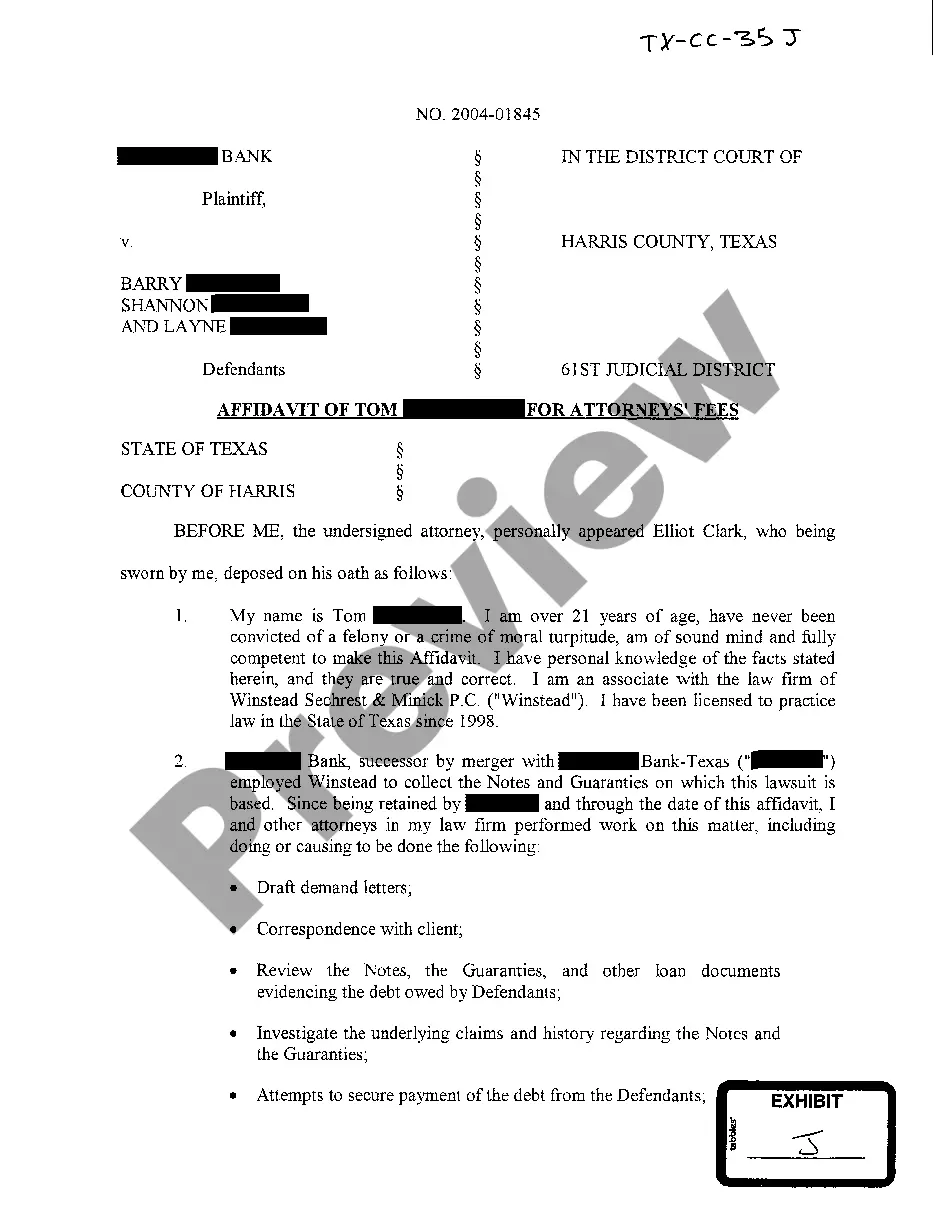

Texas General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

If you need to finish, acquire, or generate sanctioned document formats, use US Legal Forms, the leading selection of legal templates available online.

Take advantage of the site's straightforward and convenient search feature to find the documents you require.

Different templates for business and personal purposes are categorized by types and states, or keywords.

Step 3. If you are unsatisfied with the document, use the Search box at the top of the screen to find other versions in the legal form library.

Step 4. After locating the document you need, click on the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Employ US Legal Forms to locate the Texas General Guaranty and Indemnification Agreement within just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Acquire button to obtain the Texas General Guaranty and Indemnification Agreement.

- You can also access forms you've previously stored in the My documents section of your account.

- For new users of US Legal Forms, adhere to these steps.

- Step 1. Ensure you've chosen the form for your specific city/state.

- Step 2. Utilize the Preview feature to review the document’s content. Don't forget to read the description.

Form popularity

FAQ

There are 3 levels of indemnification: broad form, intermediate form, and limited form.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

A guarantee is an agreement to meet someone else's agreement to do something usually to make a payment. An indemnity is an agreement to pay for a cost or reimburse a loss incurred by someone else.

The first--often referred to as a "Type I" clause--is one in which the "indemnitor" (that is, the person agreeing to provide protection) agrees to clearly and unequivocally indemnify another person (who is referred to as the "indemnitee") for that person's negligence, whether active or passive.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

As an initial matter, there are generally three forms of indemnification agreements: (1) the broad form, which includes the sole negligence of the indemnitee; (2) the moderate form, which includes all negligence, but the sole negligence of the indemnitee; and (3) the narrow form, which includes only the negligence of

The contract of indemnity is the contract where one person compensates for the loss of the other. Contract of guarantee is a contract between three people where the third person intervenes to pay the debt if the debtor is at default in paying back.

There are different types of indemnity agreements: broad form indemnity, intermediate form indemnity, limited form indemnity, comparative, implied, and so on.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.