Stock Sale and Purchase Agreement - Short Form

Definition and meaning

A Stock Sale and Purchase Agreement - Short Form is a legal document used to outline the sale of shares of stock between a seller and a buyer. It serves as a contract where the seller agrees to transfer ownership of a specified number of shares in a corporation to the buyer in exchange for cash. This document is crucial in ensuring both parties understand the terms and conditions surrounding the transaction.

Key components of the form

This agreement typically includes the following components:

- Identification of Parties: Names and addresses of the seller and buyer.

- Description of Stock: Details about the shares being sold, including quantity and type.

- Purchase Price: The total amount to be paid for the stock.

- Closing Date: The date on which the transaction is finalized.

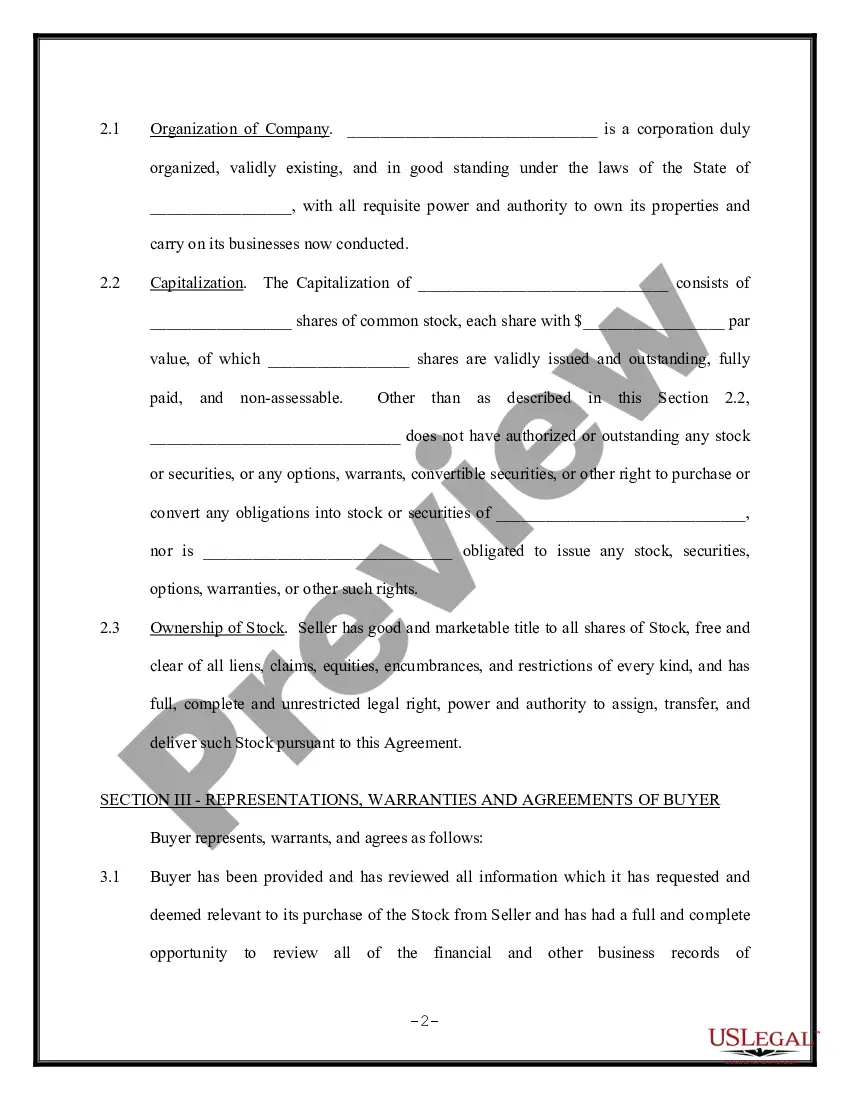

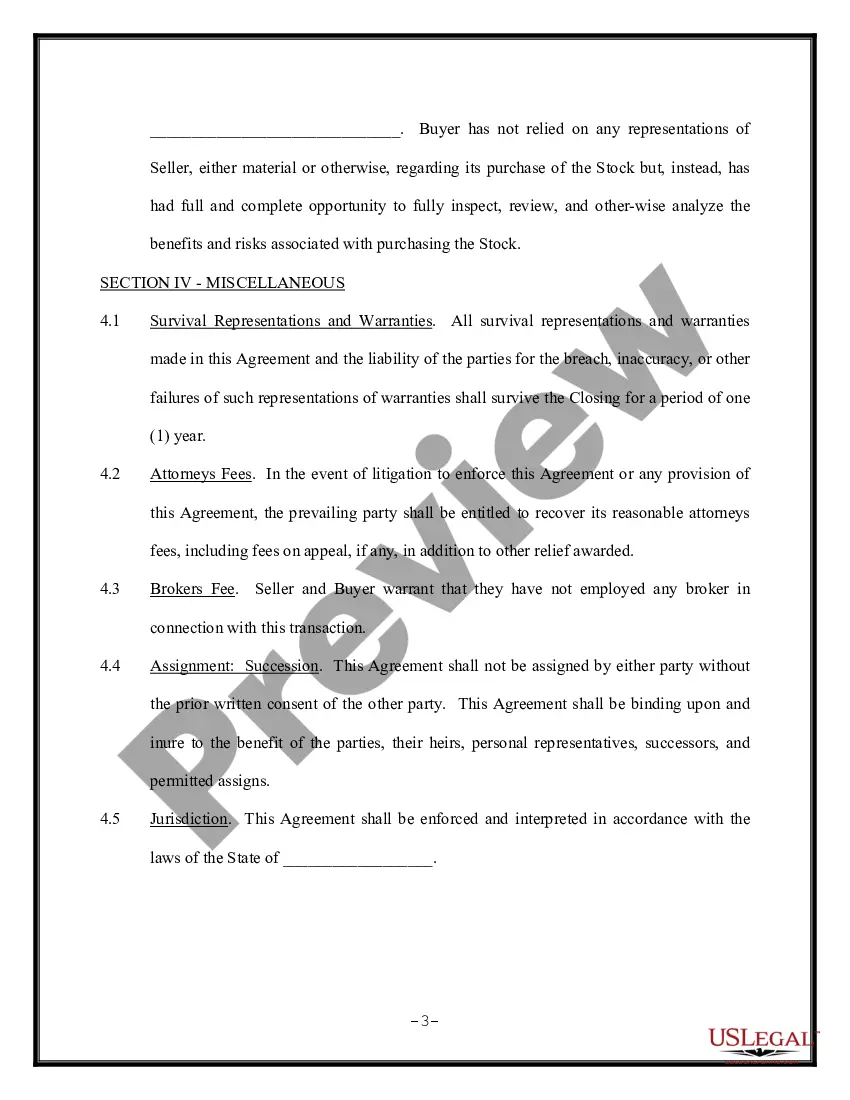

- Representations and Warranties: Statements made by both parties regarding their authority to enter the agreement and the status of the stock.

How to complete a form

To complete the Stock Sale and Purchase Agreement - Short Form, follow these steps:

- Fill in the date: Enter the specific date of the agreement.

- Identify the seller and buyer: Provide full legal names and addresses.

- Detail the stock sold: Specify the number of shares and the company name.

- State the purchase price: Write the exact amount in numbers and words.

- Closing details: Indicate the agreed-upon date and location for the closing.

- Sign and date: Ensure both parties sign the document to make it legally binding.

Who should use this form

This form is suitable for individuals or entities involved in the sale of corporate stock. It is particularly useful for:

- Business owners looking to sell part or all of their shareholding.

- Investors purchasing stock from a private company.

- Corporate shareholders facilitating ownership transfers.

- Anyone needing a formal agreement to document the sale of stock for clarity and legal protection.

Benefits of using this form online

Using an online Stock Sale and Purchase Agreement - Short Form offers several advantages:

- Convenience: Easily access and fill out the form from anywhere at any time.

- Time-saving: Quickly generate the document without the need for legal consultation.

- Cost-effective: Lower fees compared to hiring an attorney for custom drafting.

- Immediate download: Obtain a downloadable version immediately after completion for fast use.

Common mistakes to avoid when using this form

Users should be mindful of the following common pitfalls:

- Not clearly identifying all parties involved in the transaction.

- Failing to specify the exact number of shares being sold.

- Omitting or incorrectly stating the purchase price.

- Not including the closing details, which can lead to confusion later.

- Neglecting to ensure both parties sign and date the agreement, which is essential for enforceability.

Form popularity

FAQ

A 'share sale' typically involves the sale of the shares of a company. The legal contracting parties to the share sale agreement will be the actual shareholder of the company (ie, as the seller) who is disposing of his shares in the company, and the buyer who will become the new shareholder of the target company.

This Stock Purchase Agreement (sometimes called an Share Purchase Agreement or SPA) sets forth terms of the sale and transfer of a company's stock to a purchaser. Stock Purchase Agreements are often used to effect the acquisition of a company through the purchase of the majority of stock in that company.

A stock purchase agreement is an agreement wherein the owner of shares of stock (the Seller) agrees to sell the stock to a buyer (the Purchaser). Generally, this type of form is used for the stock of a small corporation. Both federal and state securities laws govern the sale of stock.

Name of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser. Possible employee issues such as benefits and bonuses. How many shares are being sold. Where and when the transaction takes place.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities.In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

A stock purchase agreement is a contract to transfer ownership of stocks from the seller to the purchaser. The key provisions of a stock purchase agreement have to do with the transaction itself, such as the date of the transaction, the number of stock certificates, and the price per share.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.