Texas FLSA Exempt / Nonexempt Compliance Form

Description

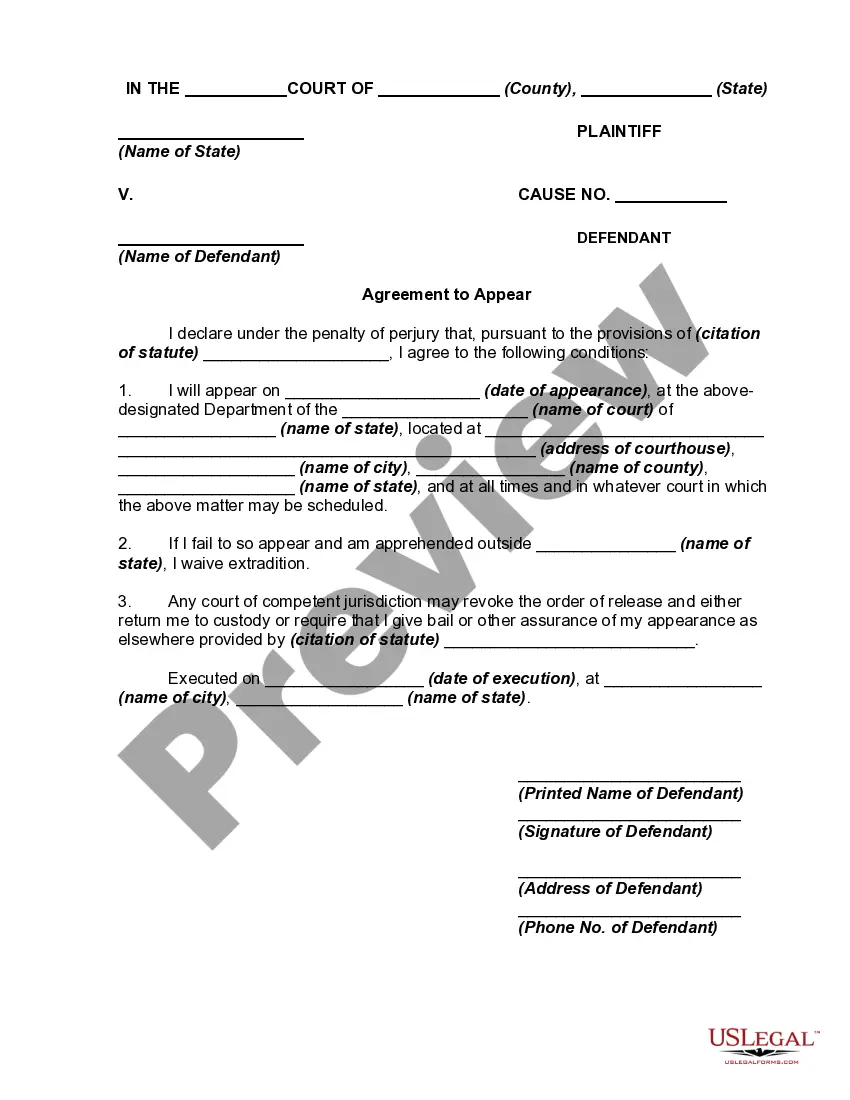

How to fill out FLSA Exempt / Nonexempt Compliance Form?

You can dedicate numerous hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are evaluated by experts.

You can access or print the Texas FLSA Exempt / Nonexempt Compliance Form from our services.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Obtain button.

- After that, you may complete, modify, print, or sign the Texas FLSA Exempt / Nonexempt Compliance Form.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, make sure you have selected the right document template for the county/city you choose.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

The 207k exemption in Texas refers to a specific classification under the Fair Labor Standards Act (FLSA) that allows certain motor carrier employees to be exempt from particular wage and hour provisions. This applies to workers involved in interstate commerce, including those who drive trucks or transport goods across state lines. Understanding this exemption is essential for employers and employees alike to ensure compliance and proper classification. Utilizing the Texas FLSA Exempt / Nonexempt Compliance Form can help streamline this important process.

Exempt employees are mostly paid on a salary basis and not per hour. Unlike non-exempt employees, employers may decide whether to pay exempt employees for any extra work outside the official 40 working hours per week. As a business owner, this allows you flexibility in your payment and employee benefits policies.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Non-exempt employees are required to be paid both the federal minimum wage of $7.25 as well as overtime pay at one and one-half times the employee's hourly rate. Exempt employees are usually not entitled to get either overtime or the minimum wage.

The primary difference in status between exempt and non-exempt employees is their eligibility for overtime. Under federal law, that status is determined by the Fair Labor Standards Act (FLSA). Exempt employees are not entitled to overtime, while non-exempt employees are.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Federal overtime laws and Texas overtime laws stipulate that salaried workers must be paid overtime pay for any hours worked beyond 40 in a work week. Salaried employees are exempt from overtime pay requirements only if two specific conditions are met: The employee's salary exceeds $455 per workweek.

Exempt employees are typically salaried employees, seasonal workers, and those who earn more than a certain amount each year. Also, some jobs are considered "exempt" by definition, including the following: Railroads and certain airline employees. Taxi drivers.

Employees Not Entitled to Overtime PayThose not covered by FLSA are known as exempt employees. These exemptions also apply in Texas. So if you're paid an annual salary and earning more than a certain amount set by law, you are considered "exempt" and not covered by the FLSA.

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.