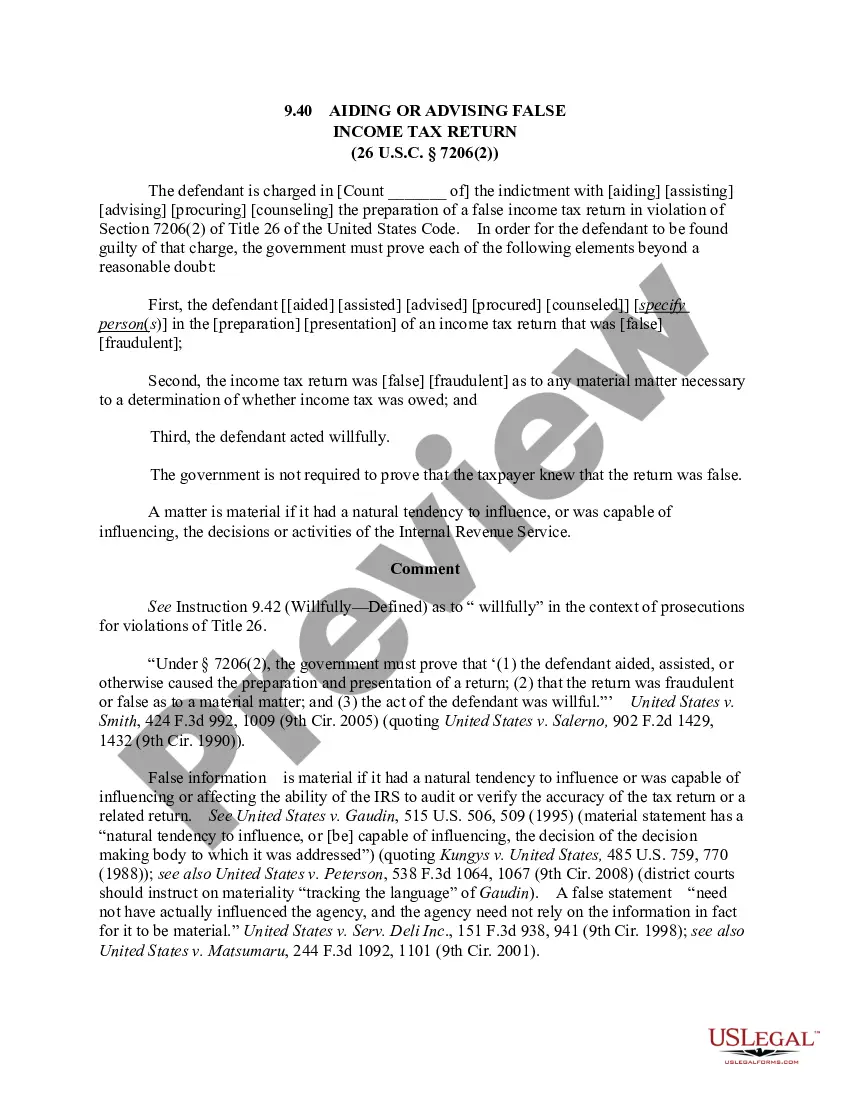

Texas Jury Instruction - Aiding And Abetting Filing False Return

Description

How to fill out Jury Instruction - Aiding And Abetting Filing False Return?

Are you currently in the position where you need files for possibly organization or specific purposes almost every day? There are a lot of lawful file layouts accessible on the Internet, but getting versions you can trust is not straightforward. US Legal Forms provides thousands of kind layouts, such as the Texas Jury Instruction - Aiding And Abetting Filing False Return, that are published to satisfy federal and state demands.

Should you be previously acquainted with US Legal Forms web site and get a merchant account, simply log in. After that, it is possible to download the Texas Jury Instruction - Aiding And Abetting Filing False Return template.

If you do not come with an accounts and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you need and ensure it is for the right city/area.

- Use the Preview key to review the shape.

- Browse the description to actually have selected the right kind.

- In case the kind is not what you are searching for, use the Look for area to find the kind that suits you and demands.

- Whenever you discover the right kind, simply click Get now.

- Select the rates plan you want, fill in the specified information and facts to create your account, and purchase the order using your PayPal or credit card.

- Select a practical data file formatting and download your duplicate.

Get all the file layouts you might have purchased in the My Forms food list. You can obtain a more duplicate of Texas Jury Instruction - Aiding And Abetting Filing False Return anytime, if required. Just select the necessary kind to download or produce the file template.

Use US Legal Forms, probably the most extensive variety of lawful varieties, to conserve time as well as avoid blunders. The assistance provides expertly created lawful file layouts which you can use for a range of purposes. Make a merchant account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

Tax evasion is an offence under section 239 of the Income Tax Act and section 327 of the Excise Tax Act. Tax fraud is an offence under section 380 of the Criminal Code.

Tax evasion is an offence under section 239 of the Income Tax Act and section 327 of the Excise Tax Act. Tax fraud is an offence under section 380 of the Criminal Code.

Tax Avoidance ? Tax avoidance tactics aren't illegal, but there are potential financial consequences involved. For example, the money in your RRSP is tax-sheltered, which means you'll have to pay taxes on it when you make a withdrawal.

The court also found that the defendant had a history of tax delinquency and that he had taken steps to conceal his income from the government, further supporting the conclusion that he acted with intent to defraud. Criminal Tax Fraud in the Third Degree under New York Tax Law § 1804 is a Class D felony.

The Texas Pattern Jury Charges series is widely accepted by attorneys and judges as the most authoritative guide for drafting questions, instructions, and definitions in a broad variety of cases.