Failure to File a Tax Return — Elements of the Offense (26 U.S.C. Sec. 7203) is a criminal offense that can be prosecuted under the United States federal law. It occurs when a taxpayer fails to file a required tax return or pay the taxes they owe on time. This is a willful violation of the Internal Revenue Code, and can result in civil and criminal penalties. The elements of this offense are as follows: 1. Willful failure: The taxpayer must have willfully failed to pay the required taxes or file a tax return by the deadline. 2. Tax liability: The taxpayer must have had a legal obligation to file a tax return or pay taxes. 3. Knowledge: The taxpayer must have been aware that they had a legal obligation to file a tax return or pay taxes. Types of Failure to File a Tax Return — Elements of the Offense (26 U.S.C. Sec. 7203) include: 1. Willful Failure to File: This occurs when a taxpayer knowingly and willfully fails to file a required tax return. 2. Willful Failure to Pay: This occurs when a taxpayer knowingly and willfully fails to pay taxes that they owe. 3. Fraudulent or False Returns: This occurs when a taxpayer knowingly and willfully files a false or fraudulent tax return.

Failure to File a Tax Return - Elements of the Offense (26 U.S.C. Sec. 7203)

Description

How to fill out Failure To File A Tax Return - Elements Of The Offense (26 U.S.C. Sec. 7203)?

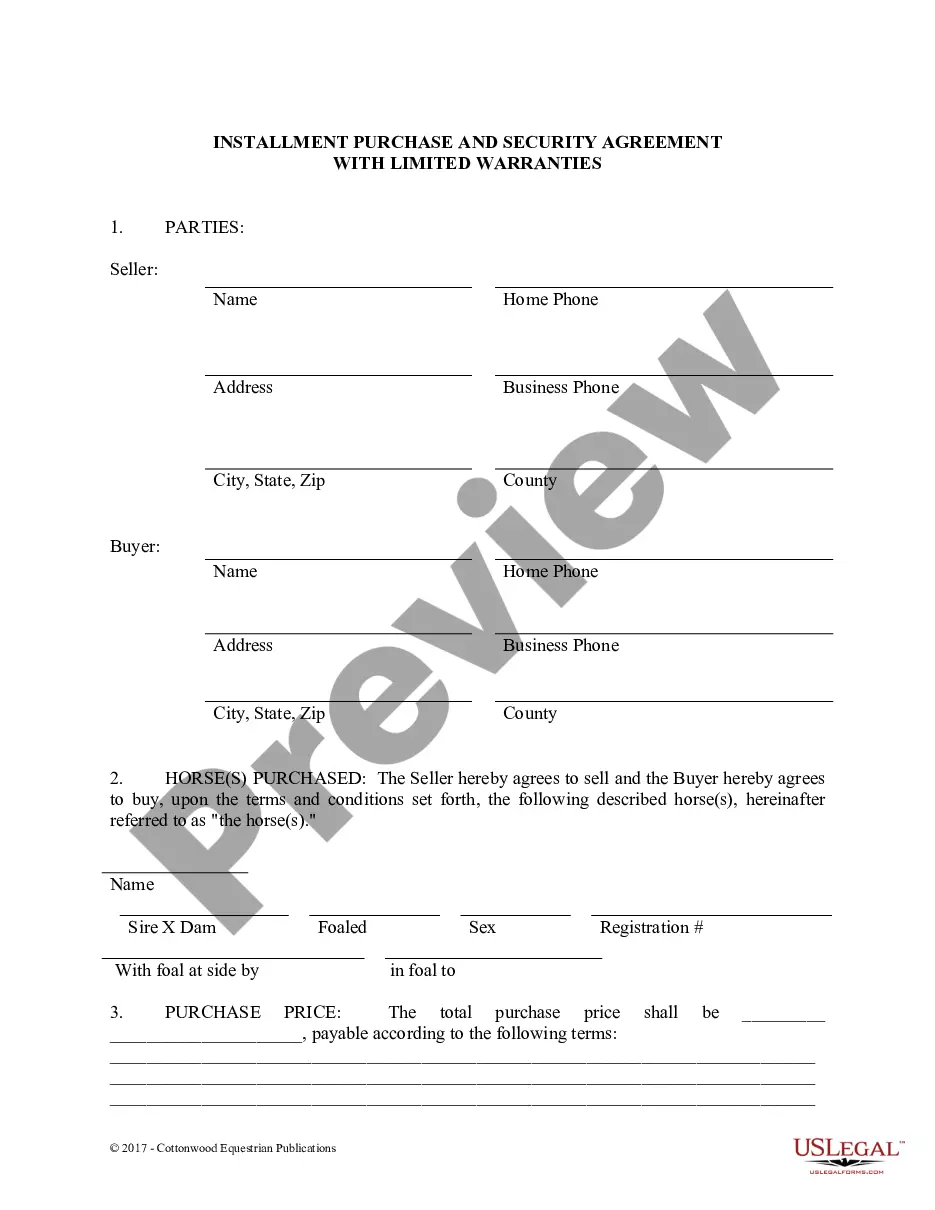

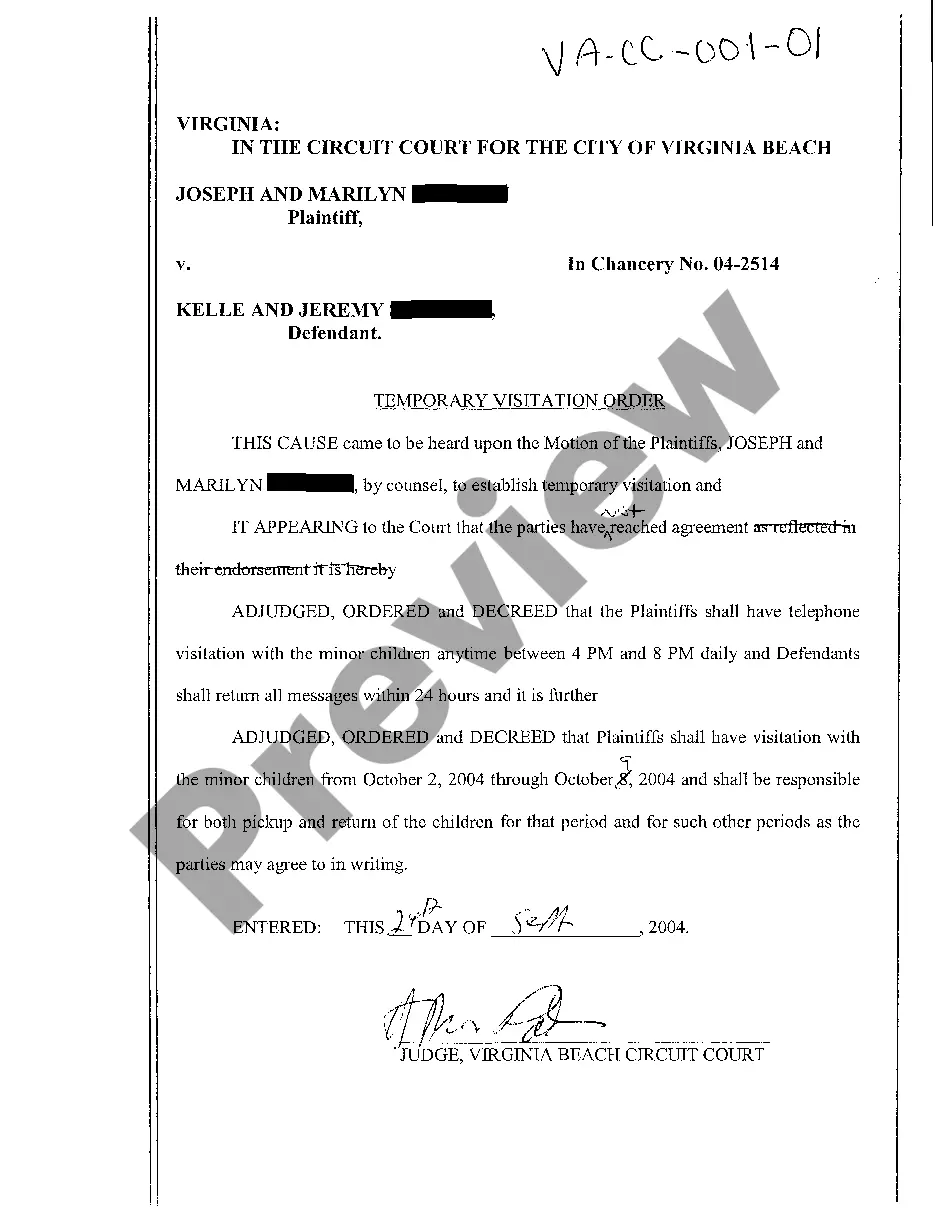

How much time and resources do you typically spend on composing formal paperwork? There’s a greater option to get such forms than hiring legal experts or spending hours searching the web for an appropriate blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Failure to File a Tax Return - Elements of the Offense (26 U.S.C. Sec. 7203).

To acquire and complete an appropriate Failure to File a Tax Return - Elements of the Offense (26 U.S.C. Sec. 7203) blank, follow these easy steps:

- Look through the form content to ensure it complies with your state requirements. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Failure to File a Tax Return - Elements of the Offense (26 U.S.C. Sec. 7203). If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Failure to File a Tax Return - Elements of the Offense (26 U.S.C. Sec. 7203) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web services. Join us today!

Form popularity

FAQ

You only need to file Schedule 3 if you're claiming any of the tax credits or made any of the tax payments mentioned above. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.

Section 7201 creates two offenses: (a) the willful attempt to evade or defeat the assessment of a tax, and (b) the willful attempt to evade or defeat the payment of a tax. Sansone v. United States, 380 U.S. 343, 354 (1965).

It may be beneficial for shareholders to complete and retain Form 7203 even for years it is not required to be filed, as this will ensure their bases are consistently maintained year after year.

Most Common Charge under 7203 is Failure to File a Return The charge most often brought under Section 7203 is the failure to make (file) a return. A number of cases are also brought under Section 7203 for failure to pay a tax. Note that the attempt to evade or defeat the payment of a tax is a felony under Section 7201.

Exceptions to Filing Form 7203 Shareholders only obtain basis from acting as a guarantee or in a similar capacity to the extent the shareholder makes a payment pursuant to the guarantee.? So typically, shareholder loan basis is only obtained by the shareholder making direct loans to the entity.

Form 7203 is used to calculate any limits on the deductions you can take for your share of an S corporation's deductions, credits, and other items. For example, your deductible loss generally can't be greater than the cost of your investment (stock and loans) in the S-Corp.

7203 the willful failure to file a return, supply information, or pay tax at the time or times required by law, are felonies and carry a penalty of imprisonment for up to 3 years, a $250,000 fine for individuals or a $500,000 fine for corporations, or both, and reimbursement to the federal government to cover the costs

Failing to include Form 7203 on a tax return in future years may result in the IRS disallowing any losses reported on the Schedule K-1 (Form 1120-S) or subject the taxpayer to a request for the form.