Texas Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

If you need to thorough, obtain, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Utilize the site's simple and convenient search to find the documents you require. A range of templates for business and personal use are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Texas Guaranty without Pledged Collateral in just a few clicks.

Each legal document template you purchase is yours indefinitely. You have access to all forms you downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay competitive and acquire, and print the Texas Guaranty without Pledged Collateral with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- When you are already a US Legal Forms member, Log Into your account and click the Download button to retrieve the Texas Guaranty without Pledged Collateral.

- You can also access forms you previously downloaded within the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for your specific city/state.

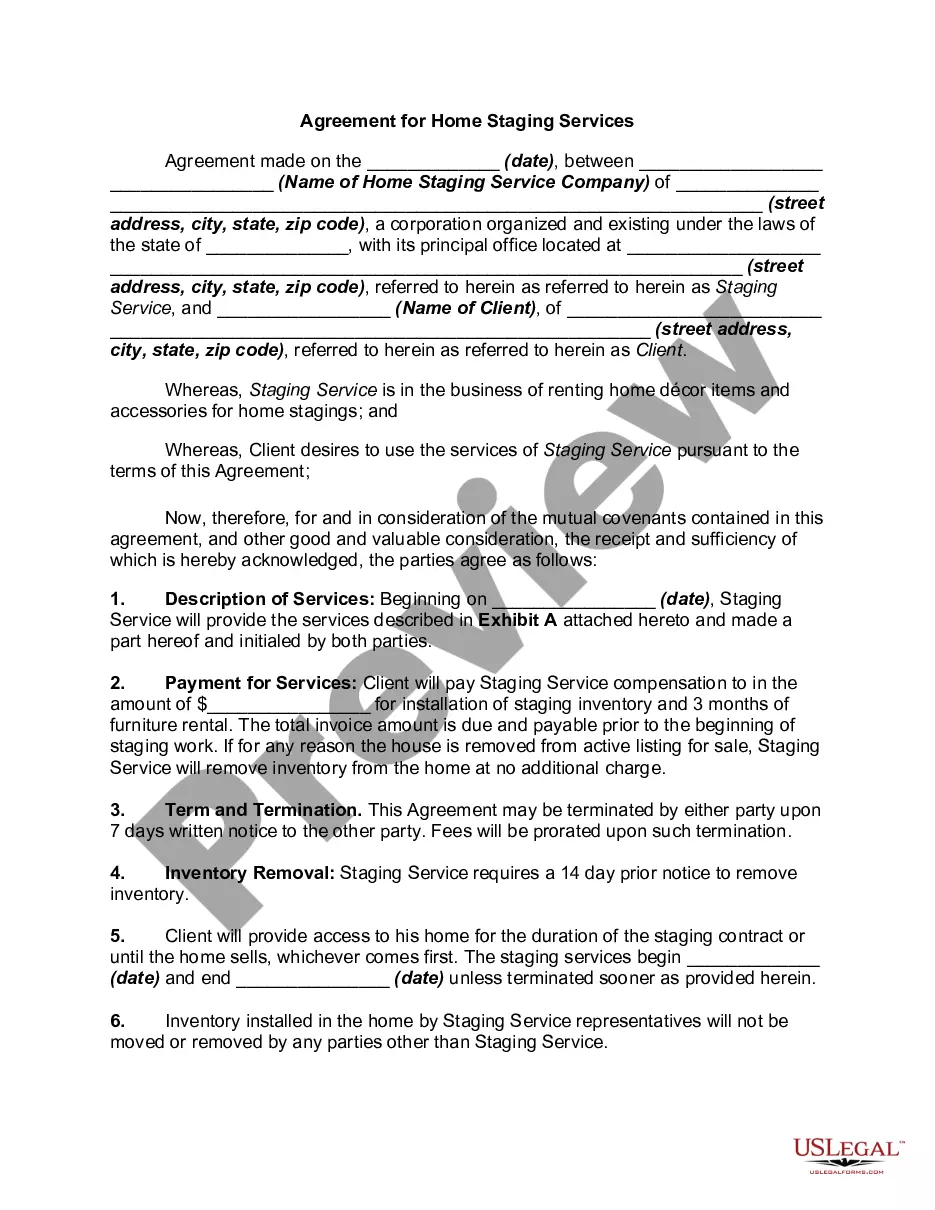

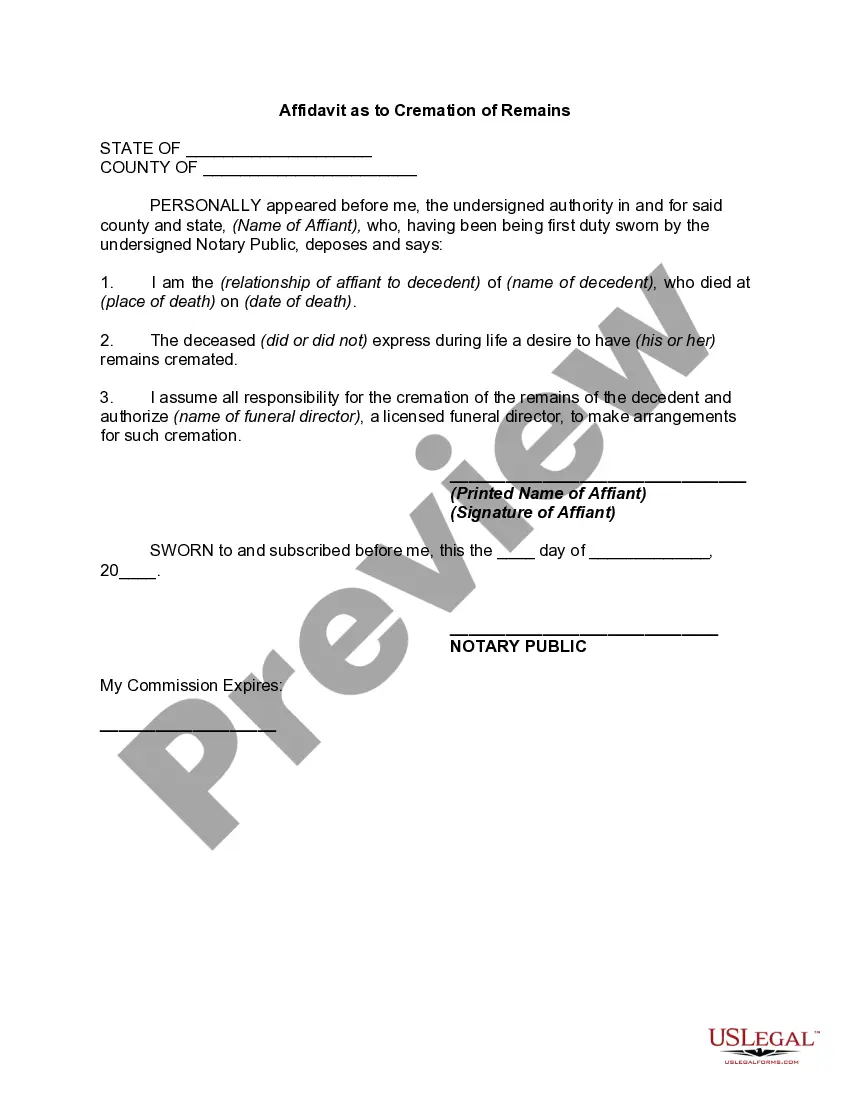

- Step 2. Utilize the Review option to inspect the form's content. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you find the form you need, click the Buy now button. Select your preferred pricing plan and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Texas Guaranty without Pledged Collateral.

Form popularity

FAQ

Guarantor unconditionally guarantees payment to Lender of all amounts owing under the Note. This Guarantee remains in effect until the Note is paid in full. Guarantor must pay all amounts due under the Note when Lender makes written demand upon Guarantor.

Guarantee. 1) v. to pledge or agree to be responsible for another's debt or contractual performance if that other person does not pay or perform.

Texas law itself provides a substantial amount of protection for certain assets. In most cases, these include your homestead, a specific amount of personal property, retirement accounts, 529 college savings accounts, life insurance and annuities.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport. Unlike a co-signer, a guarantor has no claim to the asset purchased by the borrower.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

An offer to guarantee must be accepted, either by express or implied acceptance. If a surety's assent to a guarantee has been procured by fraud by the person to whom it is given, there is no binding contract.

A guarantee must be in writing (or evidenced in writing) and signed by the guarantor or a person authorised by the guarantor (section 4, Statute of Frauds 1677). Guarantees and indemnities are often executed as deeds to overcome any argument about whether good consideration has been given.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.