Equipment Financing Agreement

Description

There is a large variety of financing techniques that businesses and consumers can use to receive financing; these techniques range from IPOs to bank loans. The use of financing is vital in any economic system as it allows consumers to purchase products out of their immediate reach, like houses, and businesses to finance large investment projects.

How to fill out Equipment Financing Agreement?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the best place for finding up-to-date Equipment Financing Agreement templates. Our service offers thousands of legal documents drafted by licensed attorneys and grouped by state.

To download a template from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our service, log in and choose the document you are looking for and purchase it. Right after buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

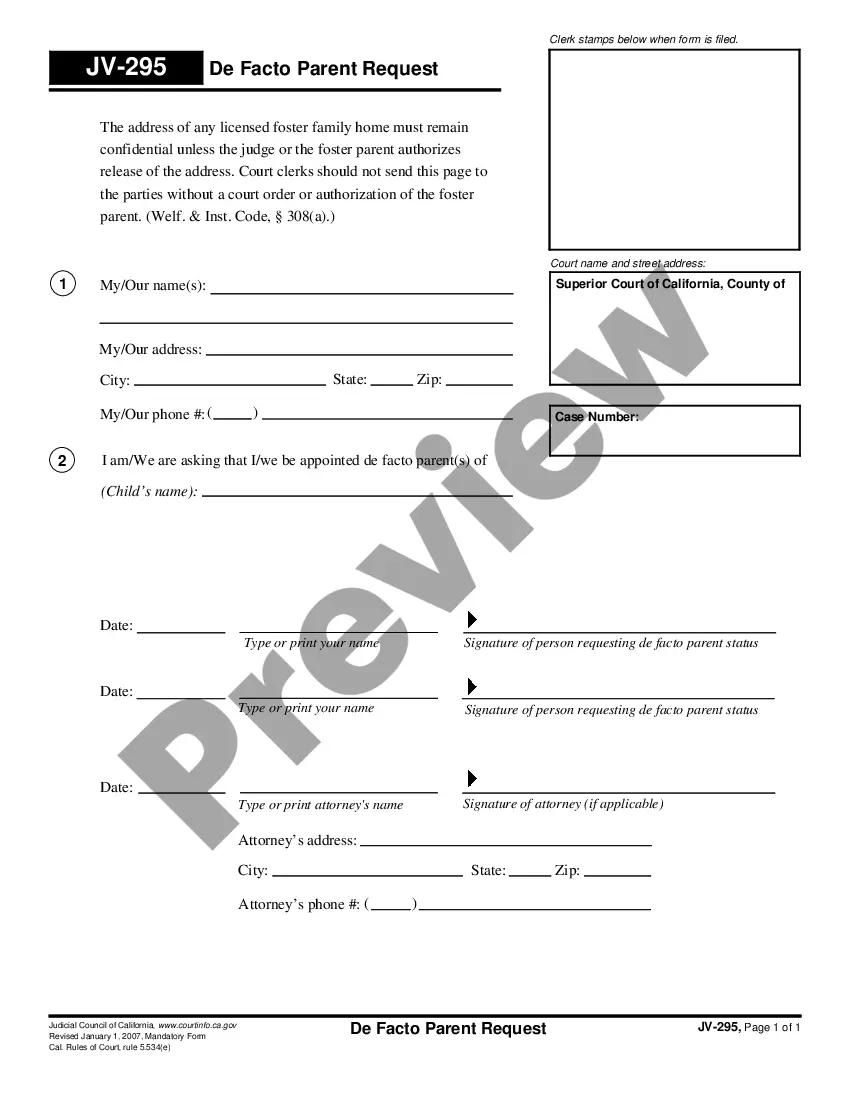

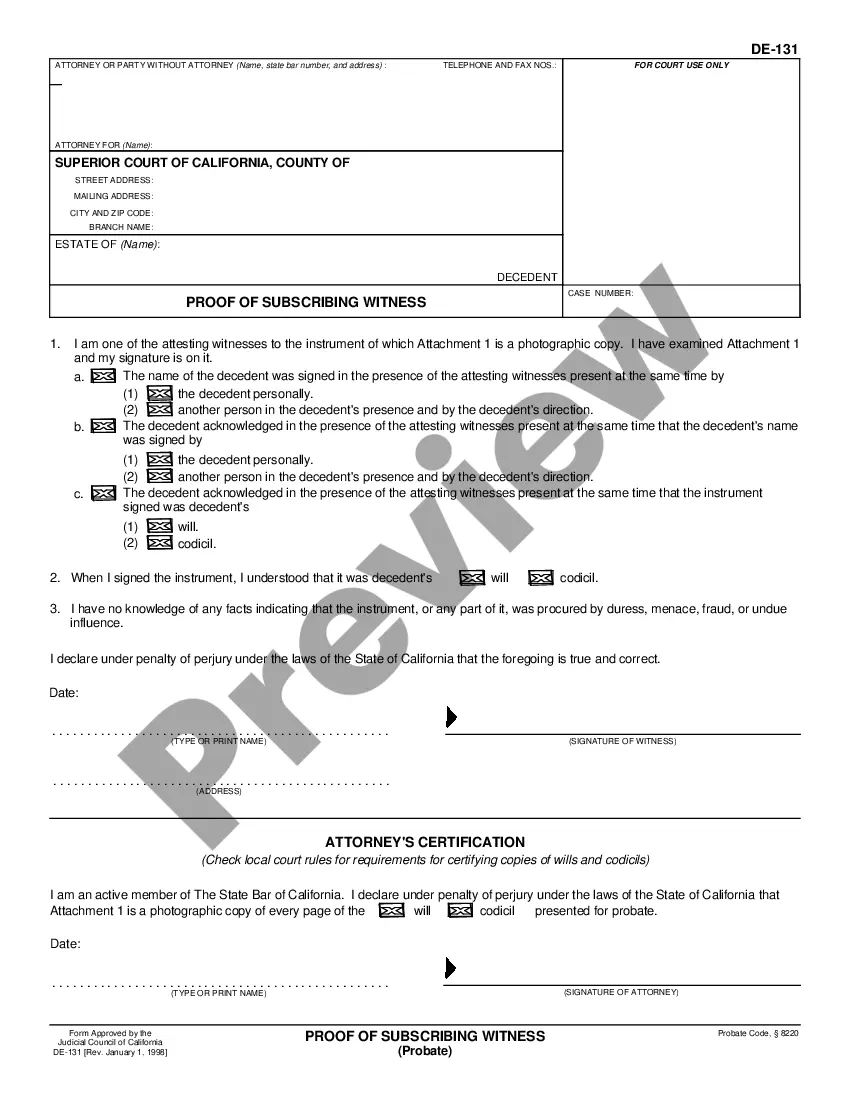

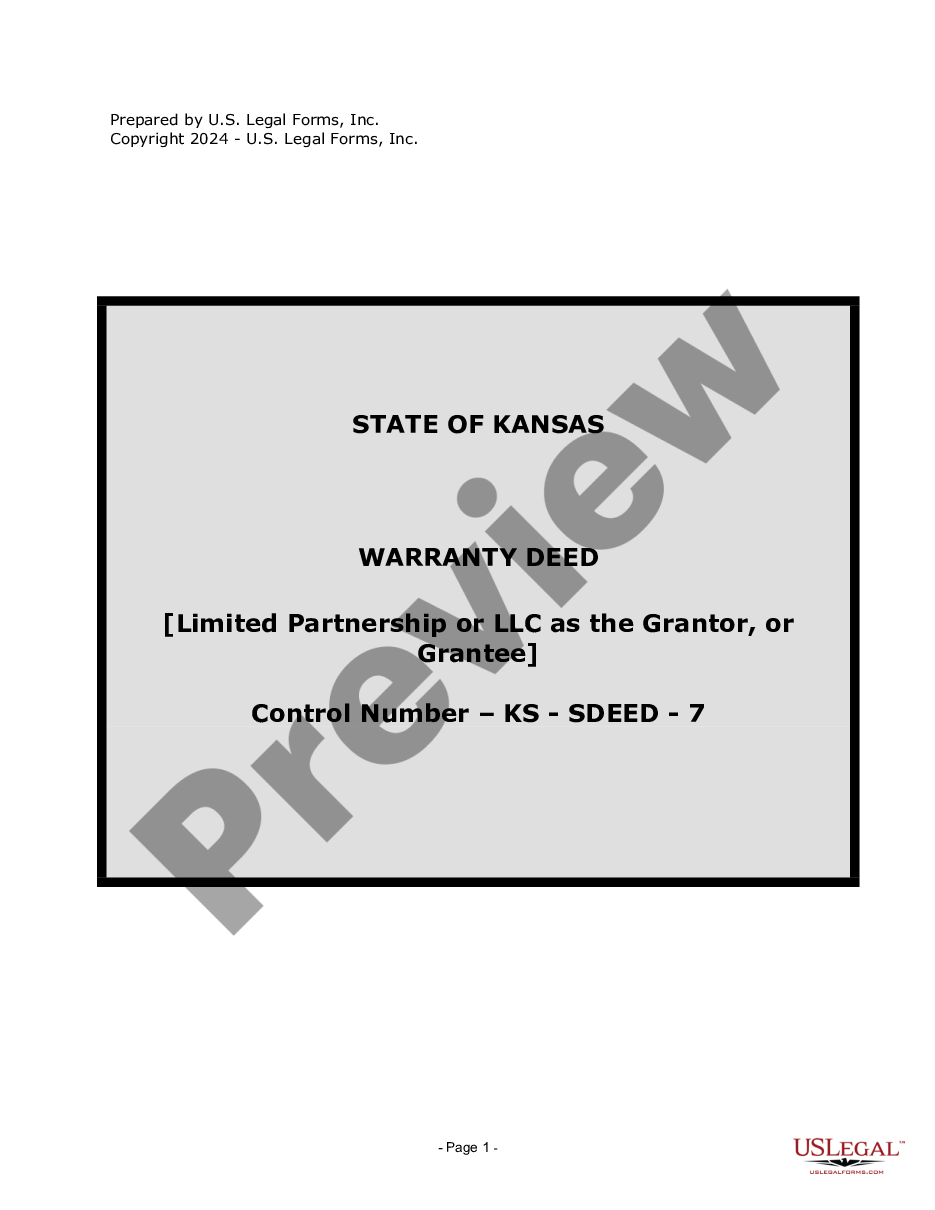

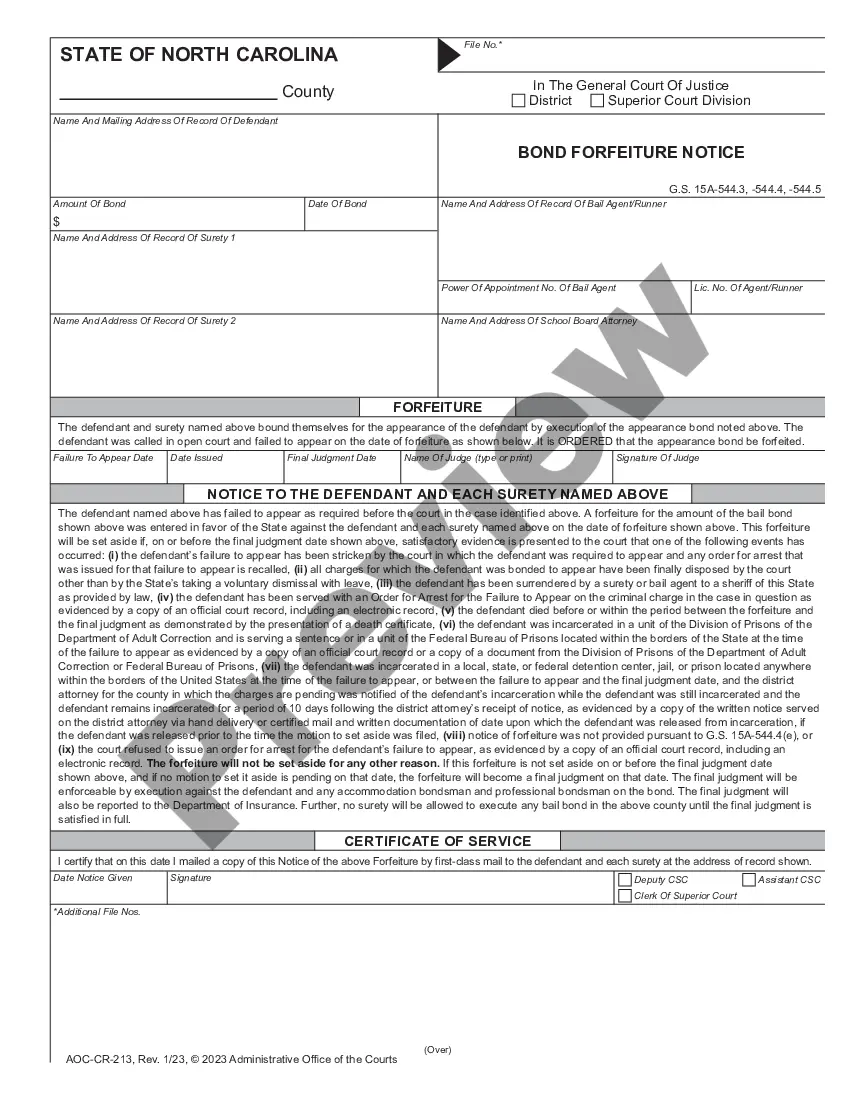

- When the form has a Preview function, utilize it to review the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Choose a document format and download the template.

- Once it is downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join thousands of happy customers who’re already using US Legal Forms!

Form popularity

FAQ

In simple terms, equipment leasing has some similarities to an equipment loan, however it's the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.

EFA: An EFA, or equipment finance agreement, is a type of business loan where the customer takes ownership of the equipment upfront, and then pays the lender monthly, annually or under a schedule agreed on by both parties. It's similar to financing a car.

Equipment financing refers to a loan used to purchase business-related equipment, such as a restaurant oven, a vehicle or a copier scanner. Equipment loans provide for periodic payments that include interest and principal over a fixed term.

Equipment Loan Terms Terms are typically 1272 months and will vary by loan option and lender.

Equipment loans. Best for: Newer businesses that need equipment financing to expand operations. Term loans. Small Business Administration CDC/504 loans. Small business line of credit. Business credit card.

How Does Equipment Financing Work?Equipment loans provide for periodic payments that include interest and principal over a fixed term. As security for the loan, the lender may require a lien on the equipment as collateral against your debt. Once the loan is paid in full, you own the equipment free of any lien.

An equipment finance agreement (EFA) is like a loan, security agreement, and promissory note all packaged together into a single document. EFAs also contain some unique features that make them one of the most popular and versatile equipment financing options.

An EFA is simply a loan and security agreement by another name. Unlike a non-true lease, the transaction is stated to be in the nature of a loan or financing rather than a lease of personal property and an EFA is much clearer on its face as to the parties' intention.