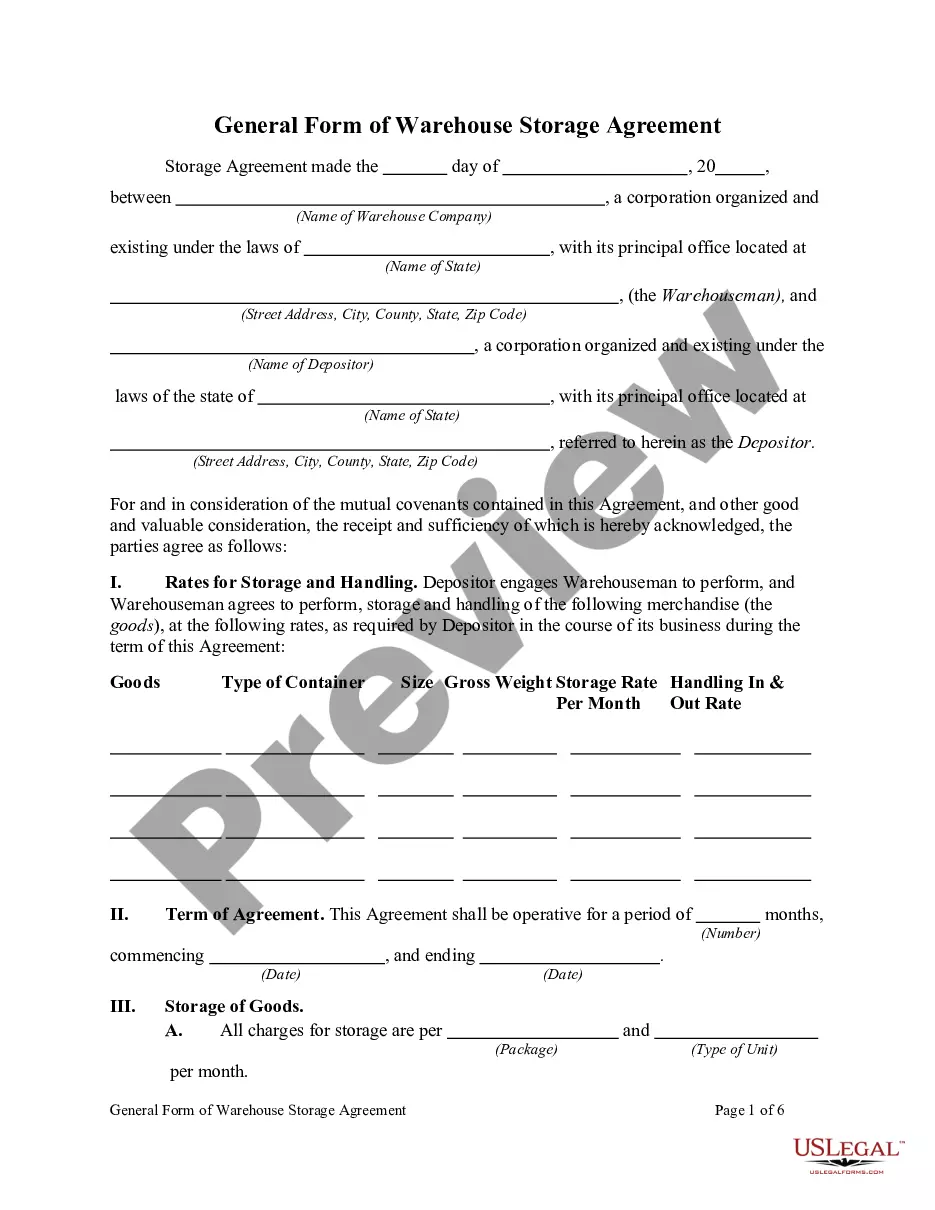

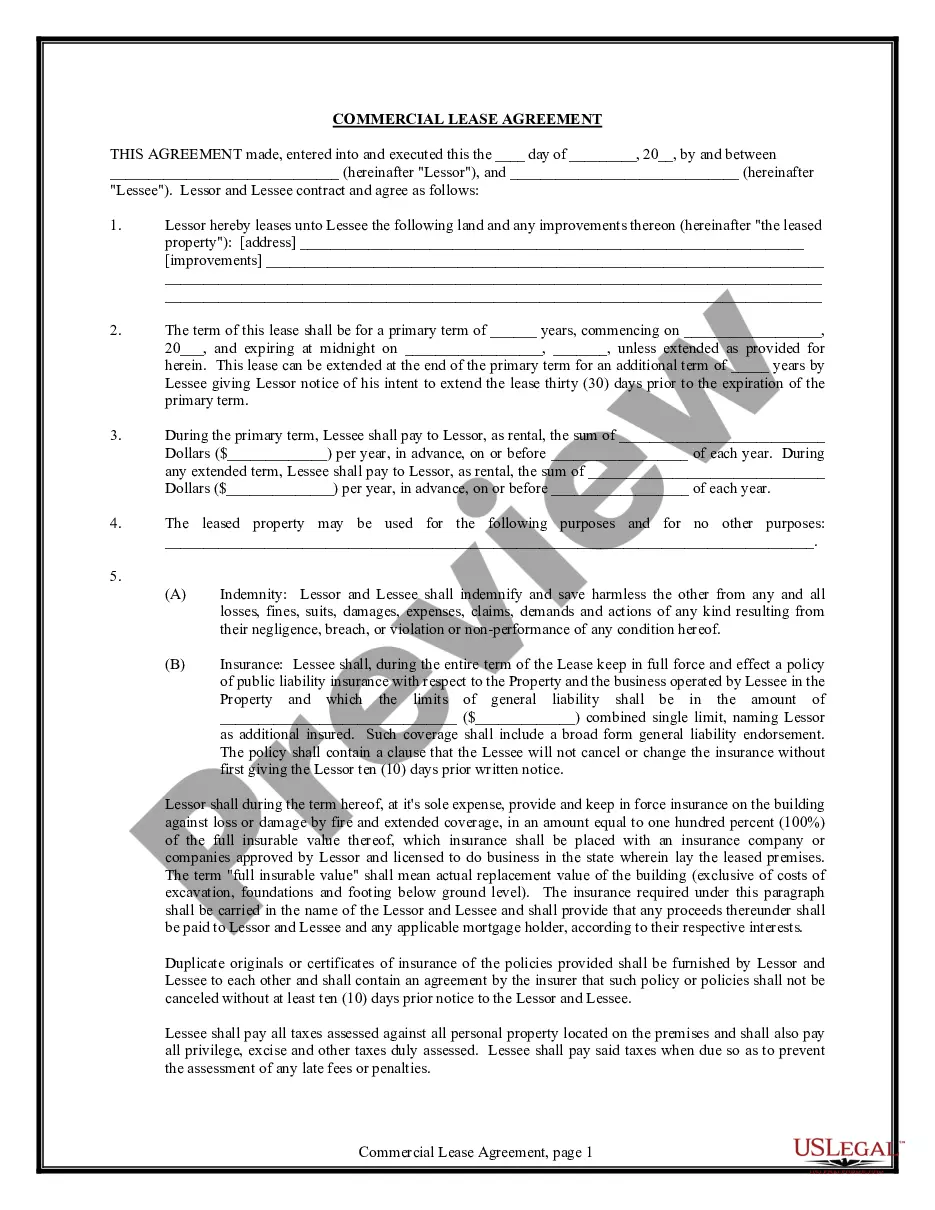

New Mexico Standard Terms and Conditions for Merchandise Warehouses

Description

How to fill out Standard Terms And Conditions For Merchandise Warehouses?

If you require extensive, obtain, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and practical search to find the documents you need.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords. Use US Legal Forms to find the New Mexico Standard Terms and Conditions for Merchandise Warehouses in just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded through your account. Select the My documents section and choose a form to print or download again.

Fill out and obtain, and print the New Mexico Standard Terms and Conditions for Merchandise Warehouses with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Utilize the Review method to examine the contents of the form. Always remember to view the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Mexico Standard Terms and Conditions for Merchandise Warehouses.

Form popularity

FAQ

To legally authorize your company to do business in New Mexico, you must register with the Secretary of State and fulfill local licensing requirements. Additionally, you must comply with state tax regulations. Ensuring all these elements are in place will help align with the New Mexico Standard Terms and Conditions for Merchandise Warehouses.

The statute of limitations for the New Mexico Consumer Protection Act is typically four years. This period begins when the consumer becomes aware of the violation. Employees and business owners should be aware of this timeline as it relates to the New Mexico Standard Terms and Conditions for Merchandise Warehouses.

Certain services may be exempt from sales tax in New Mexico, including some professional services and specific educational services. Understanding these exemptions will help you strategically plan your offerings. Ensuring compliance with the New Mexico Standard Terms and Conditions for Merchandise Warehouses includes staying informed about available exemptions.

The nexus threshold in New Mexico refers to the minimum level of contact a business must have before being subject to state taxes. This often includes having a physical location or reaching a specific sales threshold. Knowing the nexus threshold can aid you in fulfilling obligations related to the New Mexico Standard Terms and Conditions for Merchandise Warehouses.

Doing business in New Mexico generally means having a physical presence, like a store or office, or conducting business activities in the state. This definition encompasses various actions such as hiring employees and making regular sales. Understanding what constitutes doing business will help you adhere to the New Mexico Standard Terms and Conditions for Merchandise Warehouses.

To obtain a New Mexico business tax ID, you must apply with the New Mexico Taxation and Revenue Department. This can typically be done online or through a paper application. Having a tax ID is crucial for complying with tax obligations as you implement the New Mexico Standard Terms and Conditions for Merchandise Warehouses.

While New Mexico law does not require an operating agreement for LLCs, it is highly recommended. An operating agreement outlines the management structure and operational procedures. Including this essential document reinforces your adherence to the New Mexico Standard Terms and Conditions for Merchandise Warehouses, ensuring clarity in your business habits.

Yes, New Mexico does require most businesses to obtain a business license. This license ensures compliance with local regulations and helps avoid penalties. When operating under the New Mexico Standard Terms and Conditions for Merchandise Warehouses, you must have the appropriate licenses to protect your interests and maintain good standing.