Texas Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

Are you in a circumstance where you need documents for potential business or personal purposes almost daily? There are numerous authentic document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Texas Temporary Worker Agreement - Self-Employed Independent Contractor, that are designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterward, you can obtain the Texas Temporary Worker Agreement - Self-Employed Independent Contractor template.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Texas Temporary Worker Agreement - Self-Employed Independent Contractor at any time, if necessary. Simply choose the required form to download or print the document template.

Utilize US Legal Forms, the largest collection of legitimate forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to examine the document.

- Check the description to confirm that you have chosen the appropriate form.

- If the form is not what you are looking for, use the Search section to find the form that suits your needs and specifications.

- Once you find the correct form, click on Get now.

- Choose the pricing plan you prefer, enter the necessary information to create your account, and complete the payment using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

As a 1099 contractor, you can show proof of income by presenting your 1099 forms received from clients, bank statements, or detailed invoices. These documents reflect your income from your independent work. Organizing these records ensures clarity when discussing your earnings with clients or financial institutions. A Texas Temporary Worker Agreement - Self-Employed Independent Contractor can help outline and confirm your business transactions.

To provide proof of employment as an independent contractor, you can use invoices sent to clients, along with your Texas Temporary Worker Agreement - Self-Employed Independent Contractor. These documents can confirm the nature of your work and your payment details. It's also helpful to have a consistent record of your projects and earnings. Clear documentation builds trust with future clients.

To prove self-employment, you need documents like a business license, 1099 forms, or tax returns that record your earnings. Maintaining organized financial records also reinforces your self-employed status. Clients may request this information to verify your independence as a worker. Including a Texas Temporary Worker Agreement - Self-Employed Independent Contractor in your paperwork adds credibility.

Independent contractors can show proof of employment through various documents such as contracts, invoices, or tax returns. These documents demonstrate the work performed and payments received. By keeping detailed records, contractors can validate their employment status effectively. A Texas Temporary Worker Agreement - Self-Employed Independent Contractor can serve as key documentation for this purpose.

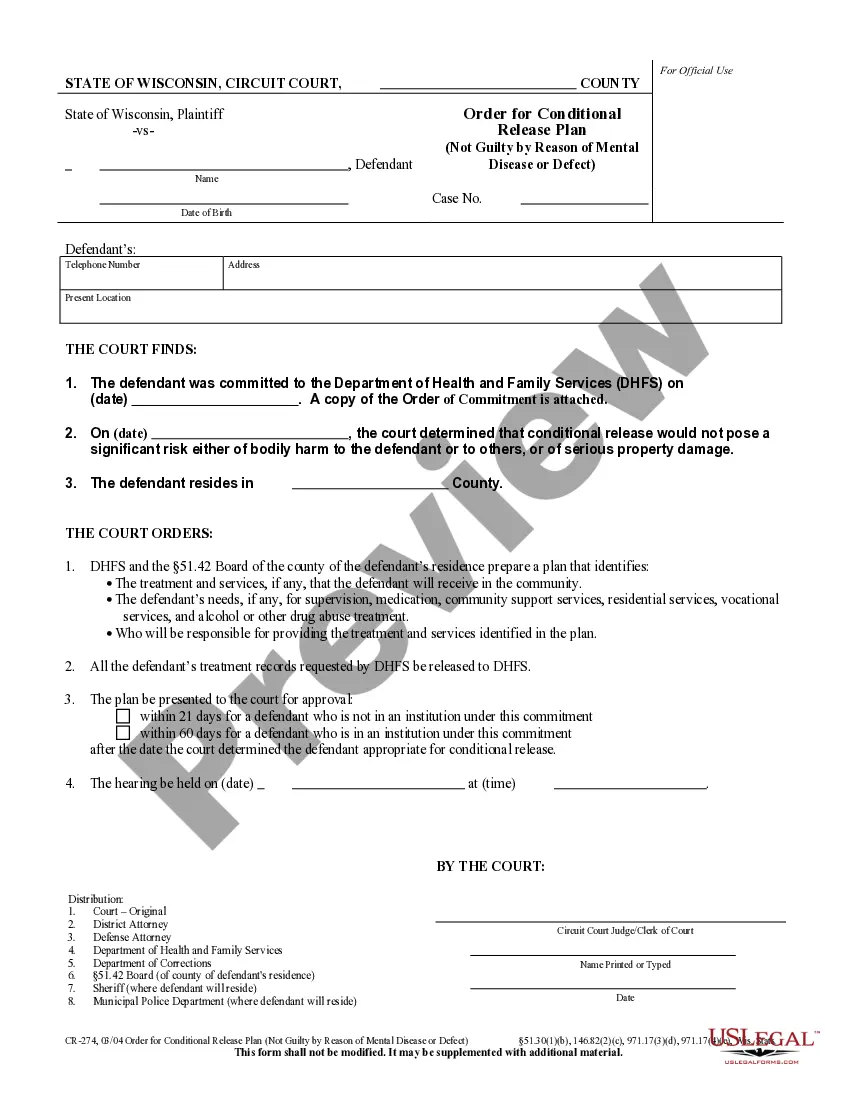

The independent contractor agreement in Texas outlines the terms between a business and an independent contractor. It details the responsibilities, payment terms, and scope of work for the contractor. This agreement is essential to clarify the nature of the relationship and protect both parties. Using a Texas Temporary Worker Agreement - Self-Employed Independent Contractor can streamline this process.

Individuals classified as 1099 workers, often linked to the Texas Temporary Worker Agreement - Self-Employed Independent Contractor, are not automatically deemed temporary employees. Instead, they are self-employed and take on specific projects or tasks as needed. Duration may vary based on agreements made with companies. If you rely on 1099 contracts, it’s essential to understand the nature of your work and any agreements you sign.

Filling out an independent contractor agreement requires you to provide specific details about the work arrangement. Start with both parties' information and describe the services to be performed in detail. Make sure to include payment arrangements, deadlines, and terms for termination. To simplify this process, you can access templates for a Texas Temporary Worker Agreement - Self-Employed Independent Contractor on the US Legal platform, ensuring you meet all legal requirements.

Writing an independent contractor agreement involves outlining the key terms of your working relationship. Begin with a clear introduction that states the purpose of the agreement and identify both parties. Include sections on scope of work, payment terms, and duration of the contract. To ensure you cover all necessary details, you can utilize resources from US Legal, which provides guidance on creating a Texas Temporary Worker Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor form effectively, start by including your personal information such as name, address, and contact details. Next, clearly specify the services you will provide as a self-employed independent contractor. Don't forget to include payment terms and deadlines. For a comprehensive solution, consider using the US Legal platform, where you can find templates for the Texas Temporary Worker Agreement - Self-Employed Independent Contractor, making the process easier.

Temp workers are not necessarily self-employed, as they often work for a staffing agency or a specific employer for a limited time. However, independent contractors operate as self-employed individuals, taking on projects without significant oversight. When drafting a Texas Temporary Worker Agreement - Self-Employed Independent Contractor, you define the nature of the work relationship clearly. This ensures that both parties understand their rights and responsibilities.