Texas Exempt Survey

Description

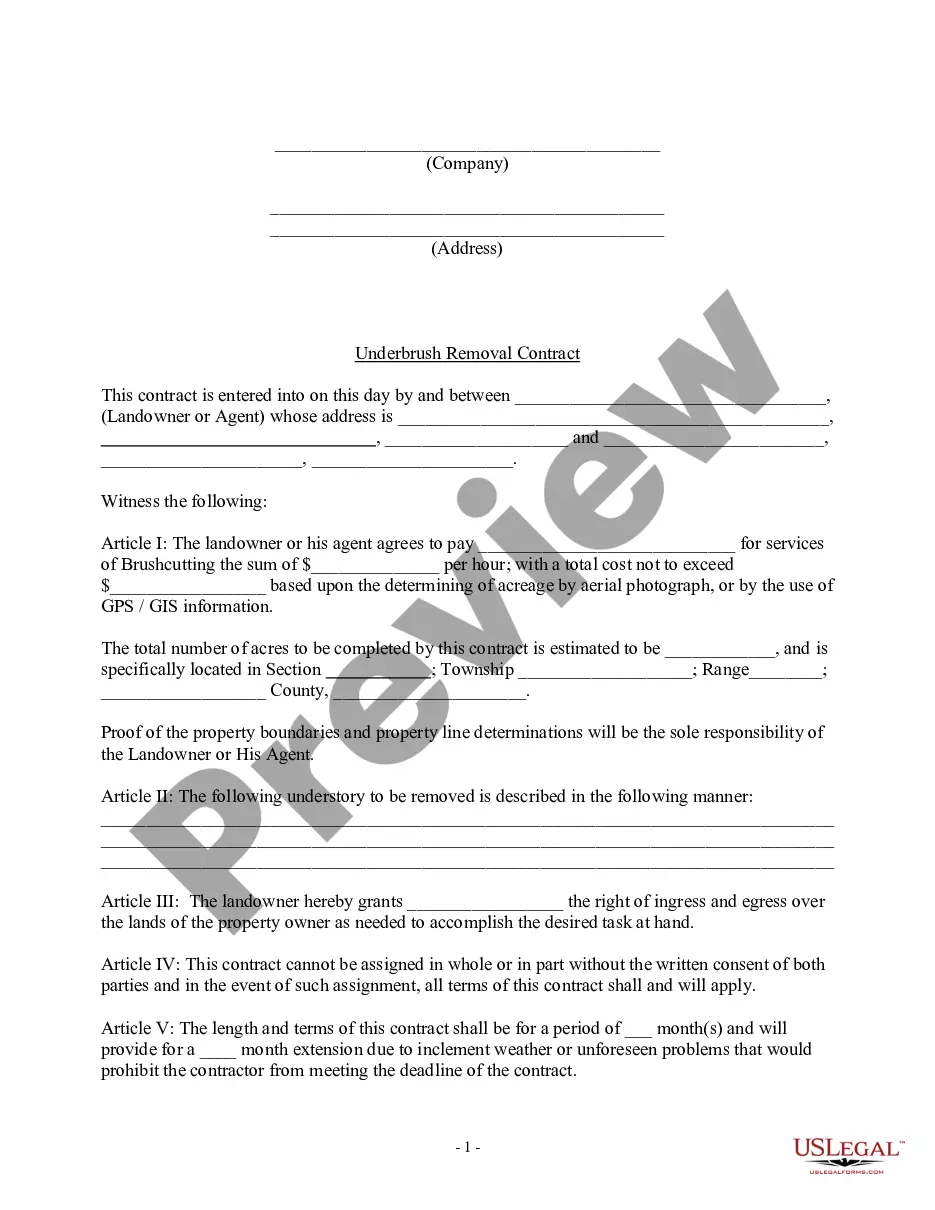

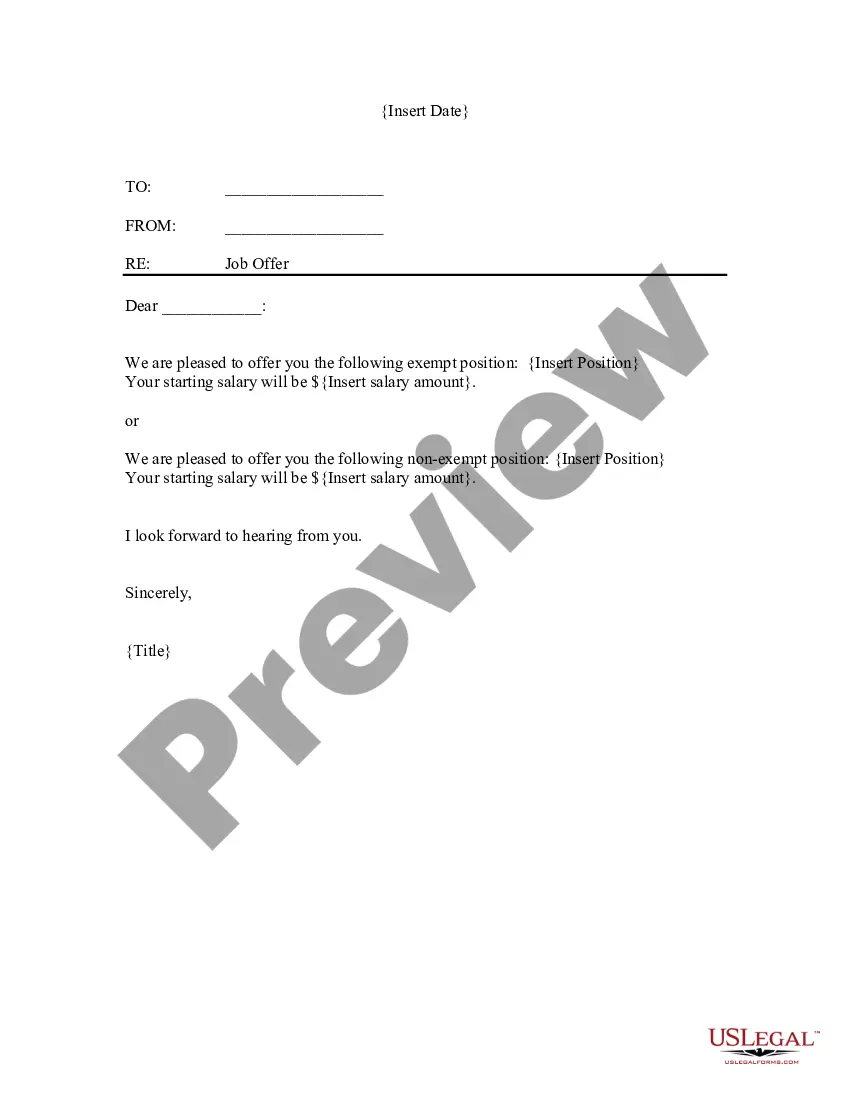

How to fill out Exempt Survey?

If you need to finish, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s straightforward and convenient search to find the documents you require.

Various templates for business and individual purposes are categorized by type and state, or keywords.

Step 4. Once you find the form you need, click on the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Use US Legal Forms to access the Texas Exempt Survey in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download option to retrieve the Texas Exempt Survey.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific town/county.

- Step 2. Use the Review feature to view the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

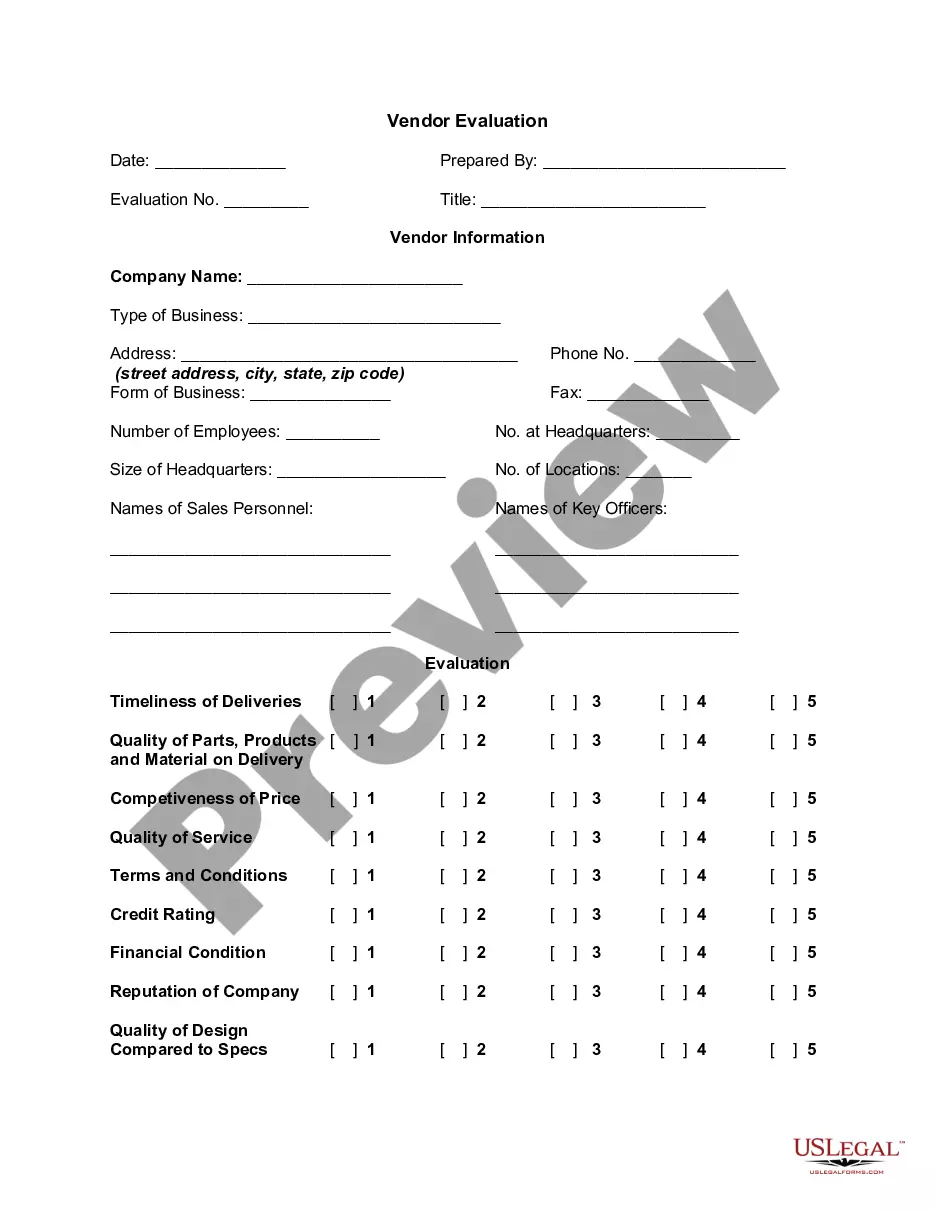

Form popularity

FAQ

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

Exempt Categories:Education research.Surveys, interviews, educational tests, public observations (that do not involve children)Benign behavioral interventions.Analysis of previously-collected, identifiable info/specimens.Federal research/demonstration projects.Taste and food evaluation studies.

Texas businesses are exempt from paying state sales and use tax on labor for constructing new facilities. Texas companies are exempt from paying state and local sales and use tax on electricity and natural gas used in manufacturing, processing, or fabricating tangible personal property.

The Concept of Non-exempt Human Subjects Research. Even when funded by a Common Rule agency, not all research involving humans is required to follow the Common Rule. The Rule only applies to activities that qualify as human subjects research under the regulation and that do not qualify for an exemption.

Human subjects research that is classified as exempt means that the research qualifies as no risk or minimal risk to subjects and is exempt from most of the requirements of the Federal Policy for the Protection of Human Subjects, but is still considered research requiring an IRB review for an exemption determination.

To qualify as an exempt study, the research must fall within one of the specific federal regulatory categories. A determination of exemption must be made by the JHM IRBs and principal investigators must submit all such studies for their review.

The Texas Tax Code provides an exemption from franchise tax and sales tax to: Nonprofit organizations with an exemption from Internal Revenue Service (IRS) under IRC Section 501(c) (3), (4), (8), (10) or (19);

The State of Texas (Texas) charges sales tax on all purchases made by individuals or entities unless the purchasing entity has state tax-exempt status. Texas State University (Texas State), as a state governmental entity, claims federal tax-exempt status under Section 115 of the Internal Revenue Code.

Exempt human subjects research is a sub-set of research involving human subjects that does not require comprehensive IRB review and approval because the only research activity involving the human subjects falls into one or more specific exemption categories as defined by the Common Rule.

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.