A Flexible Benefits Plan benefits is a plan that allows employees to select from a pool of choices, some or all of which may be tax-advantaged. Potential choices include cash, retirement plan contributions, vacation days, and insurance. It is also called a cafeteria plan.

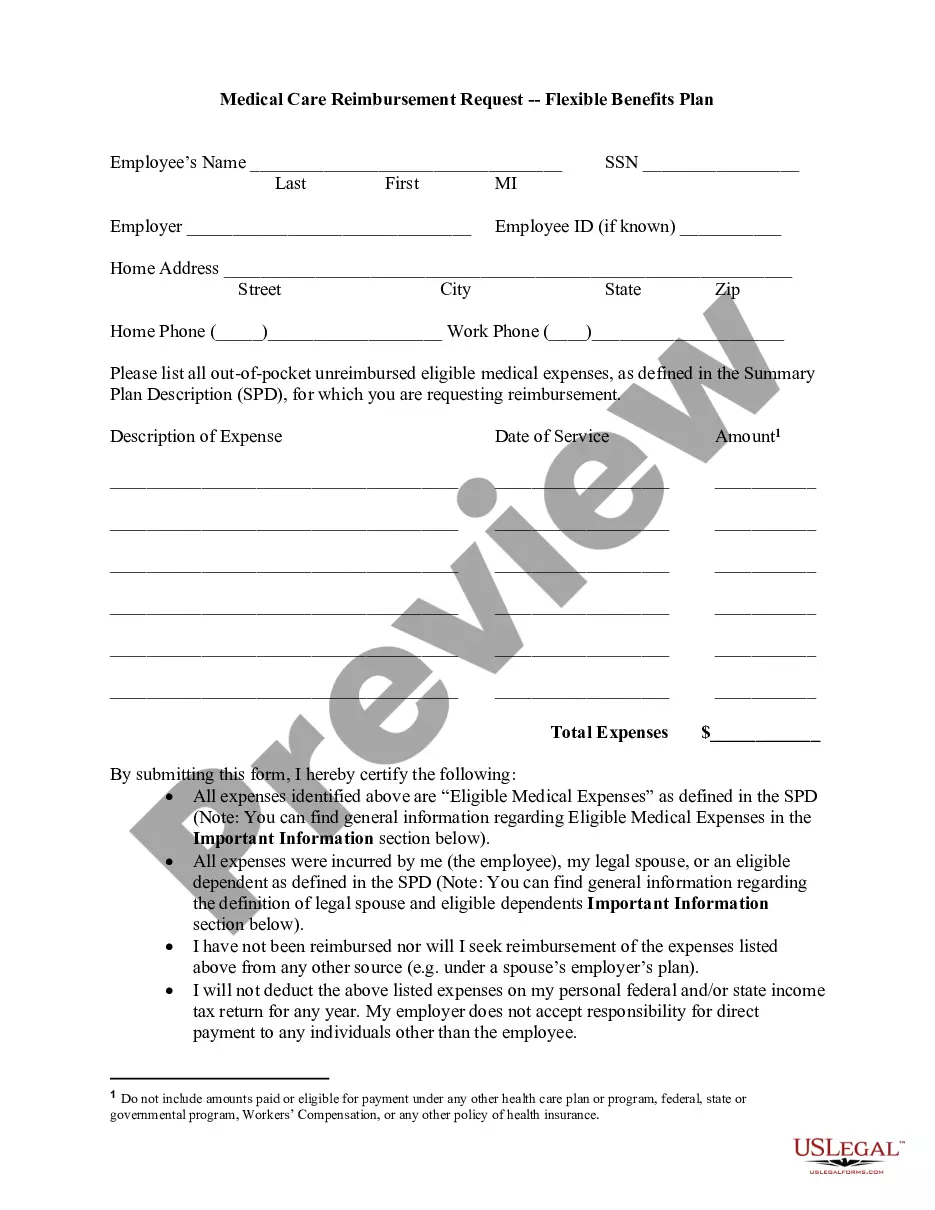

Medical Care Reimbursement Request - Flexible Benefits Plan

Description

How to fill out Medical Care Reimbursement Request - Flexible Benefits Plan?

Use the most complete legal catalogue of forms. US Legal Forms is the perfect platform for getting updated Medical Care Reimbursement Request - Flexible Benefits Plan templates. Our service offers a large number of legal documents drafted by certified legal professionals and grouped by state.

To get a template from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and select the template you are looking for and buy it. After buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the form features a Preview option, utilize it to review the sample.

- If the sample does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample meets your requirements.

- Select a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr debit/credit card.

- Choose a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your time and effort with the platform to find, download, and complete the Form name. Join a huge number of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

How to claim Medical reimbursement? One can claim reimbursement of medical expenses by submitting the original bills to the employer. The employer would accordingly reimburse such expenses incurred subject to the overall limit of Rs 15,000 without tax deduction.

Design the plan (decide on employee allowances, eligibility criteria, etc.) Decide how you will set up and administer the plan. Establish written, legal plan documents. Distribute plan documents and benefit information to employees.

Log in to the FSAFEDS app using the same username and password as your online account. Select whether to submit a claim or pay a provider. Follow the prompts to enter claims details. Take photos of your itemized receipts (and other documentation if needed) or upload from your mobile device.

Bottom line: You can reimburse yourself from an HSA or FSA. However, you need to make sure you keep track of your medical expenses and ensure they're all qualified before you reimburse yourself to avoid penalties and taxes.

Start and end dates of service 2022 Dependent's name and date of birth 2022 Itemization of charges 2022 Provider's name, address, and tax ID or Social Security number 2022 Credit card receipts, canceled checks, and balance forward statements do not meet the requirements for acceptable documentation.

A Medical Expense Reimbursement Plan is just a way for employers to give their employees tax-free money that can be used only to pay medical expenses.Employees pay for their own doctor visits and medicine, and then the employer reimburses them.

How to start an individual coverage HRA. You can set up an individual coverage HRA at any time. You'll need to provide a written notice to your employees as soon as they're eligible to participate and 90 days before the beginning of each plan year.

Employers set allowance amounts. With an MERP, employers set a monthly allowance amount for each employee. Employees purchase health care. Employees submit proof of expense. Employers review employee documentation. Employers reimburse employees.