Texas Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1

Description

How to fill out Exhibit H To Operating Agreement Memorandum Of Operating Agreement And Financing Statement - Form 1?

It is possible to invest several hours on the Internet trying to find the lawful file template that fits the federal and state requirements you require. US Legal Forms supplies thousands of lawful varieties which are evaluated by pros. It is possible to acquire or printing the Texas Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1 from your assistance.

If you already possess a US Legal Forms profile, you may log in and then click the Obtain switch. Following that, you may comprehensive, revise, printing, or sign the Texas Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1. Every lawful file template you purchase is the one you have permanently. To get yet another copy of the bought kind, proceed to the My Forms tab and then click the related switch.

Should you use the US Legal Forms website for the first time, follow the straightforward guidelines under:

- Very first, be sure that you have chosen the best file template for that county/area of your choice. Read the kind information to make sure you have chosen the right kind. If offered, make use of the Preview switch to search from the file template too.

- In order to find yet another model from the kind, make use of the Search area to get the template that meets your needs and requirements.

- Once you have discovered the template you would like, simply click Get now to continue.

- Find the rates prepare you would like, type your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to cover the lawful kind.

- Find the formatting from the file and acquire it to your gadget.

- Make alterations to your file if necessary. It is possible to comprehensive, revise and sign and printing Texas Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1.

Obtain and printing thousands of file web templates utilizing the US Legal Forms web site, which offers the greatest collection of lawful varieties. Use skilled and status-specific web templates to take on your organization or individual needs.

Form popularity

FAQ

An operating agreement isn't mandatory. But it's a great idea to have one in place, even if your LLC only has one member and you're in charge of making all of the decisions.

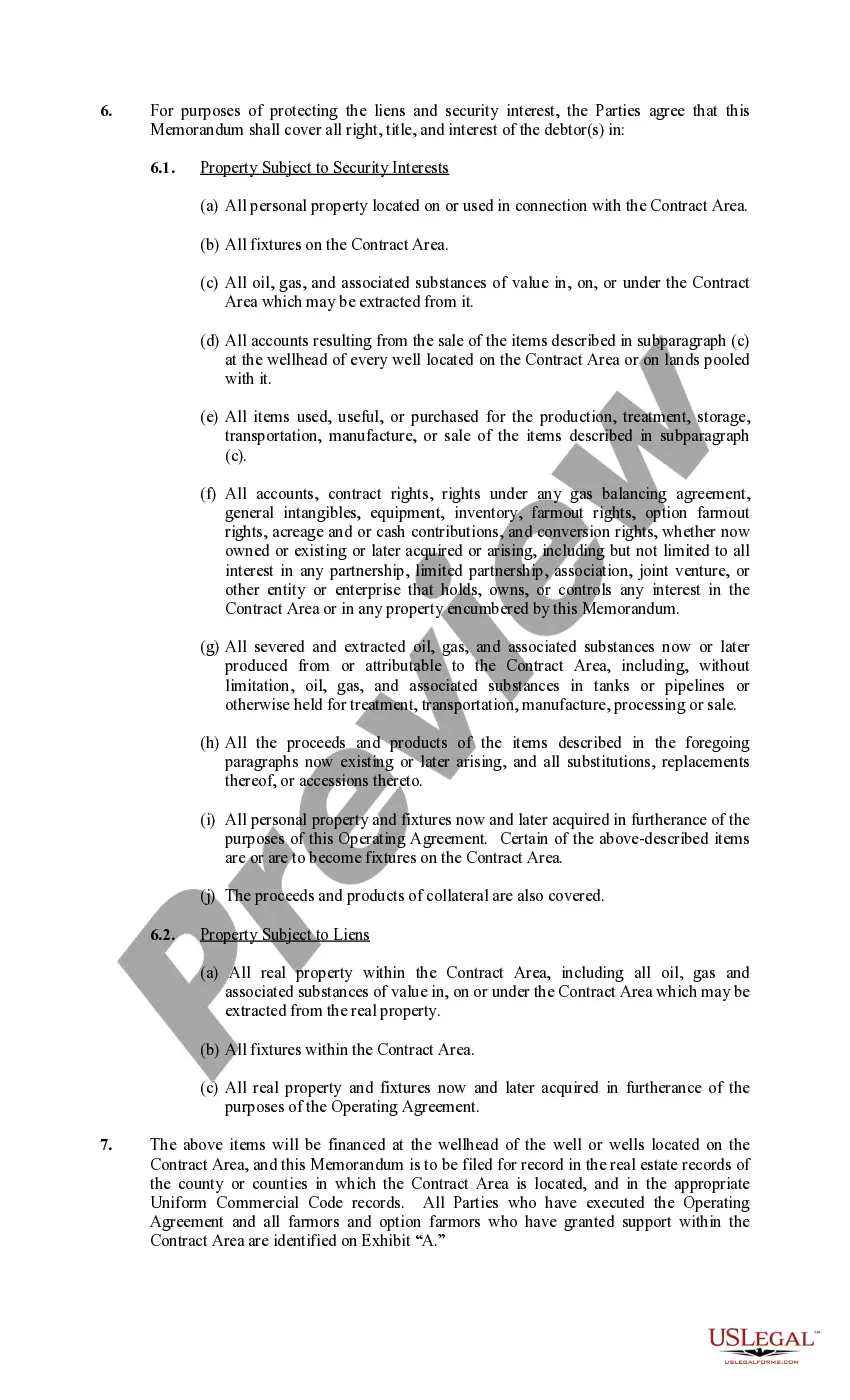

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

The benefits of a single-member LLC are as follows: The owner is shielded from the liabilities of the business. The primary benefit of conducting business through an entity like an LLC is to protect the owner's personal assets from the liabilities of the business.

In Texas, an LLC operating agreement should include the following key elements: Formation details of the LLC. The name and Texas address of a registered agent, who is designated to receive legal documents on behalf of the business. The term of the LLC. The purpose of the business. The business location.

The document doesn't need to be notarized or filed with the state. While the state law is silent on what happens if you don't have an operating agreement, it's a risk you don't want to take.

Single-member LLC Ownership ? A single-member LLC has one owner (member) who has full control over the company. The LLC is its own legal entity, independent of its owner. Multi-member LLC Ownership ? A mMulti-member LLC has two or more owners (members) that share control of the company.

Despite this, the LLC itself does not pay taxes. Although some states do not necessarily recognize single-member LLCs, Texas does. It is actually one of the most common entities in the state of Texas.