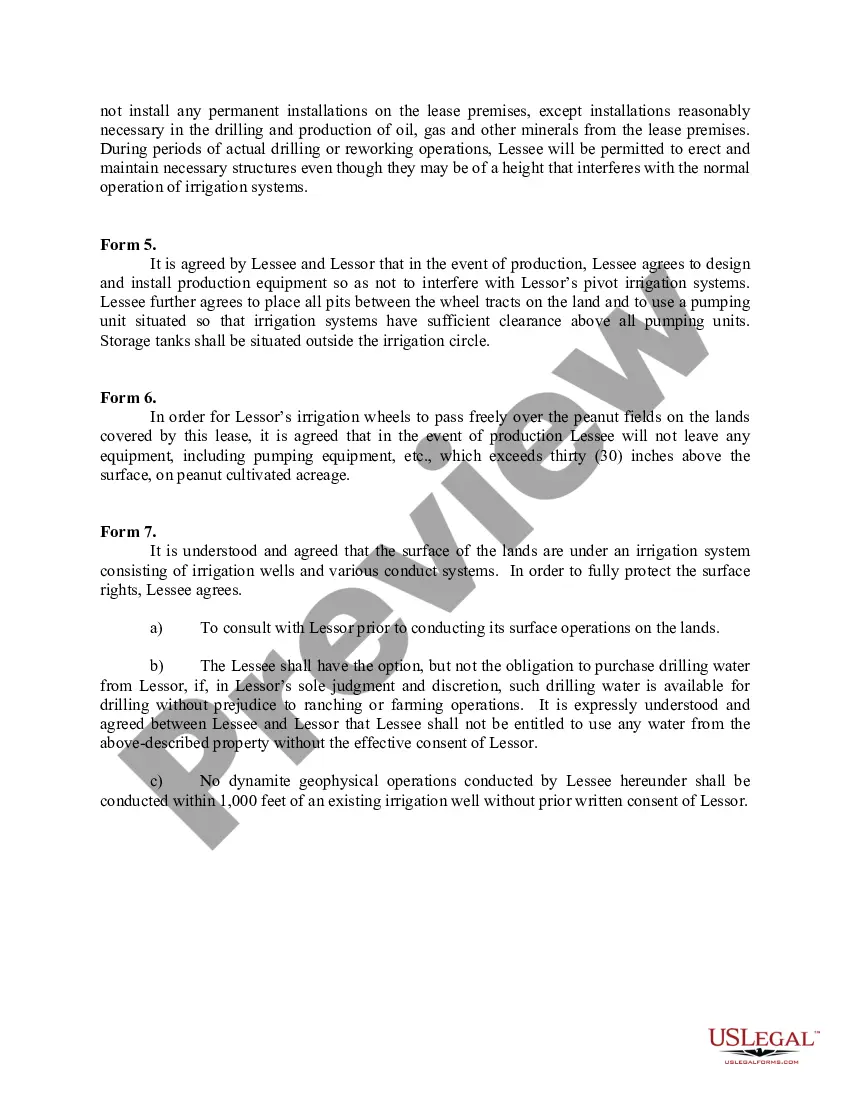

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Texas Surface Use by Lessee and Accommodation With Use of the Surface

Description

How to fill out Surface Use By Lessee And Accommodation With Use Of The Surface?

US Legal Forms - one of many greatest libraries of authorized varieties in the United States - provides a variety of authorized record web templates it is possible to download or print. Using the site, you can get a large number of varieties for organization and specific reasons, categorized by classes, states, or keywords.You can get the most recent types of varieties like the Texas Surface Use by Lessee and Accommodation With Use of the Surface in seconds.

If you currently have a registration, log in and download Texas Surface Use by Lessee and Accommodation With Use of the Surface from the US Legal Forms collection. The Down load key will show up on every form you look at. You have access to all previously delivered electronically varieties inside the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, listed here are simple directions to help you began:

- Make sure you have selected the correct form for your personal area/area. Select the Review key to review the form`s content. Browse the form description to actually have chosen the correct form.

- In case the form doesn`t suit your demands, utilize the Search industry at the top of the monitor to get the one which does.

- If you are happy with the shape, confirm your selection by clicking the Buy now key. Then, opt for the rates prepare you want and offer your references to sign up on an account.

- Method the transaction. Use your bank card or PayPal account to finish the transaction.

- Pick the structure and download the shape in your gadget.

- Make changes. Complete, modify and print and indication the delivered electronically Texas Surface Use by Lessee and Accommodation With Use of the Surface.

Each and every web template you included in your account lacks an expiry day and is also your own property for a long time. So, in order to download or print an additional copy, just check out the My Forms portion and click around the form you need.

Obtain access to the Texas Surface Use by Lessee and Accommodation With Use of the Surface with US Legal Forms, probably the most substantial collection of authorized record web templates. Use a large number of expert and status-specific web templates that fulfill your business or specific demands and demands.

Form popularity

FAQ

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

Even though the mineral owner may own no part of the surface, courts have ruled that the Mineral Estate is the Dominant Estate. The only way for the mineral rights owner to benefit from mineral ownership is by having the ability to get a well drilled from a surface location down into the hydrocarbon-bearing formation.

A surface use agreement, which is also sometimes referred to as a land use agreement, is an agreement between the landowner and an oil and gas company or an operator for the use of the landowner's land in the development of the oil and gas.

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.

In order to apply the Accommodation Doctrine, the surface owner must prove that the groundwater owner's use of the surface precludes or substantially impairs the existing use; that the surface owner has no available, reasonable alternative to continue existing use; and that the groundwater owner has reasonable, ...

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Surface interest refers to the ownership rights of the surface of a property, excluding any mineral rights. The owner of the surface interest has the right to use and enjoy the surface of the property, but must allow the owner of the mineral interest to access and use the surface for mineral extraction.

?Surface rights? refers to the right to control the surface of the land. Existing structures are included under this umbrella. Typically, when property is purchased, the transaction includes the surface and mineral rights.