Texas Guarantee of Performance of Contract

Description

How to fill out Guarantee Of Performance Of Contract?

Selecting the appropriate legal document format can be rather challenging. Naturally, there are numerous templates available online, but how can you locate the legal form you require? Utilize the US Legal Forms website.

The service provides a vast array of templates, such as the Texas Guarantee of Performance of Contract, which you can utilize for business and personal needs. All of the forms are verified by experts and adhere to federal and state regulations.

If you are already registered, sign in to your account and click on the Download button to obtain the Texas Guarantee of Performance of Contract. Use your account to review the legal forms you have acquired previously. Navigate to the My documents section of your account to retrieve another copy of the document you require.

Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the acquired Texas Guarantee of Performance of Contract. US Legal Forms is the largest collection of legal forms where you can view various document templates. Use the service to obtain properly crafted documents that comply with state requirements.

- First, ensure you have chosen the correct form for your locality/county.

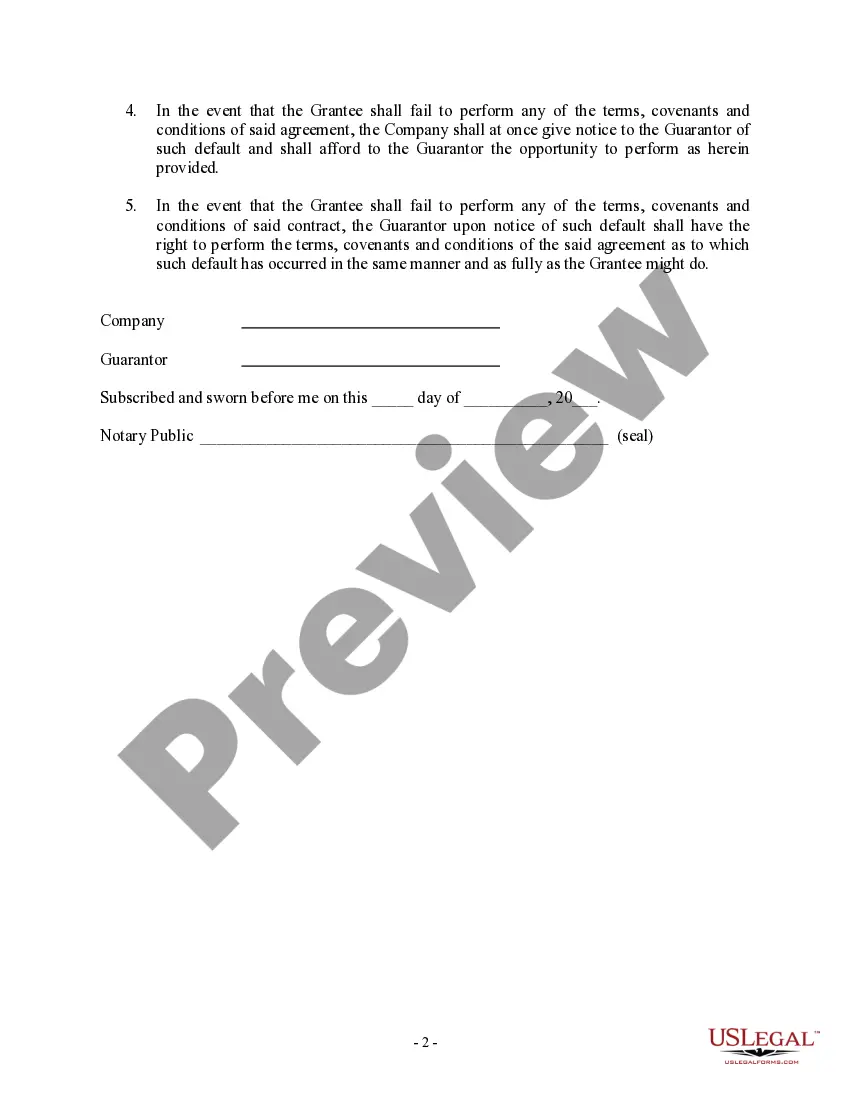

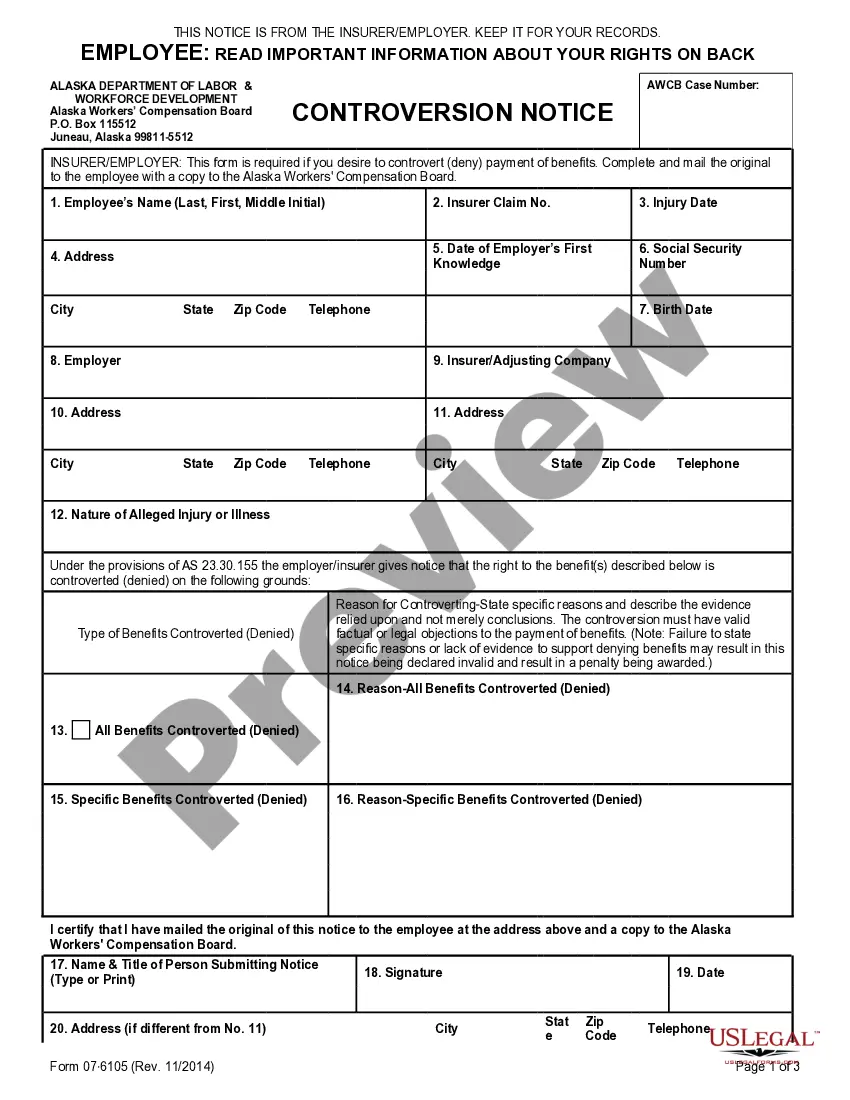

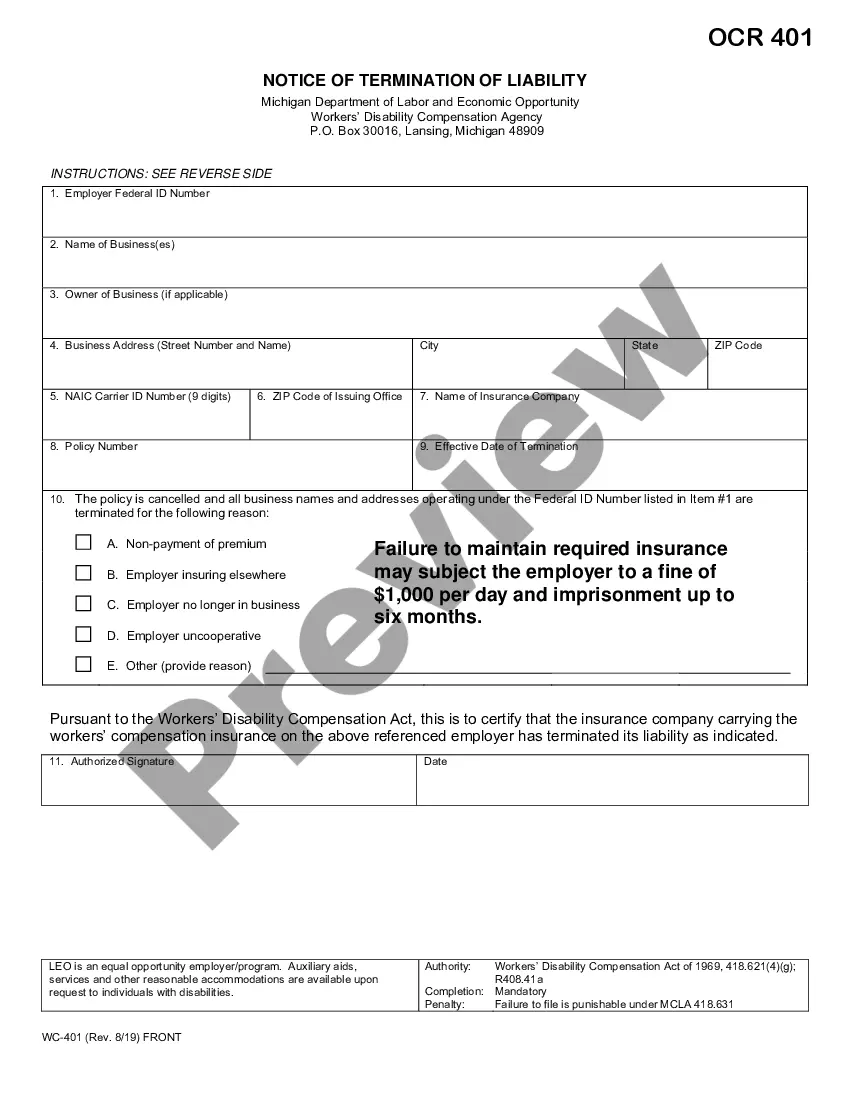

- You can preview the form using the Review option and read the form description to confirm it suits your needs.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click on the Purchase now button to obtain the form.

- Select the pricing plan you desire and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

In simple terms, a performance guarantee is a promise that a contractor will complete their work as promised. If they fail to do so, the guarantee ensures that the project owner will receive compensation for any losses. The Texas Guarantee of Performance of Contract facilitates this process, making it a vital tool for protecting investments in various projects.

A contract of guarantee against performance is an agreement where one party agrees to compensate another if a third party fails to fulfill their contractual obligations. This type of guarantee is an essential component of the Texas Guarantee of Performance of Contract, offering security to project owners. It ensures that if the contractor defaults, the guarantor will cover any financial losses incurred.

An example of a performance guarantee is a performance bond issued for a construction project. This bond ensures that if the contractor fails to complete the project or does not meet the specified quality standards, the surety company will cover the costs associated with hiring another contractor. The Texas Guarantee of Performance of Contract often utilizes such bonds to safeguard project owners and ensure successful project outcomes.

Some common examples of performance guarantees include performance bonds, letters of credit, and bank guarantees. In the realm of Texas Guarantee of Performance of Contract, these instruments serve to ensure that contractors deliver on their commitments. Each type of guarantee offers unique features, making it important to choose the right one based on your project needs.

Performance guarantees function as a safety net for project owners, ensuring that contractors complete their work as agreed. When the Texas Guarantee of Performance of Contract is in place, if a contractor fails to meet their obligations, the guarantor compensates the project owner for any losses incurred. This arrangement not only protects the owner's investment but also encourages contractors to adhere to project timelines and quality standards.

In Texas, to obtain a performance bond, contractors usually need to provide financial statements, demonstrate a solid credit history, and showcase experience in completing similar projects. The Texas Guarantee of Performance of Contract often stipulates specific bond amounts, which vary based on the project size and type. It is essential to consult with a bonding agent to ensure you meet all local regulations and requirements.

A letter of guarantee for a performance bond is a written commitment by a third party, typically a bank or insurance company, to ensure that a contractor fulfills their obligations under a contract. In the context of the Texas Guarantee of Performance of Contract, this letter provides assurance to project owners that funds are available to complete the project if the contractor defaults. This instrument helps minimize the financial risk for all parties involved.

The RFQ process step by step involves defining your project needs, drafting the RFQ, distributing it to potential bidders, collecting responses, evaluating qualifications, and finally selecting a vendor. Each step is essential to creating a successful partnership. By incorporating the Texas Guarantee of Performance of Contract into your RFQ process, you enhance the chances of selecting a reliable contractor who will deliver on their commitments.

Common RFQ mistakes include unclear project descriptions, insufficient evaluation criteria, and overlooking deadlines. These errors can lead to confusion among bidders and suboptimal selections. By utilizing the Texas Guarantee of Performance of Contract, you can minimize these mistakes and ensure that all parties understand their roles and responsibilities.

The seven steps in a Request for Proposal (RFP) include defining project goals, developing an RFP document, distributing the RFP, evaluating submissions, conducting interviews, selecting a vendor, and negotiating terms. Each step is crucial to ensure you find a provider that meets your needs. The Texas Guarantee of Performance of Contract can play a vital role in this process, ensuring that selected vendors are committed to fulfilling their contractual obligations.