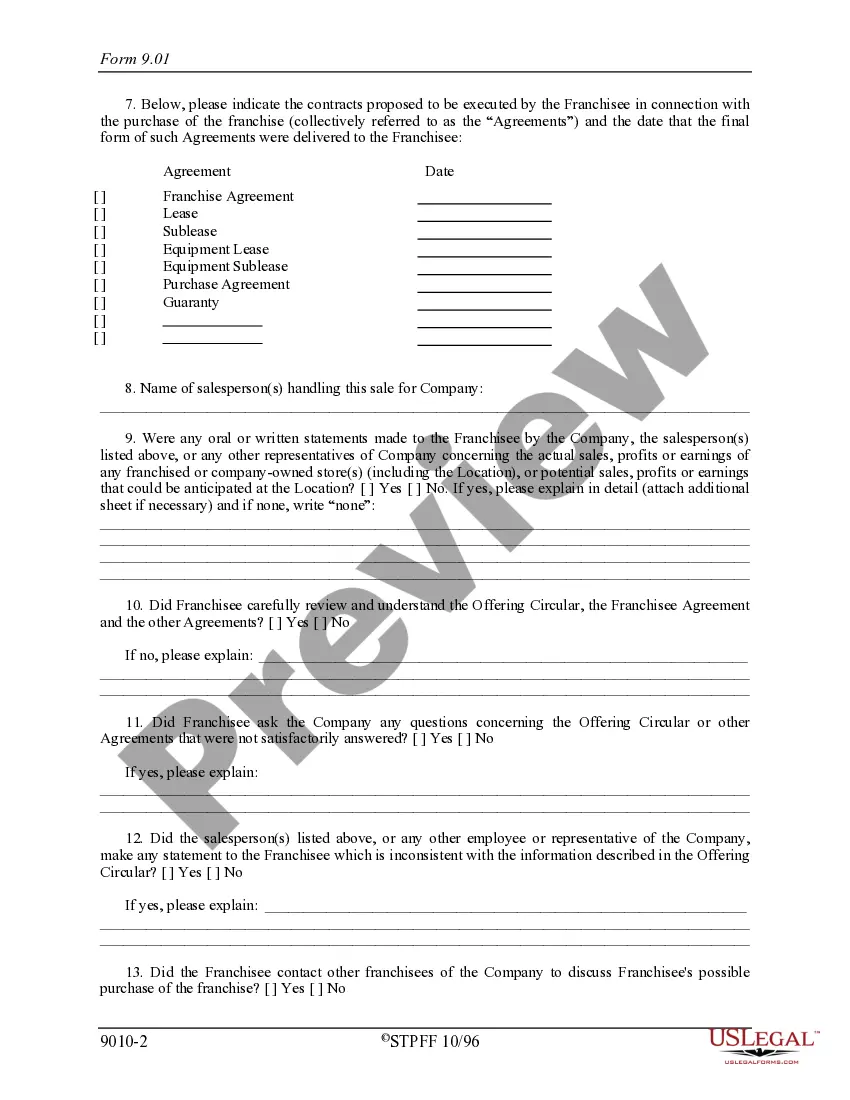

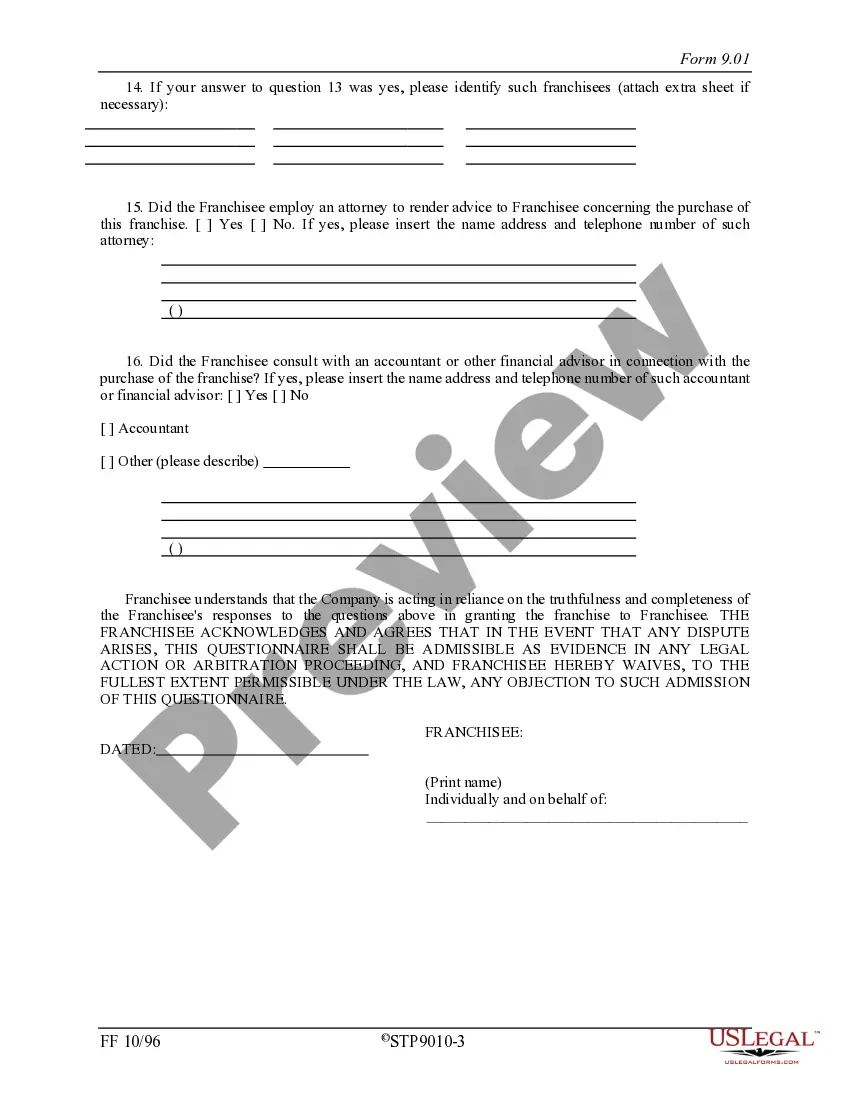

Texas Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

US Legal Forms - one of several most significant libraries of legal forms in America - gives a variety of legal record web templates you may obtain or produce. Making use of the internet site, you may get a huge number of forms for enterprise and specific purposes, sorted by groups, claims, or keywords.You will discover the most up-to-date variations of forms such as the Texas Franchisee Closing Questionnaire within minutes.

If you already possess a membership, log in and obtain Texas Franchisee Closing Questionnaire from your US Legal Forms catalogue. The Acquire button can look on every single develop you perspective. You have accessibility to all in the past acquired forms in the My Forms tab of your own profile.

If you would like use US Legal Forms initially, allow me to share simple guidelines to get you began:

- Be sure you have picked out the correct develop to your town/region. Click on the Preview button to examine the form`s content. See the develop description to ensure that you have chosen the right develop.

- When the develop does not match your needs, use the Research industry at the top of the display to obtain the one that does.

- In case you are pleased with the form, verify your option by clicking on the Acquire now button. Then, pick the pricing prepare you favor and offer your credentials to register for the profile.

- Approach the deal. Use your bank card or PayPal profile to complete the deal.

- Pick the format and obtain the form on your own product.

- Make alterations. Complete, change and produce and sign the acquired Texas Franchisee Closing Questionnaire.

Each and every web template you included in your bank account does not have an expiration time and it is the one you have for a long time. So, if you would like obtain or produce yet another backup, just go to the My Forms area and click on the develop you need.

Gain access to the Texas Franchisee Closing Questionnaire with US Legal Forms, the most extensive catalogue of legal record web templates. Use a huge number of skilled and express-specific web templates that meet up with your business or specific needs and needs.

Form popularity

FAQ

What is the Franchise Tax Accountability Questionnaire? The Comptroller sets up a franchise tax account for your business based on information provided from the Texas Secretary of State and other sources. The Franchise Tax Accountability Questionnaire allows you to update your entity's information with us online.

Penalties and Interest A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Final Franchise Tax Reports A Texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, convert or merge.

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

Forfeiture of Rights and Privileges If you do not file a franchise tax annual report within 45 days after the due date, your corporate privileges and rights to conduct business within the state will be forfeited.

For the 2023 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...

FQ Numbers: The number begins with the letters FQ followed by 6 digits. They are for completing a Franchise Tax Questionnaire, and they are printed in the right corner of the Registration Letter.

For the 2023 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the ...