Sample Letter for Reinstatement of Loan

Definition and meaning

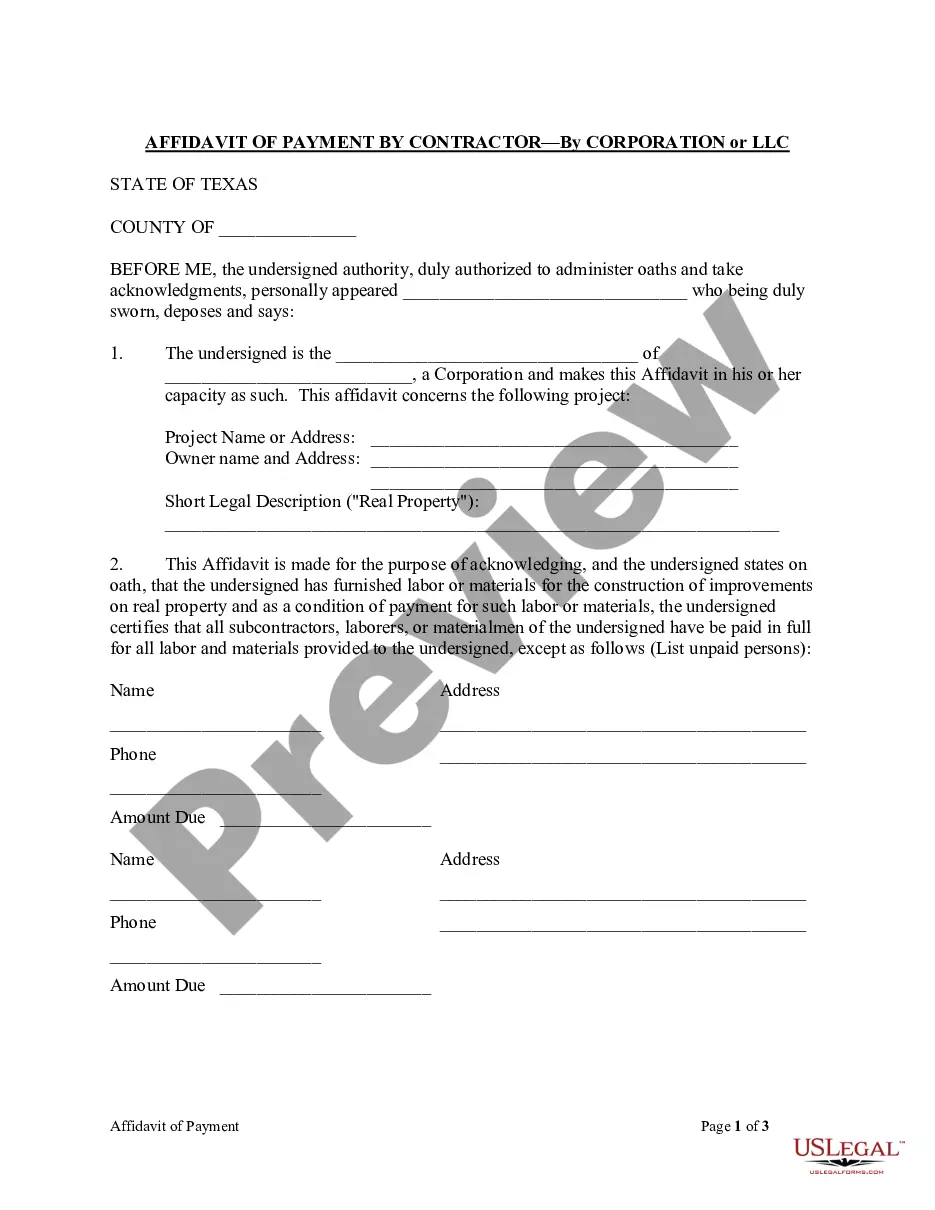

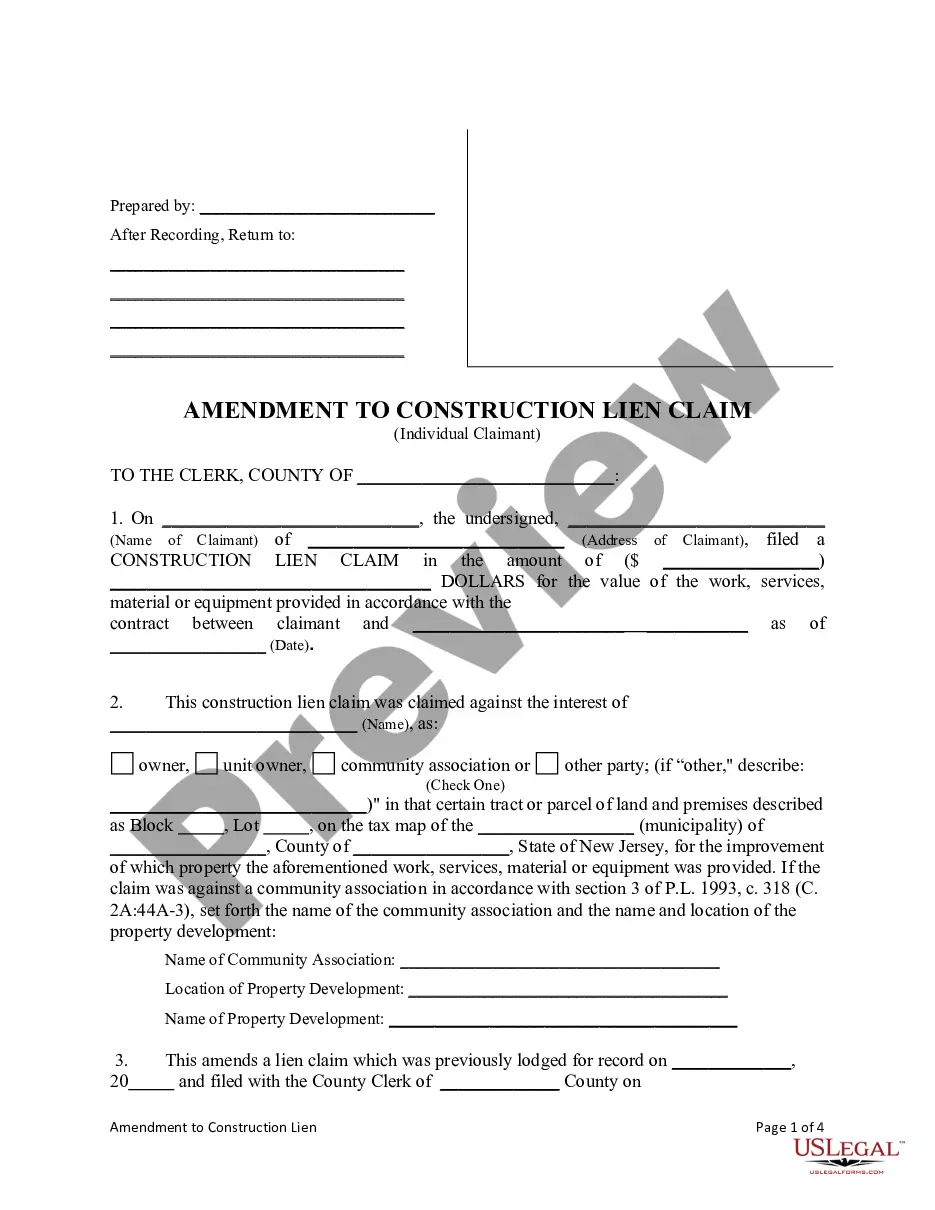

A Sample Letter for Reinstatement of Loan is a formal document that borrowers use to request the restoration of a loan agreement after defaulting on payments. This letter typically outlines the terms of the loan, the current status of payments, and the borrower’s intent to fulfill their obligations in order to avoid foreclosure or further legal action.

How to complete a form

To properly complete the Sample Letter for Reinstatement of Loan, follow these steps:

- Begin with the date at the top of the letter.

- Add your name and address, followed by the recipient’s information.

- Include a clear subject line stating the purpose of the letter.

- Briefly summarize previous communications regarding the loan status.

- Detail the payments made, missed, and the total amount needed to reinstate the loan.

- Conclude by stating your willingness to make the required payments in certified funds and express hope for further discussions.

Who should use this form

This form is essential for individuals or entities who have fallen behind on loan payments and want to negotiate the reinstatement of their loan agreement. It is particularly beneficial for those facing foreclosure or repossession and looking to clarify their intentions and obligations with the lender.

Common mistakes to avoid when using this form

When completing the Sample Letter for Reinstatement of Loan, avoid these common pitfalls:

- Failing to include all necessary contact information.

- Not clearly stating the loan details or payment history.

- Omitting the amount required to reinstate the loan.

- Using aggressive or emotional language that can create friction between parties.

- Neglecting to proofread the letter for errors before submission.

Key components of the form

A well-crafted Sample Letter for Reinstatement of Loan should incorporate several key components:

- Your contact information and the date.

- The lender’s contact information.

- A subject line specifying the purpose of the letter.

- A recap of previous communications regarding the loan.

- A detailed account of the payment history, including which payments were missed and which were made.

- The amount necessary to reinstate the loan, alongside any conditions agreed upon with the lender.

Form popularity

FAQ

Identify yourself and your previous position. Tell the recipient of the letter who you are, and explain that you are seeking reinstatement. Explain the reason for seeking reinstatement. Express gratitude.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

I request you to kindly consider me for the job because of my previous performance and achievements I made during the employment. I assure you that now there would be no such interceptions and I will perform my duties with sincerity, devotion and more commitment. Looking for your positive response.

Remind your employer of the department you worked in, along with your job title. You might also mention how long you have worked there. If you have worked there for a while, this will remind them of your dedication to the company. Start by sending the message to your former manager.

Financial hardship typically refers to a situation in which a person cannot keep up with debt payments and bills or if the amount you need to pay each month is more than the amount you earn, due to a circumstance beyond your control.

Reinstatement letters are written for several reasons, including when an employee wants to be reinstated to a job or when a student wants to be reinstated for financial aid that they lost for some reason.200bThe reinstatement letter should be sent directly to the person who deals with such matters.

A hardship letter explains why a homeowner is defaulting on their mortgage and needs to sell their home for less than what's owed. The best letters read like an attorney's pleading. They establish facts in a way as to convince a mortgage lender to grant a short sale or loan modification instead of a foreclosure.

1 Begin the letter by typing your address. Begin the letter by typing your address. 2 Start the letter. 3 Explain why your situation has improved. 4 Detail an action plan for success. 5 Thank the recipient for her time. 6 Close the letter by typing Sincerely.