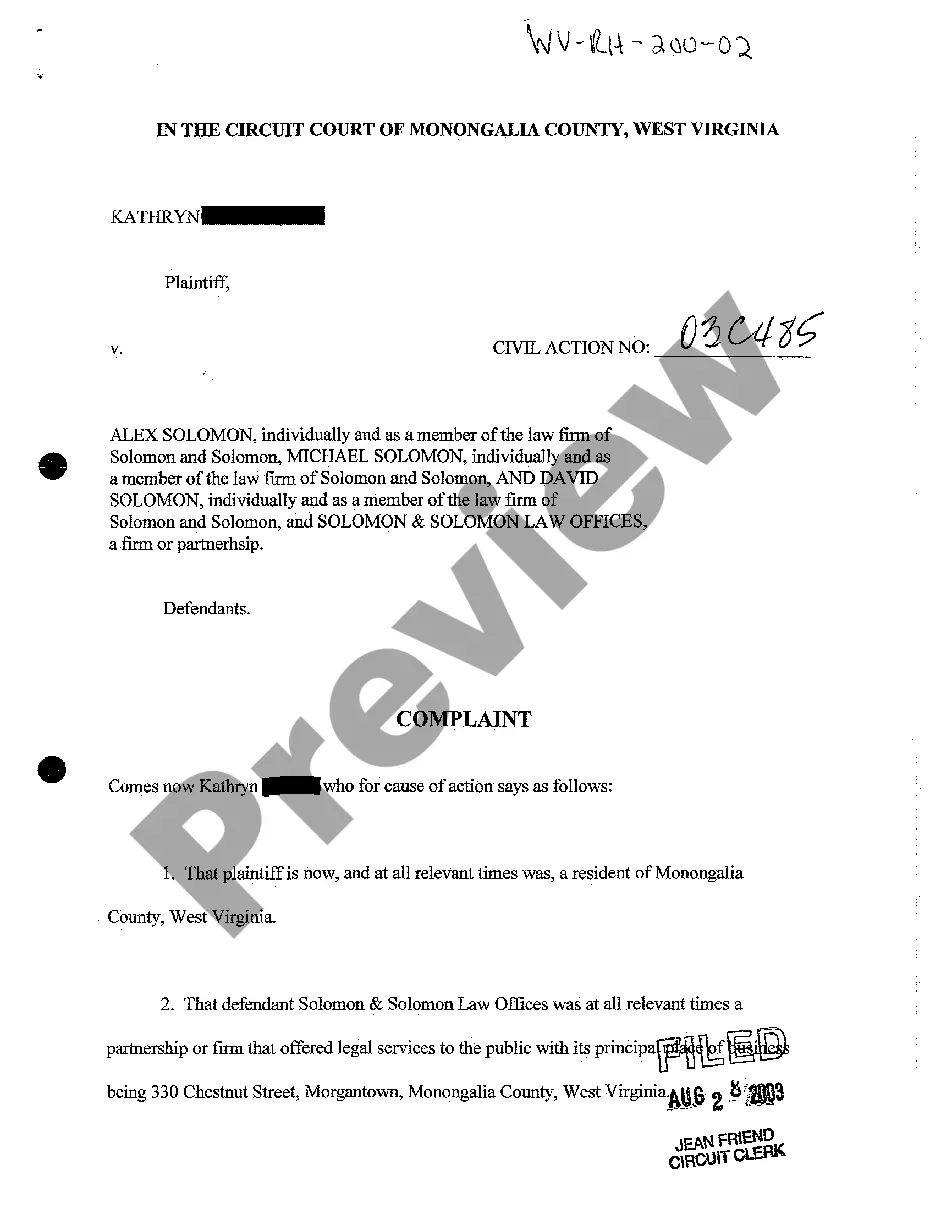

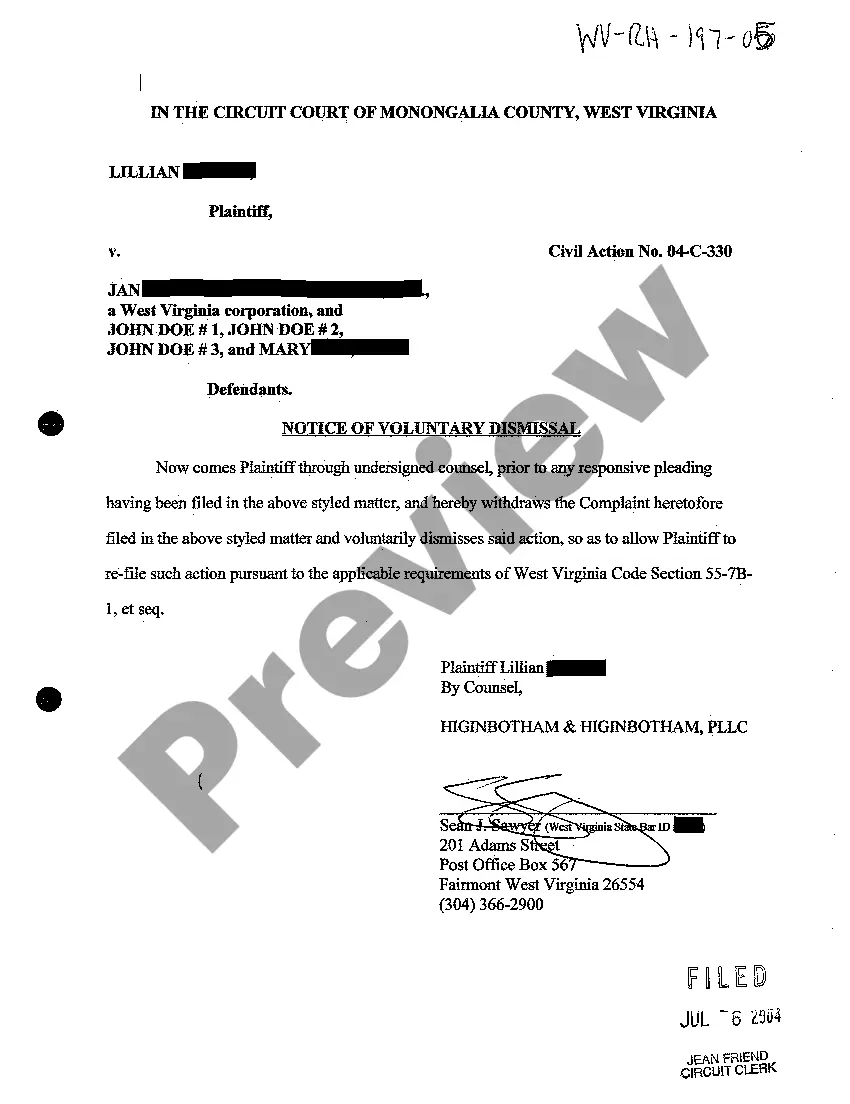

How to fill out Form Of Revolving Promissory Note?

When it comes to drafting a legal form, it’s better to leave it to the professionals. However, that doesn't mean you yourself cannot get a template to use. That doesn't mean you yourself cannot find a template to utilize, however. Download Form of Revolving Promissory Note from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you’re registered with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

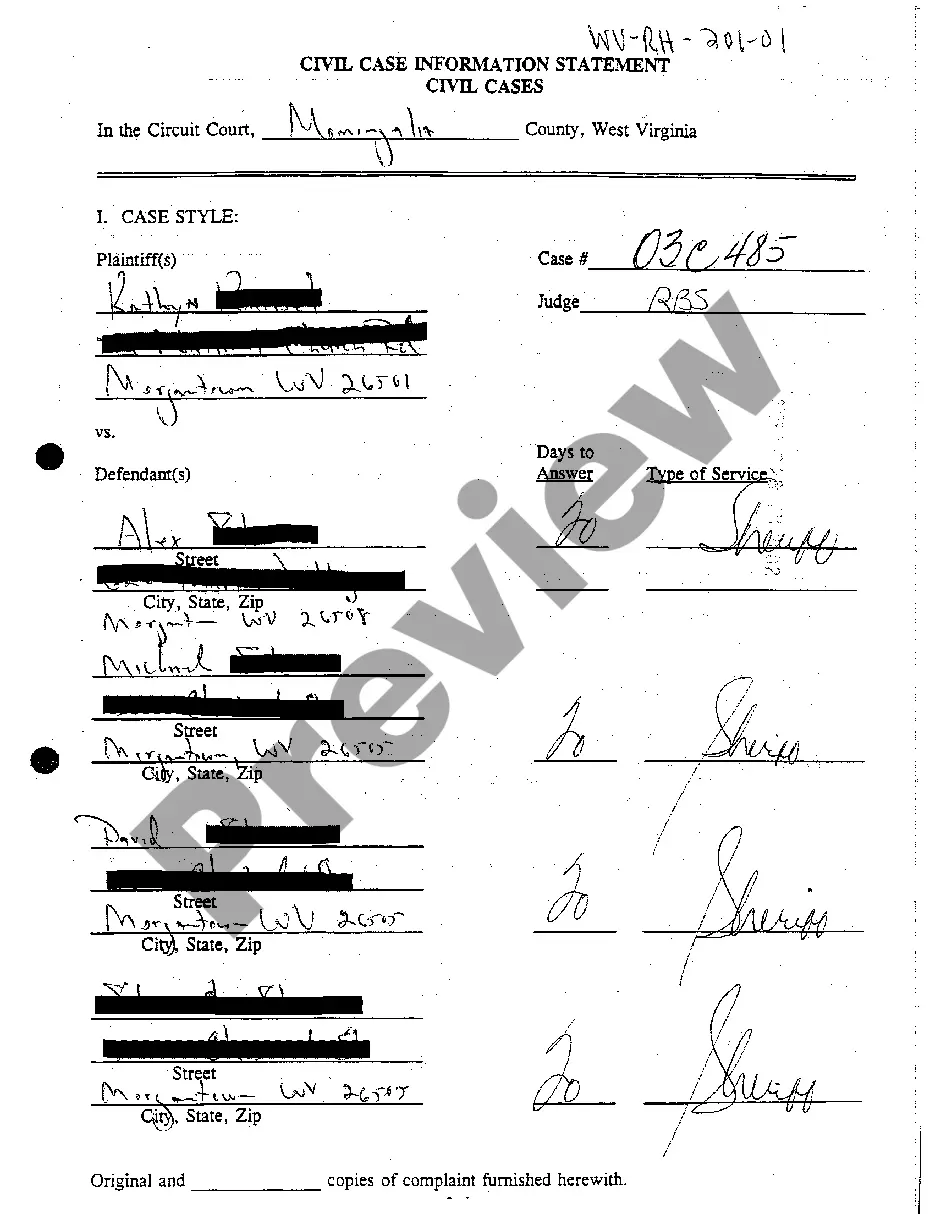

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Form of Revolving Promissory Note quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Form of Revolving Promissory Note is downloaded you may complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Personal Promissory Notes This is a particular loan taken from family or friends. Commercial Here, the note is made when dealing with commercial lenders such as banks. Real Estate This is similar to commercial notes in terms of nonpayment consequences.

There are four significant types of promissory notes in India. A personal note is the kind of promissory note that an individual should seek when lending money to family members or close relatives. A commercial note is the type of promissory note that is signed between a borrower and a financial institution.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

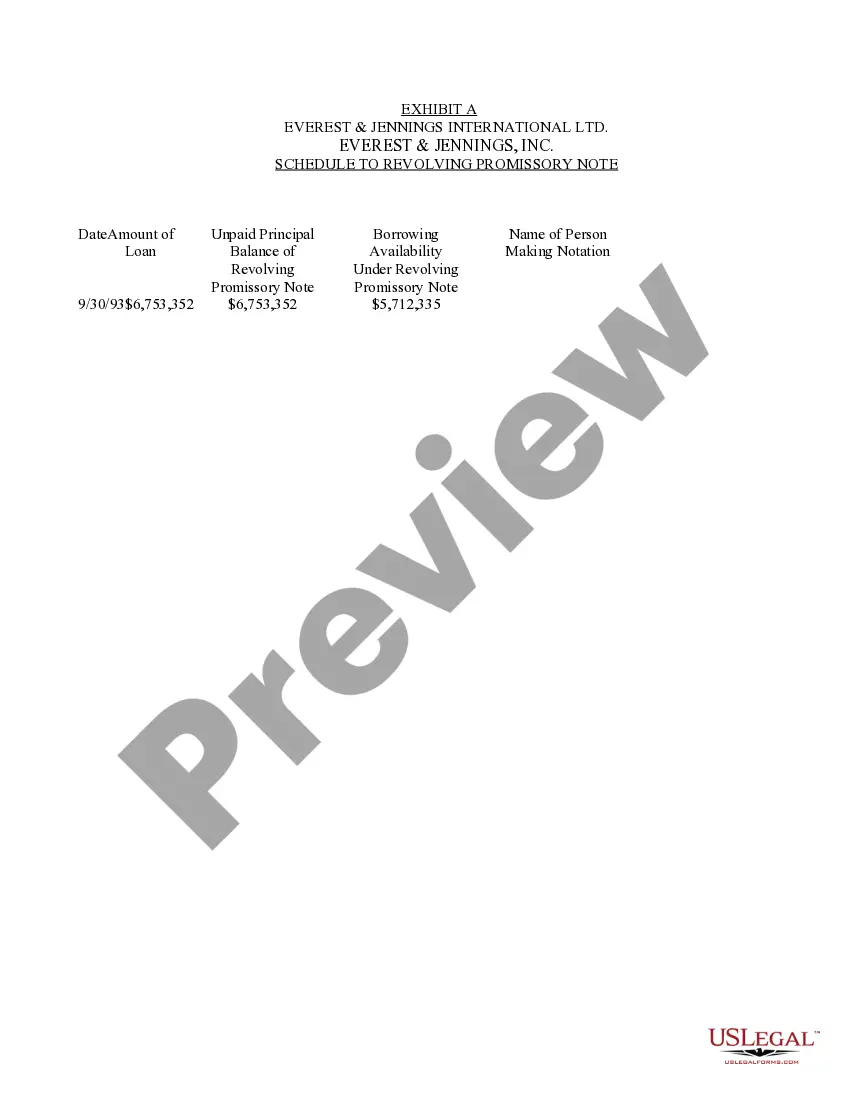

Revolving Note or "Revolving Notes" means the promissory notes of the Borrower in favor of each of the Lenders evidencing the Revolving Loans in substantially the form attached as Schedule 2.1(e), individually or collectively, as appropriate, as such promissory notes may be amended, modified, supplemented, extended,

An IOU (abbreviated from the phrase "I owe you") is usually an informal document acknowledging debt. An IOU differs from a promissory note in that an IOU is not a negotiable instrument and does not specify repayment terms such as the time of repayment.

A promissory note includes a specific promise to pay, and the steps required to do so (like the repayment schedule), while an IOU merely acknowledges that a debt exists, and the amount one party owes another.