Texas Salaried Employee Appraisal Guidelines - Employee Specific

Description

How to fill out Salaried Employee Appraisal Guidelines - Employee Specific?

Are you presently in a predicament that requires documents for either business or particular reasons almost every workday.

There are numerous official document templates accessible online, but locating forms you can rely on isn't easy.

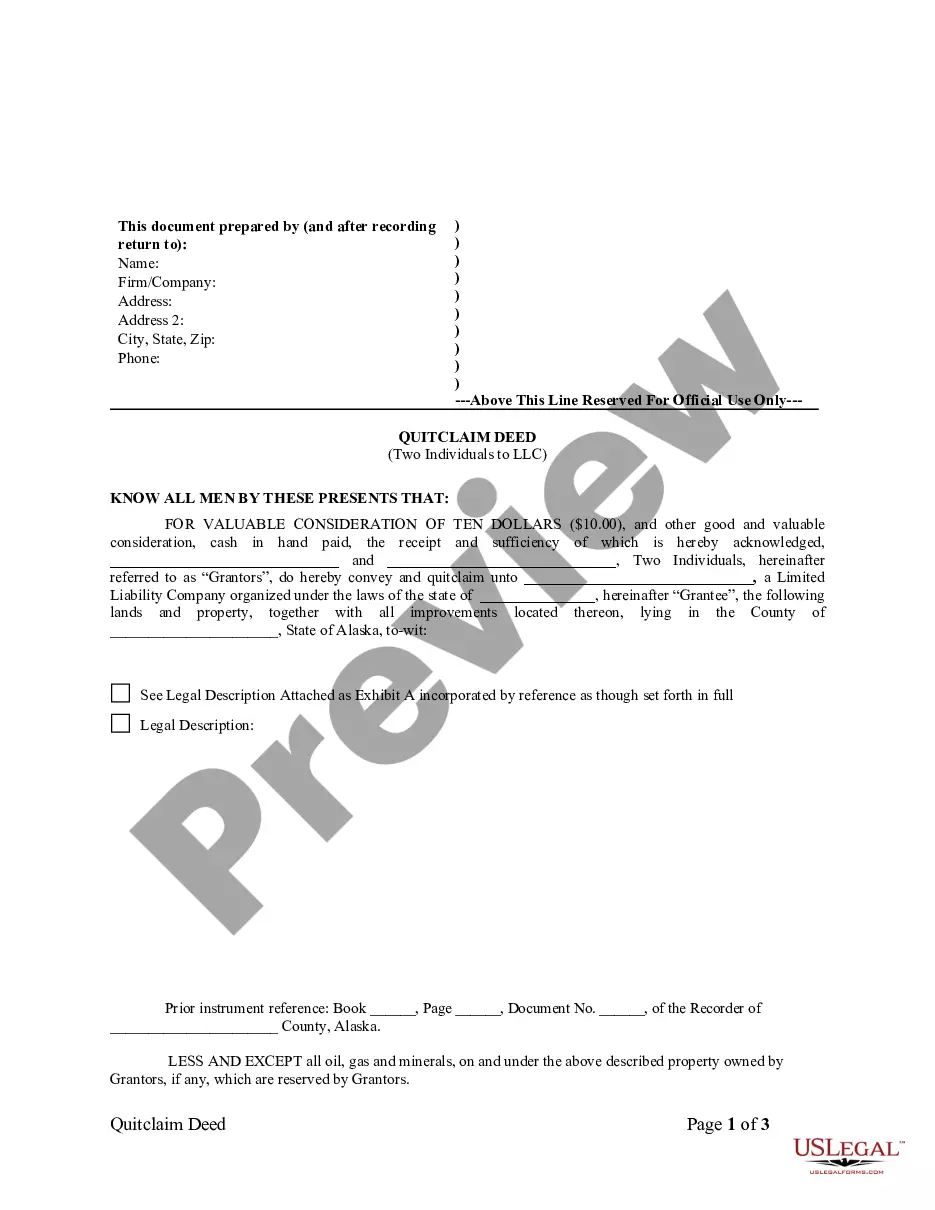

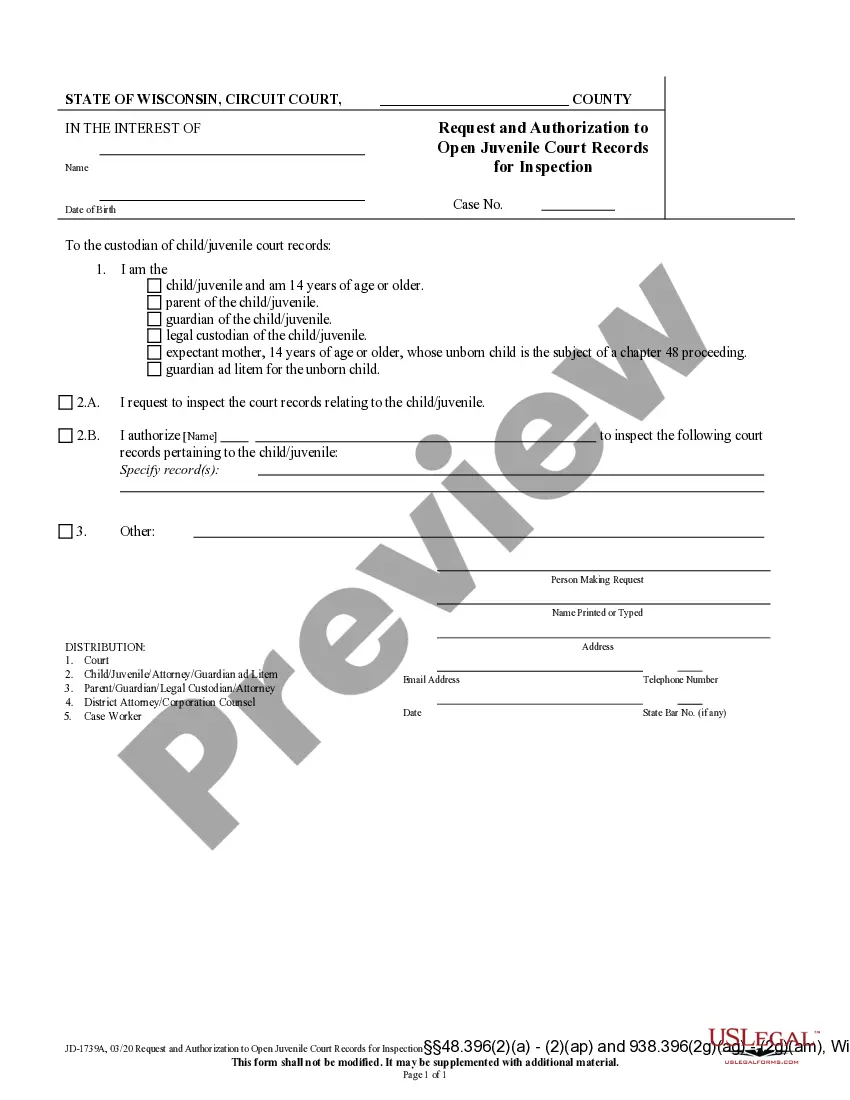

US Legal Forms provides thousands of form templates, such as the Texas Salaried Employee Appraisal Guidelines - Employee Specific, which are designed to comply with federal and state regulations.

Select the pricing plan you prefer, fill out the required information to create your account, and purchase the order using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Texas Salaried Employee Appraisal Guidelines - Employee Specific template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct area/county.

- Use the Review button to evaluate the form.

- Check the summary to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Lookup field to find the form that meets your needs and specifications.

- Once you locate the suitable form, click Acquire now.

Form popularity

FAQ

When filling out self-appraisal form answers, employees should be honest and detailed about their accomplishments and challenges. Encourage them to provide examples that illustrate their work, reflecting the standards set by the Texas Salaried Employee Appraisal Guidelines - Employee Specific. This practice fosters transparency and accountability in the appraisal process.

When filling out an employee self-appraisal, encourage the employee to reflect on their accomplishments and areas for improvement. They should provide specific examples that demonstrate their contributions while aligning with the Texas Salaried Employee Appraisal Guidelines - Employee Specific. Additionally, it's beneficial to set future goals that support professional growth.

Salaried employees have a fixed rate of pay, regardless of the number of hours they work, and do not get paid extra for overtime. Hourly employees are given a fixed hourly salary that must be at least the federal minimum wage, paid based on the number of hours worked, and eligible for overtime pay.

A salaried employee is paid a flat rate, regardless of specific hours worked, unlike hourly employees, who are paid a wage for each hour worked.

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

Salaried employees receive a set amount of compensation on a regular basis regardless of how many hours they work. They're usually exempt, meaning they don't qualify for overtime pay or minimum wageeven when expected to work long hours.

Under federal overtime law and Texas overtime law, salaried employees must receive overtime pay for hours worked over 40 in any workweek unless two specific requirements are met: (1) the salary exceeds $455 per workweek; and (2) the employee performs duties satisfying one of the narrowly-defined FLSA overtime

Generally, an employee "must receive his full salary for any week in which he performs any work without regard to the number of days or hours worked". However, the regulation recognizes "the general rule that an employee need not be paid for any workweek in which he performs no work".

Overtime Requirements Federal overtime laws and Texas overtime laws stipulate that salaried workers must be paid overtime pay for any hours worked beyond 40 in a work week.

An employer may not prohibit an employee from disclosing his or her own wages, discussing the wages of others, inquiring about another employee's wages, or aiding or encouraging any other employee to exercise rights under the Equal Pay Act.