Texas Complex Deed of Trust and Security Agreement

Description

How to fill out Complex Deed Of Trust And Security Agreement?

You are able to devote time on the web trying to find the lawful record design that fits the federal and state requirements you need. US Legal Forms offers 1000s of lawful varieties which are evaluated by pros. You can easily acquire or produce the Texas Complex Deed of Trust and Security Agreement from your assistance.

If you already have a US Legal Forms bank account, you can log in and click on the Down load option. Next, you can total, edit, produce, or signal the Texas Complex Deed of Trust and Security Agreement. Every lawful record design you buy is yours permanently. To get an additional version associated with a purchased kind, visit the My Forms tab and click on the related option.

If you use the US Legal Forms site for the first time, keep to the easy instructions under:

- Very first, make sure that you have selected the proper record design for your county/city of your choosing. Look at the kind description to ensure you have picked the appropriate kind. If readily available, take advantage of the Review option to look through the record design as well.

- If you want to locate an additional variation of your kind, take advantage of the Lookup area to discover the design that meets your needs and requirements.

- Upon having discovered the design you want, click on Buy now to continue.

- Choose the rates strategy you want, key in your references, and register for a free account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful kind.

- Choose the format of your record and acquire it to your system.

- Make modifications to your record if necessary. You are able to total, edit and signal and produce Texas Complex Deed of Trust and Security Agreement.

Down load and produce 1000s of record themes utilizing the US Legal Forms website, which provides the largest selection of lawful varieties. Use specialist and state-certain themes to handle your company or specific needs.

Form popularity

FAQ

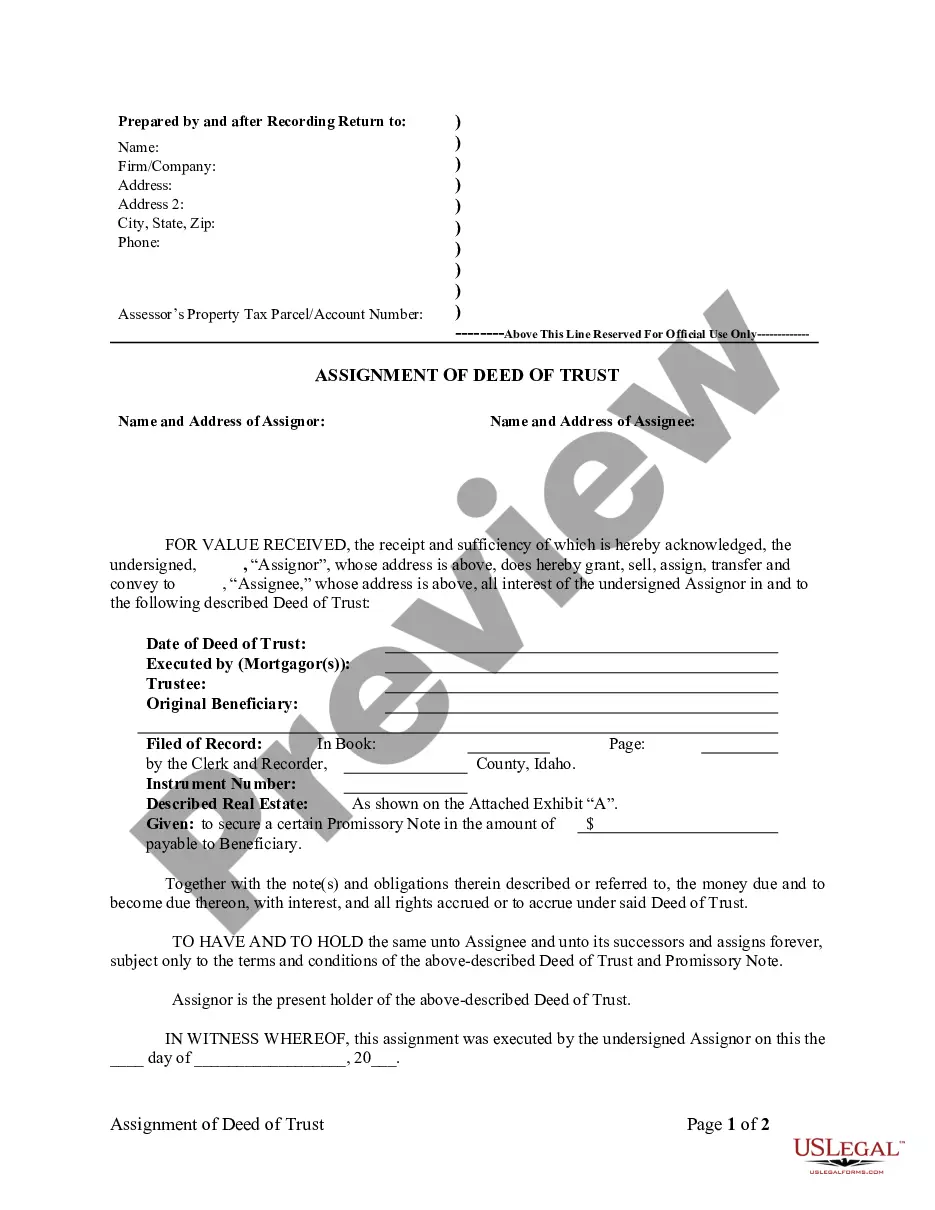

This document may be called the Security Instrument, Deed of Trust, or Mortgage. When you sign this document, you are giving the lender the right to take your property by foreclosure if you fail to pay your mortgage ing to the terms you've agreed to.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

A mortgage or deed of trust is an agreement in which a borrower puts up title to real estate as security (collateral) for a loan. People often refer to a home loan as a "mortgage." But a mortgage isn't a loan agreement. The promissory note promises to repay the amount you borrowed to buy a home.

A deed of trust is a type of secured real-estate transaction that some states use instead of mortgages. See State Property Statutes. A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money.

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee.

A deed of trust uses a third party to transfer property from one party to another. This trust acts as security against a loan on the property in case the borrower doesn't make their payments.