Definition and meaning

An Intentionally Defective Grantor Trust (IDGT) is a type of irrevocable trust designed for estate planning. It allows the grantor, the person who creates the trust, to retain certain powers that make the trust 'defective' for income tax purposes. Consequently, income generated by the trust assets is still taxable to the grantor, even though the trust is treated as a separate entity for estate and gift tax purposes. This structure can provide significant tax benefits while preserving assets for future generations.

Legal use and context

The Intentionally Defective Grantor Trust is primarily used in estate planning to achieve various tax strategies, including reducing estate taxes and providing for beneficiaries without incurring gift taxes at the time of asset transfer. By intentionally making the trust defective, grantors can ensure that they remain liable for tax on the trust's income, which may result in lower overall tax obligations. Legal guidance is often recommended when setting up such a trust due to its complexity and potential irreplaceable value in estate planning.

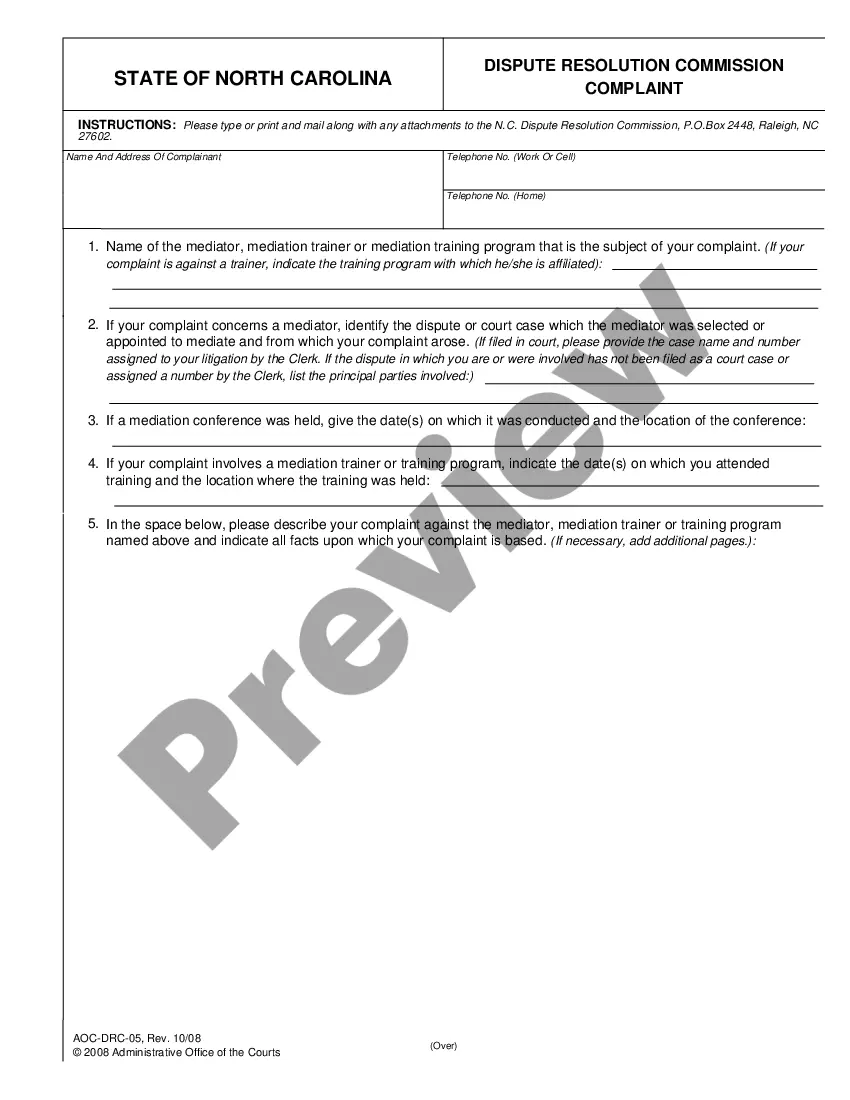

Key components of the form

When drafting an Intentionally Defective Grantor Trust, several key components must be included to ensure its effectiveness:

- Grantor Information: Identification of the person creating the trust.

- Trustee Information: Designation of one or more trustees responsible for managing the trust.

- Beneficiaries: Listing of individuals or entities who will benefit from the trust.

- Trust Terms: Specific details on how the trust's assets will be managed and distributed.

- Trust Assets: A comprehensive list of assets being transferred into the trust.

- Irrevocability Clause: A statement confirming that the trust cannot be modified or revoked after it is created.

These components work together to form a solid foundation for the trust, ensuring clarity and legal compliance.

How to complete a form

Completing an Intentionally Defective Grantor Trust form involves several important steps:

- Gather Necessary Information: Collect details about the grantor, trustee, and beneficiaries.

- Identify Trust Assets: Make a detailed list of all assets being transferred to the trust.

- Fill Out the Form: Accurately complete each section of the form, ensuring that all required information is included.

- Review the Draft: Consult with a legal professional to review the trust document for accuracy and compliance with state laws.

- Sign and Notarize: Once confirmed, have the form signed by the grantor and notarized to ensure its legal validity.

Common mistakes to avoid when using this form

When creating an Intentionally Defective Grantor Trust, it is crucial to avoid several common pitfalls:

- Not consulting with a qualified attorney, which can result in legal complications.

- Including unclear or vague terms in the trust document, leading to potential disputes.

- Failing to adequately identify all assets being transferred, which may affect trust functionality.

- Not reviewing state-specific legal requirements that may impact the trust’s validity.

- Neglecting to regularly update the trust as circumstances change (e.g., new assets or changes in beneficiaries).

Benefits of using this form online

Utilizing an online service to create an Intentionally Defective Grantor Trust offers several advantages:

- Convenience: Easily complete the process from anywhere, at any time.

- Accessibility: Access templates and tools designed for users with varying levels of legal knowledge.

- Cost-Effectiveness: Often more affordable than hiring a traditional lawyer for estate planning.

- Streamlined Process: Guided steps help ensure that all necessary information is collected and legally sound.

- Immediate Availability: Download and print the completed documents for your records immediately.

Working with official documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Intentionally Defective Grantor Trust template from our library, you can be sure it complies with federal and state laws.

Working with our service is simple and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Intentionally Defective Grantor Trust within minutes:

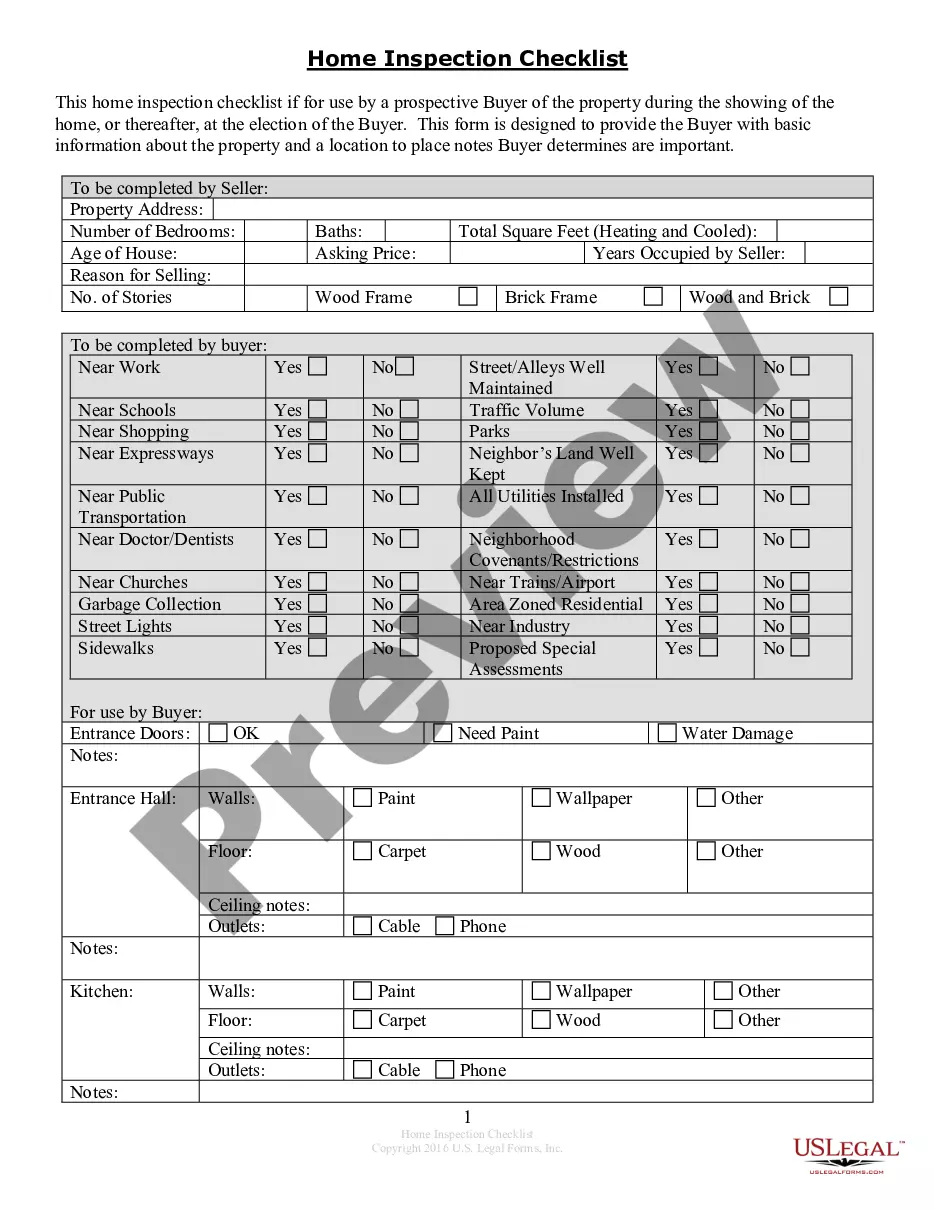

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Intentionally Defective Grantor Trust in the format you prefer. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Intentionally Defective Grantor Trust you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!