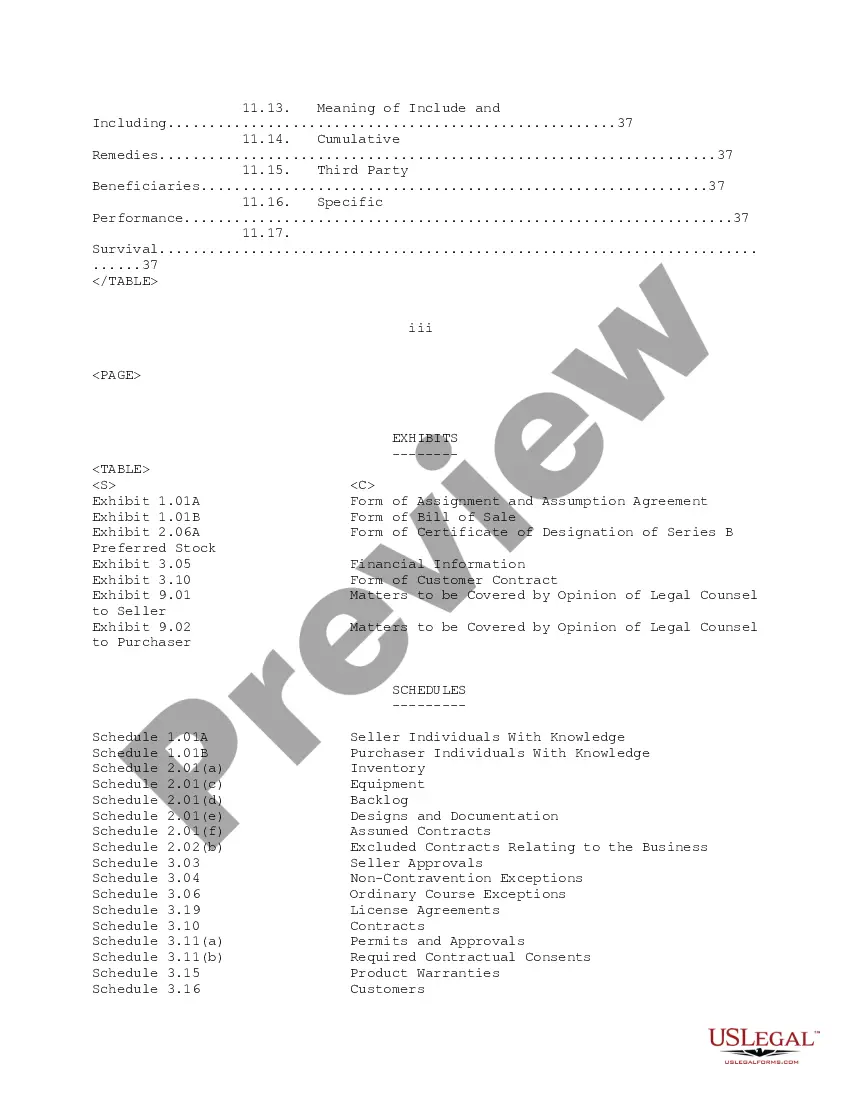

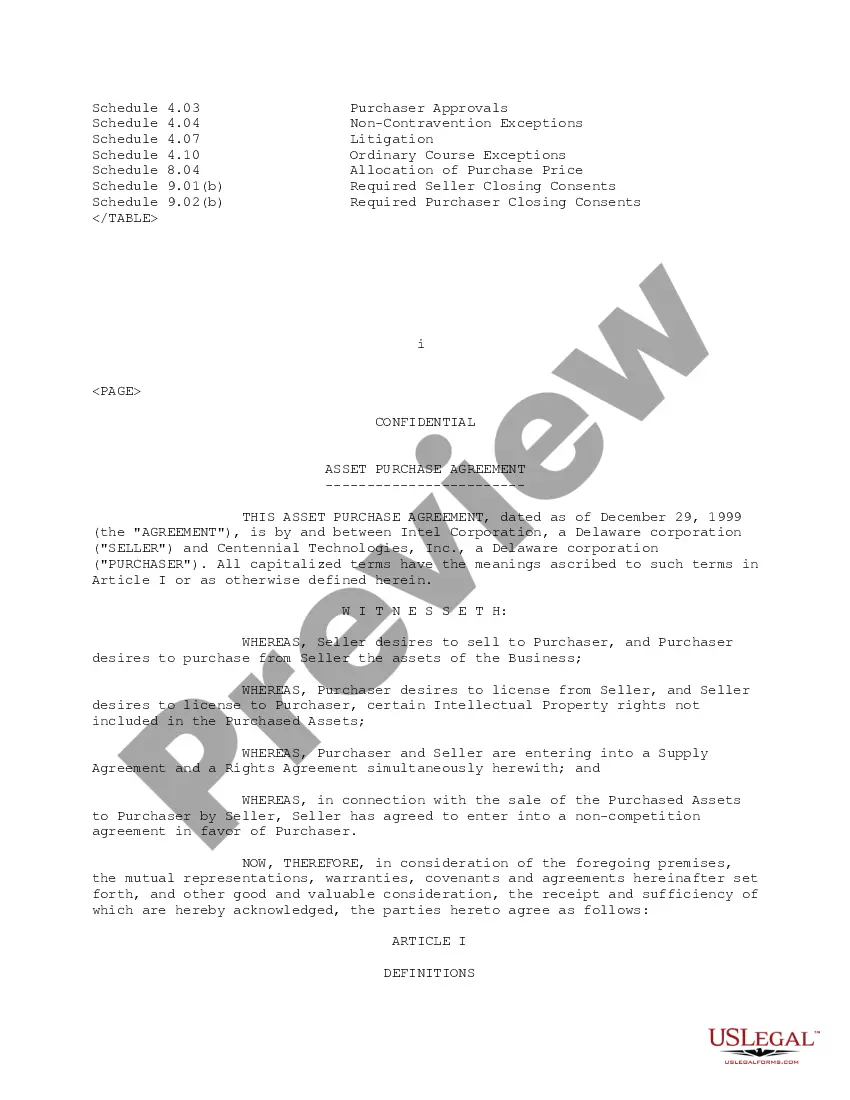

Texas Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between Centennial Technologies, Inc. And Intel Corporation - Sample?

US Legal Forms - one of several most significant libraries of legal varieties in the States - provides an array of legal file themes you are able to download or printing. Utilizing the web site, you will get thousands of varieties for organization and specific reasons, categorized by categories, says, or search phrases.You can find the latest variations of varieties much like the Texas Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample within minutes.

If you already have a subscription, log in and download Texas Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample through the US Legal Forms collection. The Download key can look on every single type you look at. You get access to all previously delivered electronically varieties in the My Forms tab of your own bank account.

If you wish to use US Legal Forms the first time, here are simple directions to get you started out:

- Be sure you have selected the best type to your city/state. Select the Review key to review the form`s content. Browse the type outline to actually have selected the appropriate type.

- In the event the type doesn`t satisfy your requirements, take advantage of the Look for area at the top of the screen to find the the one that does.

- If you are content with the form, verify your choice by clicking on the Buy now key. Then, choose the prices plan you prefer and give your accreditations to register for the bank account.

- Method the transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the transaction.

- Find the format and download the form on your own system.

- Make adjustments. Load, edit and printing and sign the delivered electronically Texas Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample.

Each and every web template you included with your money lacks an expiration date and is also your own forever. So, if you wish to download or printing one more duplicate, just check out the My Forms portion and then click on the type you require.

Get access to the Texas Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample with US Legal Forms, probably the most substantial collection of legal file themes. Use thousands of professional and state-certain themes that satisfy your company or specific demands and requirements.

Form popularity

FAQ

Such adjustment is preliminarily calculated by comparing estimated net working capital at transaction close with the pre-defined peg. If the closing net working capital is higher than the peg, the buyer may pay the seller an incremental amount, dollar-for-dollar, which effectively increases the purchase price.

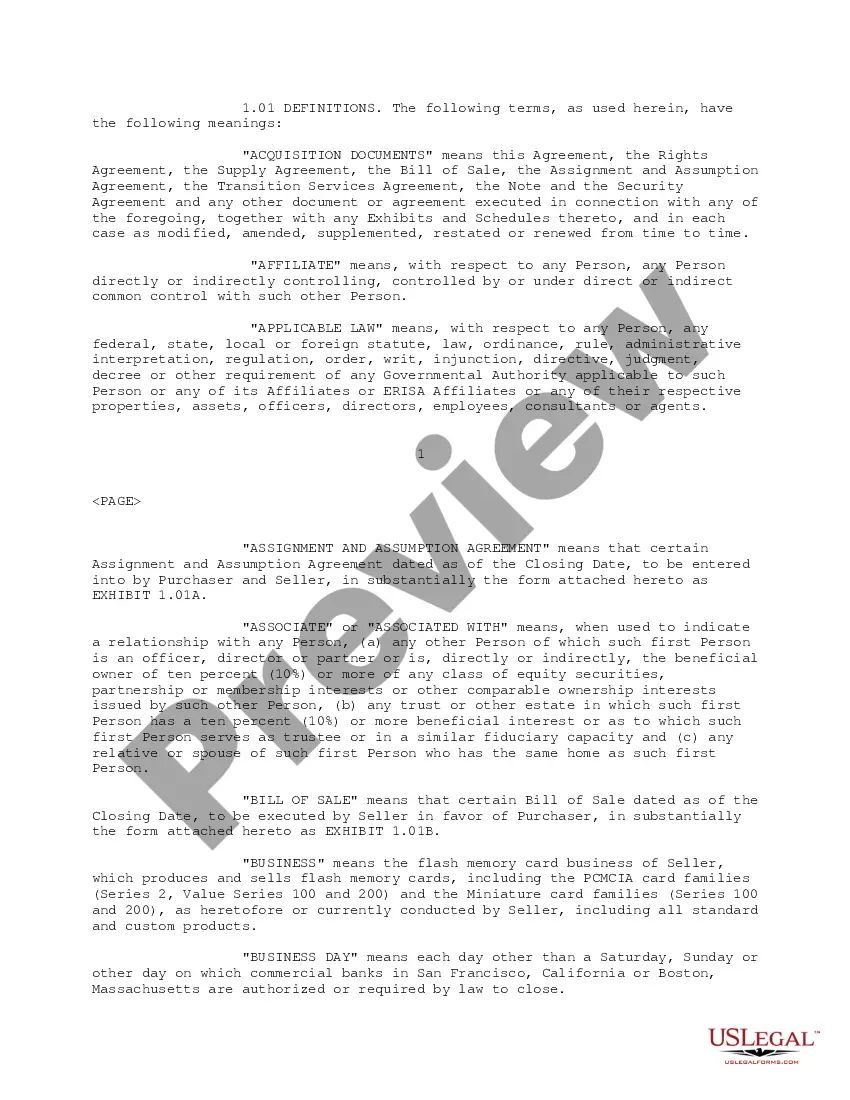

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

When considering an acquisition, working capital is typically a component of the purchase price with a dollar-for-dollar adjustment mechanism to settle the delta between the agreed-upon working capital target (or ?peg?) and the amount as of the closing date.

The simple definition of net working capital is current assets minus current liabilities. Generally, current assets and current liabilities are expected to generate or use cash within a short-term period, typically 12 months or less.

Working Capital = Current Assets (cash, accounts receivable, inventory, short term pre-paid expenses, etc.) ? Current Liabilities (accounts payable, accrued liabilities, accrued income taxes, etc.)

The Working Capital Adjustment is most common in acquisitions of private companies structured as cash-free/debt-free deals. It incentivizes the management team to run the company normally without manipulating invoices, receivables, or inventory to increase its Cash balance artificially right before a deal closes.