A Financial Support Agreement -- Guaranty of Obligation is a type of agreement that is used when a party (the "guarantor") guarantees to another party (the "creditor") the payment of a debt or other obligation by a third party (the "principal obliged"). The guarantor agrees to pay the creditor the amount of the debt or other obligation if the principal obliged fails to do so. There are two main types of Financial Support Agreement -- Guaranty of Obligation: surety guaranty and indemnity guaranty. A surety guaranty is a guarantee in which the guarantor agrees to pay the creditor if the principal obliged fails to do so. An indemnity guaranty is a guarantee in which the guarantor agrees to reimburse the creditor for any losses or damages incurred as a result of the principal obliged’s failure to pay the debt or other obligation.

Financial Support Agreement -- Guaranty of Obligation

Description

How to fill out Financial Support Agreement -- Guaranty Of Obligation?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to fill out Financial Support Agreement -- Guaranty of Obligation, our service is the best place to download it.

Obtaining your Financial Support Agreement -- Guaranty of Obligation from our library is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the proper template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guide for you:

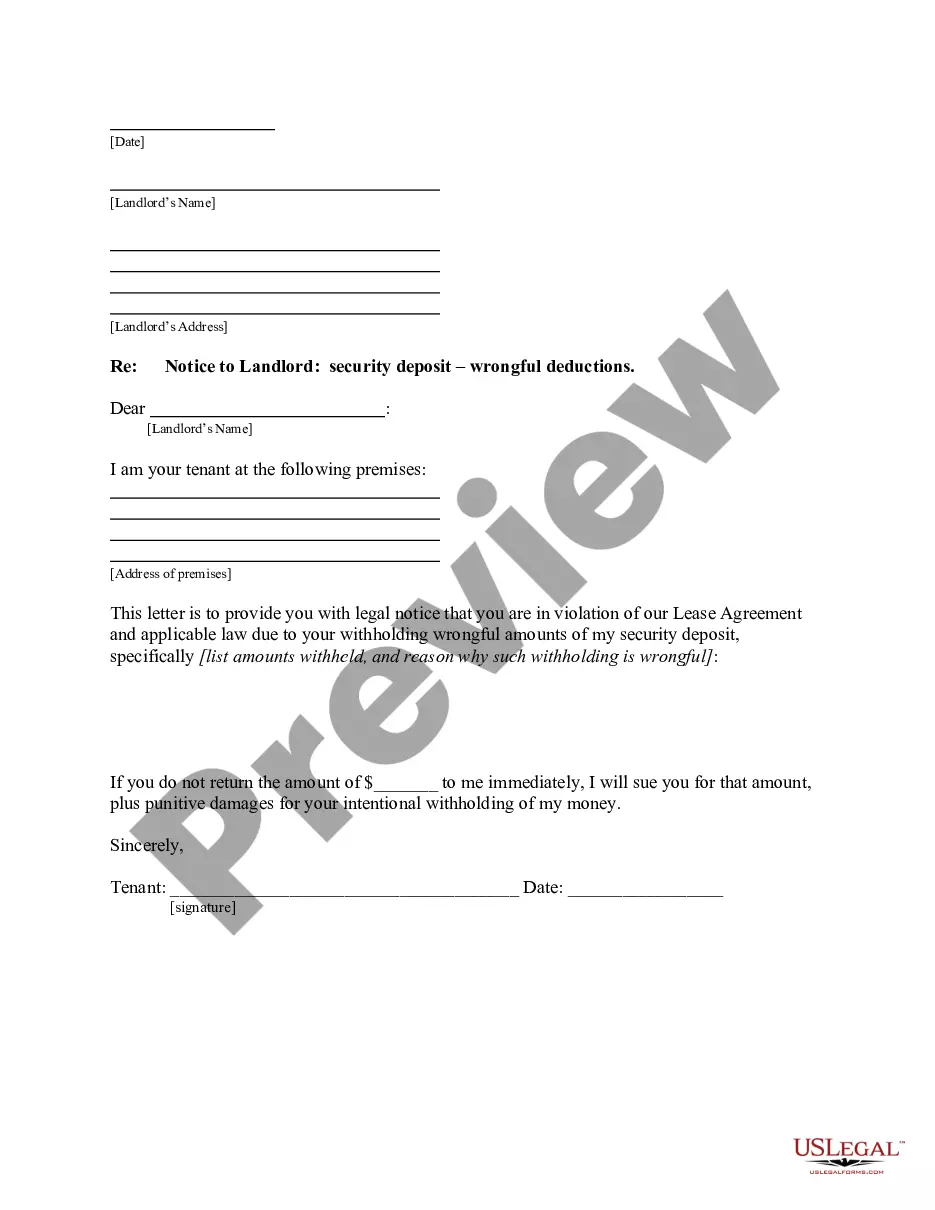

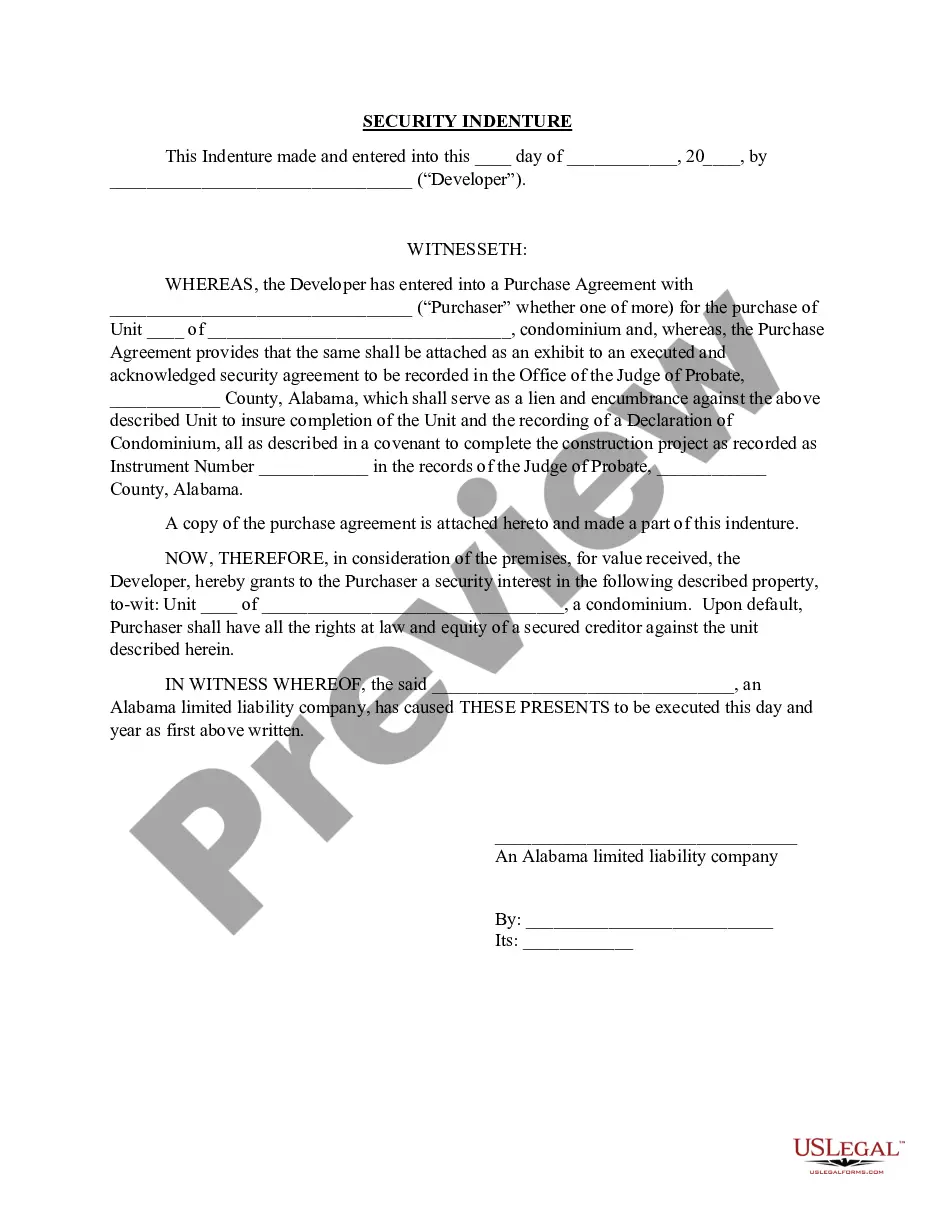

- Document compliance check. You should carefully review the content of the form you want and ensure whether it satisfies your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find an appropriate template, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Financial Support Agreement -- Guaranty of Obligation and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

If you are a guarantor for home loan, you can request to recover the amount by liquidating the property. A refusal to repay the loan, gives bank the right to take legal actions. In extreme cases, bank may seek the possession of your property to recover its dues.

A secondary obligation A guarantee is a promise by one party (the guarantor) to another party (the guaranteed party) to be responsible for the due performance of the obligations of another party (the principal) to the guaranteed party if the principal fails to perform such obligations.

The Guarantor hereby unconditionally and irrevocably guarantees to the Beneficiaries the payment and performance of all of the Obligations, together with interest thereon as provided in Section 5.4. Guarantee of Obligations.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

A guaranty clause can take many forms; a primary example is a loan agreement that is co-signed, which can signify a guaranty from the co-signer to a specific amount, even if the loan agreement does not use a specific "guarantor" title.

A guaranty can be thought as a collateral to a primary or principal obligation from the guarantor to perform. In a finance or lending context, a guarantor would be forced to answer for the debt or default of the debtor to the creditor, if a debtor does not fulfill an obligation on their part to repay their debt.

A guarantee is a promise by one party (the guarantor) to another party (the guaranteed party) to be responsible for the due performance of the obligations of another party (the principal) to the guaranteed party if the principal fails to perform such obligations.

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the