Loan Agreement - Long Form

Definition and meaning

A Loan Agreement - Long Form is a formal contract between a lender and a borrower outlining the terms and conditions under which the lender provides a specified amount of money to the borrower. This agreement includes details such as the loan amount, interest rate, repayment schedule, and any collateral that may be required. The document serves to protect the interests of both parties and ensure clarity on the obligations involved.

Key components of the form

This loan agreement consists of several essential components:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the borrowed amount, typically expressed annually.

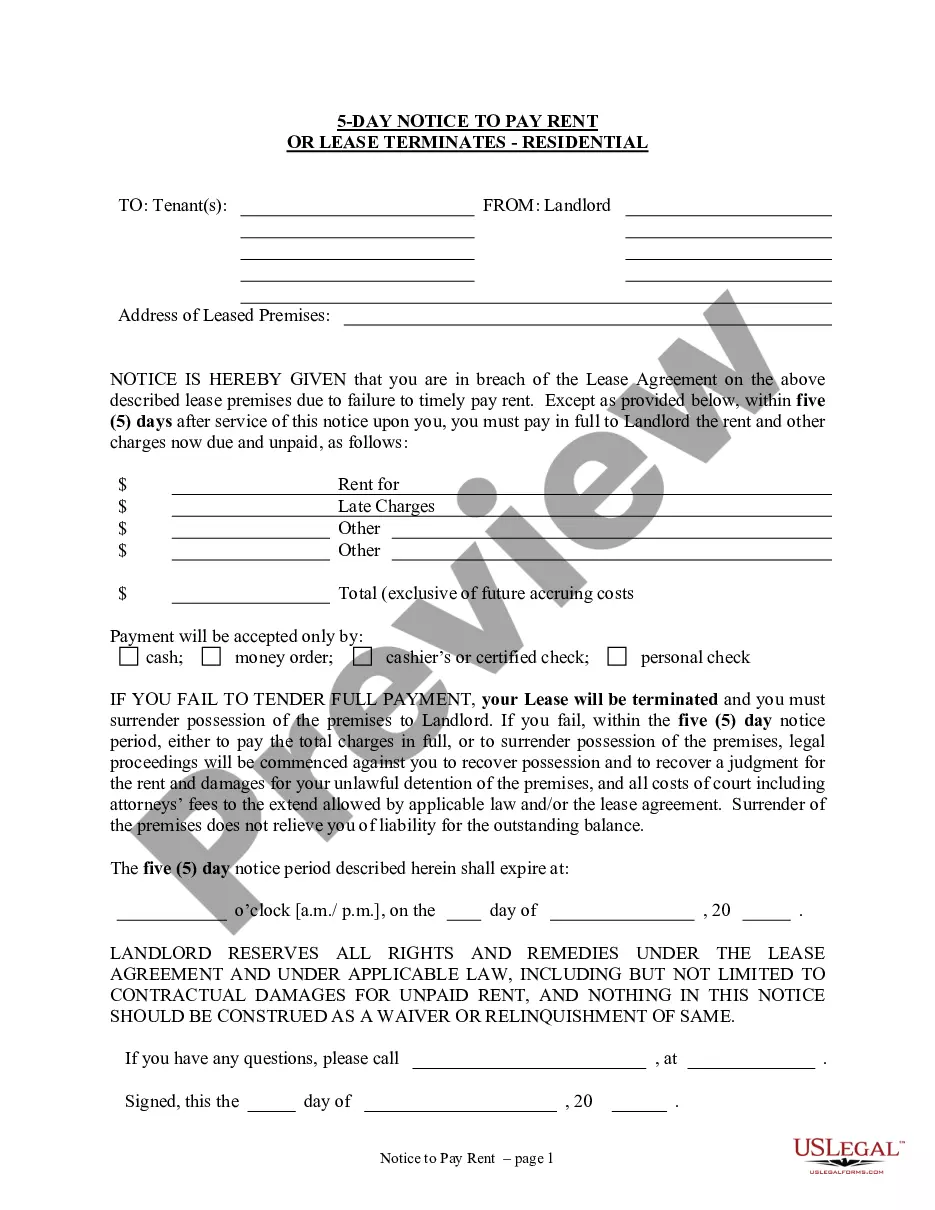

- Repayment Schedule: The timeline and method through which the borrower will repay the loan.

- Collateral: Any asset pledged by the borrower to secure the loan.

- Default Clauses: Conditions under which the loan might be considered in default.

- Governing Law: The jurisdiction whose laws will govern the agreement.

How to complete a form

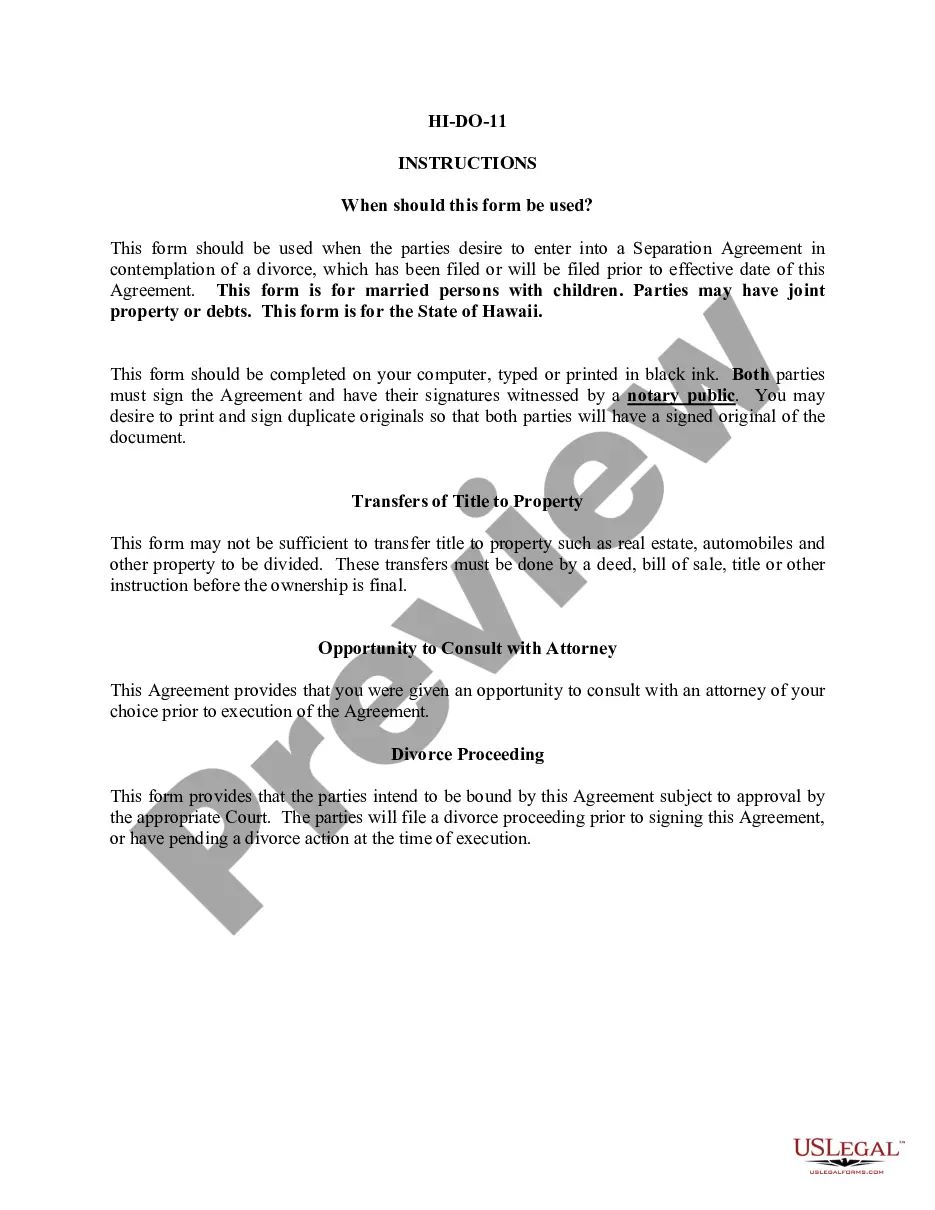

To properly complete the Loan Agreement - Long Form, follow these steps:

- Read the Agreement: Understand all terms and conditions before filling it out.

- Fill in Parties’ Information: Enter the names and addresses of both the lender and the borrower.

- Specify Loan Details: Clearly state the loan amount, interest rate, and repayment schedule.

- Signatures: Both parties must sign and date the document in the designated sections to indicate their agreement.

- Notarization: Consider having the document notarized to enhance its legal validity.

Who should use this form

This Loan Agreement - Long Form is suitable for individuals or businesses that are engaging in a lending arrangement. It is particularly relevant for:

- Businesses seeking loans from financial institutions.

- Private lenders wanting to formalize loans to friends or family.

- Individuals who want to document the terms of a personal loan to ensure clarity and legal backing.

Benefits of using this form online

Utilizing online legal forms for a Loan Agreement - Long Form offers several advantages, including:

- Convenience: Access the form anytime and complete it from the comfort of your home.

- Time-saving: Online forms often come pre-structured to assist in a quick and easy completion process.

- Cost-effective: Online forms are typically more affordable than hiring legal counsel for a simple agreement.

- Immediate access: Users can download or print the completed forms immediately after finishing.

Common mistakes to avoid when using this form

To prevent issues with your Loan Agreement - Long Form, consider these common pitfalls:

- Omitting Key Terms: Ensure all crucial information, such as the interest rate and repayment terms, is included.

- Incorrect Signatures: Verify that both parties have signed the document before finalizing.

- Ignoring Notarization: Depending on the loan amount and jurisdiction, consider notarizing the document for added legal weight.

- Not Reviewing Terms: Familiarize yourself with all stipulations before agreeing to avoid misunderstandings later.

Form popularity

FAQ

A loan agreement is a contract between you, the borrower and the lender.There are situations where you may no longer want the loan, or the item it financed. If there are valid reasons such as fraud or a breech of contract, you should be able to get out of the loan.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

Come up with a schedule for repayment. Use a family contract template that includes a repayment schedule. Set and interest rate. Put your agreement in writing. Keep payment records.

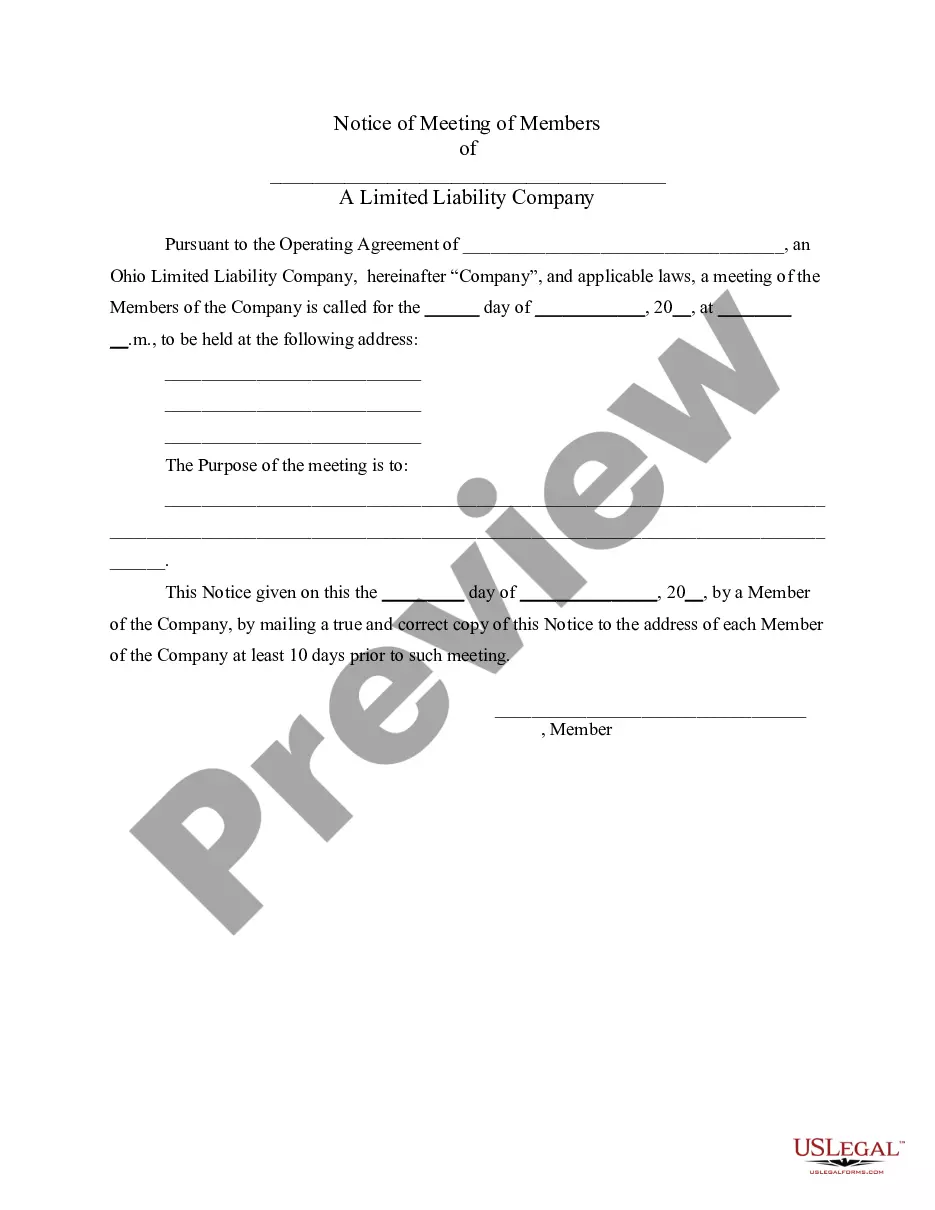

Step 1 Loan Amount, Borrower and Lender. Step 2 Payment. Step 3 Interest. Step 4 Expenses. Step 5 Governing Law. Step 6 Signing.

A loan agreement is a contract between a borrower and a lender which regulates the mutual promises made by each party.Loan agreements are usually in written form, but there is no legal reason why a loan agreement cannot be a purely oral contract (although oral agreements are more difficult to enforce).

Loan terms refers to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

Also known as a loan agreement. The main transaction document for a loan financing between one or more lenders and a borrower.

The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

A personal loan agreement is a legally binding document regardless of whether the lender is a financial institution or another person. The consequences are the same if you default on the contract. As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.

Step 1 Loan Amount, Borrower and Lender. Step 2 Payment. Step 3 Interest. Step 4 Expenses. Step 5 Governing Law. Step 6 Signing.